Peter Berezin

@peterberezin.bsky.social

Chief Global Strategist, BCA Research

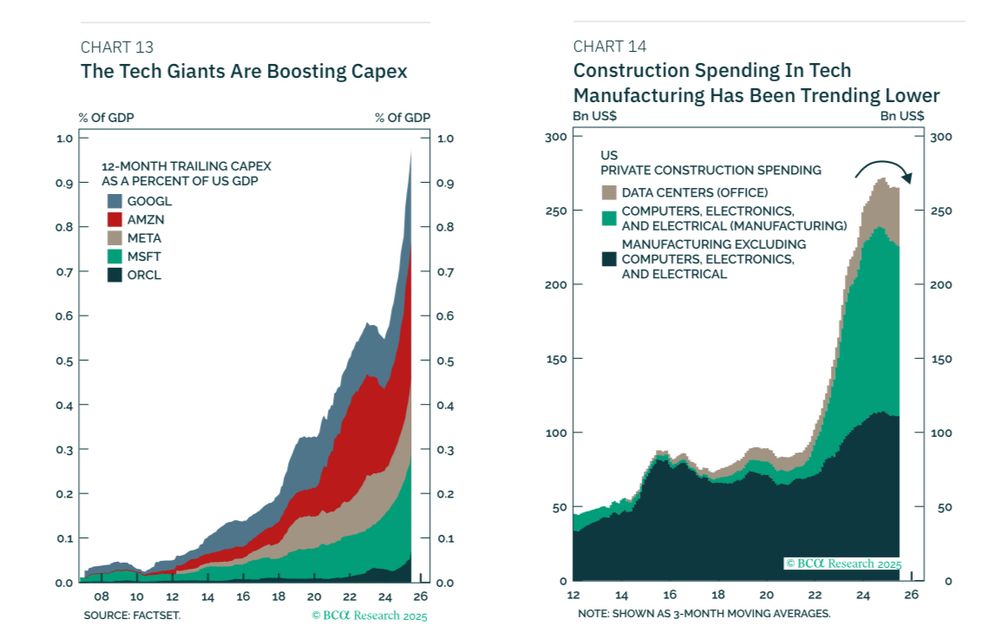

Data center construction is less than 0.2% of US GDP. A lot of the hyperscaler capex consists of equipment and chips that are not produced in the US. Thus, much of what is added to “I” in the GDP accounts must get deducted via “M” (imports).

August 6, 2025 at 4:00 PM

Data center construction is less than 0.2% of US GDP. A lot of the hyperscaler capex consists of equipment and chips that are not produced in the US. Thus, much of what is added to “I” in the GDP accounts must get deducted via “M” (imports).

