Andrew Antonino Ferrante

@andrewaferrante.bsky.social

Macroeconomic Analyst @IMF previously @FDIC | International Econ and Finance | Global Financial Stability | Market Surveillance | Views are my own

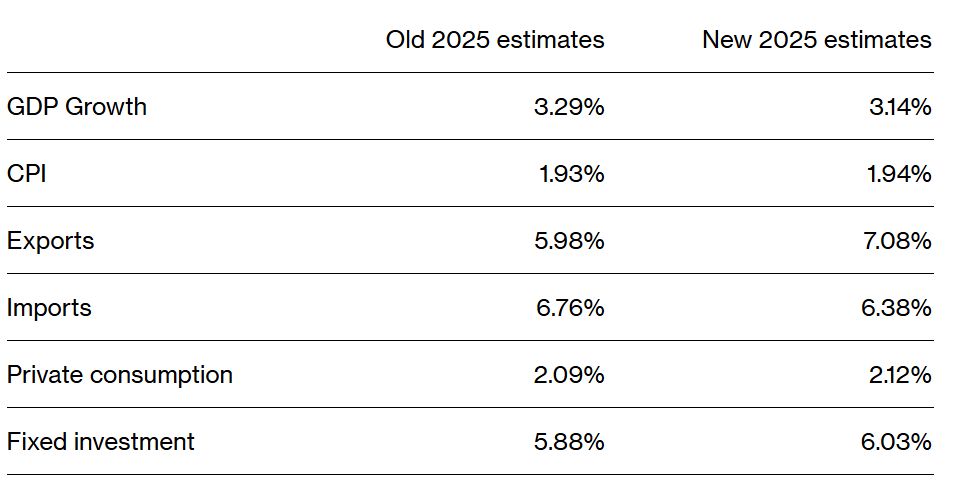

Taiwan lowered its 2025 GDP growth forecast to 3.14% from 3.29% due to concerns over US trade policies and domestic budget cuts. Despite these headwinds, exports are projected to grow by 7.08% in 2025, driven by demand for tech exports related to AI.

March 4, 2025 at 8:00 PM

Taiwan lowered its 2025 GDP growth forecast to 3.14% from 3.29% due to concerns over US trade policies and domestic budget cuts. Despite these headwinds, exports are projected to grow by 7.08% in 2025, driven by demand for tech exports related to AI.

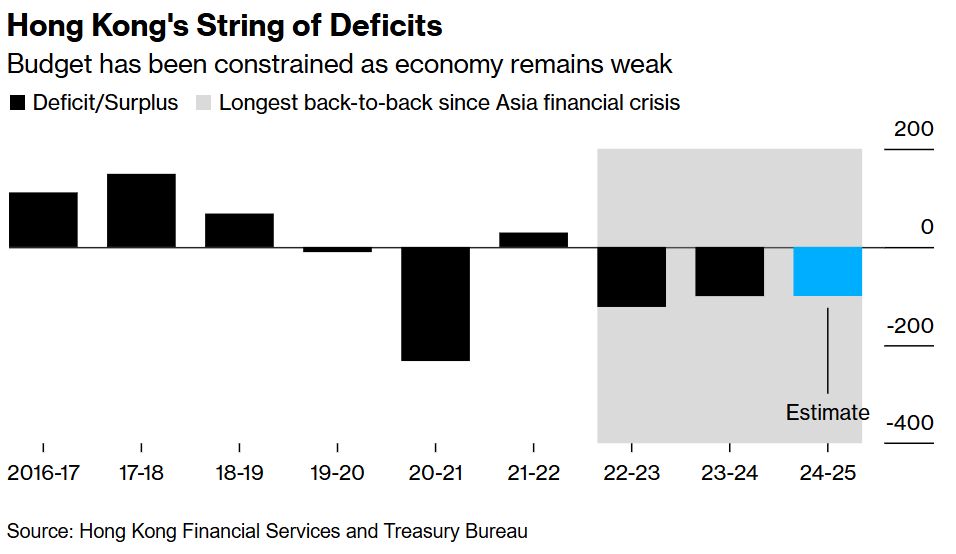

Hong Kong is facing its longest string of fiscal deficits in two decades, with a projected shortfall of $12.9 billion this year. The government is considering raising taxes on high earners, capping a transport subsidy for seniors, and legalizing basketball sports betting to increase capital.

