https://finance.yahoo.com/author/josh-schafer/

finance.yahoo.com/news/10-char...

finance.yahoo.com/news/10-char...

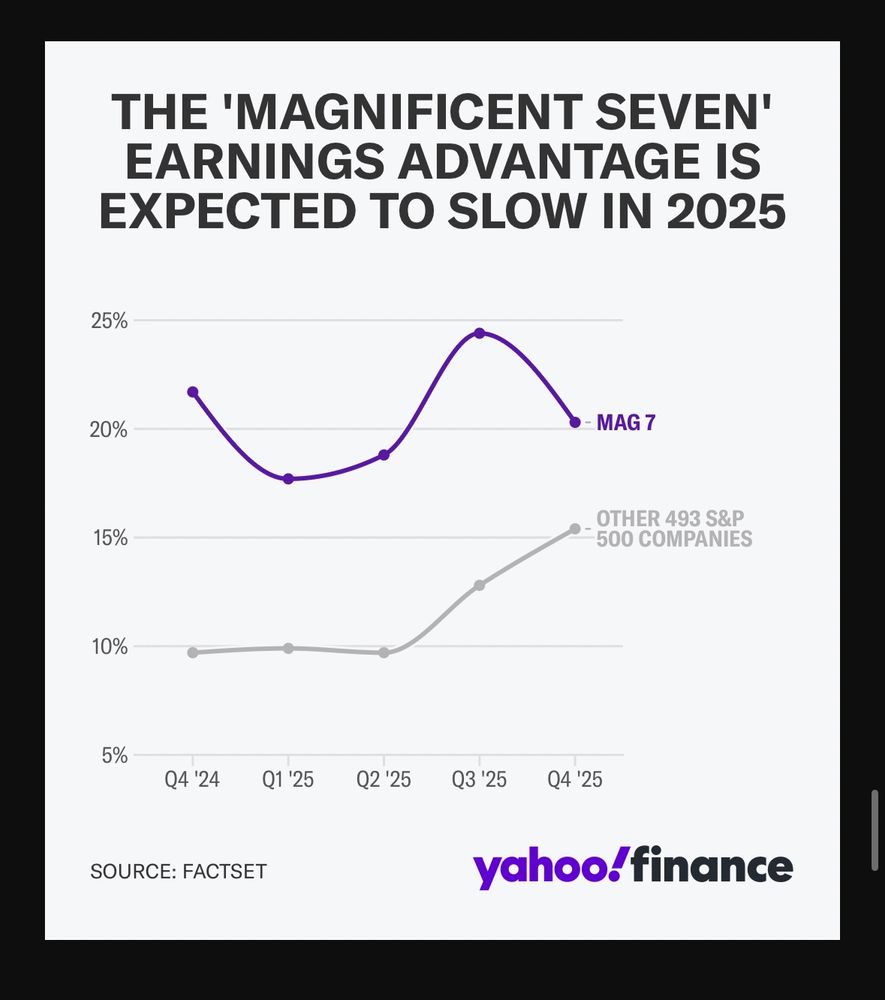

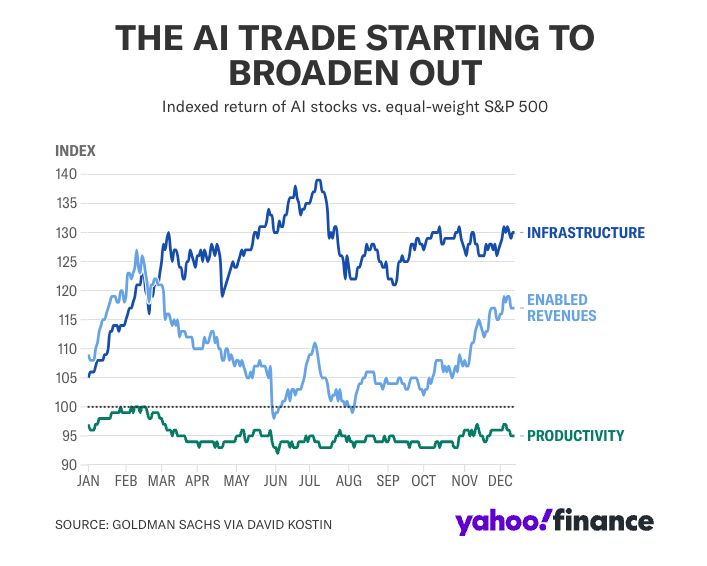

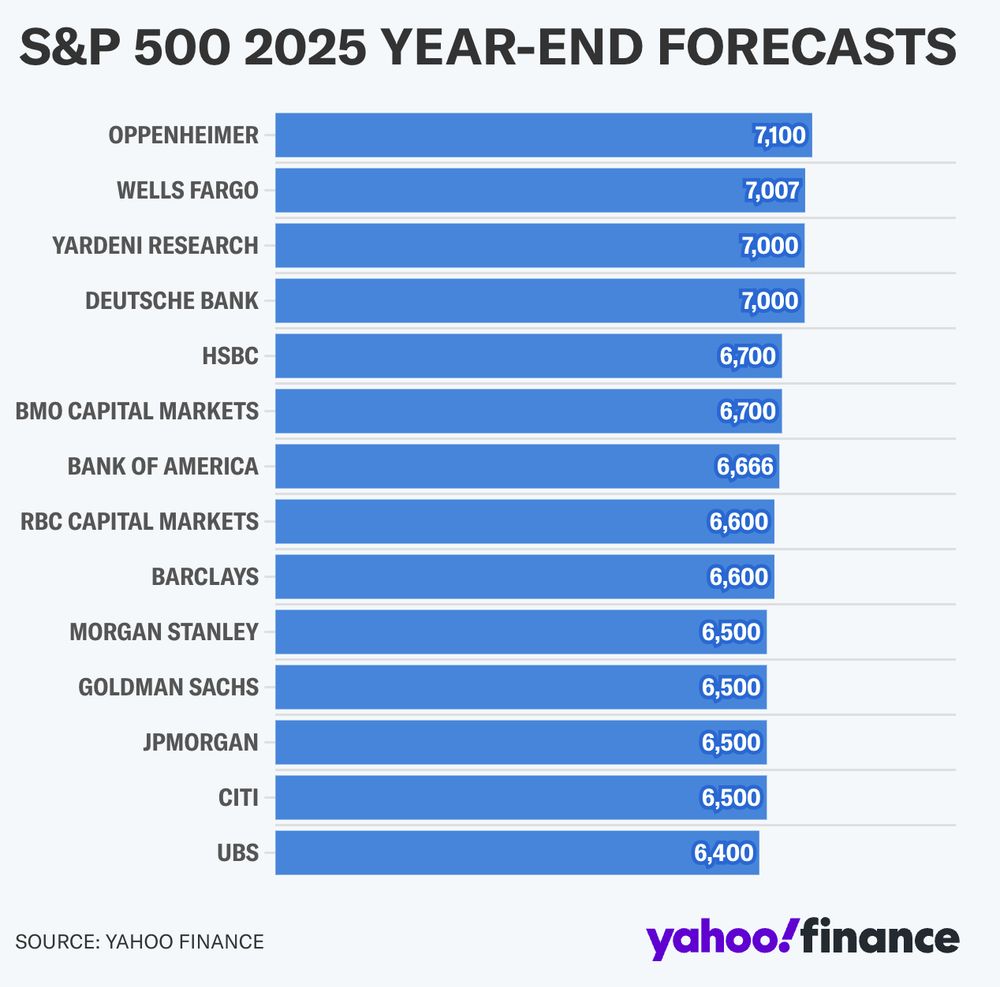

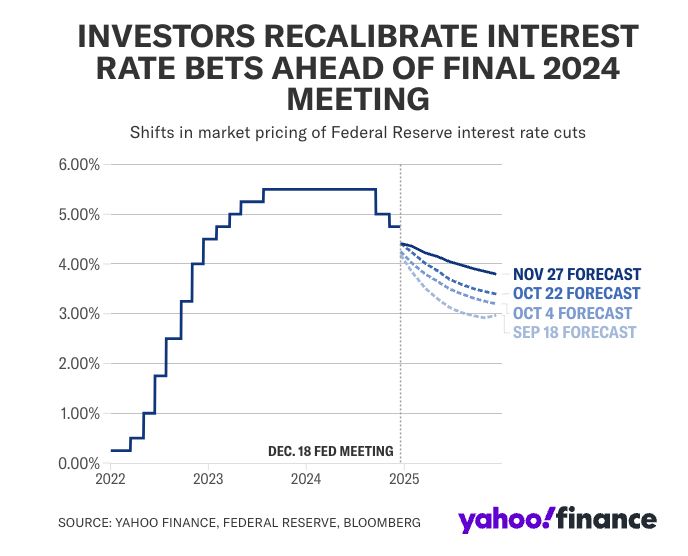

Story @yahoo-finance.bsky.social about why many are calling for the light blue line in the chart below to continue gaining steam.

Story @yahoo-finance.bsky.social about why many are calling for the light blue line in the chart below to continue gaining steam.

In today’s @yahoo-finance.bsky.social Morning Brief, we dug into the flip side and a few reasons why the US could be less “exceptional” than many are hoping in 2025:

finance.yahoo.com/news/what-co...

