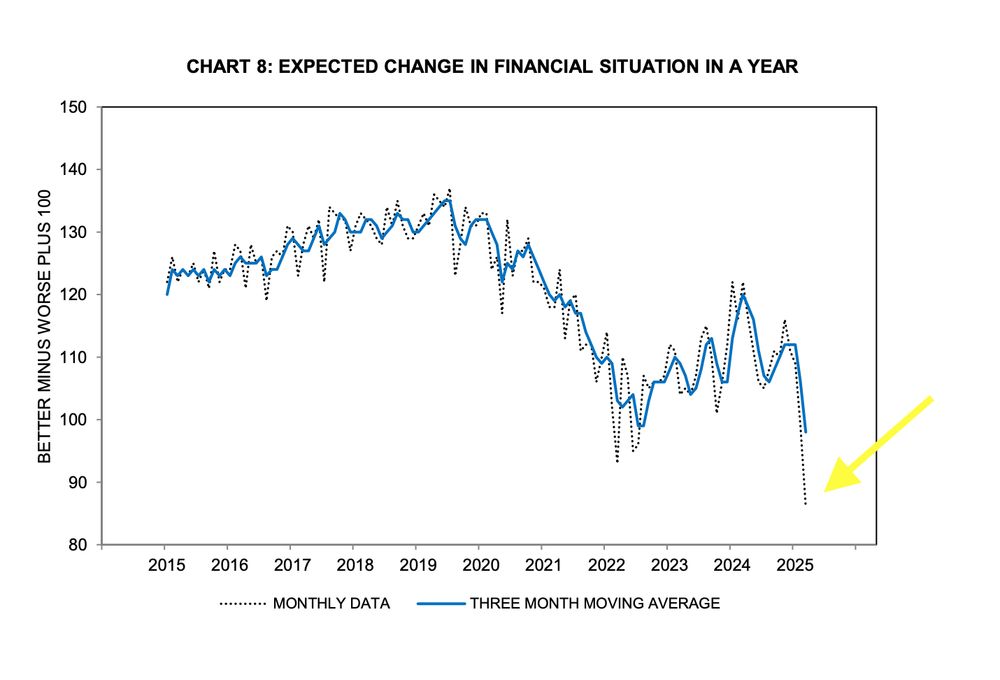

We've never seen anything like this before. Not even in the Great Recession or stagflation era (31% thought they would be worse off in 1 yr in early 1980)

via Uof Michigan Survey of Consumers

We've never seen anything like this before. Not even in the Great Recession or stagflation era (31% thought they would be worse off in 1 yr in early 1980)

via Uof Michigan Survey of Consumers

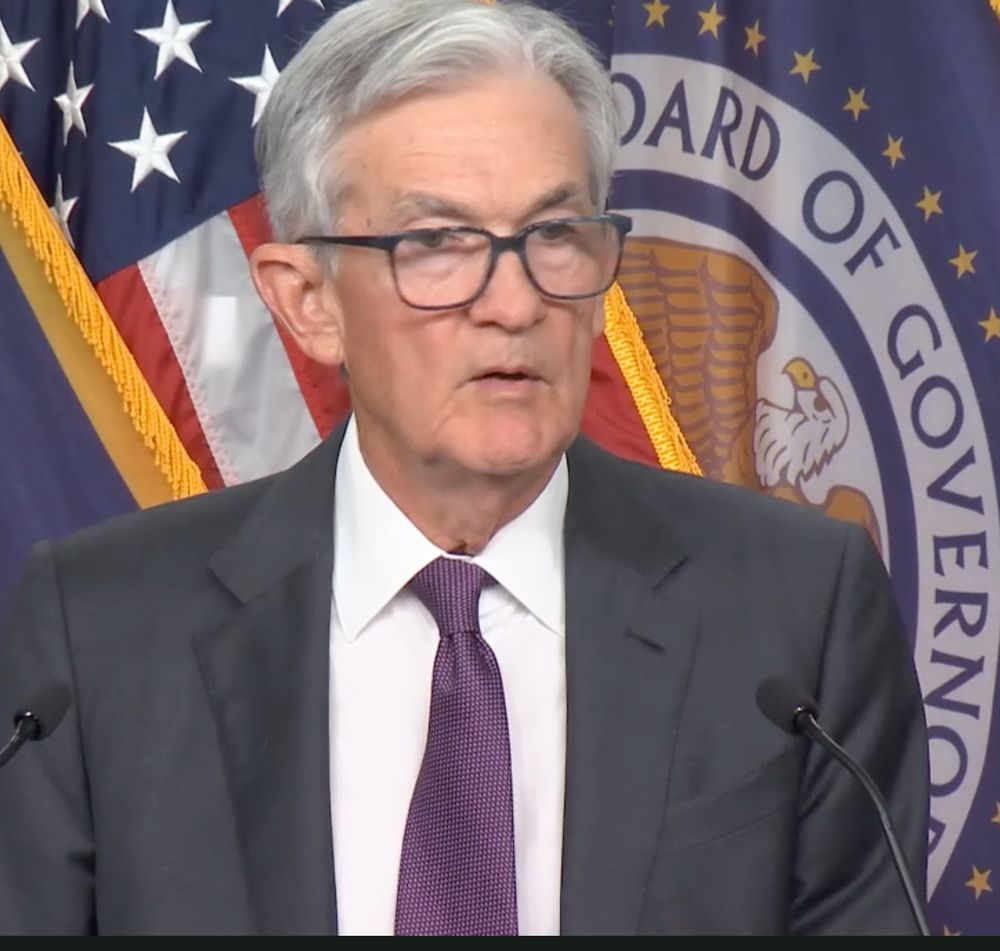

1) Recession risk "has moved up, but it’s not high."