March 4, 2025 at 7:00 PM

Hong Kong is facing its longest string of fiscal deficits in two decades, with a projected shortfall of $12.9 billion this year. The government is considering raising taxes on high earners, capping a transport subsidy for seniors, and legalizing basketball sports betting to increase capital.

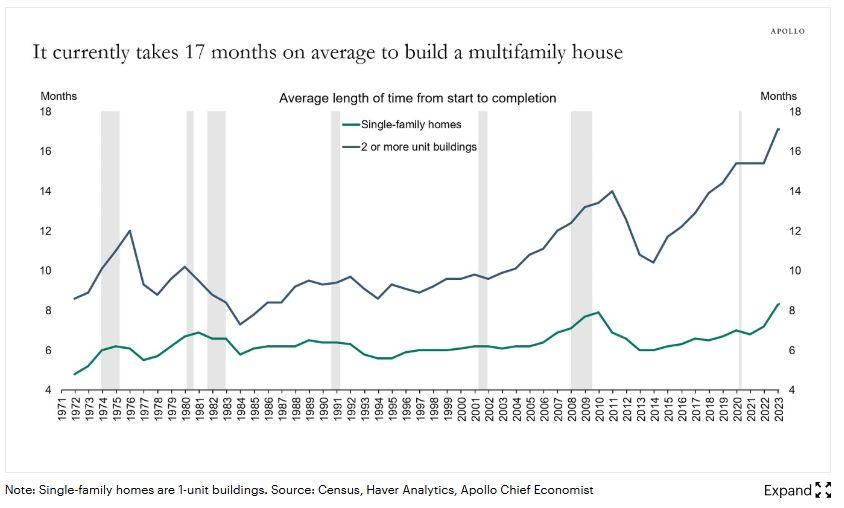

Completions of multifamily houses are expected to drop from 600k in 2024 to under 400k this year and next as the average time it takes to build increases

March 3, 2025 at 3:01 PM

Completions of multifamily houses are expected to drop from 600k in 2024 to under 400k this year and next as the average time it takes to build increases

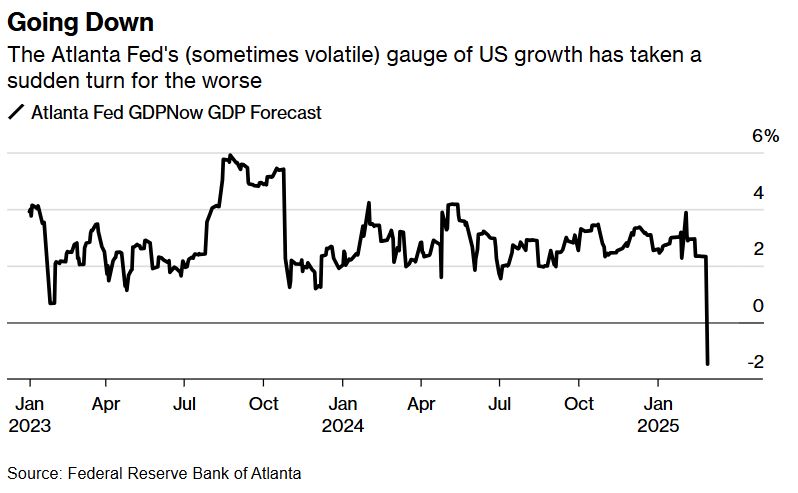

The Atlanta Fed's GDPNow Forecast nosedived on Friday after a pessimistic consumer confidence data print last week combined with slowing consumer spending

March 3, 2025 at 2:30 PM

The Atlanta Fed's GDPNow Forecast nosedived on Friday after a pessimistic consumer confidence data print last week combined with slowing consumer spending