In today’s @yahoo-finance.bsky.social Morning Brief, we dug into the flip side and a few reasons why the US could be less “exceptional” than many are hoping in 2025:

finance.yahoo.com/news/what-co...

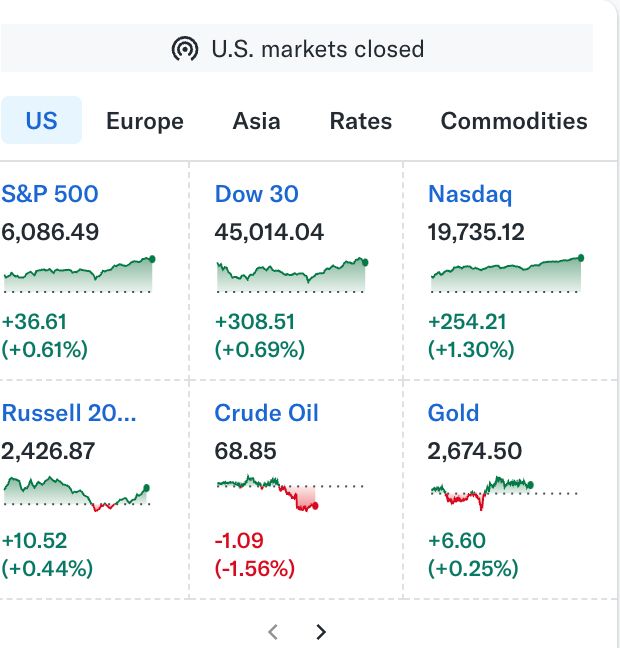

Stifel's Barry Bannister sees the S&P 500 ending 2025 in the "mid 5,000s" driven by sticky inflation, and slowing economic growth.

finance.yahoo.com/news/stocks-...

Stifel's Barry Bannister sees the S&P 500 ending 2025 in the "mid 5,000s" driven by sticky inflation, and slowing economic growth.

finance.yahoo.com/news/stocks-...

