Course on Thinkific

learnbiotechinvesting.thinkific.com

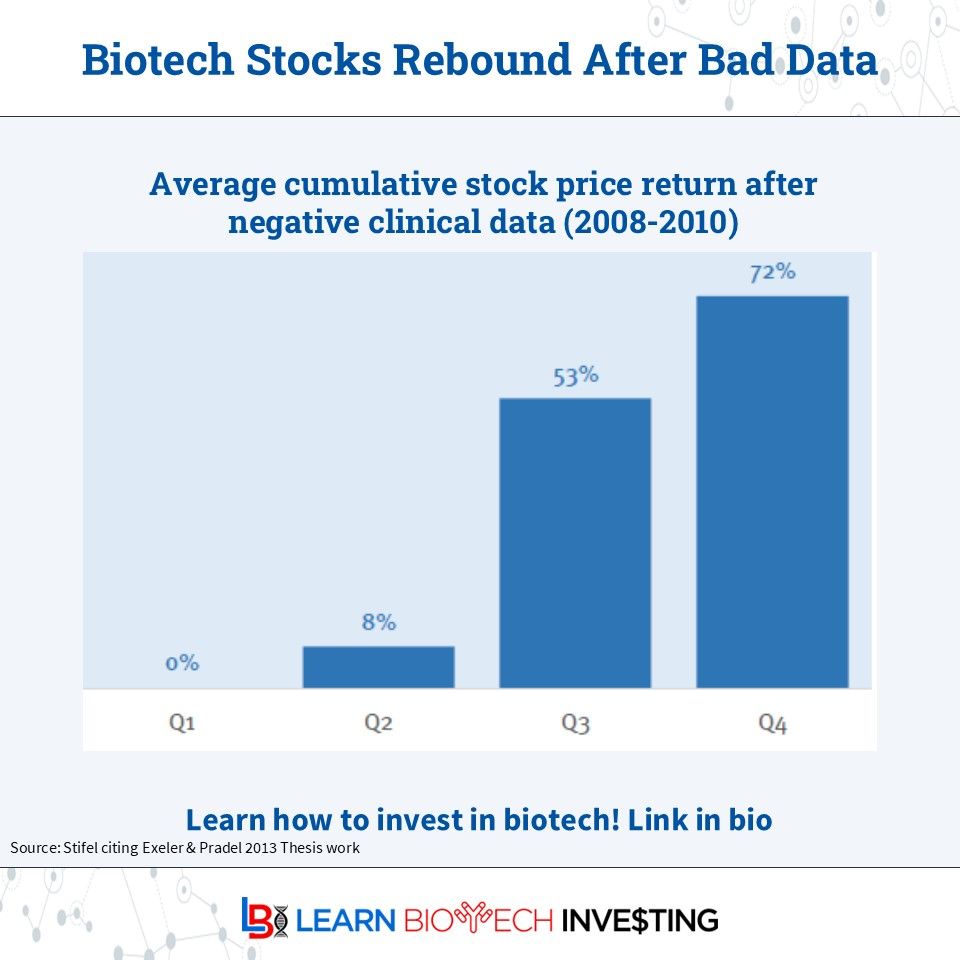

An interesting find but likely a dataset quirk

What do you think?

#learnbiotechinvesting #investing #BiotechPrometheus

An interesting find but likely a dataset quirk

What do you think?

#learnbiotechinvesting #investing #BiotechPrometheus

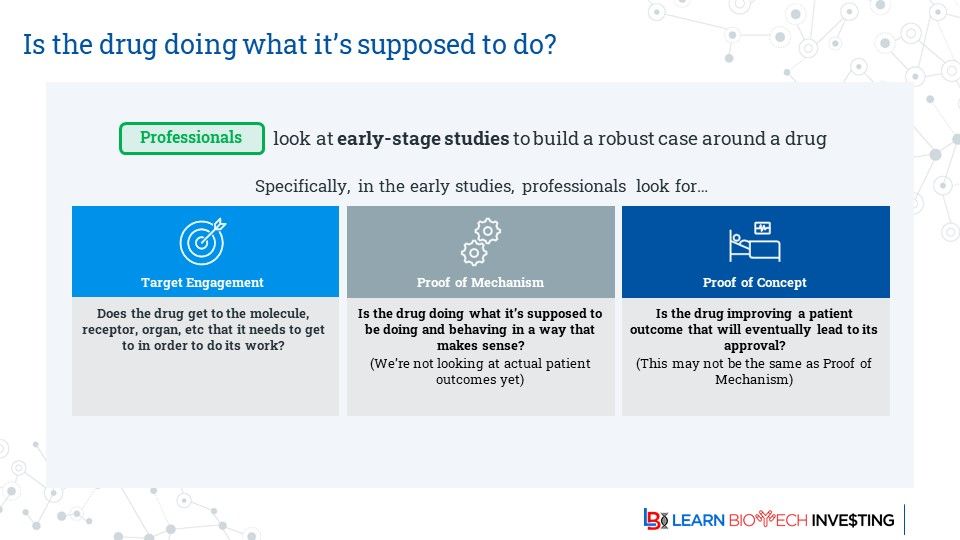

Look for: getting to right tissue, target engagement, proof of mechanism, and proof of concept

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Look for: getting to right tissue, target engagement, proof of mechanism, and proof of concept

