I’ll be posting additional details of this analysis on RFF’s web site later this week--stay tuned!

I’ll be posting additional details of this analysis on RFF’s web site later this week--stay tuned!

In the meantime, I'm looking forward to presenting this work at this summer's @aereorg.bsky.social conference! See you in New Mexico!

end/11

In the meantime, I'm looking forward to presenting this work at this summer's @aereorg.bsky.social conference! See you in New Mexico!

end/11

10/11

10/11

I estimate each +1 Bcf/d of gas exports is likely to increase US natural gas prices by about 2.5%.

9/11

I estimate each +1 Bcf/d of gas exports is likely to increase US natural gas prices by about 2.5%.

9/11

This suggests that past US crude oil exports have induced larger annual US methane emissions than what would be expected from 20 Bcf/d of additional gas exports!

8/11

This suggests that past US crude oil exports have induced larger annual US methane emissions than what would be expected from 20 Bcf/d of additional gas exports!

8/11

7/11

7/11

6/11

6/11

I find that each +1 billion cubic feet per day (Bcf/d) of additional gas exports (~1% of today's US production) comes disproportionately from the low-leak Appalachia, where drilling is more sensitive to gas prices than oil prices.

5/11

I find that each +1 billion cubic feet per day (Bcf/d) of additional gas exports (~1% of today's US production) comes disproportionately from the low-leak Appalachia, where drilling is more sensitive to gas prices than oil prices.

5/11

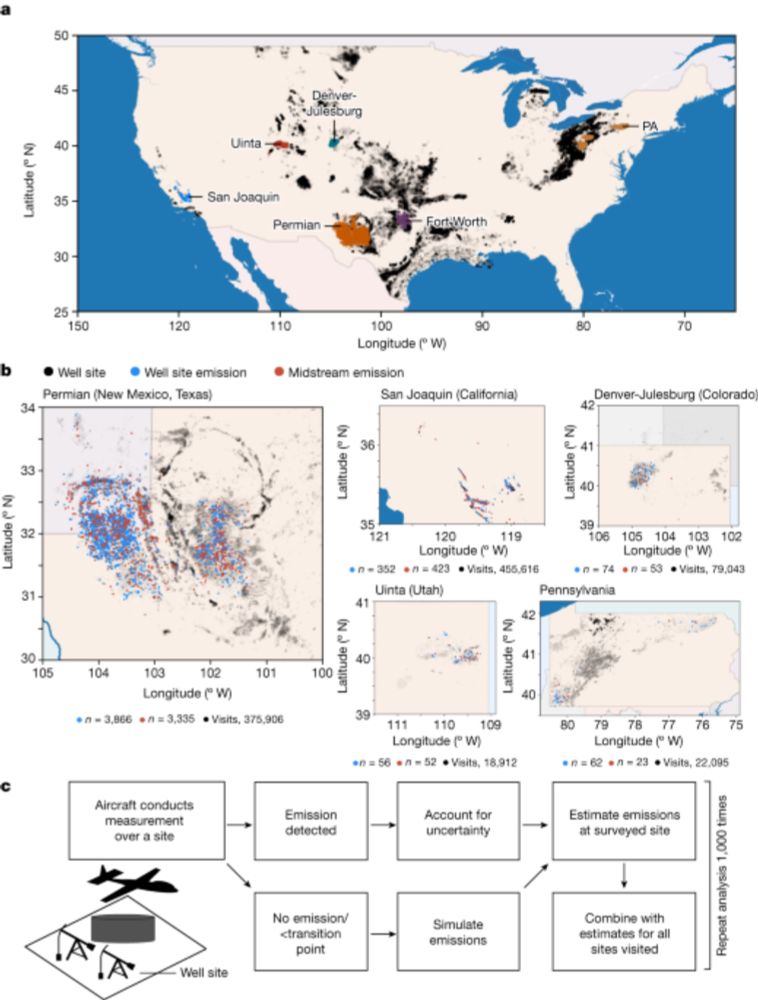

1) Appalachia, where methane leak rates are low (<1%) since companies drill for the gas,

and

2) the Permian basin, where gas is largely a byproduct of oil production, and leak rates are high (>5% average per Sherwin) amid less incentive to capture it.

4/11

1) Appalachia, where methane leak rates are low (<1%) since companies drill for the gas,

and

2) the Permian basin, where gas is largely a byproduct of oil production, and leak rates are high (>5% average per Sherwin) amid less incentive to capture it.

4/11

Sherwin (2024, Nature) found huge variation across the US in this leak rate, ranging from under 1% to above 9%!

3/11

Sherwin (2024, Nature) found huge variation across the US in this leak rate, ranging from under 1% to above 9%!

3/11

2/11

2/11