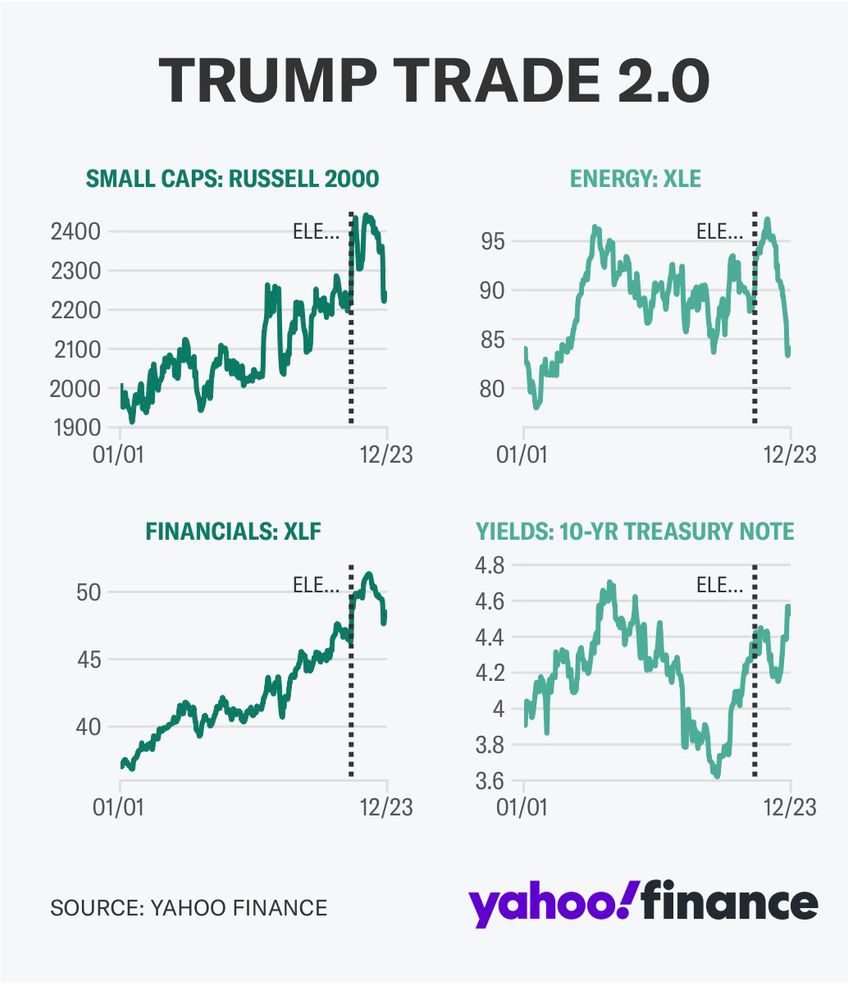

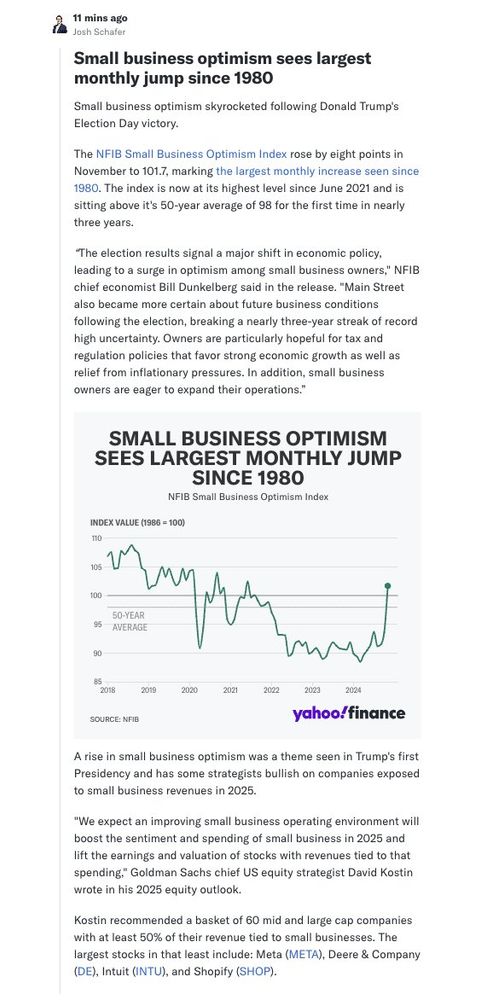

Large companies with significant revenue tied to small businesses has been an area strategist like Goldman Sachs' David Kostin have highlighted headed into 2025.

finance.yahoo.com/news/live/st...

Large companies with significant revenue tied to small businesses has been an area strategist like Goldman Sachs' David Kostin have highlighted headed into 2025.

finance.yahoo.com/news/live/st...

Story in today’s @yahoo-finance.bsky.social Morning Brief:

finance.yahoo.com/news/the-fed...

Story in today’s @yahoo-finance.bsky.social Morning Brief:

finance.yahoo.com/news/the-fed...

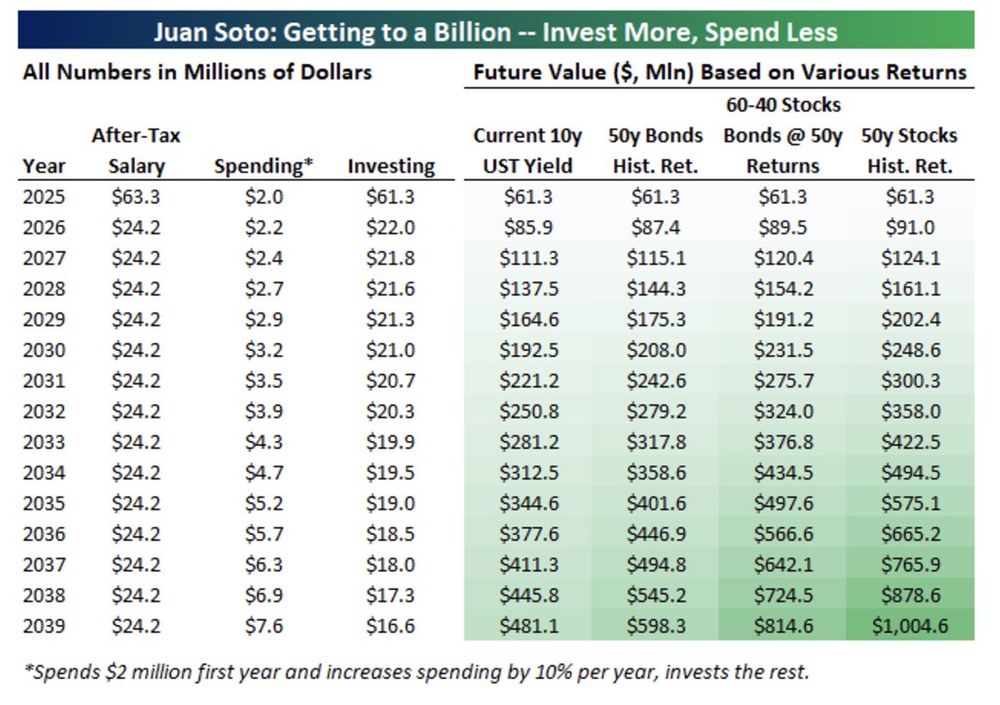

If Juan Soto put most of his earnings in a 60/40 portfolio his cash would grow to $814.6 million by 2039.

"If Soto were to put it all into the US stock market, based on annual returns over the last 50 years, he'd be at just over $1B by 2039."