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

That will impact your analysis

This is from 2013. If there's more recent data, please cite the source below

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

That will impact your analysis

This is from 2013. If there's more recent data, please cite the source below

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

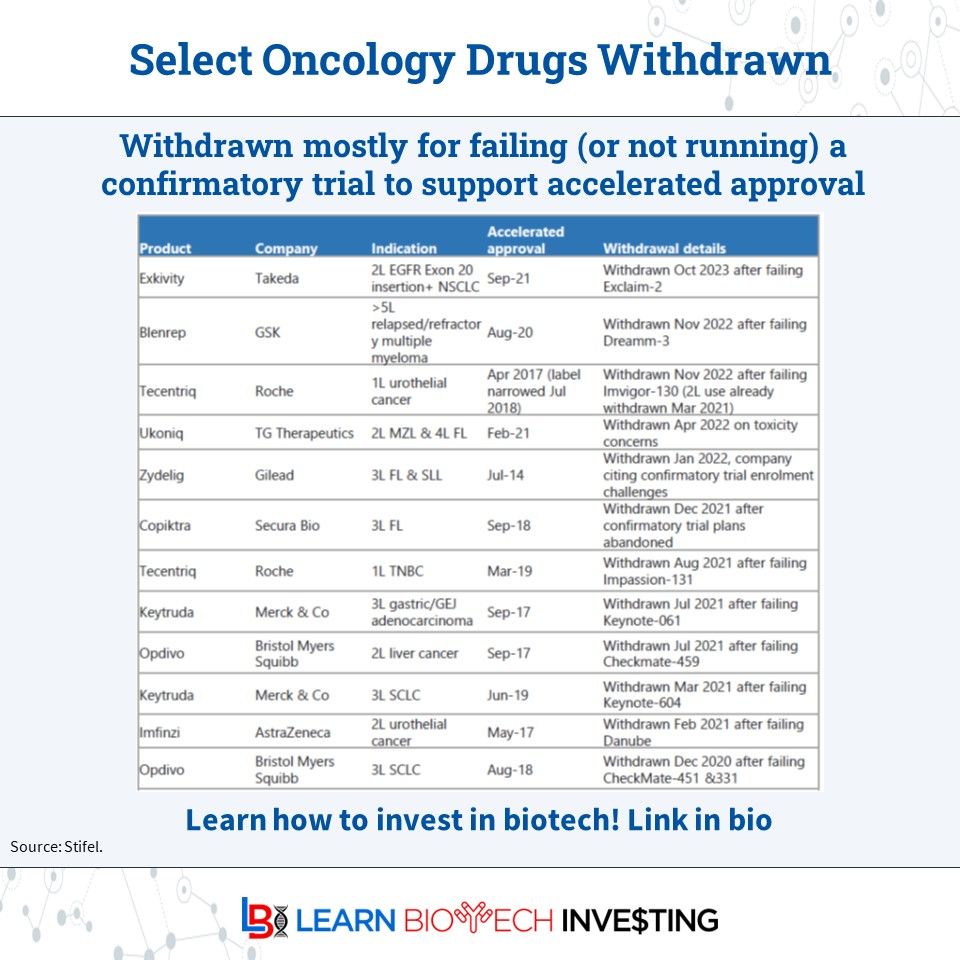

Here are recent oncology examples but it also happens in other TAs (women's health)

Here are recent oncology examples but it also happens in other TAs (women's health)

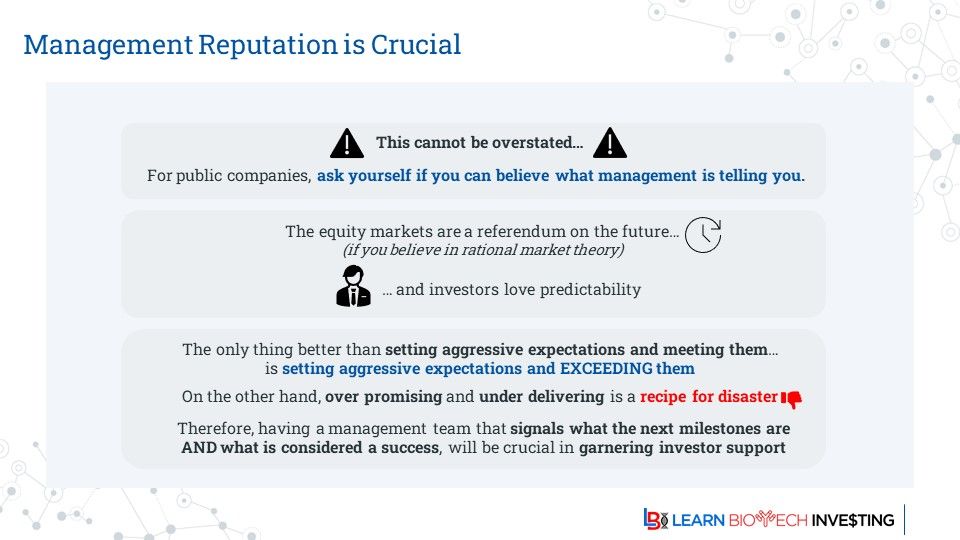

A lot that happens inside a company that is critical for success is outside of public view

Investors must ask themselves if they believe management is giving an accurate assessment, both good & bad

#learnbiotechinvesting #BiotechPrometheus

A lot that happens inside a company that is critical for success is outside of public view

Investors must ask themselves if they believe management is giving an accurate assessment, both good & bad

#learnbiotechinvesting #BiotechPrometheus

Here's what the CRs/PRs/SDs mean at a high level

These are assessed on scans

I'm using RECIST v1.1 definitions

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Here's what the CRs/PRs/SDs mean at a high level

These are assessed on scans

I'm using RECIST v1.1 definitions

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Here are the biopharma companies ranked by likelihood of first approval (LoA%) from 2006-2022

$AMGN, $NVO, #Eisai top the list

$GSK, #Astellas, $ABBV are at the bottom

#learnbiotechinvesting #BiotechPrometheus

Here are the biopharma companies ranked by likelihood of first approval (LoA%) from 2006-2022