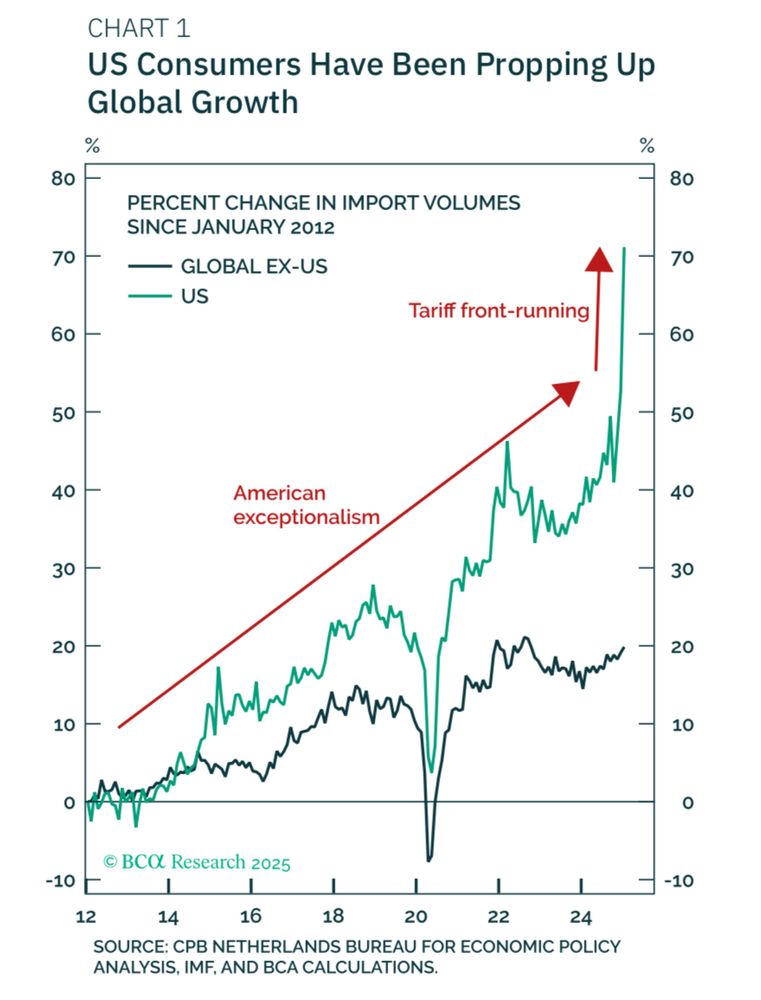

The global economy is currently benefiting from massive tariff front-running, as evidenced by the surge in imports to the US. This has temporarily propped up production in places like Europe, Canada, and China. The floor falls out next week.

March 30, 2025 at 2:59 PM

The global economy is currently benefiting from massive tariff front-running, as evidenced by the surge in imports to the US. This has temporarily propped up production in places like Europe, Canada, and China. The floor falls out next week.

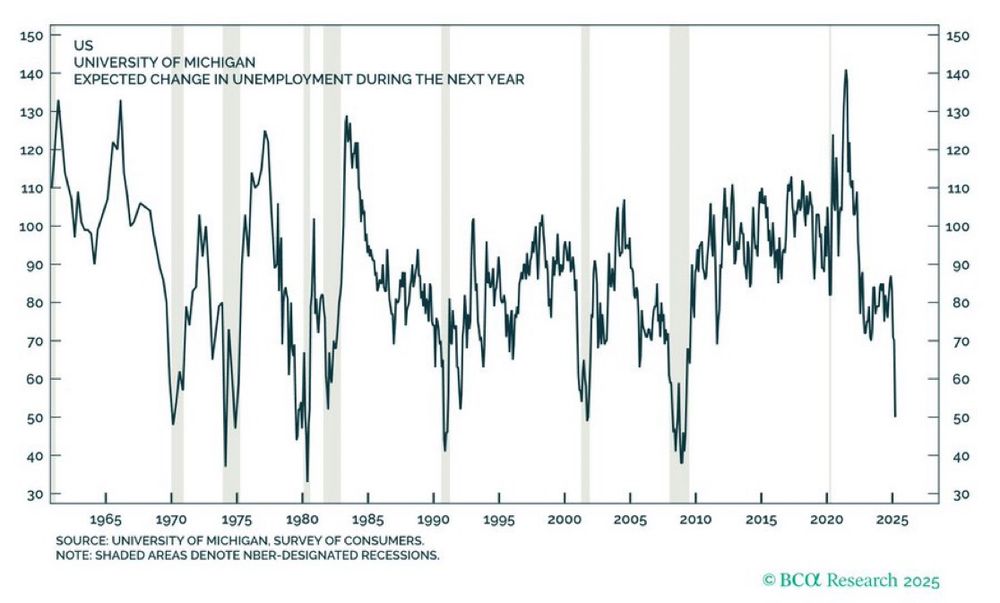

Unemployment expectations have surged to levels "never seen before" in the University of Michigan survey (outside of recessions).

March 14, 2025 at 3:45 PM

Unemployment expectations have surged to levels "never seen before" in the University of Michigan survey (outside of recessions).

