That’s more than the cost of the IRS’s Direct File program that the Trump admin just shut down.

Intuit's market share is larger, profits are up, and Americans are forced to pay more just to file their taxes.

That’s more than the cost of the IRS’s Direct File program that the Trump admin just shut down.

Intuit's market share is larger, profits are up, and Americans are forced to pay more just to file their taxes.

goodjobsfirst.org/cloudy-with-...

goodjobsfirst.org/cloudy-with-...

Corporate income taxes are $77 billion lower than in the previous year, a 15% drop. itep.org/trump-tax-la...

Corporate income taxes are $77 billion lower than in the previous year, a 15% drop. itep.org/trump-tax-la...

While families face rising costs, these lawmakers are prioritizing their own pockets: accountable.us/10-congressi...

While families face rising costs, these lawmakers are prioritizing their own pockets: accountable.us/10-congressi...

People making less than $53,000 could see their taxes increase.

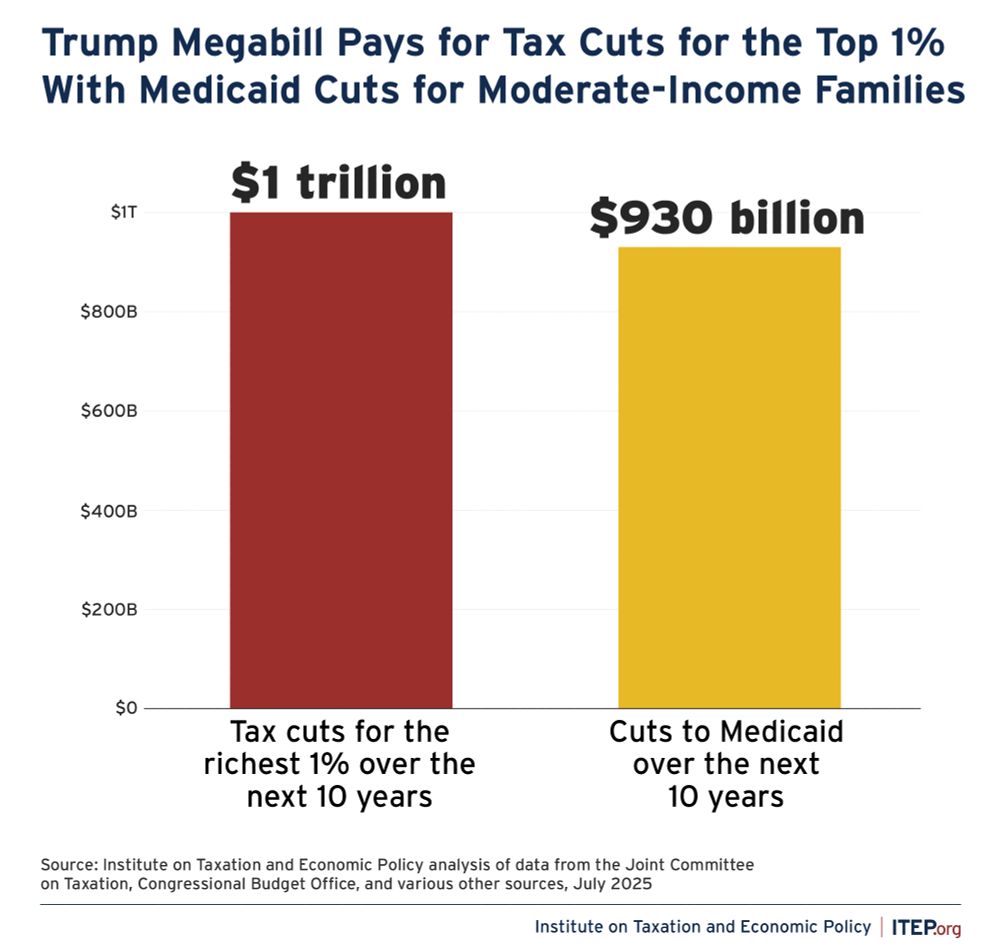

The richest 1% alone will benefit more from Trump’s tax plan than the bottom 80% of Americans.

itep.org/how-will-tru...

People making less than $53,000 could see their taxes increase.

The richest 1% alone will benefit more from Trump’s tax plan than the bottom 80% of Americans.

itep.org/how-will-tru...

I've updated the methodology to first assume an AMT patch at Clinton levels, so I'm only attributing to the Bush tax cuts their portion of the AMT patch.

I've updated the methodology to first assume an AMT patch at Clinton levels, so I'm only attributing to the Bush tax cuts their portion of the AMT patch.

On top of that, the bill also includes a new way for rich people to avoid taxes by donating to school vouchers and a harsher tax code for immigrants and their families.

itep.org/federal-tax-...

On top of that, the bill also includes a new way for rich people to avoid taxes by donating to school vouchers and a harsher tax code for immigrants and their families.

itep.org/federal-tax-...

Is that the type of experience that qualifies you to lead the IRS? 🤔

Is that the type of experience that qualifies you to lead the IRS? 🤔

The ultra-rich can afford to pay more in taxes.

The ultra-rich can afford to pay more in taxes.

Instead, they raise money needed to improve their communities.

Out of all income groups, the richest 1% pay the smallest share of income on taxes in 41 states.

Instead, they raise money needed to improve their communities.

Out of all income groups, the richest 1% pay the smallest share of income on taxes in 41 states.

Their latest move against the agency: Ending a free tax filing program to ensure that the multibillion-dollar tax prep industry can boost its profits. itep.org/trump-admini...

Their latest move against the agency: Ending a free tax filing program to ensure that the multibillion-dollar tax prep industry can boost its profits. itep.org/trump-admini...

Don’t be fooled. open.substack.com/pub/itep/p/s...

Don’t be fooled. open.substack.com/pub/itep/p/s...

www.npr.org/2025/02/26/n...

www.npr.org/2025/02/26/n...

Congressional Republicans have no way to pay for the massive tax cuts promised by Trump other than to dismantle fundamental parts of the government and increase the federal budget deficit. itep.org/house-budget...

Congressional Republicans have no way to pay for the massive tax cuts promised by Trump other than to dismantle fundamental parts of the government and increase the federal budget deficit. itep.org/house-budget...