$AMGN, $NVO, #Eisai top the list

$GSK, #Astellas, $ABBV are at the bottom

#learnbiotechinvesting #BiotechPrometheus

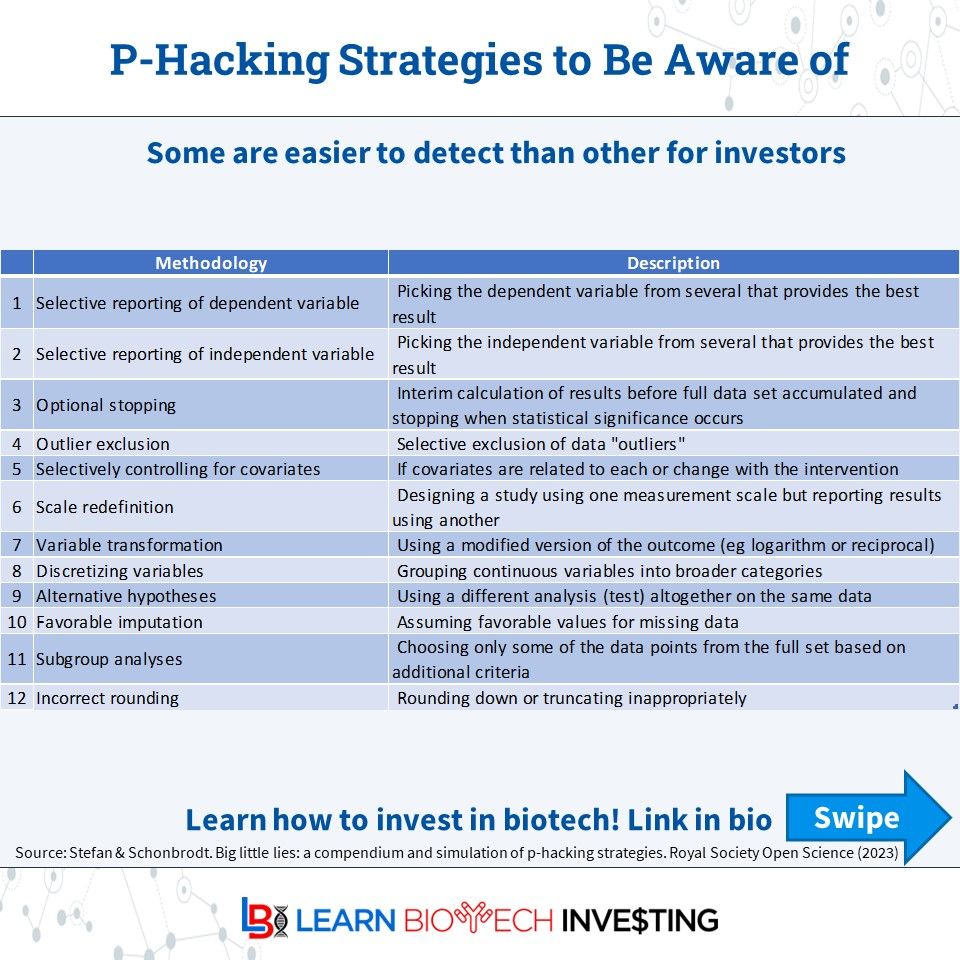

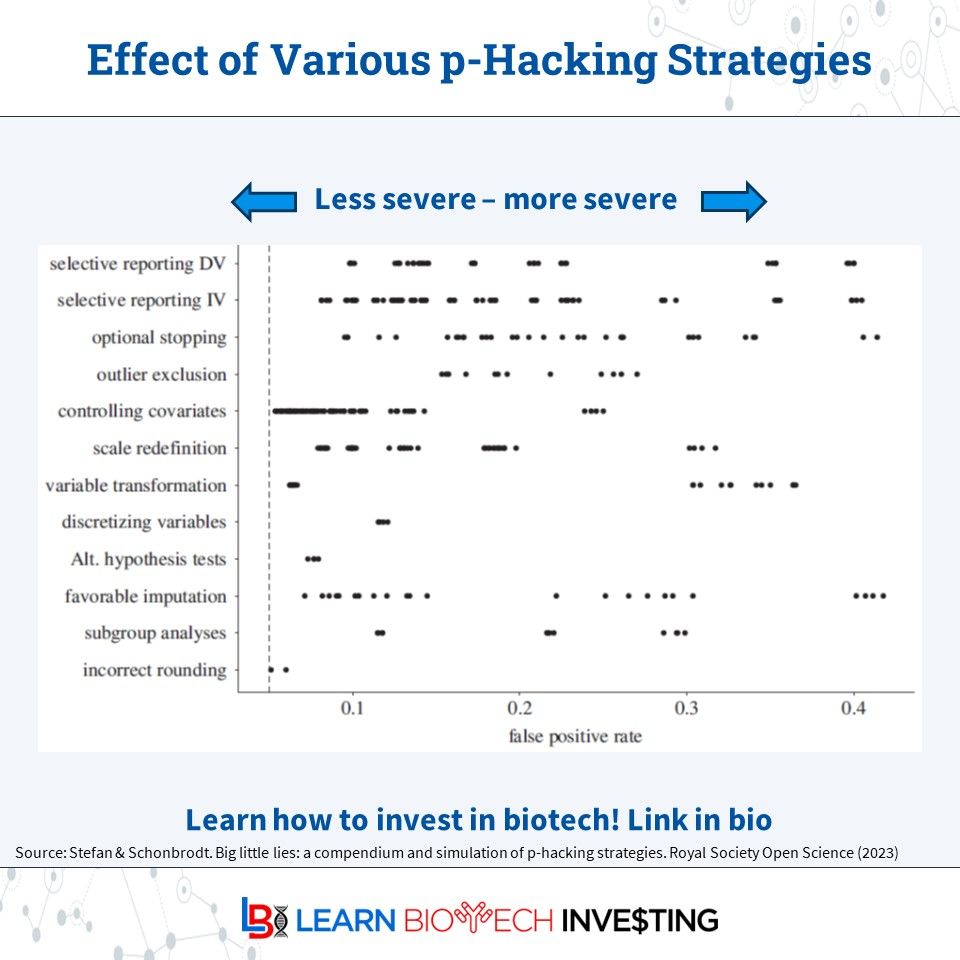

Hard to know without raw data but be prepared to ask & investigate where possible!

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Hard to know without raw data but be prepared to ask & investigate where possible!