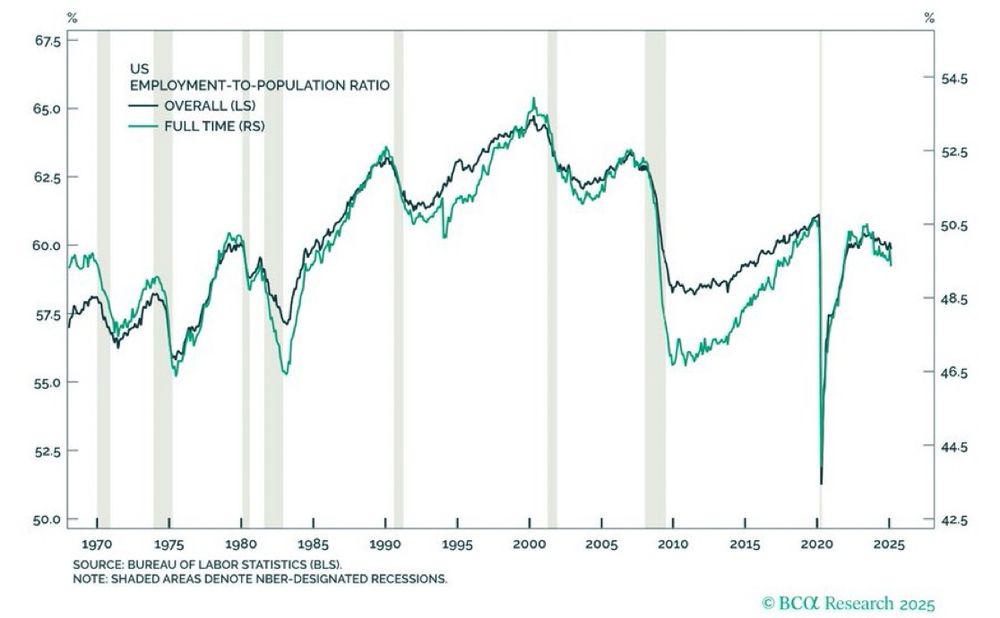

Today was a tale of two reports. The payroll report was fine, but the household report was lousy. For example, the employment/population ratio fell 0.25 ppts in February. For full-time workers, it fell 0.5 points. Usually, the E/P ratio declines in the lead-up to recessions.

March 7, 2025 at 8:10 PM

Today was a tale of two reports. The payroll report was fine, but the household report was lousy. For example, the employment/population ratio fell 0.25 ppts in February. For full-time workers, it fell 0.5 points. Usually, the E/P ratio declines in the lead-up to recessions.