2) Don't expect May rate cut. "We’re not going to be in any hurry to move"

3) "Uncertainty is remarkably high" he says over and over

4) Fed is watching big drop in sentiment, but "the hard data are pretty solid"

1) Recession risk "has moved up, but it’s not high."

2) Don't expect May rate cut. "We’re not going to be in any hurry to move"

3) "Uncertainty is remarkably high" he says over and over

4) Fed is watching big drop in sentiment, but "the hard data are pretty solid"

Kathryn doesn't just talk about problems; She puts forward ideas to solve them.

Her work is inspiring and I always leave w/new takeaways

podcasts.apple.com/us/podcast/o...

Kathryn doesn't just talk about problems; She puts forward ideas to solve them.

Her work is inspiring and I always leave w/new takeaways

podcasts.apple.com/us/podcast/o...

How Trump is reshaping reality by hiding data

"The Trump administration is deleting taxpayer-funded data — information that Americans use to make sense of the world."

www.washingtonpost.com/opinions/int...

How Trump is reshaping reality by hiding data

"The Trump administration is deleting taxpayer-funded data — information that Americans use to make sense of the world."

www.washingtonpost.com/opinions/int...

James Nelson at the #SABEW25 conference.

There's much to discuss!

Join us at this great event for business and economic journalists, journalism students and PR professionals.

James Nelson at the #SABEW25 conference.

There's much to discuss!

Join us at this great event for business and economic journalists, journalism students and PR professionals.

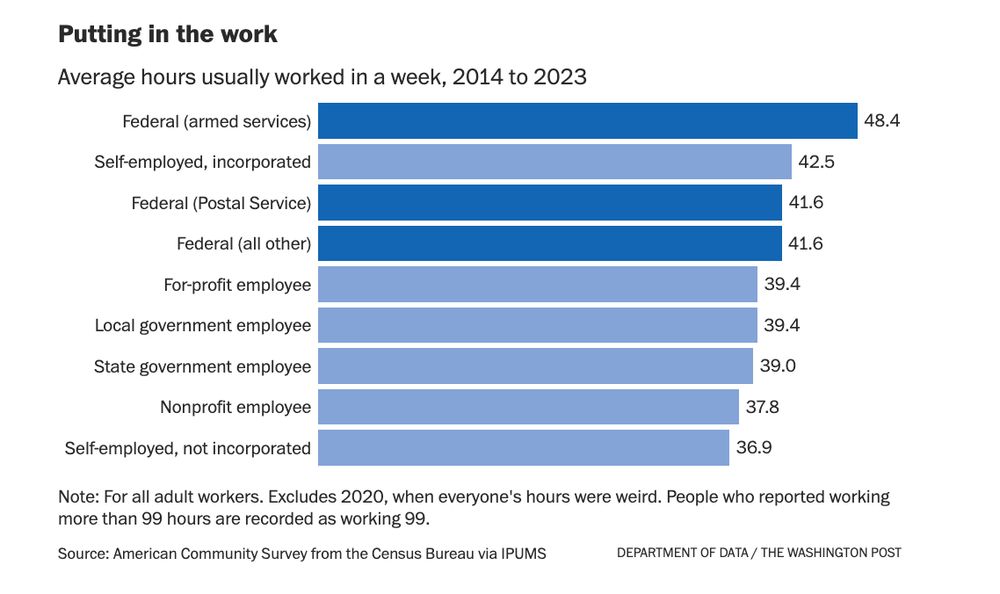

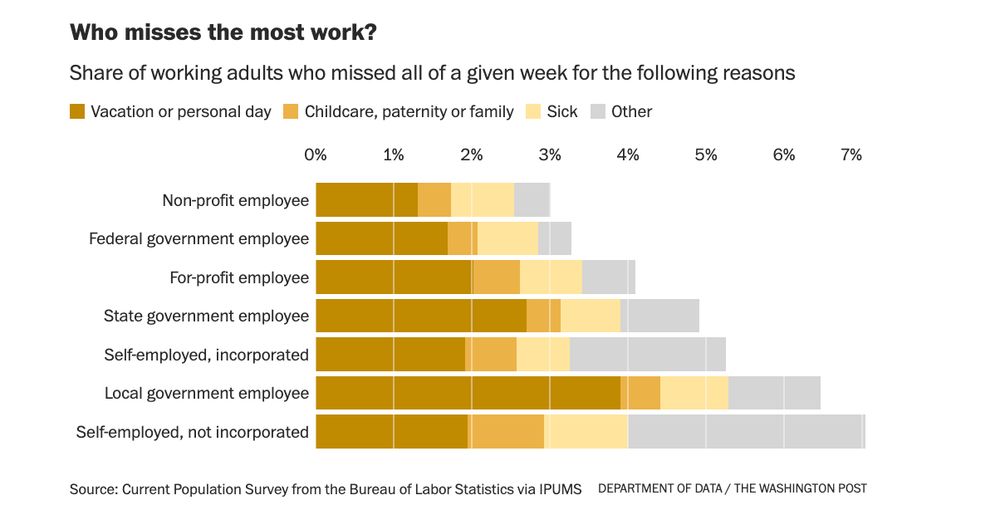

But it's striking to see the data.