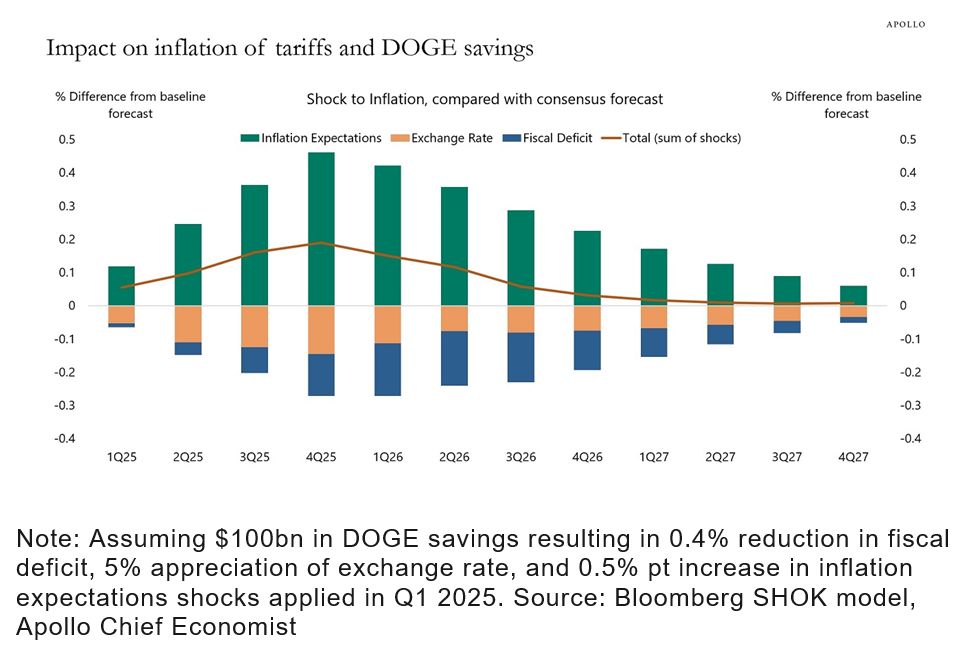

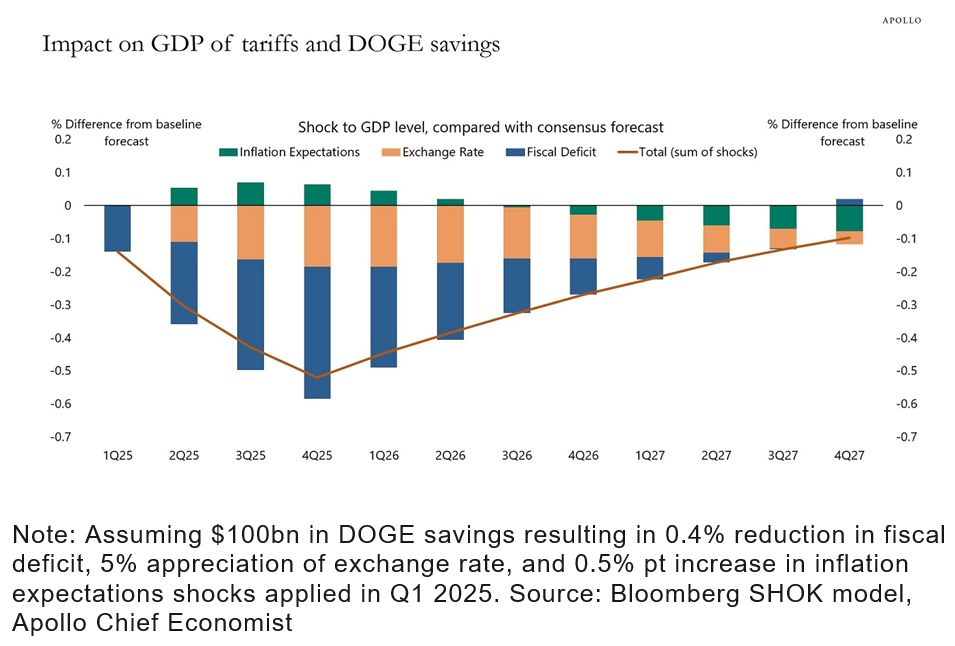

According to Apollo’s chief economist Torsten Slok, the combined impact of DOGE and tariffs will create a mild, temporary economic shock, leading to slight increases in inflation and modest decreases in GDP.

