(On Signal richardrubindc.08)

My latest:

www.wsj.com/politics/pol...

My latest:

www.wsj.com/politics/pol...

New from me: The IRS is taking a $16 billion shot at Meta Platforms' Irish tax maneuvers.

The government is using a novel approach, continuing a legal fight with the company that's dragged on for nearly a decade.

www.wsj.com/politics/pol...

New from me: The IRS is taking a $16 billion shot at Meta Platforms' Irish tax maneuvers.

The government is using a novel approach, continuing a legal fight with the company that's dragged on for nearly a decade.

www.wsj.com/politics/pol...

Out: Abolition, suffrage, civil rights.

In: Mayflower Compact, Revolutionary War, Gettysburg Address.

www.wsj.com/politics/pol...

Out: Abolition, suffrage, civil rights.

In: Mayflower Compact, Revolutionary War, Gettysburg Address.

www.wsj.com/politics/pol...

www.reuters.com/world/tax-pr...

www.reuters.com/world/tax-pr...

Latest data show OECD tax levels hitting a record high as the U.S. stays flat:

www.wsj.com/livecoverage...

Latest data show OECD tax levels hitting a record high as the U.S. stays flat:

www.wsj.com/livecoverage...

Trump just pulled the plug on his nomination. My latest:

www.wsj.com/politics/pol...

Trump just pulled the plug on his nomination. My latest:

www.wsj.com/politics/pol...

www.wsj.com/articles/wit...

www.wsj.com/articles/wit...

Companies (Meta, Qualcomm) are disclosing billions of dollars in tax breaks they can't use. And there's pressure on Treasury to ease the rules.

www.wsj.com/politics/pol...

Companies (Meta, Qualcomm) are disclosing billions of dollars in tax breaks they can't use. And there's pressure on Treasury to ease the rules.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

We go through some key tax-planning ideas:

www.wsj.com/personal-fin...

We go through some key tax-planning ideas:

www.wsj.com/personal-fin...

It's a nod to their popularity -- and an attempt to highlight the new law's limits.

www.wsj.com/politics/pol...

It's a nod to their popularity -- and an attempt to highlight the new law's limits.

www.wsj.com/politics/pol...

We visualized a few examples:

www.wsj.com/personal-fin...

We visualized a few examples:

www.wsj.com/personal-fin...

The corporate tax, which is a crucial component of the US revenue system at the very top of the income distribution, according to a new study.

www.wsj.com/personal-fin...

The corporate tax, which is a crucial component of the US revenue system at the very top of the income distribution, according to a new study.

www.wsj.com/personal-fin...

The "no tax on overtime" deduction is big, popular -- and a little messy.

Employers and workers are starting to grapple with the rules for who qualifies and who doesn't.

www.wsj.com/politics/pol...

The "no tax on overtime" deduction is big, popular -- and a little messy.

Employers and workers are starting to grapple with the rules for who qualifies and who doesn't.

www.wsj.com/politics/pol...

How will that all shake out?

www.wsj.com/politics/pol...

How will that all shake out?

www.wsj.com/politics/pol...

US exporters -- particularly those with factories and research expenses -- scored a big win in the tax law.

www.wsj.com/politics/pol...

US exporters -- particularly those with factories and research expenses -- scored a big win in the tax law.

www.wsj.com/politics/pol...

Lob in your questions now:

www.wsj.com/politics/pol...

Lob in your questions now:

www.wsj.com/politics/pol...

Pretty even spread over job types, including a 26% decline in revenue agents (auditors).

Here are all the details:

www.tigta.gov/sites/defaul...

Pretty even spread over job types, including a 26% decline in revenue agents (auditors).

Here are all the details:

www.tigta.gov/sites/defaul...

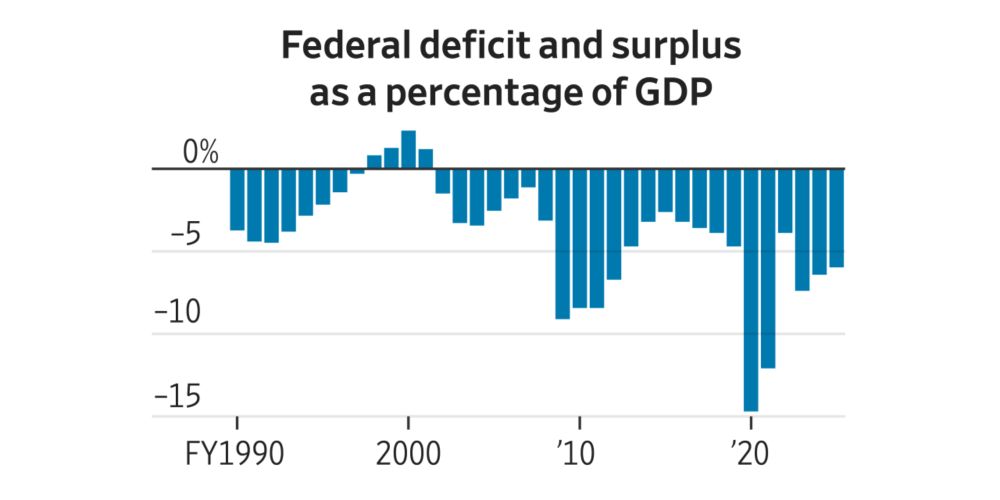

Unless Congress extends "no tax on" & cancels spending cuts.

Unless Congress extends "no tax on" & cancels spending cuts.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

Are we calling it:

--Baseline formerly known as current policy

--The then-current policy baseline

--Prior policy baseline

None of those are particularly fun and/or clear.

Are we calling it:

--Baseline formerly known as current policy

--The then-current policy baseline

--Prior policy baseline

None of those are particularly fun and/or clear.