Federal workers put in more hours a week than anyone except military and self-employed.

Federal workers take fewer days off than almost any others

www.washingtonpost.com/business/202...

But it's striking to see the data.

Federal workers put in more hours a week than anyone except military and self-employed.

Federal workers take fewer days off than almost any others

www.washingtonpost.com/business/202...

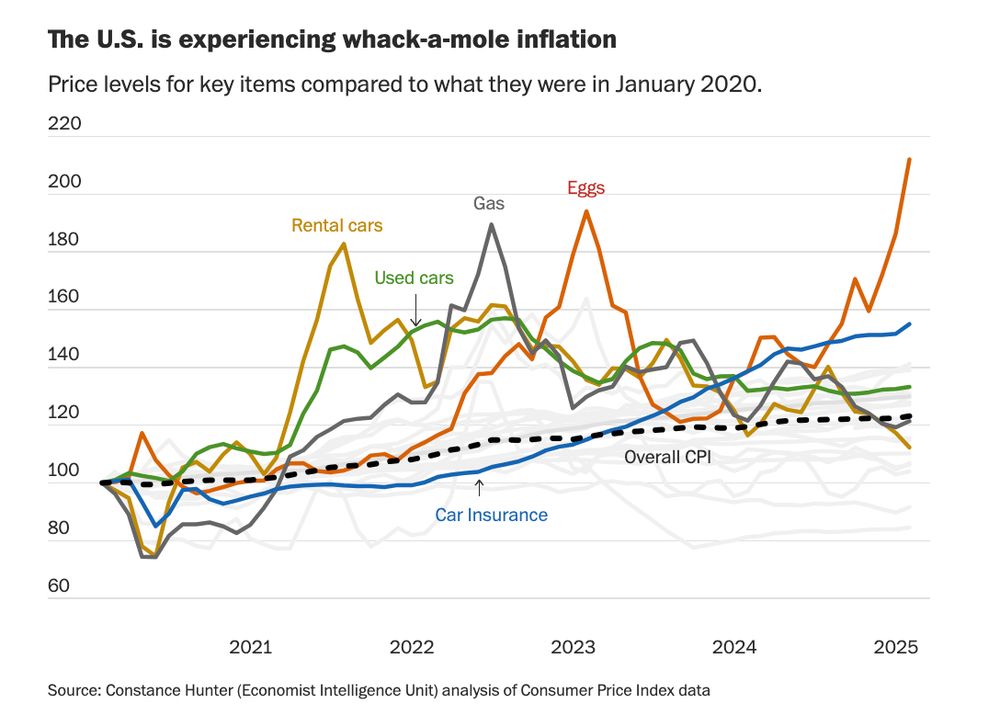

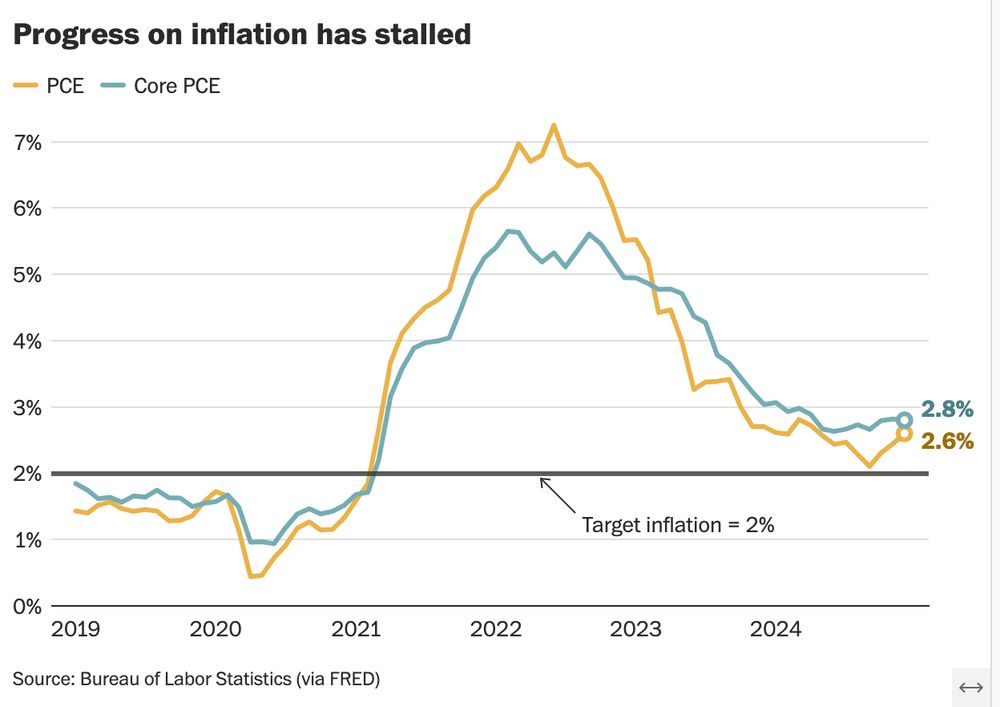

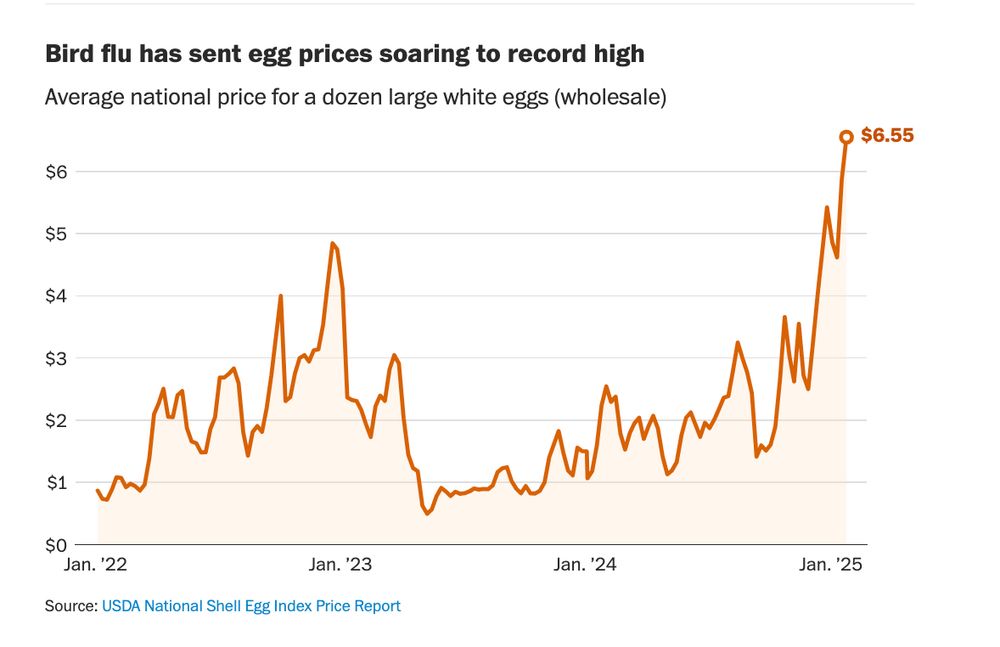

We've been experiencing what I call "whack-a-mole" inflation. There have been many eye-popping spikes (i.e. eggs). This has a deep psychological impact. They fear what will spike next.