March 1, 2025 at 5:58 PM

According to Apollo’s chief economist Torsten Slok, the combined impact of DOGE and tariffs will create a mild, temporary economic shock, leading to slight increases in inflation and modest decreases in GDP.

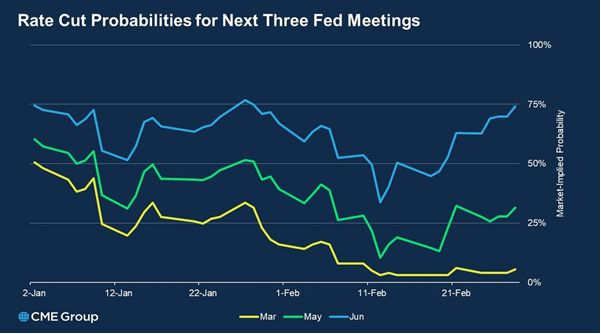

Expectations for June rate reductions have risen back to nearly 75%, after dipping to a mere 34% two weeks prior.

March 1, 2025 at 5:53 PM

Expectations for June rate reductions have risen back to nearly 75%, after dipping to a mere 34% two weeks prior.

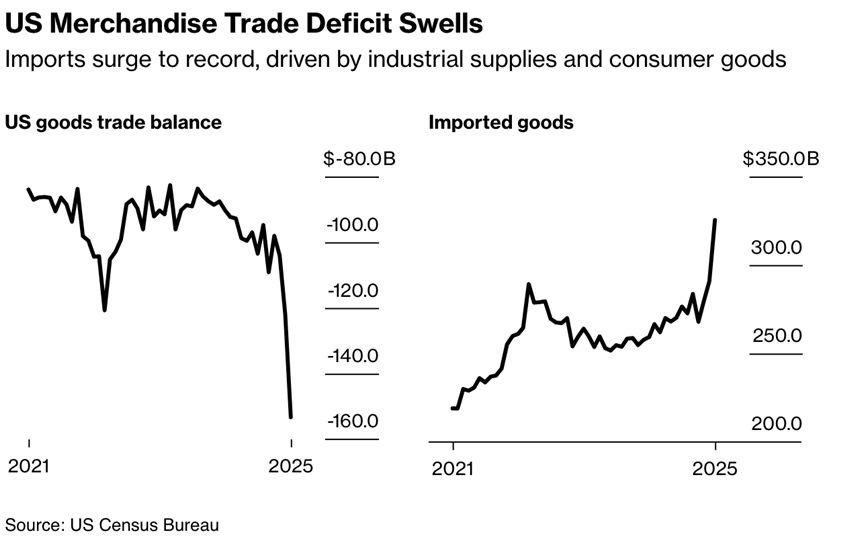

Us imports have surged in January ahead of Trump's tariffs being implemented

March 1, 2025 at 5:51 PM

Us imports have surged in January ahead of Trump's tariffs being implemented

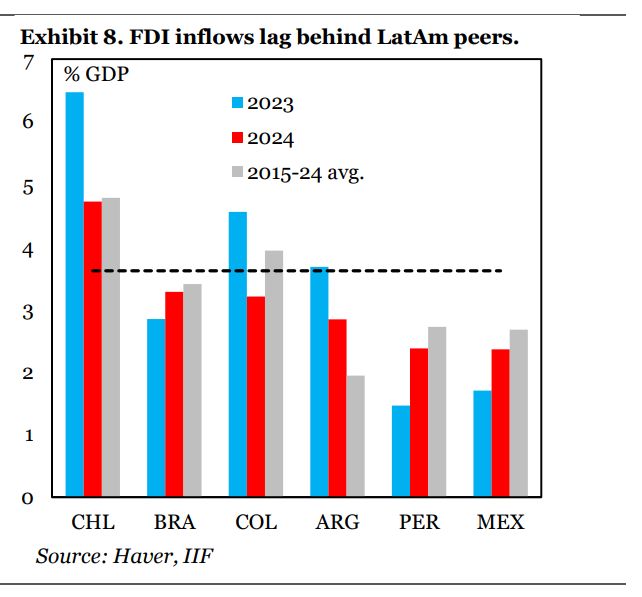

While foreign direct investment into Peru and Mexico has grown over the past two years, it still lags behind their pre-pandemic average and peer econoomies.