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

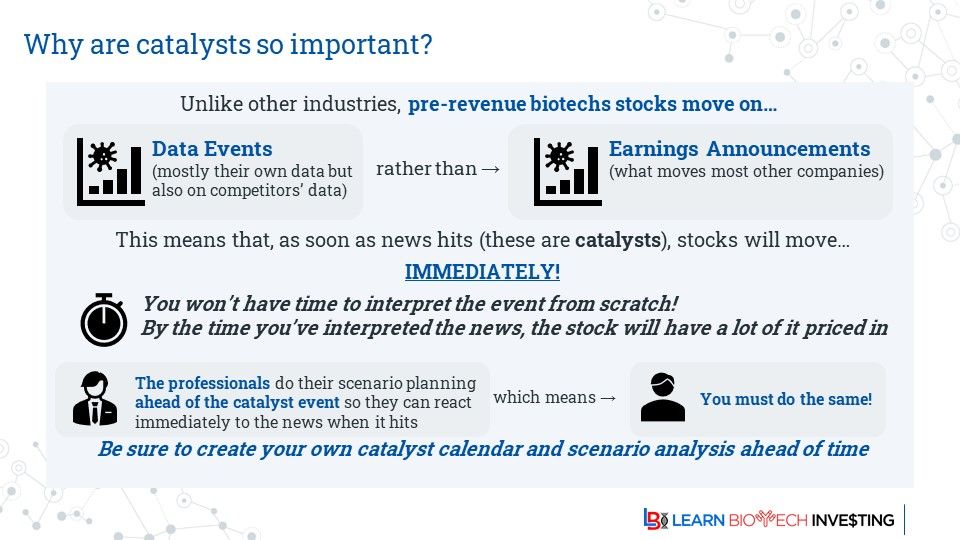

You won't have time to thoughtfully analyze the data when it hits

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

You won't have time to thoughtfully analyze the data when it hits

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

It tries to factor development risk into revenue and cost assumptions.

Here is a table of PoS values:

#learnbiotechinvesting #investing #BiotechPrometheus

It tries to factor development risk into revenue and cost assumptions.

Here is a table of PoS values:

#learnbiotechinvesting #investing #BiotechPrometheus

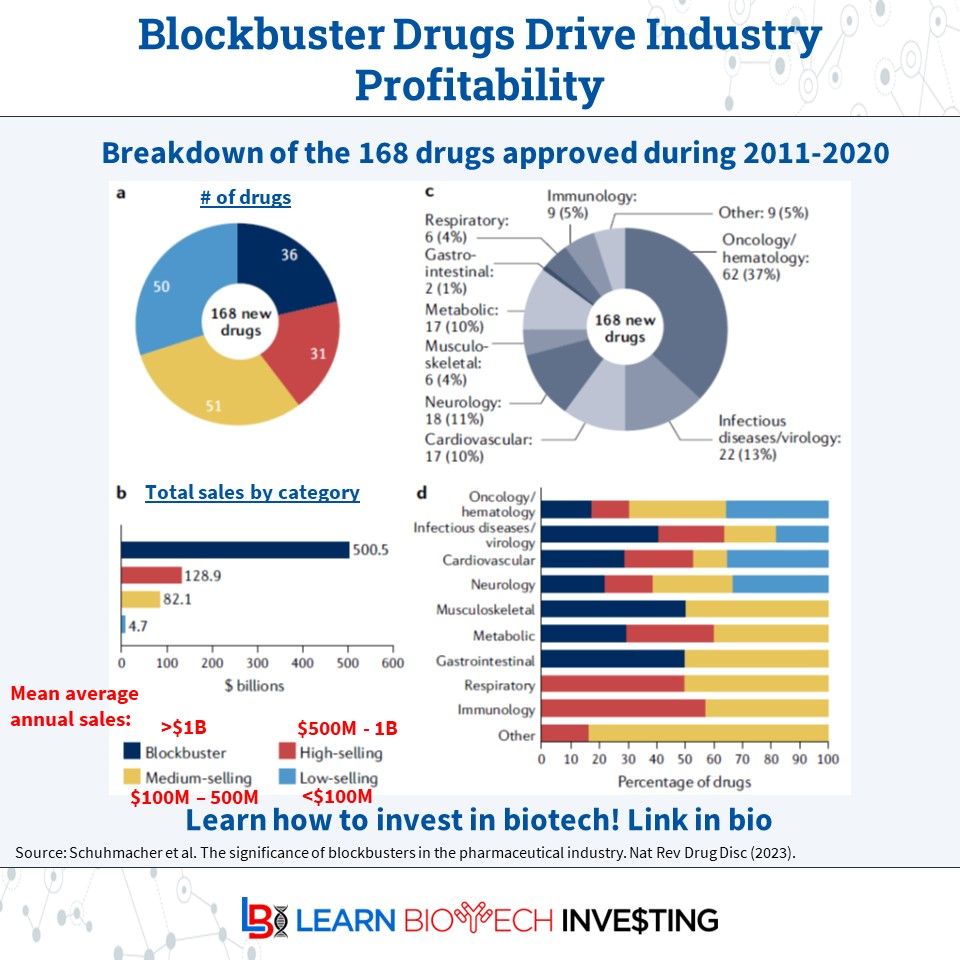

From 2011-2020, all blockbuster were profitable but no low selling drugs were

No immunology blockbusters in the time frame but there are now

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

From 2011-2020, all blockbuster were profitable but no low selling drugs were

No immunology blockbusters in the time frame but there are now

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

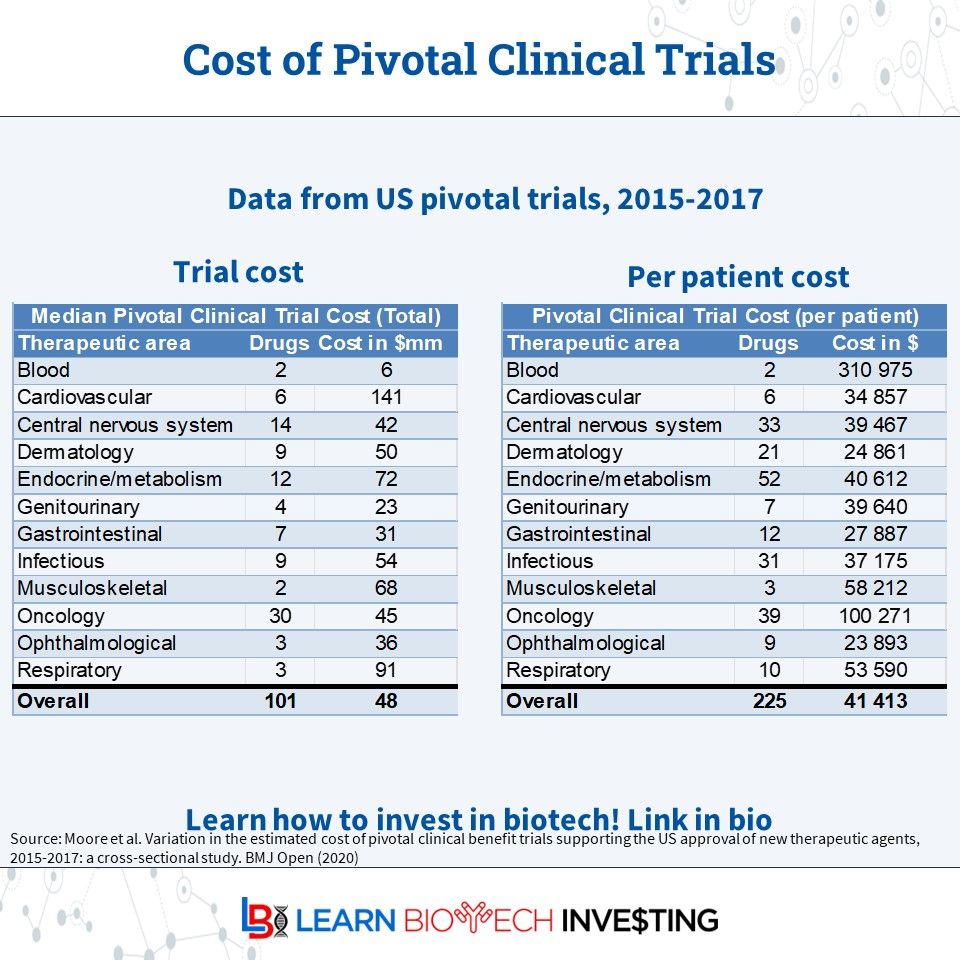

You can see it varies by Therapeutic Area

Remember, good clinical trials CANNOT be done on the cheap!

If anyone has updated numbers, please share!!!

#learnbiotechinvesting #BiotechPrometheus

You can see it varies by Therapeutic Area

Remember, good clinical trials CANNOT be done on the cheap!

If anyone has updated numbers, please share!!!

#learnbiotechinvesting #BiotechPrometheus

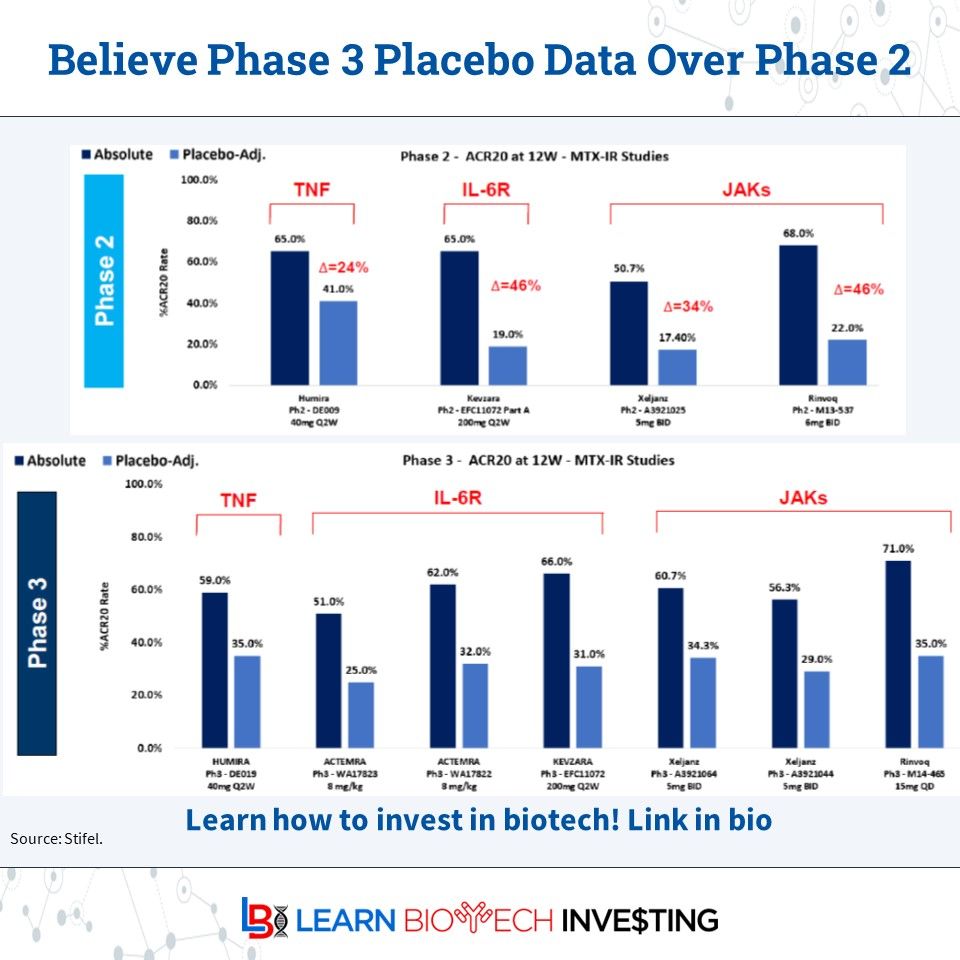

Use Phase 3 data, often on drug labels, to make comparisons; They're more consistent