This backdrop makes Trump's tariffs even worse

www.washingtonpost.com/opinions/202...

We've been experiencing what I call "whack-a-mole" inflation. There have been many eye-popping spikes (i.e. eggs). This has a deep psychological impact. They fear what will spike next.

This backdrop makes Trump's tariffs even worse

www.washingtonpost.com/opinions/202...

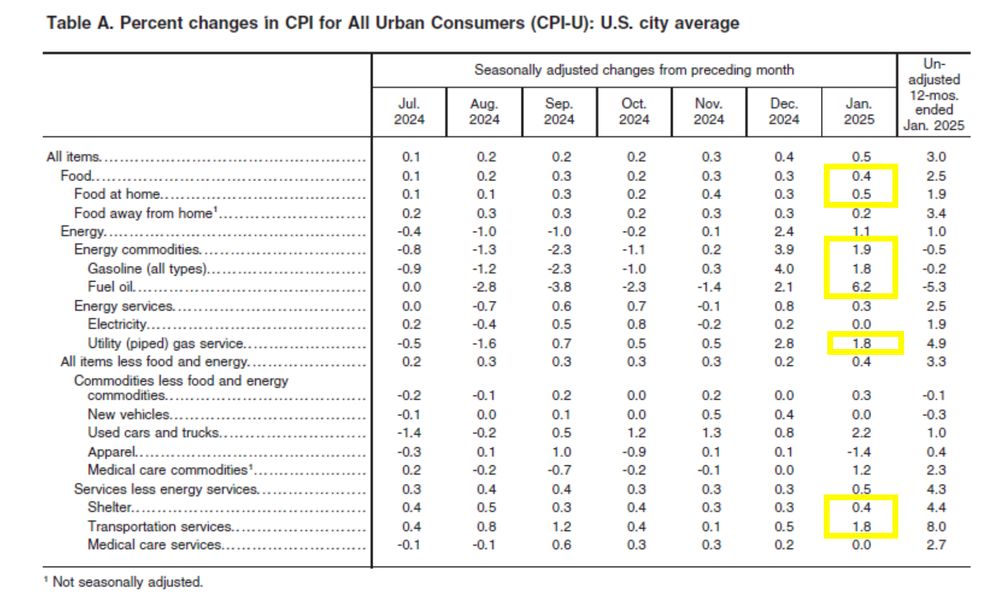

Why?

-Gas prices up

-Energy/utility prices up

-Food prices (esp. groceries) up

-Transportation costs up

-Rent still rising (albeit much more slowly now)

Why?

