blogs.lse.ac.uk/businessrevi...

Full article 👉 https://ow.ly/JYmB50XvChB

Full article 👉 https://ow.ly/JYmB50XvChB

www.nytimes.com/2025/11/10/c...

www.nytimes.com/2025/11/10/c...

www.lse.ac.uk/granthaminst...

www.lse.ac.uk/granthaminst...

How do you reconcile these two aspects?

@granthamlse.bsky.social

www.sciencedirect.com/science/arti...

www.sciencedirect.com/science/arti...

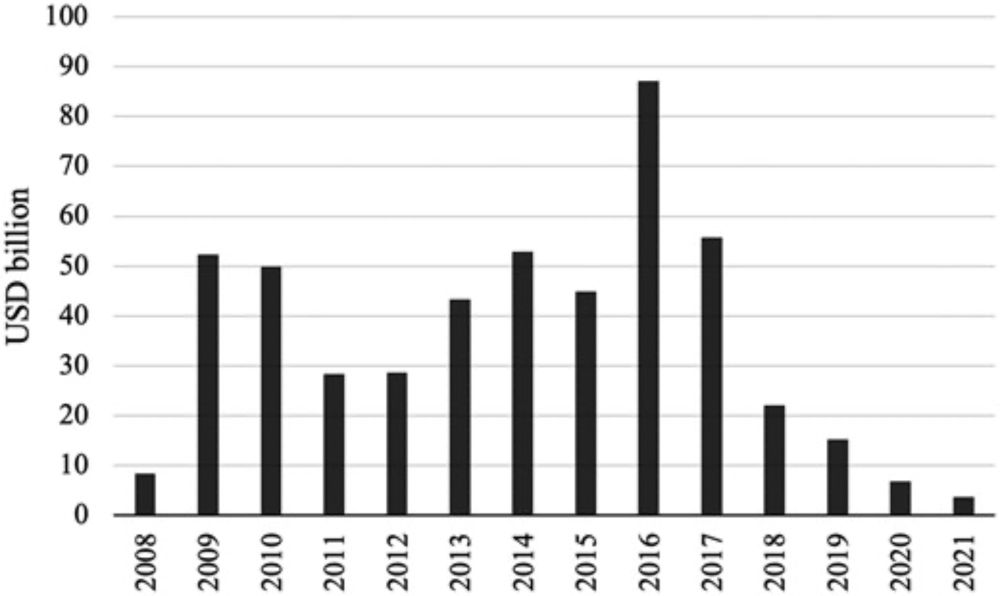

NEW: @70sbachchan.bsky.social & @mathiaslarsen.bsky.social on the BRI 2.0

NEW: @70sbachchan.bsky.social & @mathiaslarsen.bsky.social on the BRI 2.0

carnegieendowment.org/posts/2025/0...

carnegieendowment.org/posts/2025/0...

carnegieendowment.org/posts/2025/0...

www.netzeropolicylab.com/china-green-...

www.netzeropolicylab.com/china-green-...

journals.sagepub.com/doi/10.1177/...

journals.sagepub.com/doi/10.1177/...

thediplomat.com/2025/08/chin...

thediplomat.com/2025/08/chin...

www.sciencedirect.com/science/arti...

www.sciencedirect.com/science/arti...

doi.org/10.1080/0969...

doi.org/10.1080/0969...

www.environmental-finance.com/content/anal...

www.environmental-finance.com/content/anal...

doi.org/10.1093/ser/...

doi.org/10.1093/ser/...

@james7jackson.bsky.social, and I propose the concept of 'green financial planning' to capture how the Paris Agreement presents a state-capital relationship around planning.

www.tandfonline.com/doi/full/10....

@james7jackson.bsky.social, and I propose the concept of 'green financial planning' to capture how the Paris Agreement presents a state-capital relationship around planning.

www.tandfonline.com/doi/full/10....

www.cambridge.org/core/journal...

www.cambridge.org/core/journal...

journals.sagepub.com/doi/10.1177/...

journals.sagepub.com/doi/10.1177/...

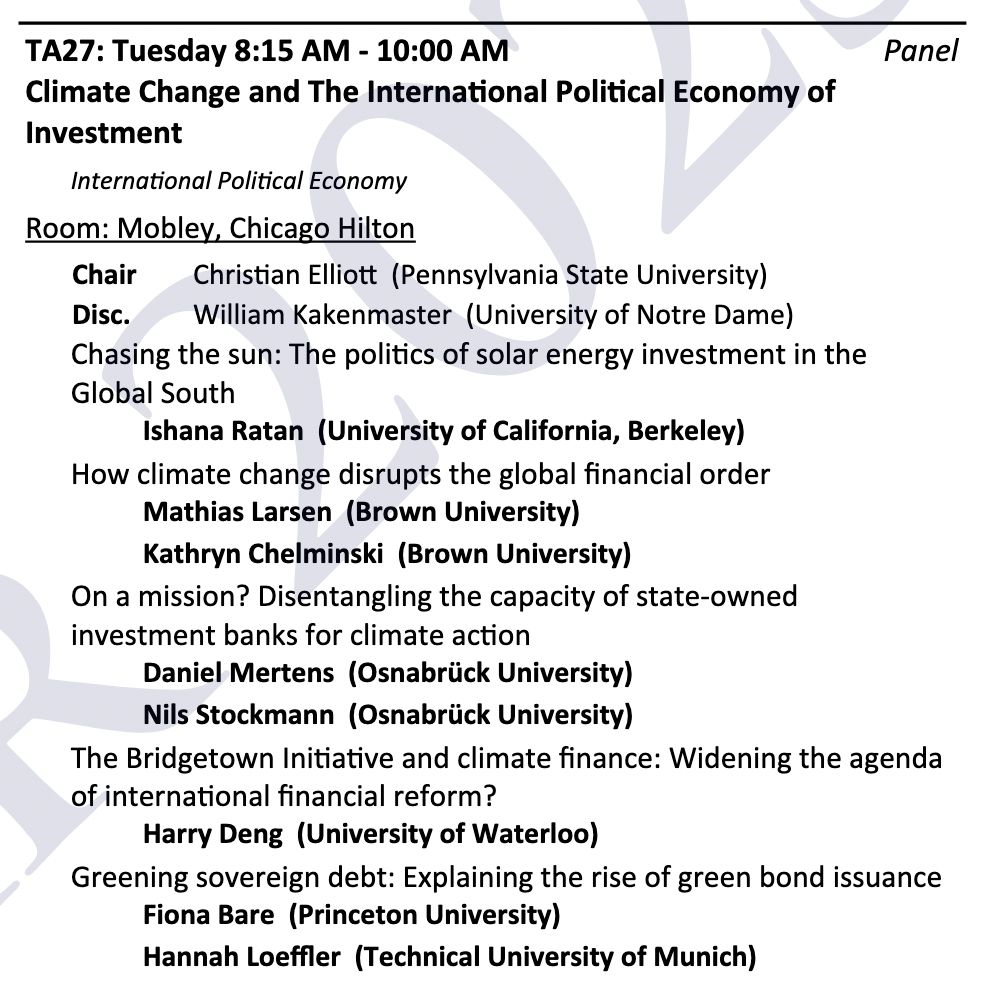

8:15 am in the Mobley Room!

8:15 am in the Mobley Room!