The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/1...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/1...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/1...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/1...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/1...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/1...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The new Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The new Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

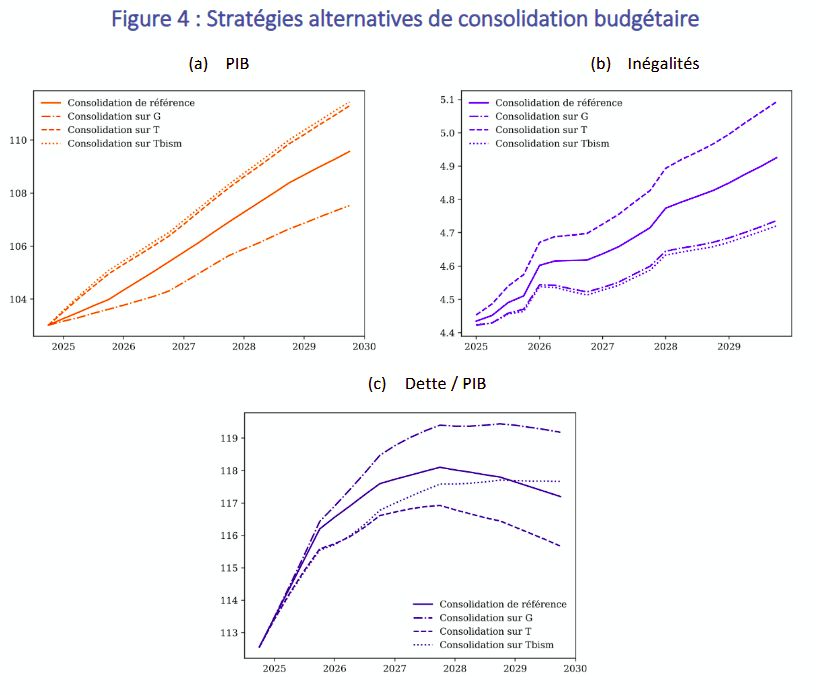

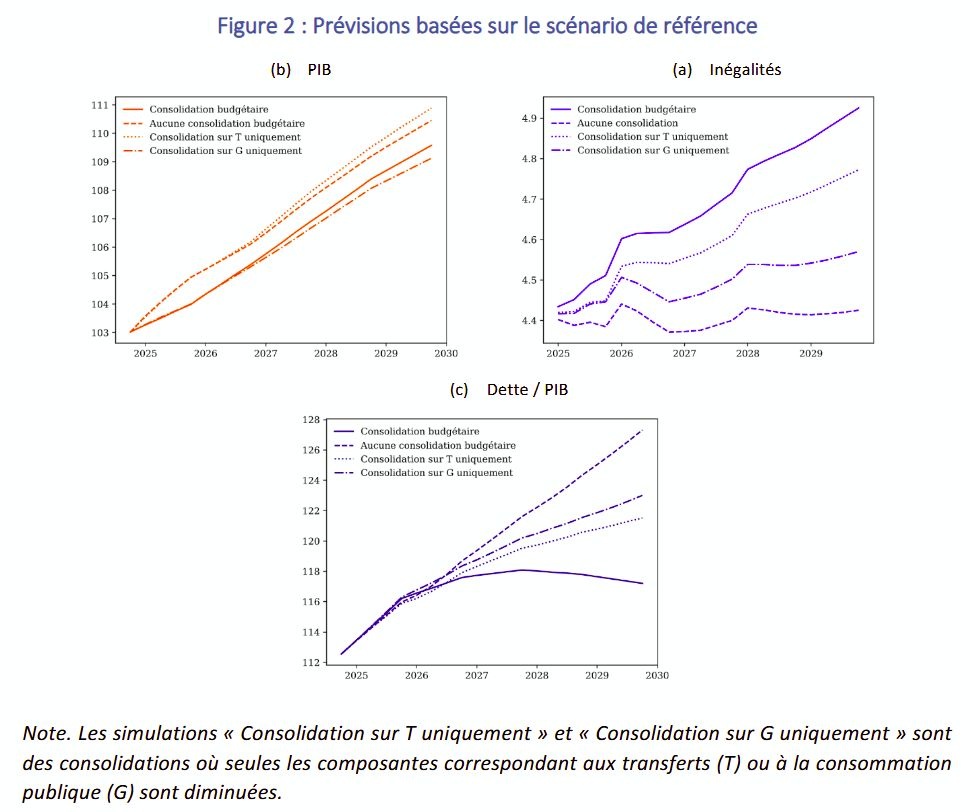

❌ Réduire uniquement la consommation publique nuit à la croissance

❌ Réduire uniquement les transferts augmente les inégalités

❌ Réduire uniquement la consommation publique nuit à la croissance

❌ Réduire uniquement les transferts augmente les inégalités