-Gas prices up

-Energy/utility prices up

-Food prices (esp. groceries) up

-Transportation costs up

-Rent still rising (albeit much more slowly now)

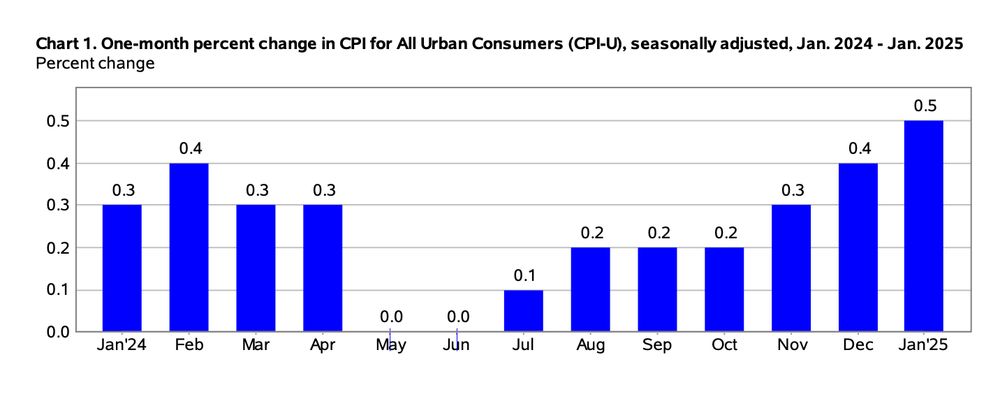

Rent made up 30% of the increase. Gas and food also contributed.

"Core CPI," which excludes food and gas, rose 3.3%. Core CPI has basically stalled since June.

Rent made up 30% of the increase. Gas and food also contributed.

"Core CPI," which excludes food and gas, rose 3.3%. Core CPI has basically stalled since June.

Trump said Friday there is nothing Canada, Mexico and China can do to stop it.

1) Tariffs will be enacted on Feb. 1

2) Tariffs on oil and gas by Feb. 18

3) Oil tariff could be 10%

4) He said there "absolutely" will be tariffs on Europe, too.

Trump said Friday there is nothing Canada, Mexico and China can do to stop it.

1) Tariffs will be enacted on Feb. 1

2) Tariffs on oil and gas by Feb. 18

3) Oil tariff could be 10%

4) He said there "absolutely" will be tariffs on Europe, too.

Those payment systems distribute ~$6 trillion in US gov't payments.

Only a few people are supposed to have access to that payment system.

Those payment systems distribute ~$6 trillion in US gov't payments.

Only a few people are supposed to have access to that payment system.

PCE inflation was up 2.6% in 2024. PCE excluding food and energy was up 2.8%. Both metrics have risen slightly since the summer.

Now President Trump is about to add tariffs on Mexico and Canada that will almost certainly raise prices.

PCE inflation was up 2.6% in 2024. PCE excluding food and energy was up 2.8%. Both metrics have risen slightly since the summer.

Now President Trump is about to add tariffs on Mexico and Canada that will almost certainly raise prices.

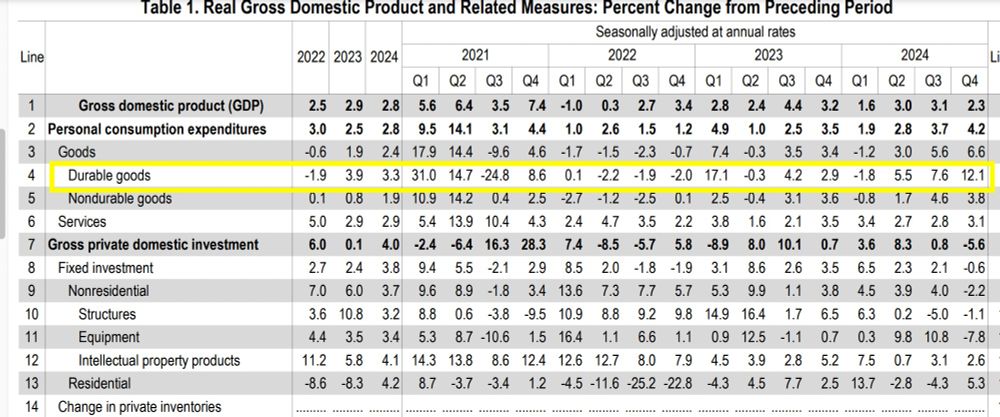

Was that people trying to get ahead of tariffs??

We heard many anecdotes about that happening, but it's striking to see a 12.1% surge in durable goods in Q4.

Was that people trying to get ahead of tariffs??

We heard many anecdotes about that happening, but it's striking to see a 12.1% surge in durable goods in Q4.