March 1, 2025 at 5:47 PM

While foreign direct investment into Peru and Mexico has grown over the past two years, it still lags behind their pre-pandemic average and peer econoomies.

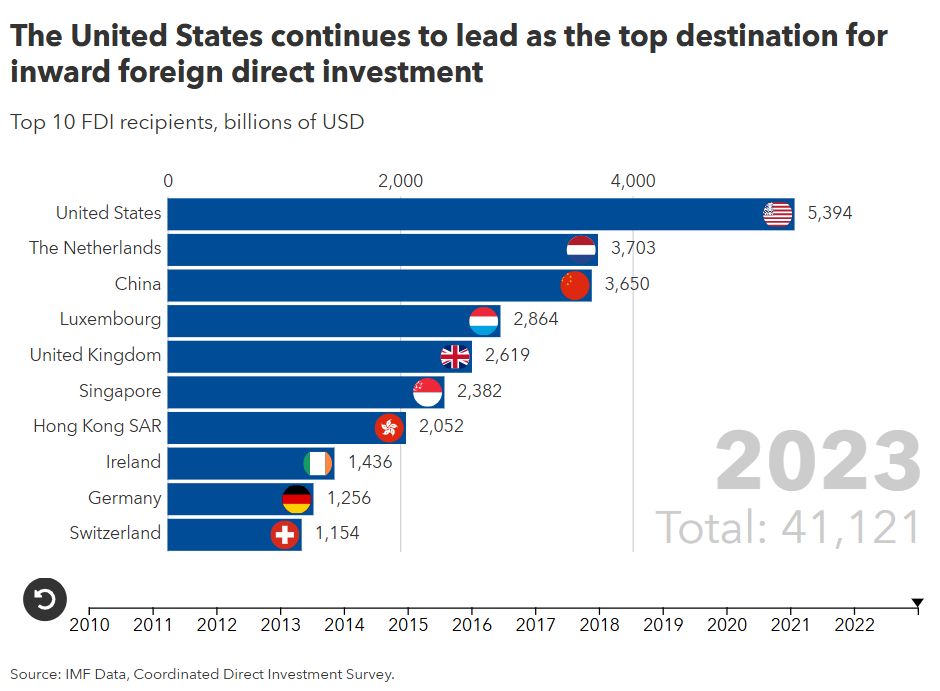

Global foreign direct investment grew to $41 trillion in 2023 (+4.4% y/y; + $1.75). FDI between advanced economies grew by 3.6% ($880 million), while investments from AEs to emerging markets rose by 7.6% ($538 million). The US maintained its position as the top FDI destination.

March 1, 2025 at 5:27 PM

Global foreign direct investment grew to $41 trillion in 2023 (+4.4% y/y; + $1.75). FDI between advanced economies grew by 3.6% ($880 million), while investments from AEs to emerging markets rose by 7.6% ($538 million). The US maintained its position as the top FDI destination.

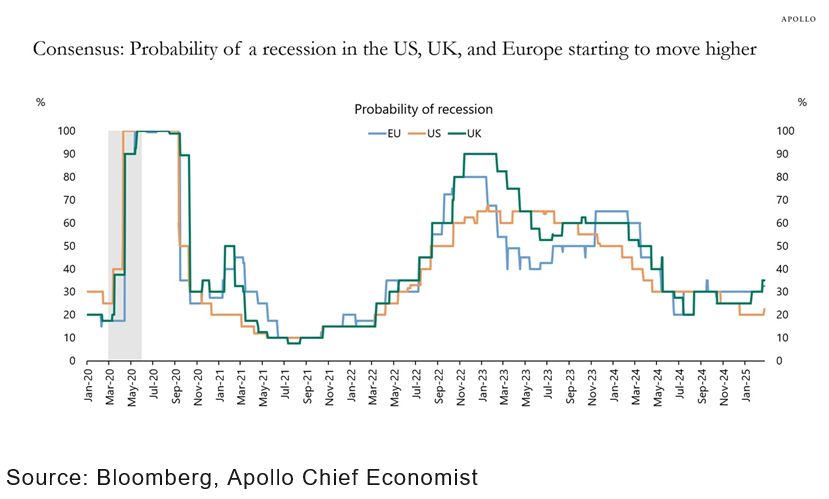

The probability of a recession in the next 12 months for the US, UK, and Euro Area has ticked up slightly over recent weeks

