Ben Lockwood

@benlockwood.com

Business Economics and Public Policy prof at Wharton. Optimal taxation, inequality, and behavioral economics.

benlockwood.com

bepp.wharton.upenn.edu/profile/benlo/

benlockwood.com

bepp.wharton.upenn.edu/profile/benlo/

That really does ruin it. Especially the 0.5.

May 5, 2025 at 4:26 PM

That really does ruin it. Especially the 0.5.

What do you think of this exercise as a commentary on whether the methods are trustworthy, rather than on the truth of the implied conclusion? (This reminds me a bit of the height tax paper and its authors’ differing interpretations of it.)

May 2, 2025 at 6:38 PM

What do you think of this exercise as a commentary on whether the methods are trustworthy, rather than on the truth of the implied conclusion? (This reminds me a bit of the height tax paper and its authors’ differing interpretations of it.)

Direct File’s future is in doubt as this administration evaluates whether the renew it. I hope they do. Taxpayers say it makes filing easier and more efficient. If the administration allows the program to scale up, it will get credit for that improvement. (Not to mention the boost to GDP.)

March 13, 2025 at 8:23 PM

Direct File’s future is in doubt as this administration evaluates whether the renew it. I hope they do. Taxpayers say it makes filing easier and more efficient. If the administration allows the program to scale up, it will get credit for that improvement. (Not to mention the boost to GDP.)

Some say that the free filing options from private sources, like TurboTax, are enough. But this is one area where government is well placed to be more efficient—it has the information necessary to pre-fill tax returns. There’s a reason other countries do this in-house.

March 13, 2025 at 8:23 PM

Some say that the free filing options from private sources, like TurboTax, are enough. But this is one area where government is well placed to be more efficient—it has the information necessary to pre-fill tax returns. There’s a reason other countries do this in-house.

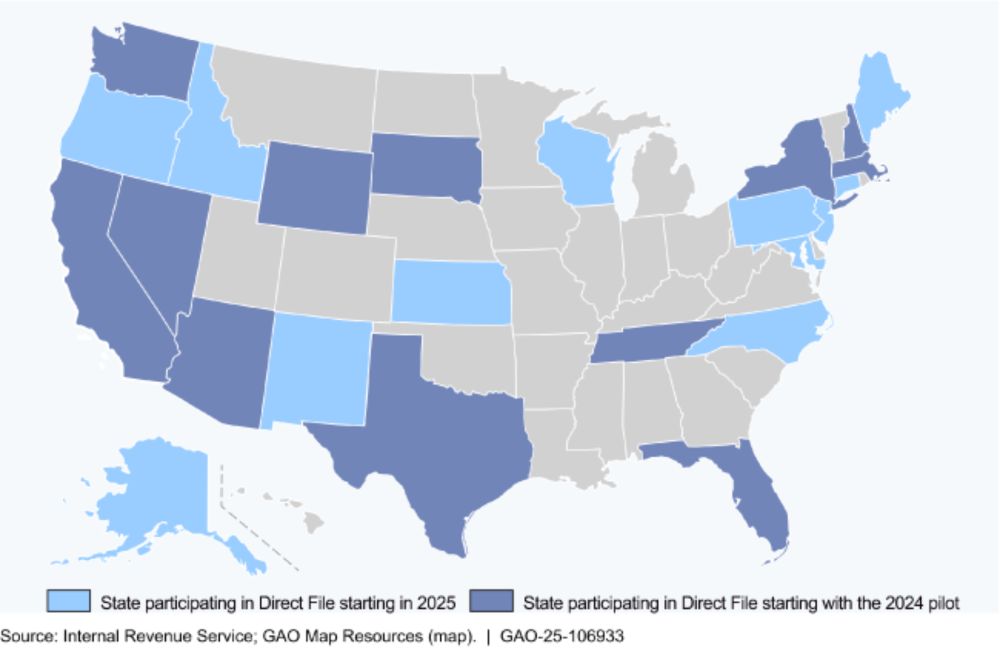

Direct File has been a big step toward making tax filing easier and more efficient. It has started small, with 12 states in 2024, and has expanded in scale (up to 25 states this year) and scope (supporting more tax situations, with plans to have more pre-filled information).

Direct File: IRS Successfully Piloted Online Tax Filing but Opportunities Exist to Expand Access

IRS is offering a new, free service to help taxpayers prepare and file tax returns electronically. It piloted Direct File in 2024 for taxpayers with...

www.gao.gov

March 13, 2025 at 8:23 PM

Direct File has been a big step toward making tax filing easier and more efficient. It has started small, with 12 states in 2024, and has expanded in scale (up to 25 states this year) and scope (supporting more tax situations, with plans to have more pre-filled information).

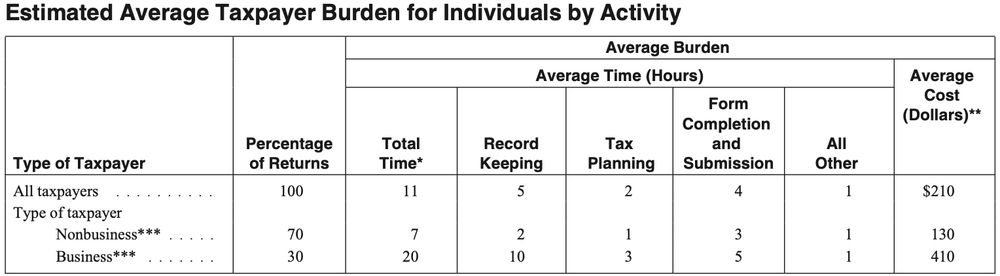

In contrast, the average American spends an estimated $210 and 11 hours to file their 1040 personal income tax return. Those are real costs—that time could be spent producing real goods and contributing to GDP. www.irs.gov/pub/irs-prio...

March 13, 2025 at 8:23 PM

In contrast, the average American spends an estimated $210 and 11 hours to file their 1040 personal income tax return. Those are real costs—that time could be spent producing real goods and contributing to GDP. www.irs.gov/pub/irs-prio...

Americans are often jealous (or incredulous) to find out that in many other countries it is trivially easy to file taxes—you receive a form pre-filled with info the government already knows about your tax situation. Denmark adopted this in the 1980s, and by 2020 most OECD countries had as well.

What are prepopulated tax returns?

taxpolicycenter.org

March 13, 2025 at 8:23 PM

Americans are often jealous (or incredulous) to find out that in many other countries it is trivially easy to file taxes—you receive a form pre-filled with info the government already knows about your tax situation. Denmark adopted this in the 1980s, and by 2020 most OECD countries had as well.

I like the urgency and thrill story. Not sure I believe discounts are simpler than stable prices. I can also believe this is highly heterogeneous—Johnson’s strategy came from his success at Apple retail, which has stable prices, but it fared terribly at JCP.

November 28, 2024 at 5:40 PM

I like the urgency and thrill story. Not sure I believe discounts are simpler than stable prices. I can also believe this is highly heterogeneous—Johnson’s strategy came from his success at Apple retail, which has stable prices, but it fared terribly at JCP.