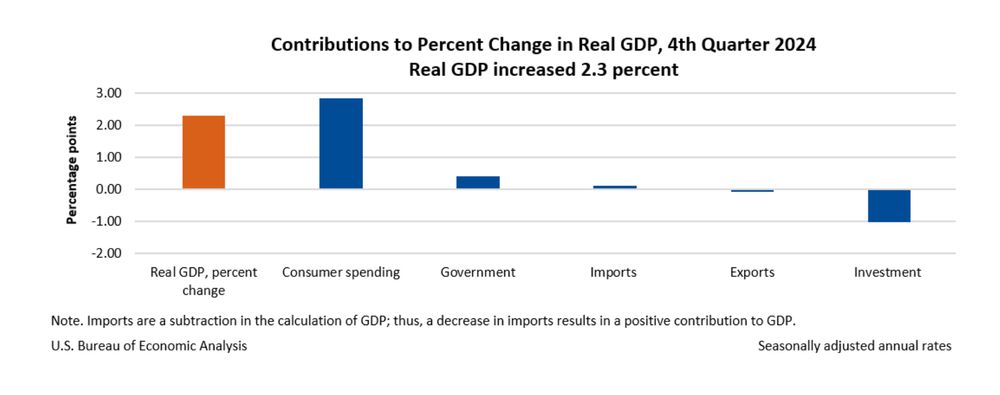

US consumer spending is driving almost all the growth. Gov't is a very small contributor now.

Note: Biz investment was a drag on Q4 GDP (due to a big decline in equipment purchases). We want to see this pick up in 2025.

US consumer spending is driving almost all the growth. Gov't is a very small contributor now.

Note: Biz investment was a drag on Q4 GDP (due to a big decline in equipment purchases). We want to see this pick up in 2025.

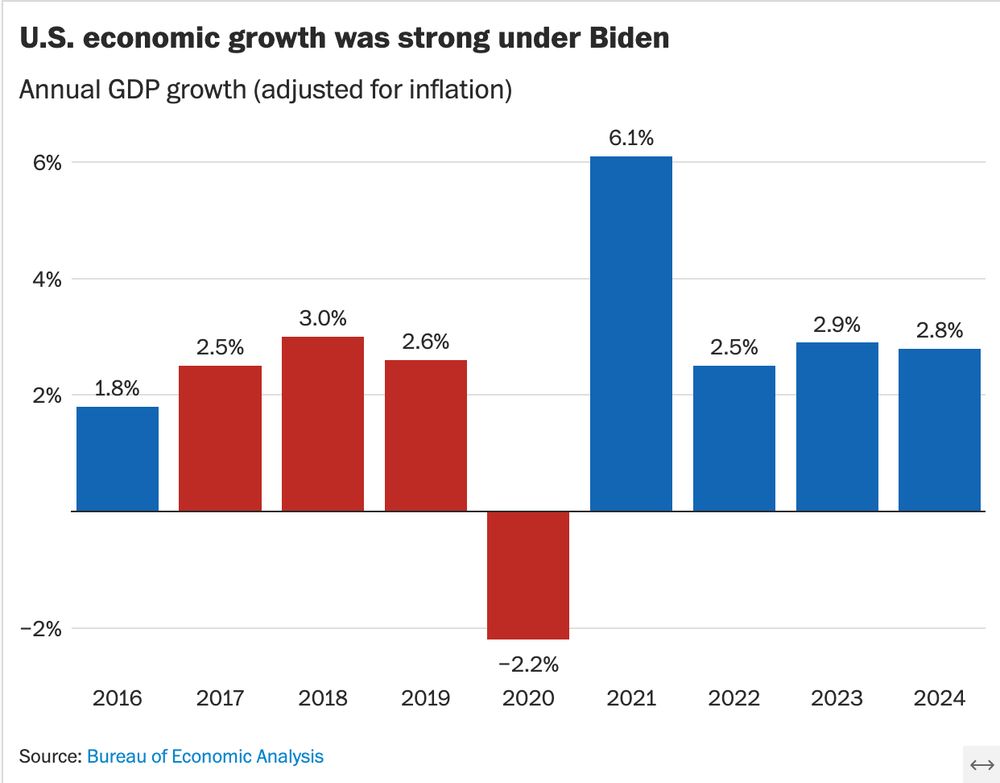

President Trump inherited a very good economy.

Q4 growth was 2.3%, driven mainly by strong consumer spending.

GDP growth under Biden (adj. for inflation)

6.1% in 2021

2.5% in 2022

2.9% in 2023

2.8% in 2024

President Trump inherited a very good economy.

Q4 growth was 2.3%, driven mainly by strong consumer spending.

GDP growth under Biden (adj. for inflation)

6.1% in 2021

2.5% in 2022

2.9% in 2023

2.8% in 2024

[Remember in Davos last week Trump demanded that interest rates should decline in the US -- and around the world ]

[Remember in Davos last week Trump demanded that interest rates should decline in the US -- and around the world ]