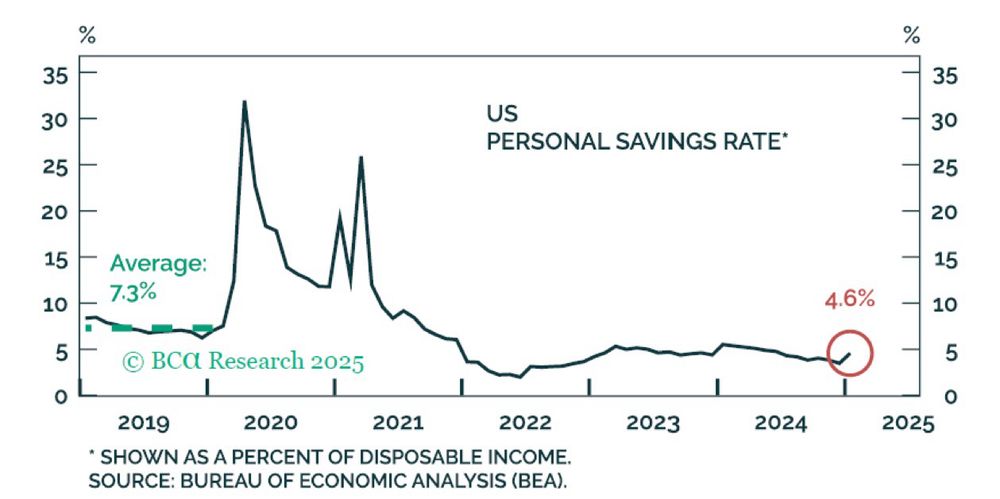

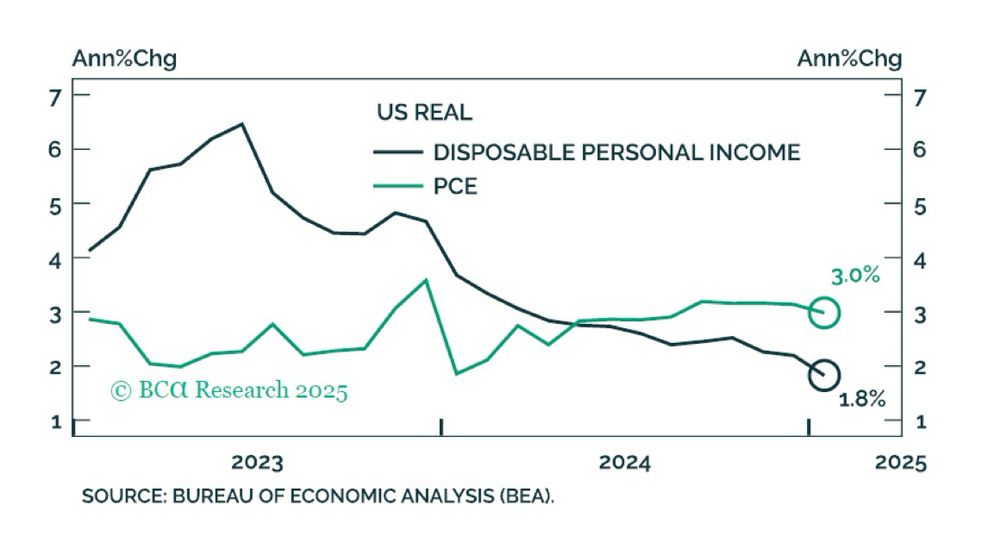

The savings rate jumped in January but remains below where it was in 2019. Even if the savings rate stabilizes at current levels, consumption growth would still fall significantly because it is currently running well above income growth.

March 3, 2025 at 1:10 PM

The savings rate jumped in January but remains below where it was in 2019. Even if the savings rate stabilizes at current levels, consumption growth would still fall significantly because it is currently running well above income growth.

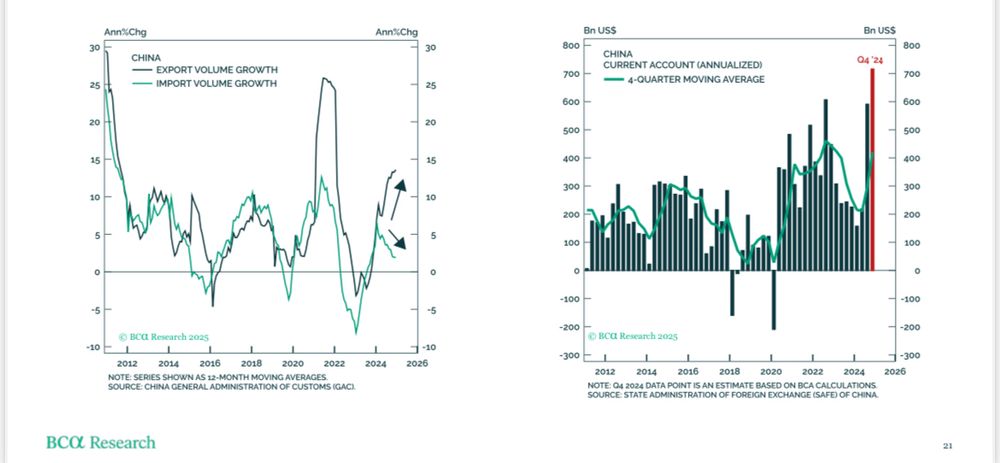

Global manufacturing demand has benefitted from the front running of Trump’s tariffs. This can be clearly seen in the divergence between Chinese import and export growth. As this effect goes into reverse, manufacturing activity will start to weaken again.

