Why isn't the war in Ukraine over under Trump?

Why is it so hard to afford housing under Trump?

Why do we have so much government waste under Trump?

Why do we have a geriatric president under Trump?

Why isn't the war in Ukraine over under Trump?

Why is it so hard to afford housing under Trump?

Why do we have so much government waste under Trump?

Why do we have a geriatric president under Trump?

In my experience, 90%+ of people buying a house NEVER run basic calculations (buy vs. rent, amortization)

Same for buying a car & investing fees

Meanwhile, they agonize over coffee

In my experience, 90%+ of people buying a house NEVER run basic calculations (buy vs. rent, amortization)

Same for buying a car & investing fees

Meanwhile, they agonize over coffee

Money For Couples shows you how to build a Rich Life together. Use the word-for-word scripts to stop fighting and build a shared vision. Set your accounts up to make it all flow smoothly

Best of all, use money to bring you both closer together

iwt.com/moneyforcouples

Money For Couples shows you how to build a Rich Life together. Use the word-for-word scripts to stop fighting and build a shared vision. Set your accounts up to make it all flow smoothly

Best of all, use money to bring you both closer together

iwt.com/moneyforcouples

- Venmo'ing each other for expenses: No

- Each person having their own no-questions-asked account: Yes

- One person being the "Money Person": No

- Secret accounts: No

- Talking about money every month with an agenda that starts with a compliment: Yes

- Venmo'ing each other for expenses: No

- Each person having their own no-questions-asked account: Yes

- One person being the "Money Person": No

- Secret accounts: No

- Talking about money every month with an agenda that starts with a compliment: Yes

- Fixed Costs: 50-60% of net income (take-home)

- Investments: 5-10% (the more, the better)

- Savings: 5-10%

- Guilt-Free Spending: 20-35%

Within those ranges? GREAT! If not, make a change. No need to track the price of pickles

- Fixed Costs: 50-60% of net income (take-home)

- Investments: 5-10% (the more, the better)

- Savings: 5-10%

- Guilt-Free Spending: 20-35%

Within those ranges? GREAT! If not, make a change. No need to track the price of pickles

It’s almost always about how much they spend on (1) housing, (2) cars, & (3) their values

But they don’t know they’re overspending, so they fight about $20 expenses

It’s almost always about how much they spend on (1) housing, (2) cars, & (3) their values

But they don’t know they’re overspending, so they fight about $20 expenses

- Small # of credit cards

- Automatic investing into low-cost index funds

- Healthy margin of error

- Long time horizon

- Focus on $300,000 questions including increasing income

- Small # of credit cards

- Automatic investing into low-cost index funds

- Healthy margin of error

- Long time horizon

- Focus on $300,000 questions including increasing income

1. Ask: What's our Rich Life? How are we using our money to live it?

2. Set up accounts so your money goes into a joint account, but each of you gets a separate, no-questions-asked account that only you have access to

1. Ask: What's our Rich Life? How are we using our money to live it?

2. Set up accounts so your money goes into a joint account, but each of you gets a separate, no-questions-asked account that only you have access to

They did not see a connection

They did not see a connection

If you're part of an organization like this, please email me the name of the org, description, and how you'd use them

ramit.sethi@iwillteachyoutoberich.com

If you're part of an organization like this, please email me the name of the org, description, and how you'd use them

ramit.sethi@iwillteachyoutoberich.com

youtu.be/MvLinlXiI_A?...

"I'm not saying everyone who lives in Florida is a scammer, but a lotta scammers sure live in Florida!"

🤣🤣🤣

youtu.be/MvLinlXiI_A?...

"I'm not saying everyone who lives in Florida is a scammer, but a lotta scammers sure live in Florida!"

🤣🤣🤣

There is no virtue in living a smaller life than you have to

There is no virtue in living a smaller life than you have to

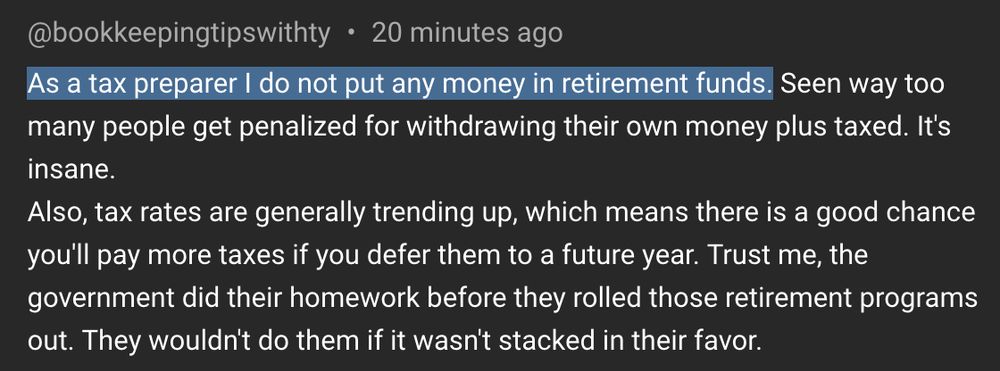

Instead, we get posts like this

Remember: Your feelings about money are highly uncorrelated with the amount in your bank

Instead, we get posts like this

Remember: Your feelings about money are highly uncorrelated with the amount in your bank

Try these word-for-word scripts

If one partner is a spender

Try these word-for-word scripts

If one partner is a spender

Parents can open up a custodial account for kids and help them start investing early

I started investing at age 14 (with the help of my dad) and, almost 30 years later, I'm very glad I did

Parents can open up a custodial account for kids and help them start investing early

I started investing at age 14 (with the help of my dad) and, almost 30 years later, I'm very glad I did

This is Los Angeles. At 8 seconds, you will finally see "density"

This is Los Angeles. At 8 seconds, you will finally see "density"