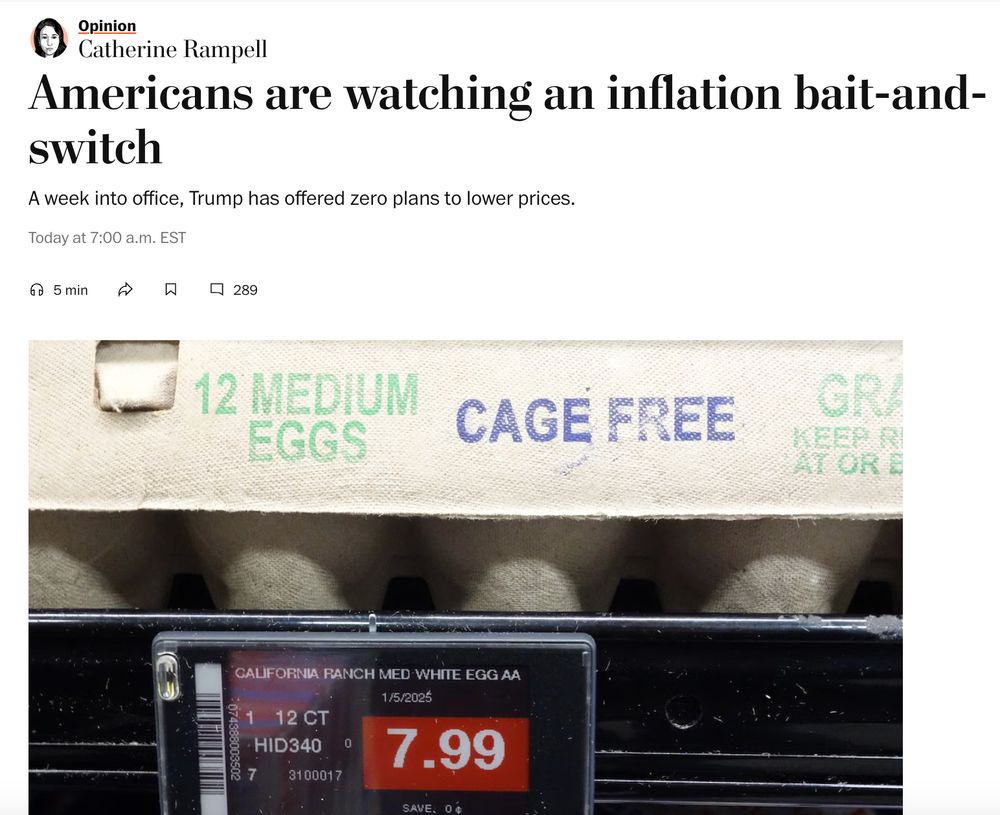

"Americans are watching an inflation bait-and-switch"

Trump promised to bring down prices on Day 1

"A week into office, he has offered zero plans to do so," Rampell says. "Worse, he has undertaken a litany of measures that would raise the cost of living."

"Americans are watching an inflation bait-and-switch"

Trump promised to bring down prices on Day 1

"A week into office, he has offered zero plans to do so," Rampell says. "Worse, he has undertaken a litany of measures that would raise the cost of living."

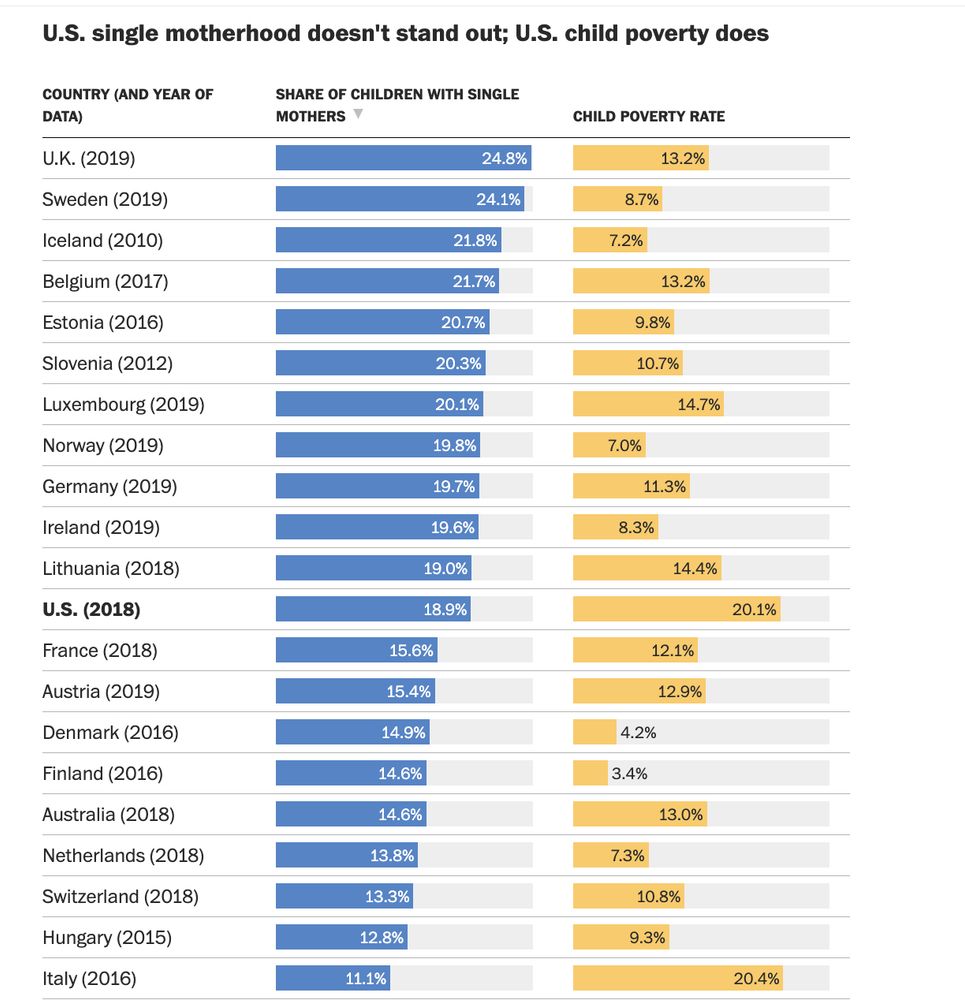

The US share of single moms (19%) is actually pretty similar to many other advanced economy nations.