March 1, 2025 at 12:19 AM

The probability of a recession in the next 12 months for the US, UK, and Euro Area has ticked up slightly over recent weeks

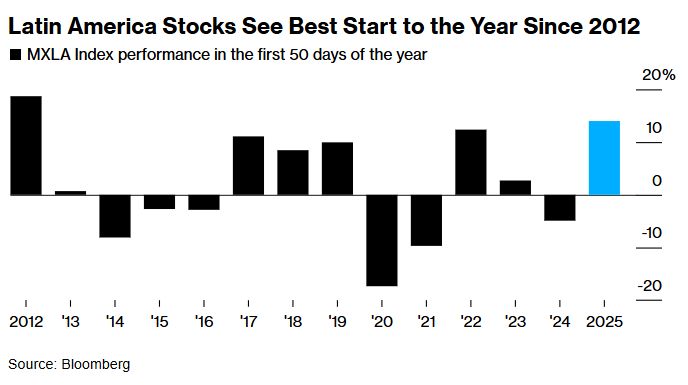

Investors are snapping up Latin American assets, betting on potential business friendly political shifts in the Brazilian and Mexican2026 elections

YTD equity performance

- Venezuela 62%

- Colombia 17%

- Chile 9%

- Mexico 6%

- Ecuador 2%

- Brazil 2%

YTD equity performance

- Venezuela 62%

- Colombia 17%

- Chile 9%

- Mexico 6%

- Ecuador 2%

- Brazil 2%

February 28, 2025 at 11:54 PM

Investors are snapping up Latin American assets, betting on potential business friendly political shifts in the Brazilian and Mexican2026 elections

YTD equity performance

- Venezuela 62%

- Colombia 17%

- Chile 9%

- Mexico 6%

- Ecuador 2%

- Brazil 2%

YTD equity performance

- Venezuela 62%

- Colombia 17%

- Chile 9%

- Mexico 6%

- Ecuador 2%

- Brazil 2%

Europe has been in dire need to create a security market union

February 26, 2025 at 5:45 PM

Europe has been in dire need to create a security market union

Kenya's gross public debt fell by 2% to $84.6 billion (as of December) due an appreciating shilling, which rose 21% last year

February 24, 2025 at 4:45 PM

Kenya's gross public debt fell by 2% to $84.6 billion (as of December) due an appreciating shilling, which rose 21% last year

Great waterfall chart showing how the fiscal deficit has changed between 2017 and 2024

Unsurprisingly non-discretionary spending accounts for 2/3 of total spending

Unsurprisingly non-discretionary spending accounts for 2/3 of total spending

February 15, 2025 at 12:33 AM

Great waterfall chart showing how the fiscal deficit has changed between 2017 and 2024

Unsurprisingly non-discretionary spending accounts for 2/3 of total spending

Unsurprisingly non-discretionary spending accounts for 2/3 of total spending

In the past 30 years Chinese manufacturing as a share of the world has risen from 5% to 32% making it difficult for companies/countries to break ties and reroute supply chains

February 15, 2025 at 12:28 AM

In the past 30 years Chinese manufacturing as a share of the world has risen from 5% to 32% making it difficult for companies/countries to break ties and reroute supply chains

Goods imports make up 11% of US GDP and 43% of US imports come from Canada, Mexico, and China

Therefore 5% of US GDP is directly impacted by tariffs on our largest trading partners

Therefore 5% of US GDP is directly impacted by tariffs on our largest trading partners

February 3, 2025 at 5:42 PM

Goods imports make up 11% of US GDP and 43% of US imports come from Canada, Mexico, and China

Therefore 5% of US GDP is directly impacted by tariffs on our largest trading partners

Therefore 5% of US GDP is directly impacted by tariffs on our largest trading partners

Ah this is very useful! And this chart is amazing - suppliers are putting fake destinations on EU customs declarations

Also expands on "dual use" goods from the video game console example, but to your point, the range of dual use sanctions still has limited effect