If Juan Soto put most of his earnings in a 60/40 portfolio his cash would grow to $814.6 million by 2039.

"If Soto were to put it all into the US stock market, based on annual returns over the last 50 years, he'd be at just over $1B by 2039."

finance.yahoo.com/news/wall-st...

finance.yahoo.com/news/wall-st...

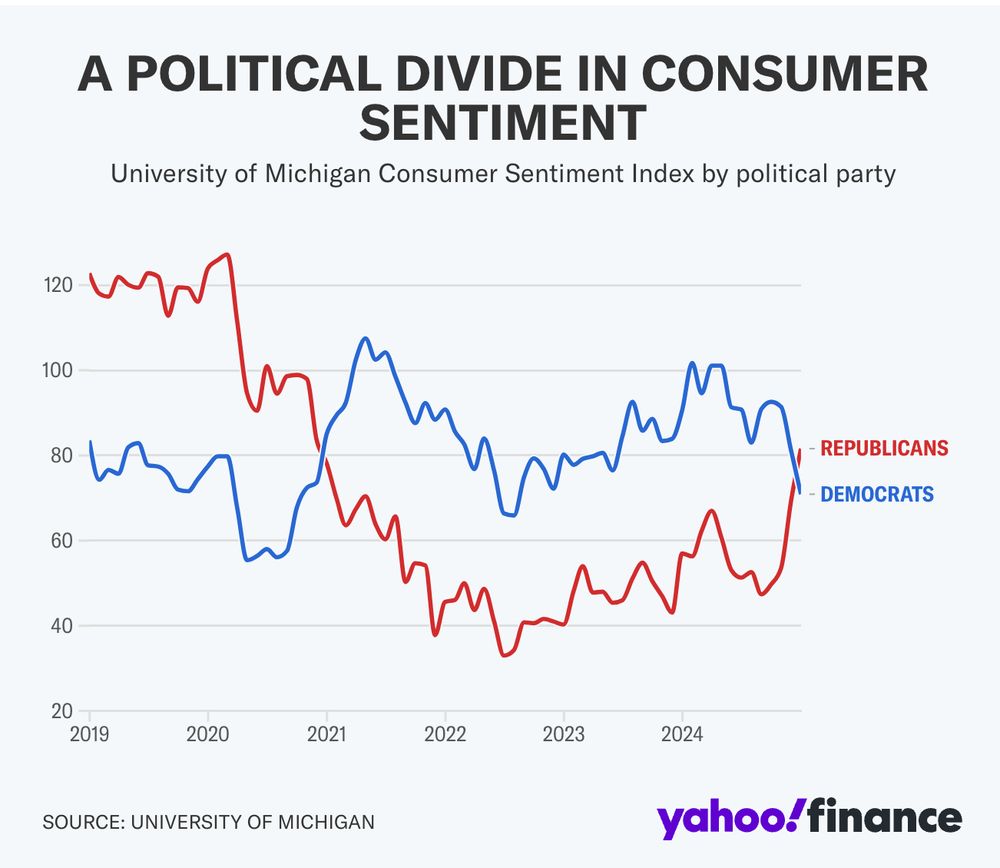

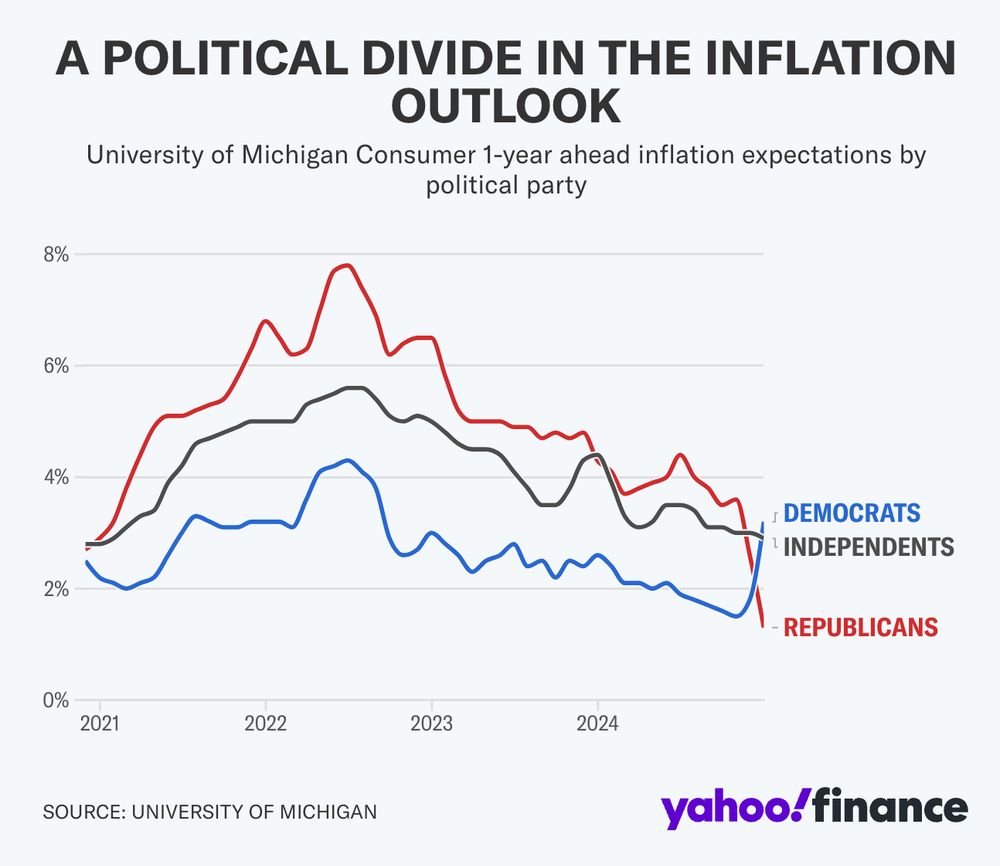

Democrats see inflation rising to 3.2% in the next year while Republicans are much more optimistic, believing inflation will fall to 1.3% over the next year.

t.co/mnmja9iiTj