#learnbiotechinvesting

Use Phase 3 data, often on drug labels, to make comparisons; They're more consistent

#learnbiotechinvesting

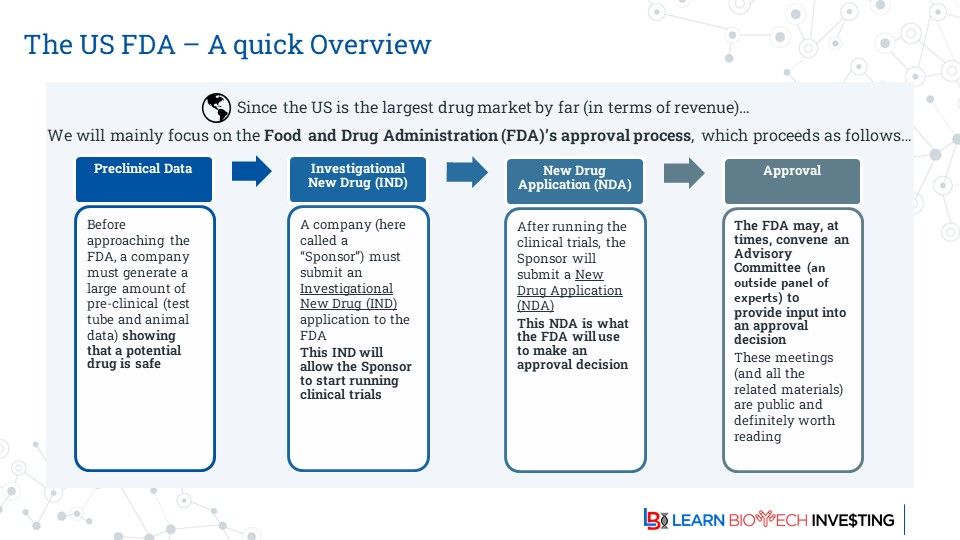

At each step investors should ask themselves if the company is developing things in a way that will satisfy the FDA

Until a drug is approved the FDA is the most important decision maker

#BiotechPrometheus

At each step investors should ask themselves if the company is developing things in a way that will satisfy the FDA

Until a drug is approved the FDA is the most important decision maker

#BiotechPrometheus

What do you think?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

What do you think?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

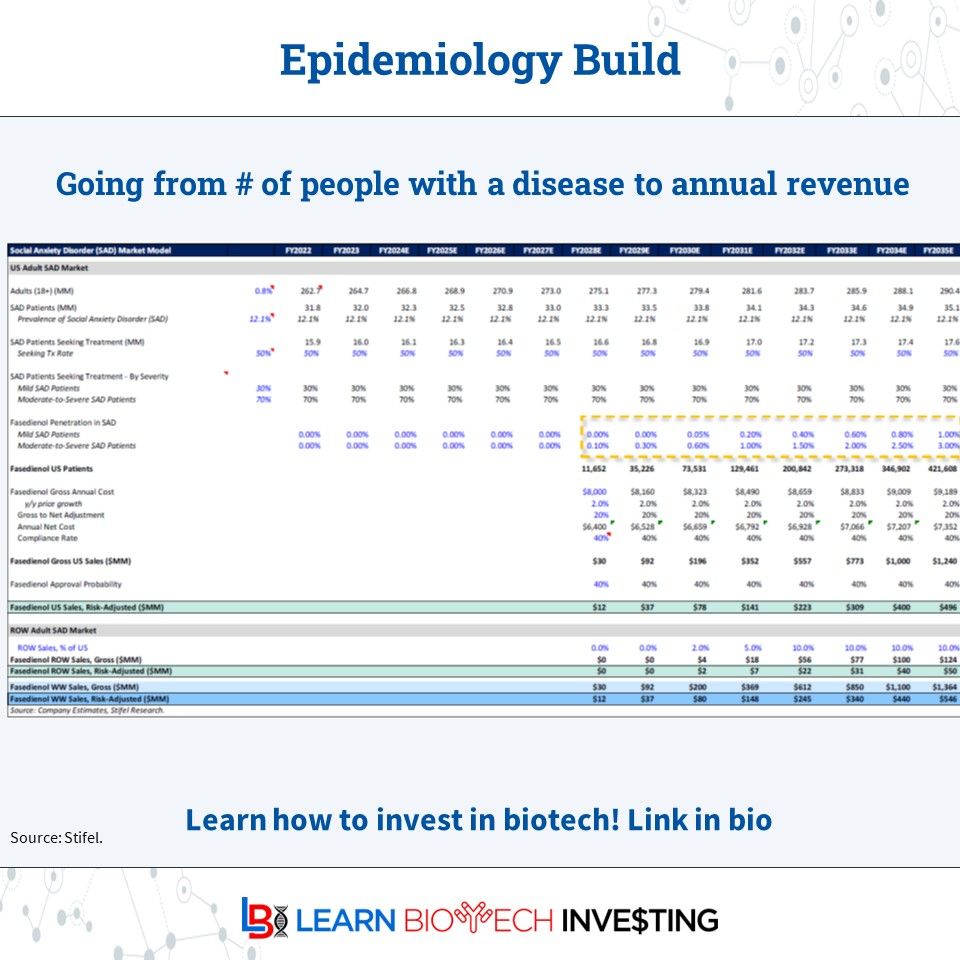

It takes a disease prevalence (or incidence) and turns it into annual revenue. This is what is plugged into other models

Here's an example:

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

It takes a disease prevalence (or incidence) and turns it into annual revenue. This is what is plugged into other models

Here's an example:

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

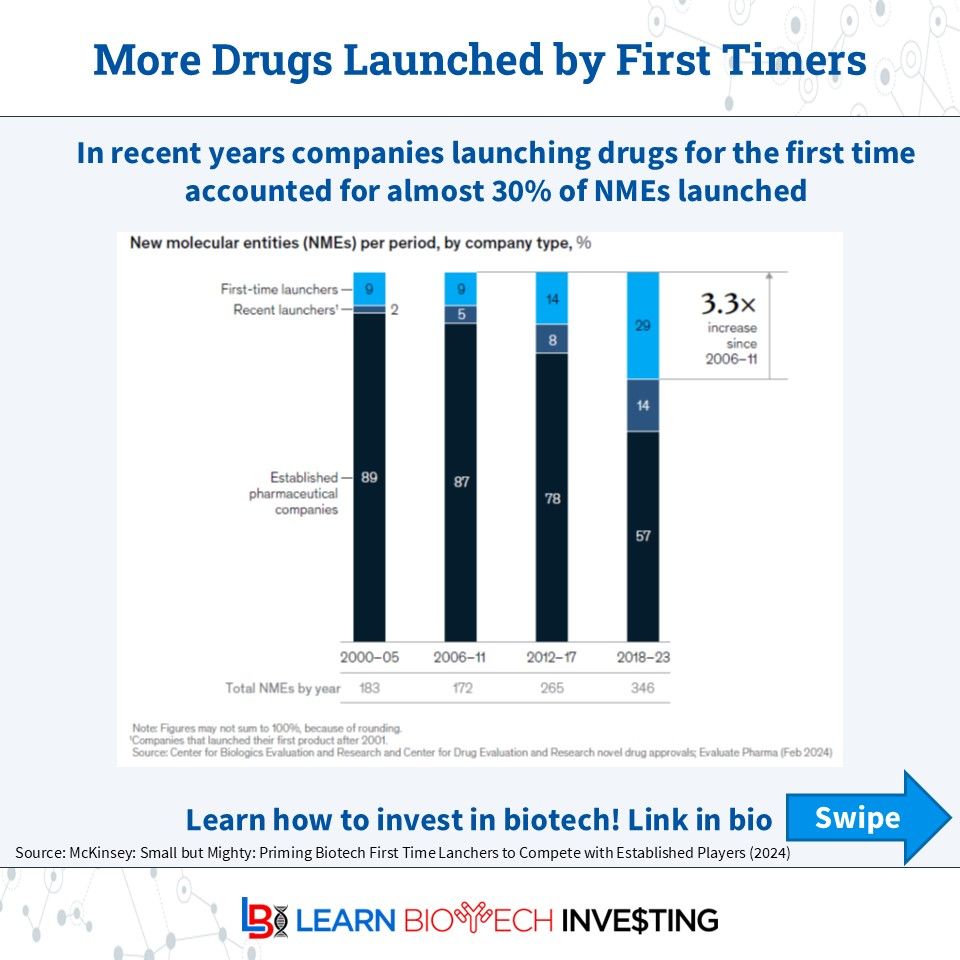

First timers underperform expectations vs experienced peers ~75% vs ~55% of the time

McKinsey correlates this to greater & earlier commercial investment from experience

Do you agree?

First timers underperform expectations vs experienced peers ~75% vs ~55% of the time

McKinsey correlates this to greater & earlier commercial investment from experience

Do you agree?

This is a drastic simplification but useful to know

Be aware of the perverse incentives #PBM

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

This is a drastic simplification but useful to know

Be aware of the perverse incentives #PBM

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Recently multiples have declined reflecting lower valuations, later stage acquisitions, and smaller market opportunities

What are some other reasons?

#learnbiotechinvesting

Recently multiples have declined reflecting lower valuations, later stage acquisitions, and smaller market opportunities

What are some other reasons?

