#Startups #VC #SAFEs

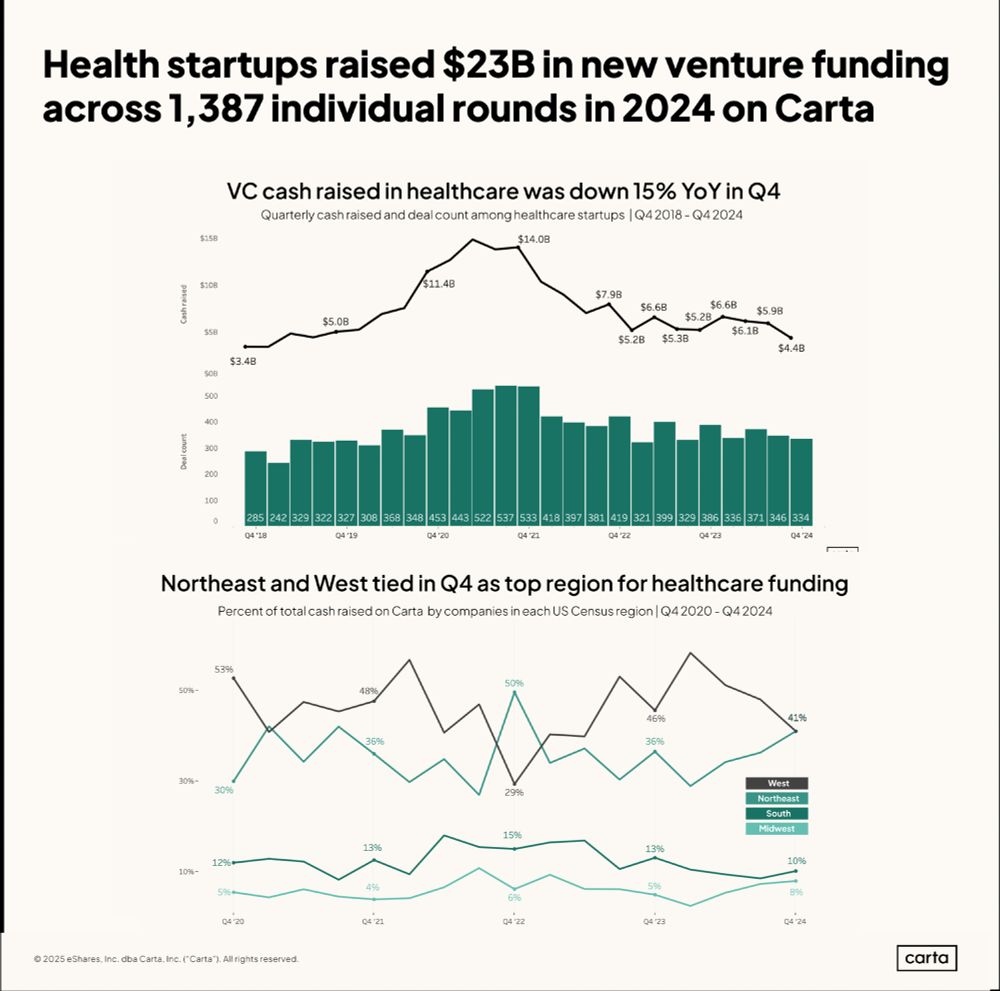

Healthcare spotlight released today: carta.com/data #Healthcare #Startups #Carta

Healthcare spotlight released today: carta.com/data #Healthcare #Startups #Carta

Read more in Carta’s 2024 VC Fund Performance Report. z.carta.com/3QODdY0

Read more in Carta’s 2024 VC Fund Performance Report. z.carta.com/3QODdY0

between Jan '22 and Jan '24, new monthly hires declined by more than 50%. In 2024, startups on Carta's platform made 1.06 hires for every departure, down from 1.75 in 2022.

Join Ashley for our webinar on Wednesday at 10am PST. z.carta.com/4l1v00o

between Jan '22 and Jan '24, new monthly hires declined by more than 50%. In 2024, startups on Carta's platform made 1.06 hires for every departure, down from 1.75 in 2022.

Join Ashley for our webinar on Wednesday at 10am PST. z.carta.com/4l1v00o