Never mind retirement, for almost everyone of working age it's entirely unachievable. Col below on the lifestyles we want vs what we can attain

inews.co.uk/inews-lifest...

Never mind retirement, for almost everyone of working age it's entirely unachievable. Col below on the lifestyles we want vs what we can attain

inews.co.uk/inews-lifest...

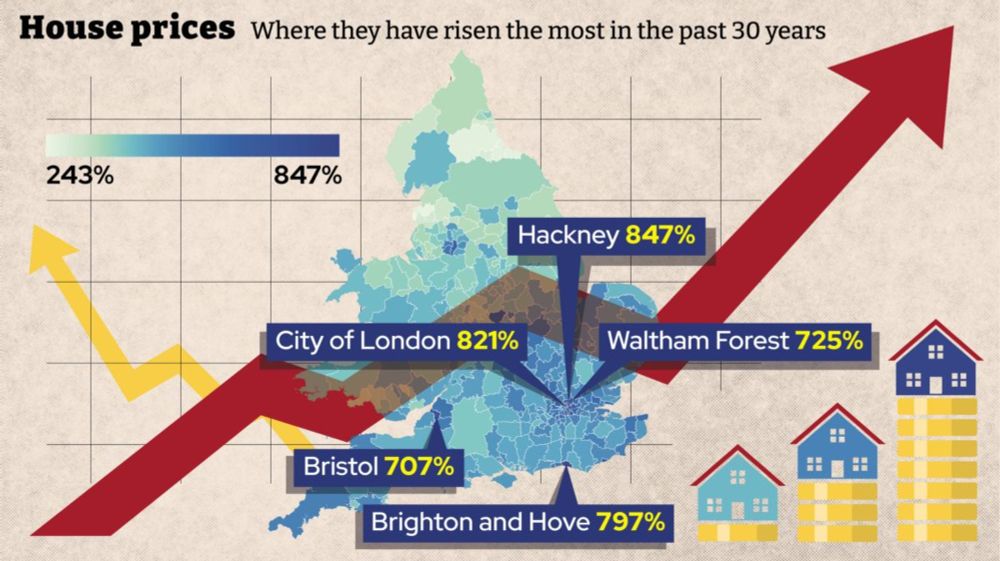

& Savills - a look at house prices at a local level and how they've changed over the past three decades, with some areas seeing 800% growth.

@callumcmason.bsky.social reports

& Savills - a look at house prices at a local level and how they've changed over the past three decades, with some areas seeing 800% growth.

United Learning, the country's biggest academy chain, planned to launch the scheme in April, but will not go ahead after a DfE intervention. inews.co.uk/inews-lifest...

United Learning, the country's biggest academy chain, planned to launch the scheme in April, but will not go ahead after a DfE intervention. inews.co.uk/inews-lifest...

United Learning, the country's biggest academy chain, planned to launch the scheme in April, but will not go ahead after a DfE intervention. inews.co.uk/inews-lifest...

United Learning, the country's biggest academy chain, planned to launch the scheme in April, but will not go ahead after a DfE intervention. inews.co.uk/inews-lifest...

Experts say that trying to play the markets is "fraught with danger" inews.co.uk/inews-lifest...

Experts say that trying to play the markets is "fraught with danger" inews.co.uk/inews-lifest...

I spoke to experts on just how tough it would be, and the negative consequences it could have.

inews.co.uk/inews-lifest...

I spoke to experts on just how tough it would be, and the negative consequences it could have.

inews.co.uk/inews-lifest...

Looking pretty certain that one of them, Bank of America, will be spot on. First cut was in August and barring a miracle we'll end the year on 4.75%.

Looking pretty certain that one of them, Bank of America, will be spot on. First cut was in August and barring a miracle we'll end the year on 4.75%.

Part of the rise was expected, because of the increase in energy prices, but these are always volatile.

Majority of economists expected 'core' inflation to fall, but it's risen too. inews.co.uk/inews-lifest...

Part of the rise was expected, because of the increase in energy prices, but these are always volatile.

Majority of economists expected 'core' inflation to fall, but it's risen too. inews.co.uk/inews-lifest...

They’re also set to face a reduction in the value of homes they can buy without facing stamp duty from next year.

inews.co.uk/inews-lifest...

They’re also set to face a reduction in the value of homes they can buy without facing stamp duty from next year.

inews.co.uk/inews-lifest...

(Follower count predicted to balloon after this so get in early).

(Follower count predicted to balloon after this so get in early).