Important disclosure information: http://bit.ly/MRS0818

It's good to see cheap versions of popular ETFs in the top 10 by inflows: $SPLG and $QQQM. Long-term investors will benefit from the cost savings.

It's good to see cheap versions of popular ETFs in the top 10 by inflows: $SPLG and $QQQM. Long-term investors will benefit from the cost savings.

Four of the five largest fund families were among the five cheapest in 2024, with Dimensional the cheapest provider outside the five biggest firms.

4/5

Four of the five largest fund families were among the five cheapest in 2024, with Dimensional the cheapest provider outside the five biggest firms.

4/5

3/5

3/5

2/5

2/5

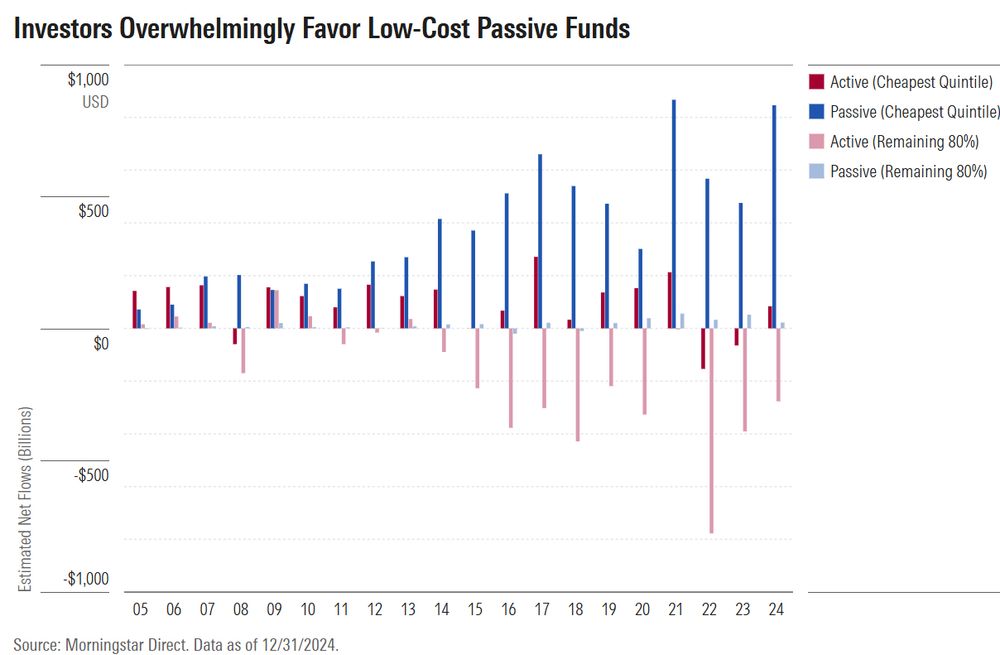

We estimate that investors saved $5.9 billion in fund expenses last year compared to 2023.

My colleague, Zachary Evens, analyzed the fee trends shaping the fund industry and explains what they mean for investors.

1/5

We estimate that investors saved $5.9 billion in fund expenses last year compared to 2023.

My colleague, Zachary Evens, analyzed the fee trends shaping the fund industry and explains what they mean for investors.

1/5

We’re proud to announce we're extending our Medalist Rating to cover these vehicles, helping investors make sense of the options.

We’re proud to announce we're extending our Medalist Rating to cover these vehicles, helping investors make sense of the options.

Check out the link for more!

https://www.morningstar.com/funds/how-etf-diversifiers-performed-during-market-turmoil

Check out the link for more!

https://www.morningstar.com/funds/how-etf-diversifiers-performed-during-market-turmoil

$SPY and $VOO were the main beneficiaries, while bond investors rotated out of credit risk into Treasuries and ultrashort bond ETFs.

http://spr.ly/63327FLUPf

$SPY and $VOO were the main beneficiaries, while bond investors rotated out of credit risk into Treasuries and ultrashort bond ETFs.

http://spr.ly/63327FLUPf

Leverage resets daily, so the ETF buys more when prices go up and sells when they go down. This is known as volatility decay. More vol = faster decay. Over its short lifetime, $TSLL has lost 55% while $TSLA has lost 4%.

Leverage resets daily, so the ETF buys more when prices go up and sells when they go down. This is known as volatility decay. More vol = faster decay. Over its short lifetime, $TSLL has lost 55% while $TSLA has lost 4%.