Rather than trying to replicate his success, most investors should take Buffett's advice: Invest in low-cost index funds.

Rather than trying to replicate his success, most investors should take Buffett's advice: Invest in low-cost index funds.

"Both large and small investors should stick with low-cost index funds.”

"Both large and small investors should stick with low-cost index funds.”

Ten or so. In his lifetime. That’s something to think about. Buffett concludes this section of the 2016 letter with this:

Ten or so. In his lifetime. That’s something to think about. Buffett concludes this section of the 2016 letter with this:

He says “There are, of course, some skilled individuals who are highly likely to out-perform the S&P over long stretches."

He says “There are, of course, some skilled individuals who are highly likely to out-perform the S&P over long stretches."

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund."

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund."

"My money, I should add, is where my mouth is: What I advise here [low-cost index funds being sensible for most investors] is essentially identical to certain instructions I’ve laid out in my will."

"My money, I should add, is where my mouth is: What I advise here [low-cost index funds being sensible for most investors] is essentially identical to certain instructions I’ve laid out in my will."

After winning, he explained that he wanted to demonstrate that investors are not getting value from the high fees often paid for investment management, and are likely better-off with low-cost index funds.

After winning, he explained that he wanted to demonstrate that investors are not getting value from the high fees often paid for investment management, and are likely better-off with low-cost index funds.

He bet Protégé Partners that they couldn't pick funds that would beat an S&P 500 index fund over 10 years. They picked five funds-of-funds with over 200 underlying funds.

He bet Protégé Partners that they couldn't pick funds that would beat an S&P 500 index fund over 10 years. They picked five funds-of-funds with over 200 underlying funds.

Buffett agrees with me, and has for many years. In his 1996 letter to shareholders, he explains:

Buffett agrees with me, and has for many years. In his 1996 letter to shareholders, he explains:

Investors identify skilled managers based on performance, and allocate to them up to the point that they can no longer beat the market. doi.org/10.1086/424739

Investors identify skilled managers based on performance, and allocate to them up to the point that they can no longer beat the market. doi.org/10.1086/424739

Once it’s obvious that they are good managers, they run into the same problem of getting too large to continue their outperformance.

Once it’s obvious that they are good managers, they run into the same problem of getting too large to continue their outperformance.

The crux of the problem is well known: diminishing returns to scale. The larger an active manager’s base of assets gets, the harder it gets for them to outperform the market.

The crux of the problem is well known: diminishing returns to scale. The larger an active manager’s base of assets gets, the harder it gets for them to outperform the market.

He mentions that his best year was in 1954 when he was managing a relatively small amount of money, but that it’s gotten harder to outperform with larger amounts.

He mentions that his best year was in 1954 when he was managing a relatively small amount of money, but that it’s gotten harder to outperform with larger amounts.

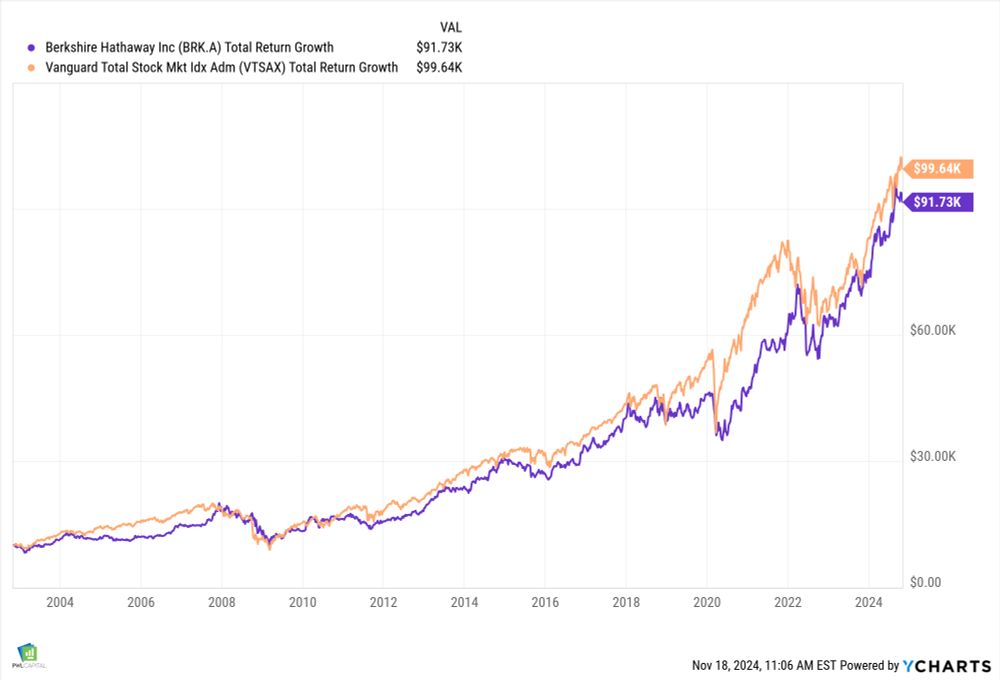

Buffett was asked about Berkshire’s underperformance at the 2020 shareholder meeting.

Buffett was asked about Berkshire’s underperformance at the 2020 shareholder meeting.

I don’t want to come off as disrespectful or dismissive. Buffett is a wealth of knowledge and wisdom, a pleasure to listen to and read, and his long-term success in undeniable.

I don’t want to come off as disrespectful or dismissive. Buffett is a wealth of knowledge and wisdom, a pleasure to listen to and read, and his long-term success in undeniable.

As the current Warren Buffett himself will tell you, he is no longer the obvious answer to beating the market, and he hasn’t been for a while.

As the current Warren Buffett himself will tell you, he is no longer the obvious answer to beating the market, and he hasn’t been for a while.

If you can find the next Warren Buffett, you should absolutely invest with them...

If you can find the next Warren Buffett, you should absolutely invest with them...