Come get one at the Future Proof Festival on Huntington Beach CA Sunday-Wednesday.

I’ll be at the Wiley booth.

futureproofhq.com/festival/reg...

Come get one at the Future Proof Festival on Huntington Beach CA Sunday-Wednesday.

I’ll be at the Wiley booth.

futureproofhq.com/festival/reg...

Deadline Impact Fades.

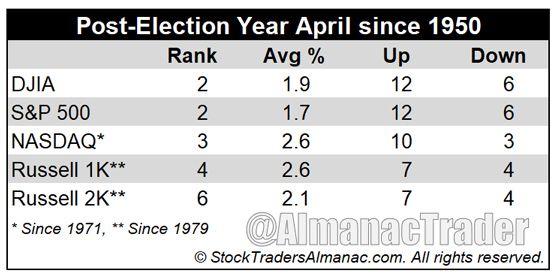

1st half April no longer outperforms. Bullish all month long recent 21 years and post-election since 1950 w/some minor blips along the way jeffhirsch.tumblr.com/post/7791111...

Deadline Impact Fades.

1st half April no longer outperforms. Bullish all month long recent 21 years and post-election since 1950 w/some minor blips along the way jeffhirsch.tumblr.com/post/7791111...

Stormy March markets battered stocks 1st half of the month in recent years. 5300-5400 support in Sep low & last March highs area in play. Catalyst Trump, Fed, Congress, rates, inflation or geopolitics to trigger it.

Stormy March markets battered stocks 1st half of the month in recent years. 5300-5400 support in Sep low & last March highs area in play. Catalyst Trump, Fed, Congress, rates, inflation or geopolitics to trigger it.

Deeper look from member’s webinar post-elect yr perf under new republican admins. Looks like Pres Trump taking page out of our 2025 Stock Trader’s Almanac 4-year cycle playbook. Detail of p28 table.

Deeper look from member’s webinar post-elect yr perf under new republican admins. Looks like Pres Trump taking page out of our 2025 Stock Trader’s Almanac 4-year cycle playbook. Detail of p28 table.

Fear on The Street is palpable. I’ve warned all year volatility expected esp. Q1. New rep admins get down brass tacks creating uncertainty. Trump 2.0 faster than ever. More on members webinar tmrw… www.tumblr.com/jeffhirsch/7...

Fear on The Street is palpable. I’ve warned all year volatility expected esp. Q1. New rep admins get down brass tacks creating uncertainty. Trump 2.0 faster than ever. More on members webinar tmrw… www.tumblr.com/jeffhirsch/7...

DJIA up 51x in 75 years. Recent 25-year track record strong. S&P 500 best, up 68.0% of times. NASDAQ avg 0.65% www.tumblr.com/jeffhirsch/7...

DJIA up 51x in 75 years. Recent 25-year track record strong. S&P 500 best, up 68.0% of times. NASDAQ avg 0.65% www.tumblr.com/jeffhirsch/7...

Rather turbulent in recent years w/ wild fluctuations & large gains and losses, March has been taking some mean end-of-quarter hits. Post-election years open strong then fade midmonth. Recent years trend lower early then rally after the ides. www.tumblr.com/jeffhirsch/7...

Rather turbulent in recent years w/ wild fluctuations & large gains and losses, March has been taking some mean end-of-quarter hits. Post-election years open strong then fade midmonth. Recent years trend lower early then rally after the ides. www.tumblr.com/jeffhirsch/7...

Buying the dip? Feels like correx in the works. Feb & Post-elect yr Q1 weakness in charts. S&P ATH last wk on poor breadth. @realDonaldTrump shaking things up like never b4. Not down 5% yet x R2K retest of elect gap only 6% $SPX drop

Buying the dip? Feels like correx in the works. Feb & Post-elect yr Q1 weakness in charts. S&P ATH last wk on poor breadth. @realDonaldTrump shaking things up like never b4. Not down 5% yet x R2K retest of elect gap only 6% $SPX drop

Stocks are suffering from typical midwinter struggles. The market tends to rally the first half of February, but gains tend to fade after mid-month, and even sooner in post-election years.

Stocks are suffering from typical midwinter struggles. The market tends to rally the first half of February, but gains tend to fade after mid-month, and even sooner in post-election years.

No other month signals as much upside for the year when it’s up than January. Since 1938, years with a positive January outperformed a down January by 10.6%. Over the following 12 months, the outperformance grew to 11.3%. $SPY

No other month signals as much upside for the year when it’s up than January. Since 1938, years with a positive January outperformed a down January by 10.6%. Over the following 12 months, the outperformance grew to 11.3%. $SPY

Cycle reset to track 2025-2028. Traditional 1st-year slump hasn’t materialized since Reagan’s reelection in 1984. Cycle compression makes 1st years like 3rd years. Incumbents try to hang on to slim margins in the midterms.

Cycle reset to track 2025-2028. Traditional 1st-year slump hasn’t materialized since Reagan’s reelection in 1984. Cycle compression makes 1st years like 3rd years. Incumbents try to hang on to slim margins in the midterms.

Stock Trader’s Almanac p132 shows post-election notorious history as worst. Much improved since WWII & best since 1985 averaging 17.2%. Bull continues in 2025 up 8-12%, but bumpier ride than past 2 years.

Stock Trader’s Almanac p132 shows post-election notorious history as worst. Much improved since WWII & best since 1985 averaging 17.2%. Bull continues in 2025 up 8-12%, but bumpier ride than past 2 years.

DJIA closed below Dec low (p36 STA 2025) 1/10/25 39th x since 1950 can signal more weakness. Best years w/ down Santa Claus Rally, Dec low breach & +First Five Days&/or Jan Barometer. Quick rebound in line w/25 forecast base case 8-12% best 12-20%.

DJIA closed below Dec low (p36 STA 2025) 1/10/25 39th x since 1950 can signal more weakness. Best years w/ down Santa Claus Rally, Dec low breach & +First Five Days&/or Jan Barometer. Quick rebound in line w/25 forecast base case 8-12% best 12-20%.

Upbeat jobs data fanned inflation fears rate cut reality. people working & making money is a good thing. But the market continues to wrestle with rising 10-year yields & policy uncertainties as a new administration prepares to take over in DC

Upbeat jobs data fanned inflation fears rate cut reality. people working & making money is a good thing. But the market continues to wrestle with rising 10-year yields & policy uncertainties as a new administration prepares to take over in DC