Clare McCann

@claremccann.bsky.social

#HigherEd policy @PEERresearch.bsky.social. Formerly at New America Education, US Department of Education, Arnold Ventures. Bucks County, PA native. A fan of chocolate and The Container Store. Posts are my own.

And for more on how the graduate and professional limits will affect student borrowing (and how parent borrowers will be affected by those new limits), here's another piece with more data from @peerresearch.bsky.social! www.american.edu/spa/peer/upl... 4/4

November 6, 2025 at 7:46 PM

And for more on how the graduate and professional limits will affect student borrowing (and how parent borrowers will be affected by those new limits), here's another piece with more data from @peerresearch.bsky.social! www.american.edu/spa/peer/upl... 4/4

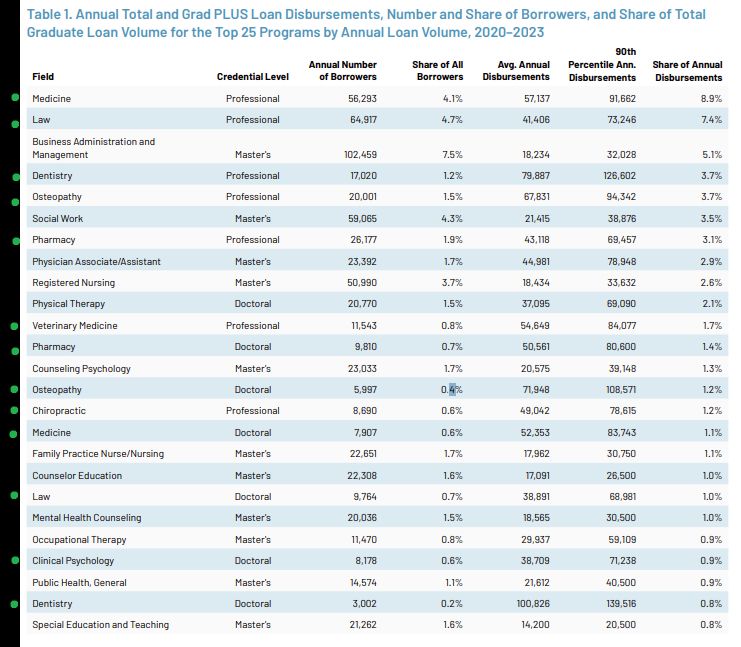

Negotiators have also raised concern about the exclusion of other fields, like physical therapy, occupational therapy, audiology, and physician assistant programs. For more on current graduate borrowing, check out this report: www.american.edu/spa/peer/upl... 3/

www.american.edu

November 6, 2025 at 7:46 PM

Negotiators have also raised concern about the exclusion of other fields, like physical therapy, occupational therapy, audiology, and physician assistant programs. For more on current graduate borrowing, check out this report: www.american.edu/spa/peer/upl... 3/

@peerresearch.bsky.social's @jdmatsudaira.bsky.social has looked at the current borrowing levels across fields of study. Check out the attached (green dots for fields that fall in the new definition) for more on the average annual borrowing of the largest professional fields today. 2/

November 6, 2025 at 7:46 PM

@peerresearch.bsky.social's @jdmatsudaira.bsky.social has looked at the current borrowing levels across fields of study. Check out the attached (green dots for fields that fall in the new definition) for more on the average annual borrowing of the largest professional fields today. 2/

Again, full report here! www.american.edu/spa/peer/upl... END/

www.american.edu

April 2, 2025 at 6:35 PM

Again, full report here! www.american.edu/spa/peer/upl... END/

What does this mean? Clearly, there are programs where graduates are left with too much debt. But uniform loan limits (like those Congress is debating) would have very different impacts on different fields -- a point worthy of deeper consideration as we think about the right limits to set. 7/

April 2, 2025 at 6:35 PM

What does this mean? Clearly, there are programs where graduates are left with too much debt. But uniform loan limits (like those Congress is debating) would have very different impacts on different fields -- a point worthy of deeper consideration as we think about the right limits to set. 7/

There are also big differences in debt within fields, too. Some schools leave graduates with way more debt than others -- but not necessarily with similarly higher earnings. Take law schools, for instance: Of 197 law programs in the data, 17 had median debt levels at least $50k above the median. 6/

April 2, 2025 at 6:35 PM

There are also big differences in debt within fields, too. Some schools leave graduates with way more debt than others -- but not necessarily with similarly higher earnings. Take law schools, for instance: Of 197 law programs in the data, 17 had median debt levels at least $50k above the median. 6/