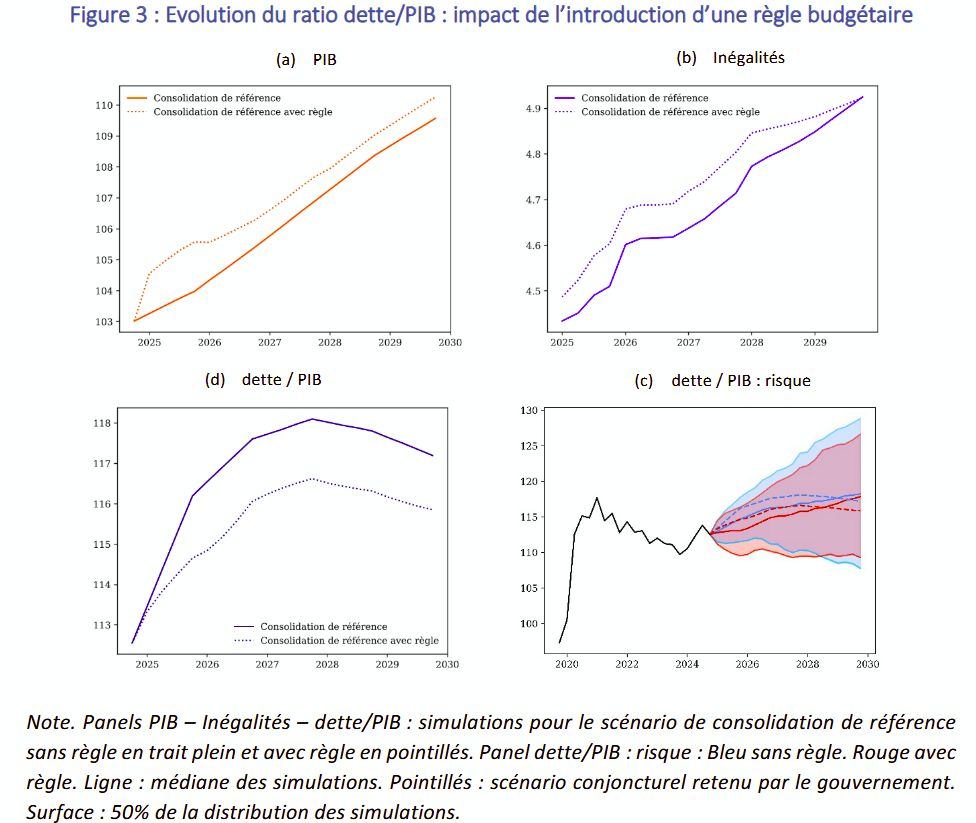

✅ Dette plus faible (baisse de 1,2 point)

✅ Plus de croissance (gain de 0,13 point)

✅ Moins de risques de dérapage

✅ Dette plus faible (baisse de 1,2 point)

✅ Plus de croissance (gain de 0,13 point)

✅ Moins de risques de dérapage

✅ Réduire la dette de 10,1 points

❌ Au prix d’une perte annuelle de 0,16 pt de croissance

❌ Et d’une hausse des inégalités

✅ Réduire la dette de 10,1 points

❌ Au prix d’une perte annuelle de 0,16 pt de croissance

❌ Et d’une hausse des inégalités

À lire ici 👉 i-mip.eu/wp-content/u...

Et à partager si ces sujets vous intéressent !

À lire ici 👉 i-mip.eu/wp-content/u...

Et à partager si ces sujets vous intéressent !

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...

The latest Macroeconomic Outlook is online 👉 www.cepremap.fr/depot/2025/0...