https://www.andrewwhitten.com

have signed an MOU to ensure researchers worldwide continue accessing critical tax microsimulation tools.

We're building an open-source TAXSIM emulator, combining NBER's 50+ years of tax expertise with modern open-source infrastructure.

have signed an MOU to ensure researchers worldwide continue accessing critical tax microsimulation tools.

We're building an open-source TAXSIM emulator, combining NBER's 50+ years of tax expertise with modern open-source infrastructure.

I found a typo or two (notably an x where there should've been an ϵ on p 37) and have posted an updated edition. Get it at b--k.bandcamp.com/album/topolo... .

I found a typo or two (notably an x where there should've been an ϵ on p 37) and have posted an updated edition. Get it at b--k.bandcamp.com/album/topolo... .

"State Auto-IRA policies and firm behavior: Lessons from administrative tax data"

By Adam Bloomfield, Lucas Goodman, @manirao.bsky.social, & Sita Slavov

www.sciencedirect.com/science/arti...

#econsky #pension #publiceconomics #publicfinance

"State Auto-IRA policies and firm behavior: Lessons from administrative tax data"

By Adam Bloomfield, Lucas Goodman, @manirao.bsky.social, & Sita Slavov

www.sciencedirect.com/science/arti...

#econsky #pension #publiceconomics #publicfinance

Relevant to folks pondering/evaluating/designing corporate tax bases!

Relevant to folks pondering/evaluating/designing corporate tax bases!

"Tax Avoidance through corporate accounting: Insights for corporate tax bases"

By Eric Heiser, Michael Love, & @jm0rt.bsky.social

www.sciencedirect.com/science/arti...

#econsky

"Tax Avoidance through corporate accounting: Insights for corporate tax bases"

By Eric Heiser, Michael Love, & @jm0rt.bsky.social

www.sciencedirect.com/science/arti...