Democrats see inflation rising to 3.2% in the next year while Republicans are much more optimistic, believing inflation will fall to 1.3% over the next year.

t.co/mnmja9iiTj

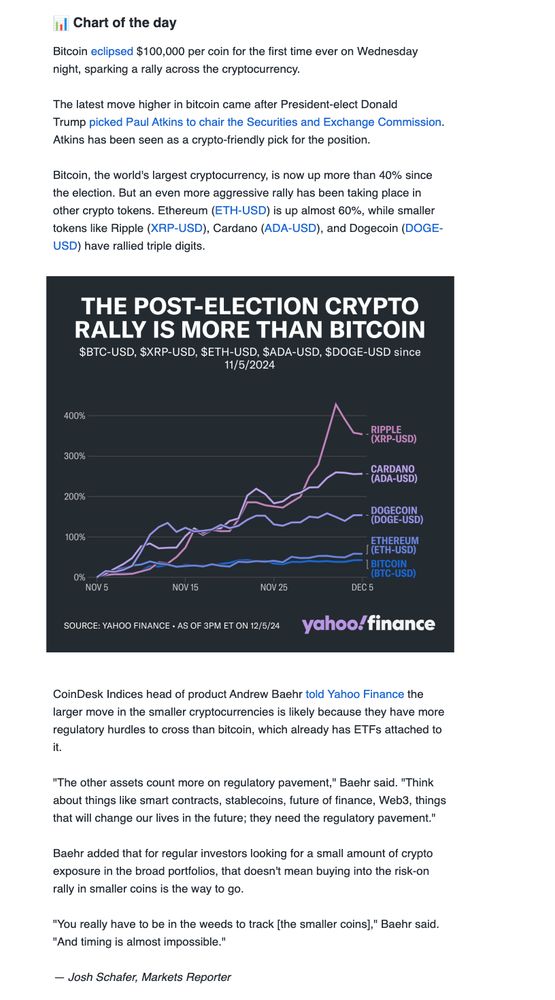

After a year mainly led by bitcoin, it’s risk-on all over crypto.

After a year mainly led by bitcoin, it’s risk-on all over crypto.

finance.yahoo.com/news/live/st...

finance.yahoo.com/news/live/st...

Why stronger-than-expected economic growth is a key part of Wall Street's bullish calls for stocks in 2025:

finance.yahoo.com/news/wall-st...

Why stronger-than-expected economic growth is a key part of Wall Street's bullish calls for stocks in 2025:

finance.yahoo.com/news/wall-st...