February 28, 2025 at 9:00 AM

Global manufacturing demand has benefitted from the front running of Trump’s tariffs. This can be clearly seen in the divergence between Chinese import and export growth. As this effect goes into reverse, manufacturing activity will start to weaken again.

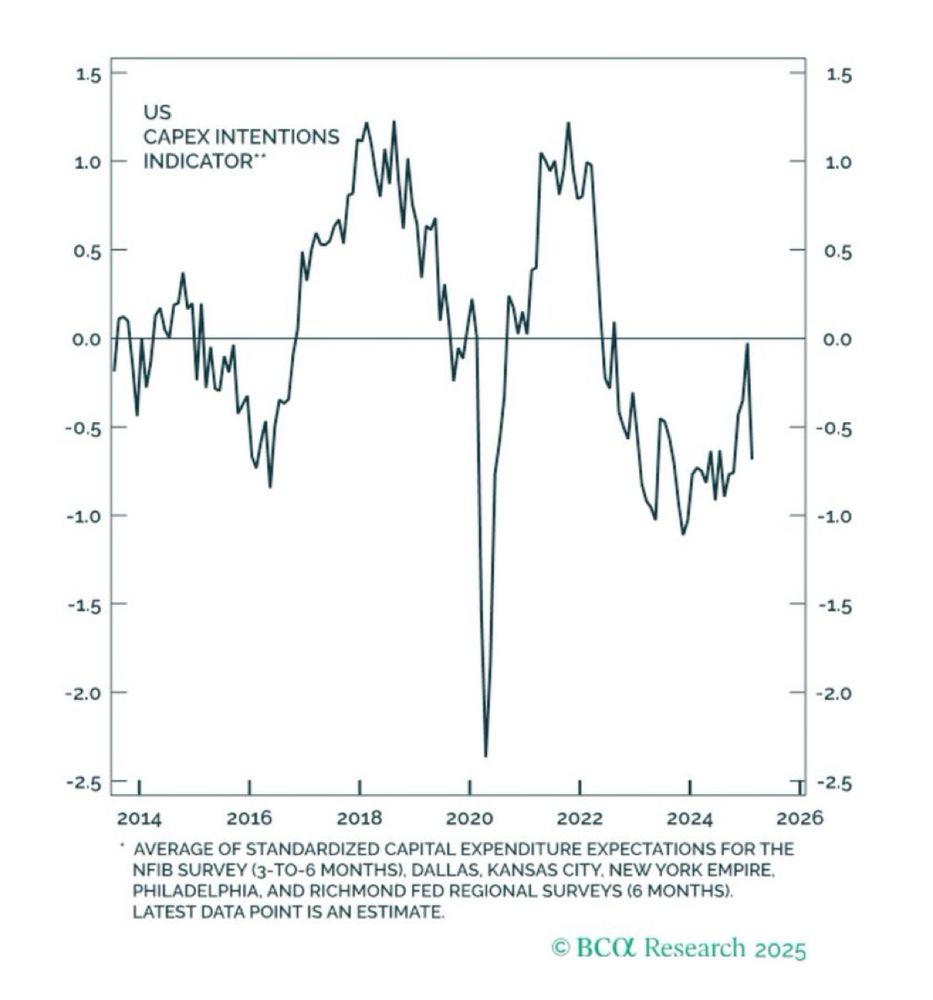

After briefly surging after Trump’s election victory, capex intentions have fallen back into contractionary territory. Sad!

February 28, 2025 at 12:30 AM

After briefly surging after Trump’s election victory, capex intentions have fallen back into contractionary territory. Sad!