#learnbiotechinvesting

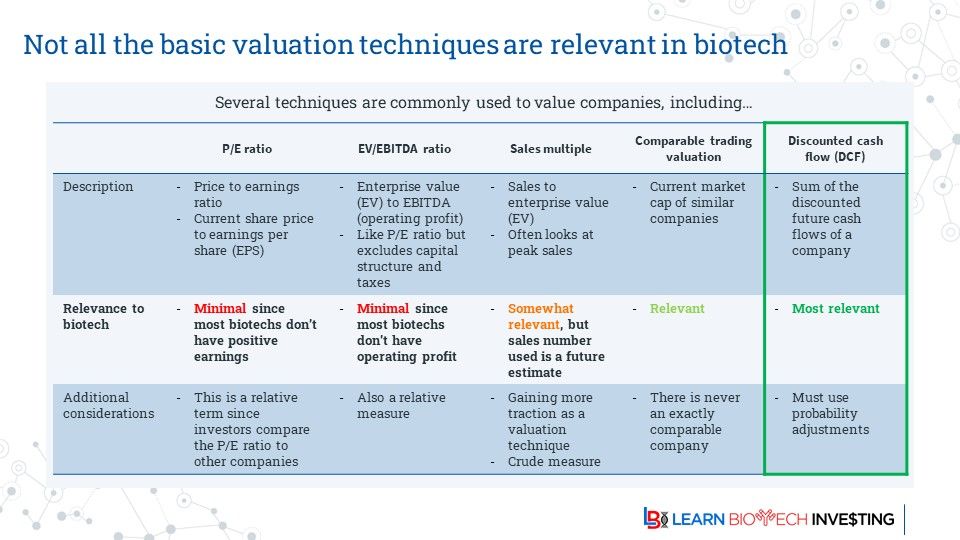

Though it too has drawbacks

#DCF #PoS #learnbiotechinvesting #biotech #investing #BiotechPrometheus

Though it too has drawbacks

#DCF #PoS #learnbiotechinvesting #biotech #investing #BiotechPrometheus

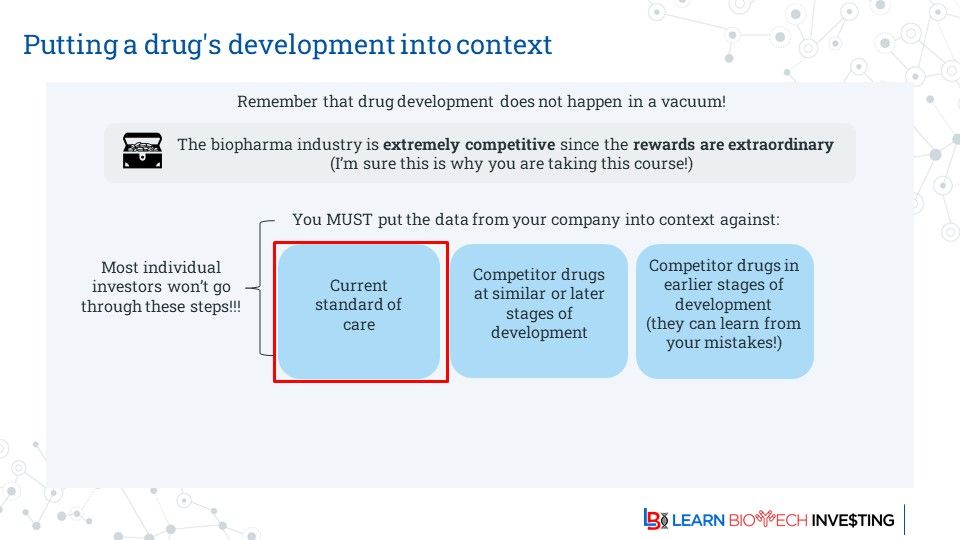

This framework will help investors organise their thoughts

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

This framework will help investors organise their thoughts

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Also keep an eye on the competition

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Also keep an eye on the competition

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Usually applied to multiple drugs in the same class it can hamper revenue potential if alternatives exist

Investors should be aware

#learnbiotechinvesting

Usually applied to multiple drugs in the same class it can hamper revenue potential if alternatives exist

Investors should be aware

#learnbiotechinvesting

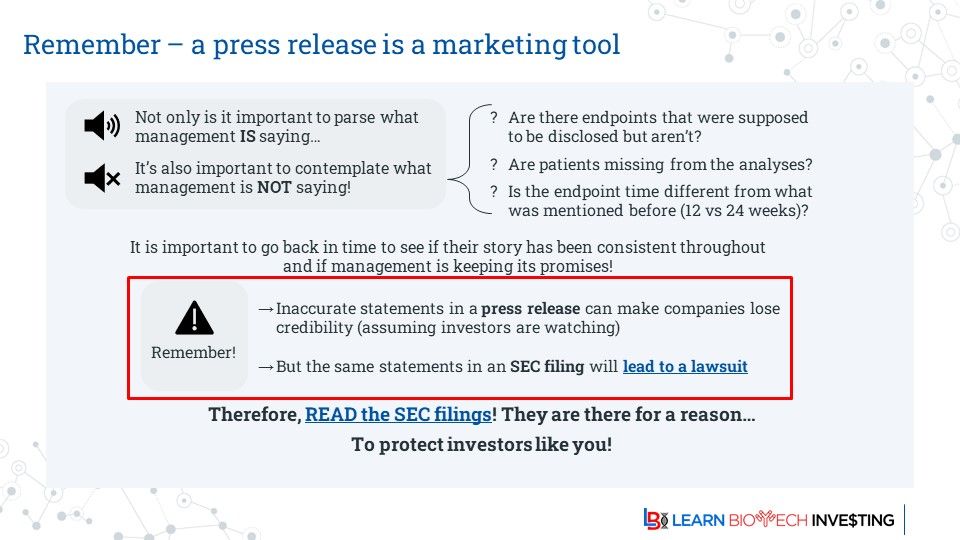

Read the SEC filings! They exist to help #investors! And they are freely available, often on the company website

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

Read the SEC filings! They exist to help #investors! And they are freely available, often on the company website

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

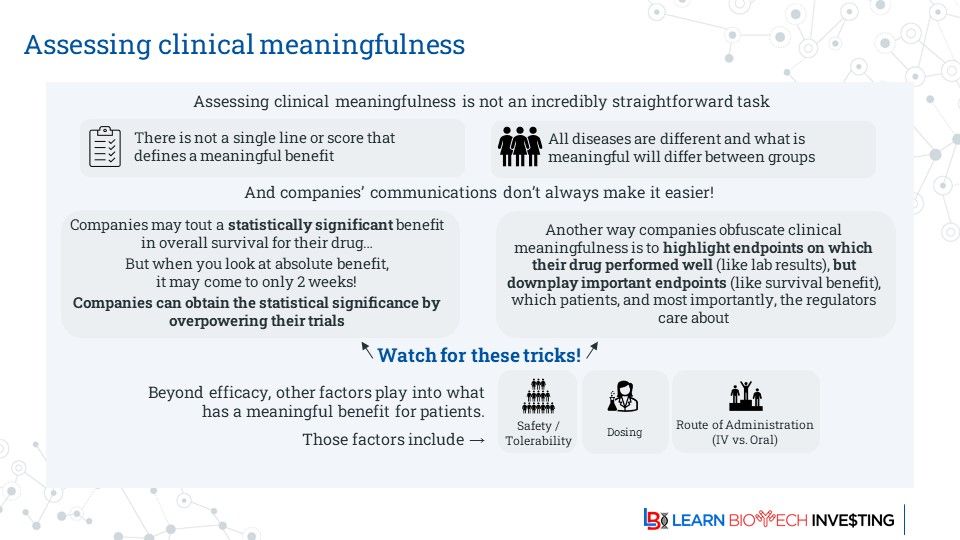

A "positive" result sometimes isn't enough if it doesn't significantly change the treatment landscape. But this can be subjective

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

A "positive" result sometimes isn't enough if it doesn't significantly change the treatment landscape. But this can be subjective

#learnbiotechinvesting #biotech #investing #BiotechPrometheus