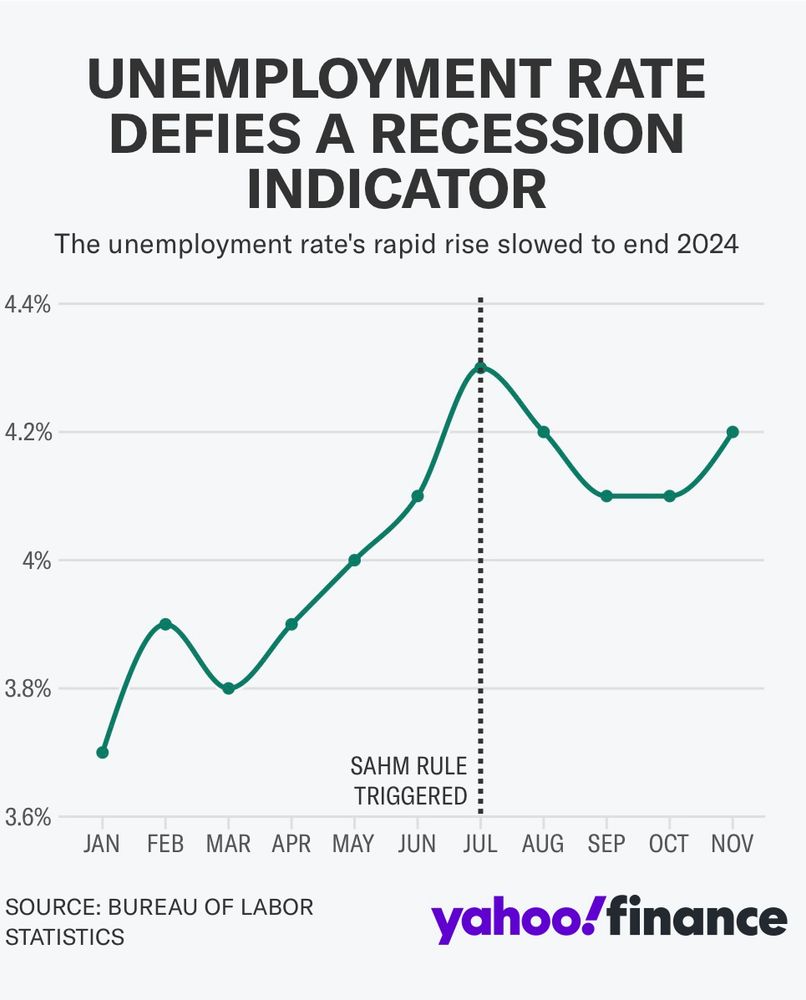

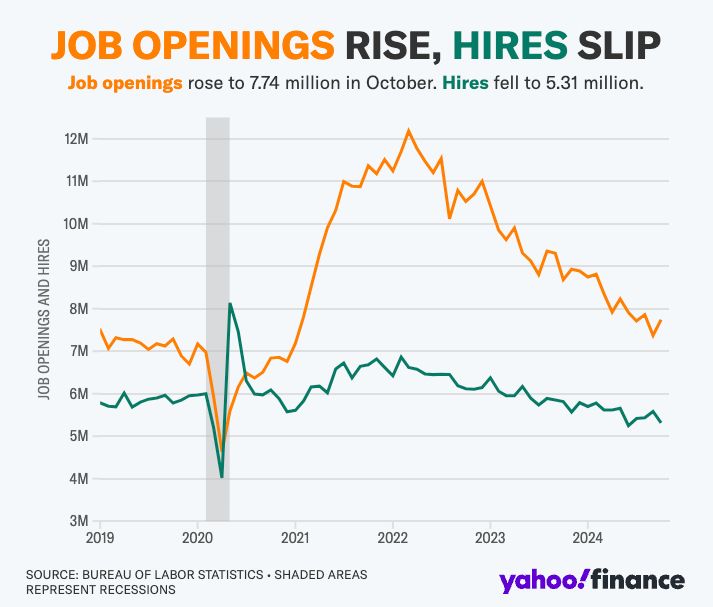

"Today’s report is yet another indication that labor demand is softening but not collapsing."

finance.yahoo.com/news/job-ope...

"Today’s report is yet another indication that labor demand is softening but not collapsing."

finance.yahoo.com/news/job-ope...