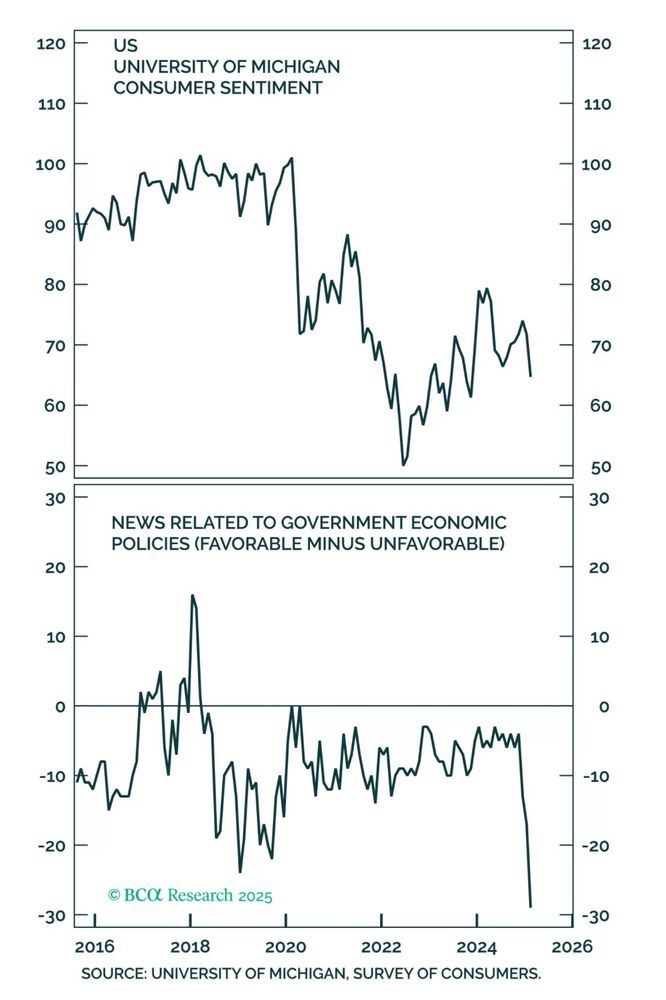

The perception that government policy has gone astray has been the main driver of the recent decline in consumer confidence in the University of Michigan survey.

February 25, 2025 at 1:33 AM

The perception that government policy has gone astray has been the main driver of the recent decline in consumer confidence in the University of Michigan survey.