#econsky

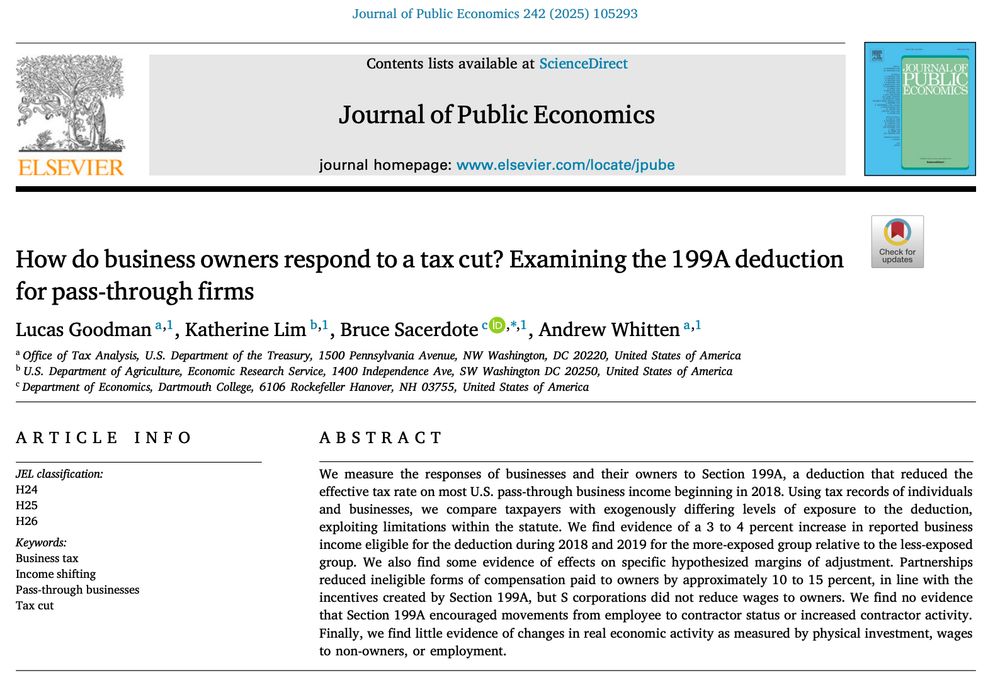

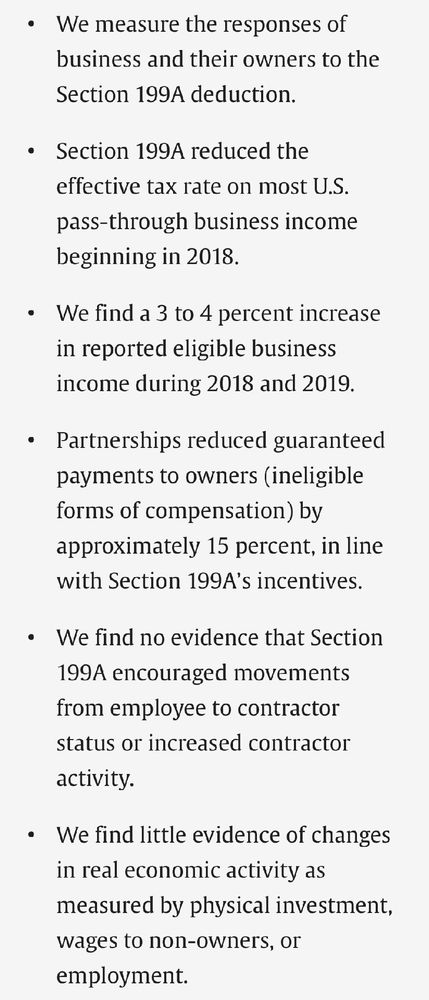

"How Do Business Owners Respond to a Tax Cut? Examining the 199A Deduction for Pass-through Firms"

By Lucas Goodman, Katherine Lim, Bruce Sacerdote, & @andrew-whitten.bsky.social

www.sciencedirect.com/science/arti... #econsky

"How Do Business Owners Respond to a Tax Cut? Examining the 199A Deduction for Pass-through Firms"

By Lucas Goodman, Katherine Lim, Bruce Sacerdote, & @andrew-whitten.bsky.social

www.sciencedirect.com/science/arti... #econsky

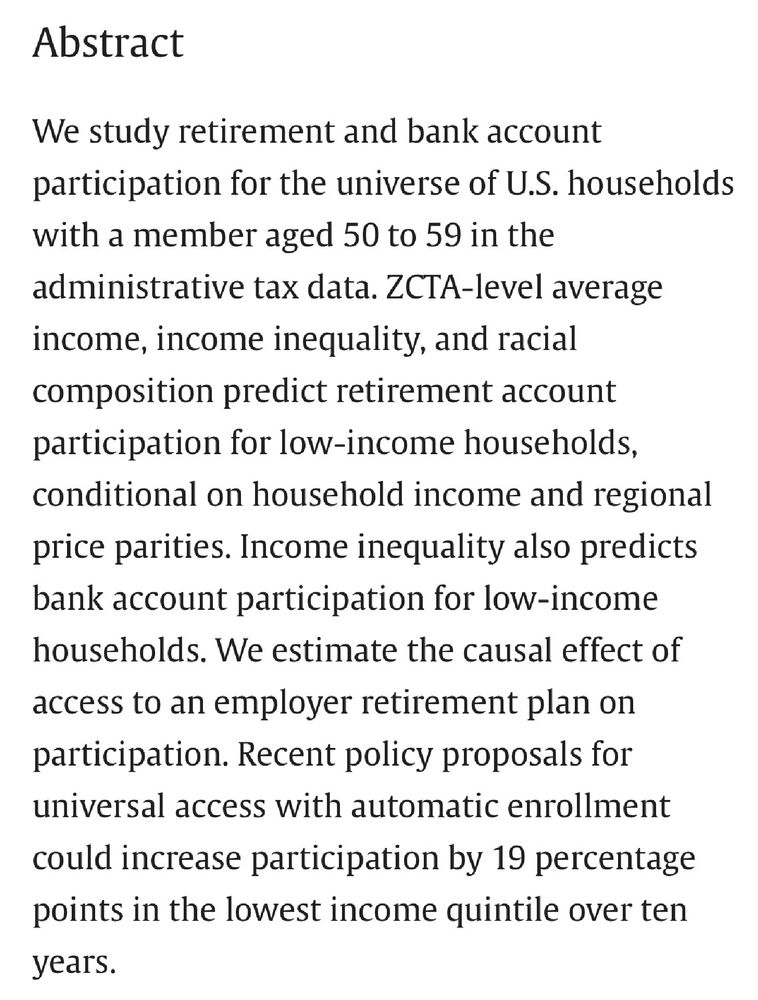

“Financial Inclusion Across the United States”

by Moto Yogo, Natalie Cox, and me

https://www.sciencedirect.com/science/article/pii/S0304405X2500011X?dgcid=coauthor

“Financial Inclusion Across the United States”

by Moto Yogo, Natalie Cox, and me

https://www.sciencedirect.com/science/article/pii/S0304405X2500011X?dgcid=coauthor

“How do business owners respond to a tax cut? Examining the 199A deduction for pass-through firms.”

by me, Lucas Goodman, Katie Lim, & Bruce Sacerdote

https://authors.elsevier.com/c/1kSICAlw9w-Nx

“How do business owners respond to a tax cut? Examining the 199A deduction for pass-through firms.”

by me, Lucas Goodman, Katie Lim, & Bruce Sacerdote

https://authors.elsevier.com/c/1kSICAlw9w-Nx

home.treasury.gov/system/files...

home.treasury.gov/system/files...