President CEPR

André Hoffmann Chair and Professor of Economics @ Geneva Graduate Institute

Centre for Economic Policy Research; Graduate Institute of International and Development Studies; INSEAD • Global Financial Crisis and Policies, Banking stability, regulation, efficiency, European Monetary and Fiscal Policies

Reposted by Beatrice Weder di Mauro

Reposted by Beatrice Weder di Mauro

Reposted by Beatrice Weder di Mauro

Reposted by Beatrice Weder di Mauro

Reposted by Beatrice Weder di Mauro

Reposted by Beatrice Weder di Mauro

Reposted by Beatrice Weder di Mauro

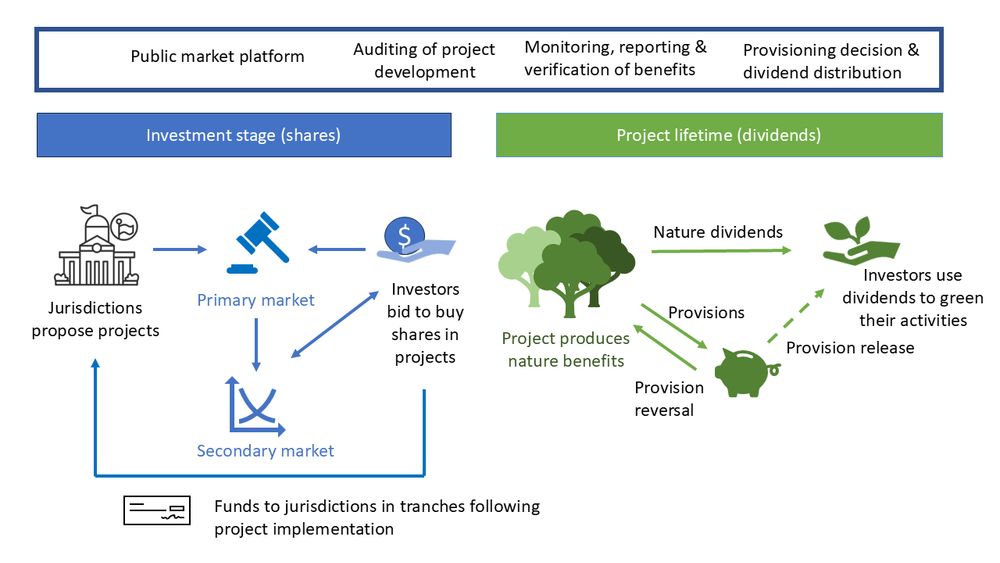

@estellecantillon.bsky.social, E Lambin & @wederdim.bsky.social describe a new approach to finance nature-based provision of carbon and biodiversity benefits through shares instead of credits.

cepr.org/publications...

#EconSky

Reposted by Beatrice Weder di Mauro

@pisaniferry.bsky.social @wederdim.bsky.social & @jzettelmeyer.bsky.social advocate for pragmatic coalitions of the willing to align climate, biodiversity, trade & finance objectives.

cepr.org/publications...

Reposted by Jean P. Ferry, Beatrice Weder di Mauro

Edited by @jzettelmeyer.bsky.social, @pisaniferry.bsky.social & @wederdim.bsky.social