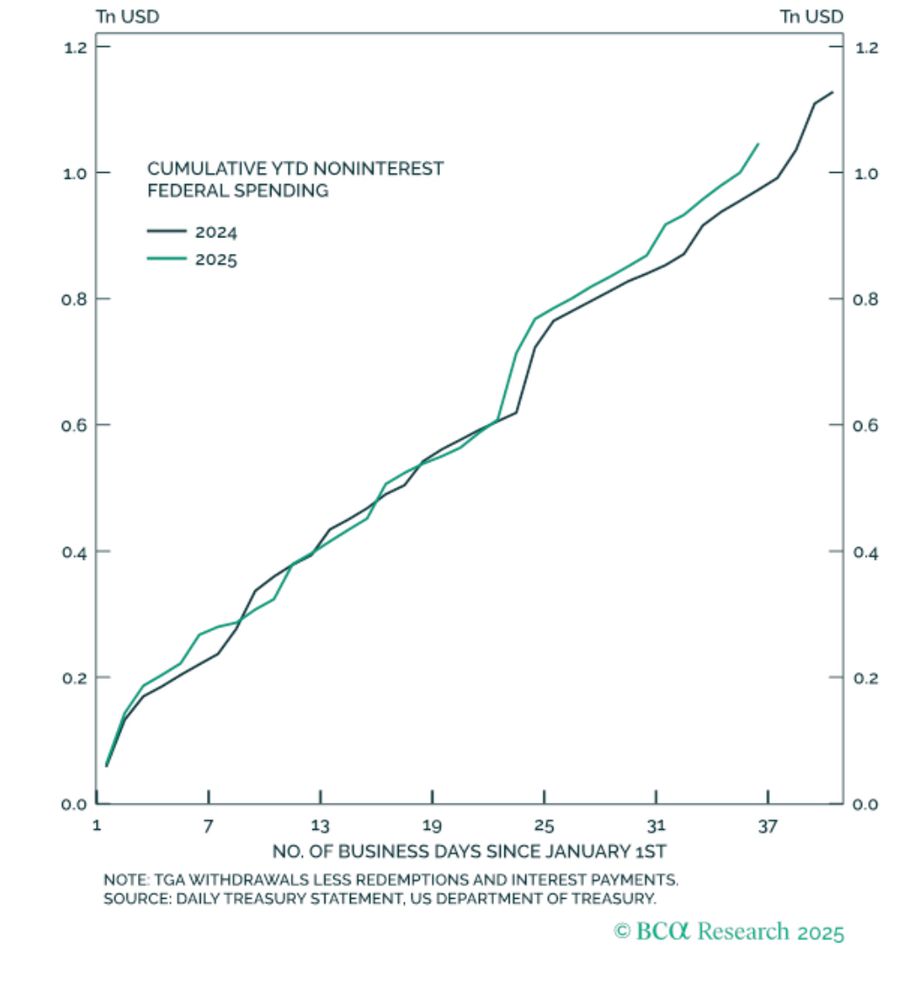

Despite all the DOGE bluster, government spending is trending higher in 2025 than in 2024.

February 21, 2025 at 12:36 AM

Despite all the DOGE bluster, government spending is trending higher in 2025 than in 2024.

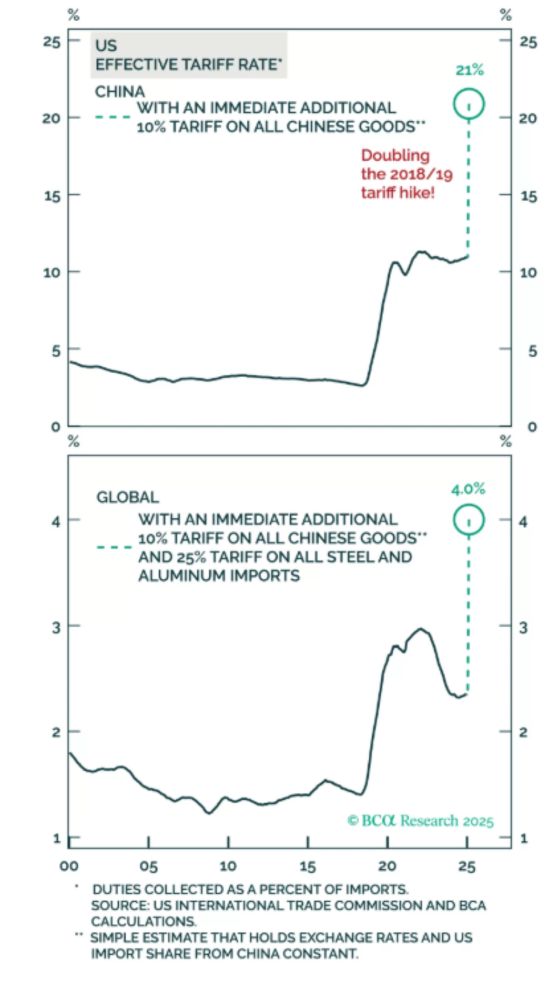

With Trump set to further increase tariffs later today, it’s worth noting that the effective US tariff rate has already risen over the past few weeks as much as it did during the entirety of Trump’s first term.

February 12, 2025 at 4:26 PM

With Trump set to further increase tariffs later today, it’s worth noting that the effective US tariff rate has already risen over the past few weeks as much as it did during the entirety of Trump’s first term.