What is different? = US child poverty (20%) is way higher than other nations.

From @andrewvandam.bsky.social

www.washingtonpost.com/business/202...

The US share of single moms (19%) is actually pretty similar to many other advanced economy nations.

What is different? = US child poverty (20%) is way higher than other nations.

From @andrewvandam.bsky.social

www.washingtonpost.com/business/202...

www.washingtonpost.com/opinions/202...

www.washingtonpost.com/opinions/202...

Hiring right now is anemic (esp. outside healthcare & gov)

People aren't moving

Promotions and bonuses are down

People even keep cars for record time

People feel cemented in place. That's tough if you don't like your current job or home.

Hiring right now is anemic (esp. outside healthcare & gov)

People aren't moving

Promotions and bonuses are down

People even keep cars for record time

People feel cemented in place. That's tough if you don't like your current job or home.

for the first time since May.

Freddic Mac says the average rate is 7.04%

This is one of the least affordable times to buy a home in the past 40 years. It's a big problem for the US, esp. Millennials and Gen Z.

for the first time since May.

Freddic Mac says the average rate is 7.04%

This is one of the least affordable times to buy a home in the past 40 years. It's a big problem for the US, esp. Millennials and Gen Z.

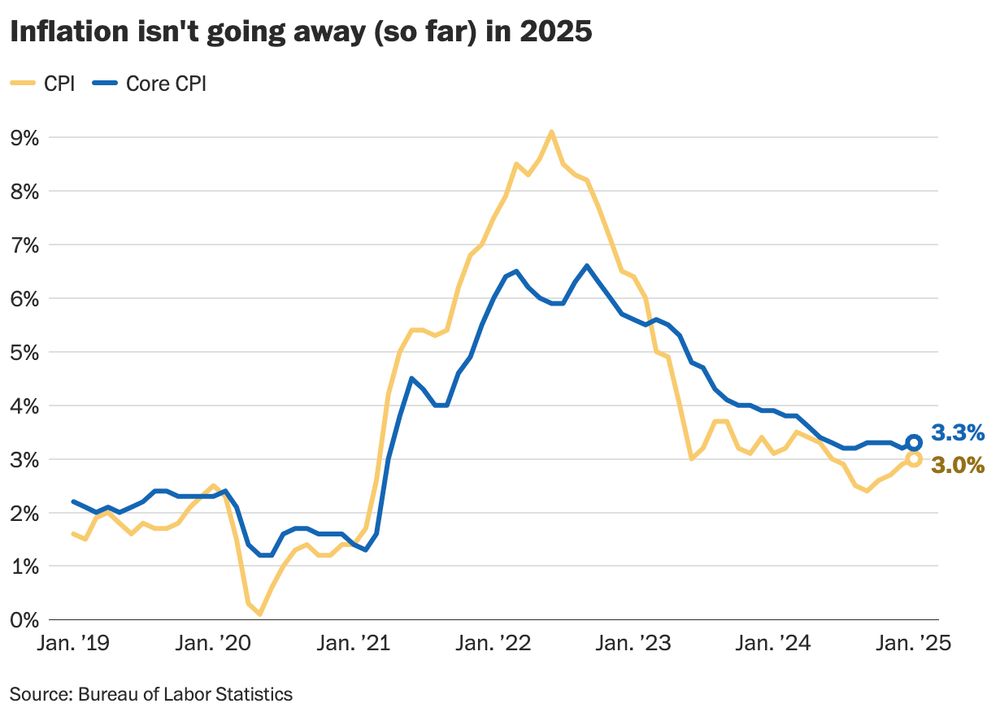

The Fed's goal = 2%

"Core inflation" down in December, but that's not much comfort to the middle class.

Bottom line: It's going to be a battle in 2025 to get inflation fully gone. This is a warning to Trump as he readies tariffs and big tax cuts

The Fed's goal = 2%

"Core inflation" down in December, but that's not much comfort to the middle class.

Bottom line: It's going to be a battle in 2025 to get inflation fully gone. This is a warning to Trump as he readies tariffs and big tax cuts

For the month of December alone, inflation rose 0.4% —> the highest since March. Energy (esp. gas) accounted for 40% of the increase. Food also up.

Core CPI rose 3.2% (y/y).

For the month of December alone, inflation rose 0.4% —> the highest since March. Energy (esp. gas) accounted for 40% of the increase. Food also up.

Core CPI rose 3.2% (y/y).

(Note: US Customs and Border Protection currently collects tariffs and duties as goods enter the USA).

(Note: US Customs and Border Protection currently collects tariffs and duties as goods enter the USA).

Normally the Sahm Rule is triggered and it keeps going up as a recession becomes clearer.

This time? It's coming back down.

December level = 0.4

Normally the Sahm Rule is triggered and it keeps going up as a recession becomes clearer.

This time? It's coming back down.

December level = 0.4