Also expands on "dual use" goods from the video game console example, but to your point, the range of dual use sanctions still has limited effect

February 2, 2025 at 12:00 AM

Ah this is very useful! And this chart is amazing - suppliers are putting fake destinations on EU customs declarations

Also expands on "dual use" goods from the video game console example, but to your point, the range of dual use sanctions still has limited effect

Also expands on "dual use" goods from the video game console example, but to your point, the range of dual use sanctions still has limited effect

Straightforward trend of less "unicorns" (private startup that's achieved a $1 billion valuation) during periods of high interest rates

February 1, 2025 at 10:17 PM

Straightforward trend of less "unicorns" (private startup that's achieved a $1 billion valuation) during periods of high interest rates

Only 6% of companies report using AI for regular production today (top chart), even though the types of work tasks automatable by Gen AI would result in several thousand dollars of cost savings per worker (bottom chart)

The (good?) thing is most industries expect to expand adoption in 6 months+

The (good?) thing is most industries expect to expand adoption in 6 months+

February 1, 2025 at 10:14 PM

Only 6% of companies report using AI for regular production today (top chart), even though the types of work tasks automatable by Gen AI would result in several thousand dollars of cost savings per worker (bottom chart)

The (good?) thing is most industries expect to expand adoption in 6 months+

The (good?) thing is most industries expect to expand adoption in 6 months+

Thank you for helping me get to 1,000 followers! 🥳

Hope to continue sharing insightful international macrofinance until we reach 2k!

Hope to continue sharing insightful international macrofinance until we reach 2k!

February 1, 2025 at 9:07 PM

Thank you for helping me get to 1,000 followers! 🥳

Hope to continue sharing insightful international macrofinance until we reach 2k!

Hope to continue sharing insightful international macrofinance until we reach 2k!

European stocks have outperformed equities in the US for January, benefiting from solid earnings and on speculation the region will be spared from immediate US tariffs

The Stoxx Europe 600 Index is up 6.6%, their biggest monthly gain in two years, while the S&P 500 is up 3.2%

The Stoxx Europe 600 Index is up 6.6%, their biggest monthly gain in two years, while the S&P 500 is up 3.2%

January 31, 2025 at 11:07 PM

European stocks have outperformed equities in the US for January, benefiting from solid earnings and on speculation the region will be spared from immediate US tariffs

The Stoxx Europe 600 Index is up 6.6%, their biggest monthly gain in two years, while the S&P 500 is up 3.2%

The Stoxx Europe 600 Index is up 6.6%, their biggest monthly gain in two years, while the S&P 500 is up 3.2%

Investors are struggling to reach consensus on DeepSeek's disruption to Magnificent 7 stocks

January 31, 2025 at 11:04 PM

Investors are struggling to reach consensus on DeepSeek's disruption to Magnificent 7 stocks

Even during the DeepSeek AI disruptions this week and after the NASDAQ fell nearly 3% on Monday, its largest ETF saw its largest one-day inflow since 2021 of more than $4.3 billion

By sector, technology ETFs easily saw the largest amount of investment flows in January

By sector, technology ETFs easily saw the largest amount of investment flows in January

January 31, 2025 at 11:04 PM

Even during the DeepSeek AI disruptions this week and after the NASDAQ fell nearly 3% on Monday, its largest ETF saw its largest one-day inflow since 2021 of more than $4.3 billion

By sector, technology ETFs easily saw the largest amount of investment flows in January

By sector, technology ETFs easily saw the largest amount of investment flows in January

While US household debt has been on the rise and delinquency rates for credit cards have been climbing, the ratio of deb-service payments to disposable (post-tax) income remains around the 2019 level, a period when interest rates were much lower, showing that US consumer resilience is very real

January 31, 2025 at 11:00 PM

While US household debt has been on the rise and delinquency rates for credit cards have been climbing, the ratio of deb-service payments to disposable (post-tax) income remains around the 2019 level, a period when interest rates were much lower, showing that US consumer resilience is very real

Mentioning of "tariffs" during corporate earnings calls have been skyrocketing since the outcome of the US election

January 31, 2025 at 10:57 PM

Mentioning of "tariffs" during corporate earnings calls have been skyrocketing since the outcome of the US election