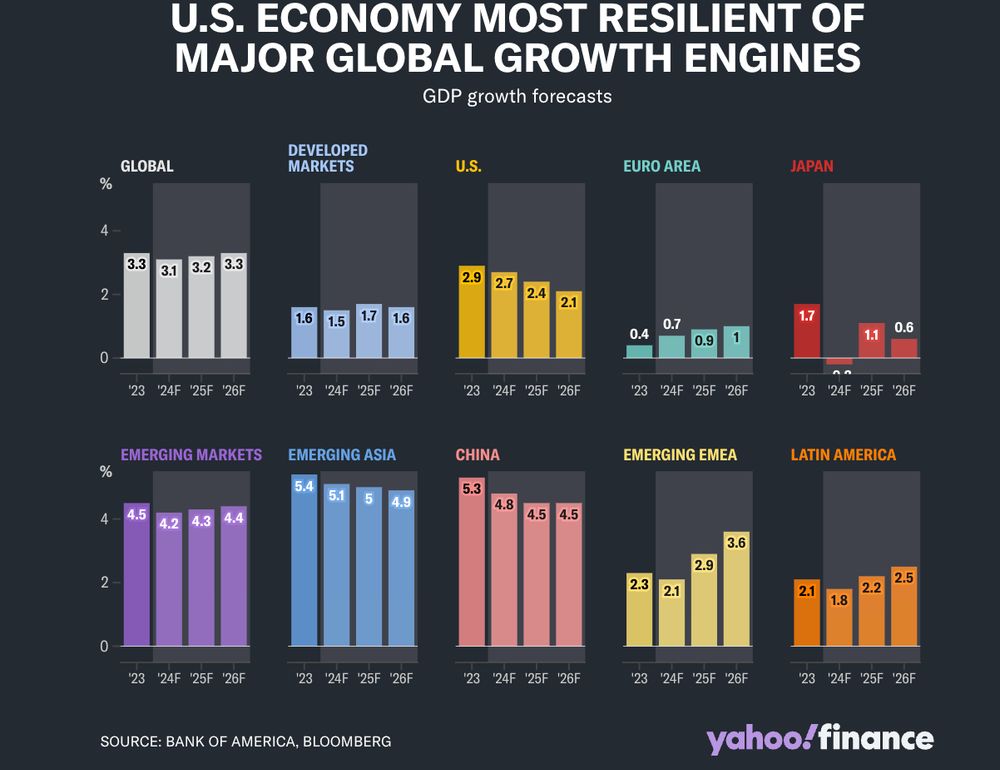

"We like to say that the US imports a lot of stuff, but it doesn't import recessions," Aditya Bhave, senior US economist at BofA, said on Monday.

My story on @yahoo-finance.bsky.social ⤵️

finance.yahoo.com/news/us-econ...

"We like to say that the US imports a lot of stuff, but it doesn't import recessions," Aditya Bhave, senior US economist at BofA, said on Monday.

My story on @yahoo-finance.bsky.social ⤵️

finance.yahoo.com/news/us-econ...

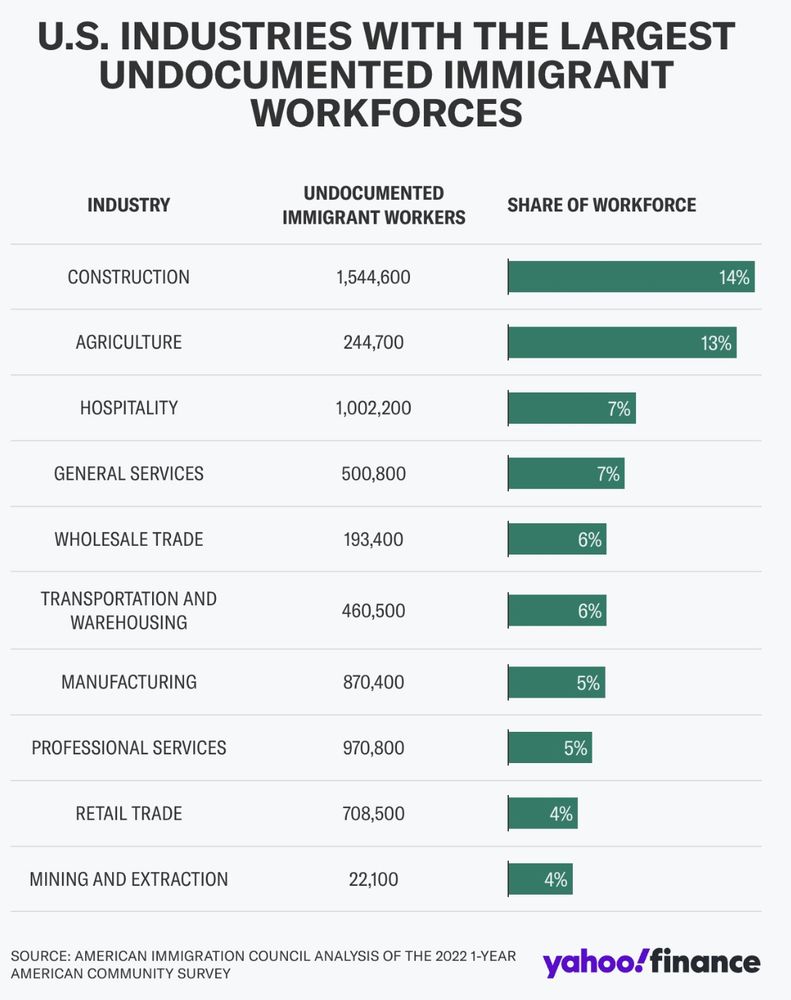

“The reason that it's disruptive is not simply because our economy relies on this labor; it's the abruptness of it."

finance.yahoo.com/news/us-labo...

“The reason that it's disruptive is not simply because our economy relies on this labor; it's the abruptness of it."

finance.yahoo.com/news/us-labo...

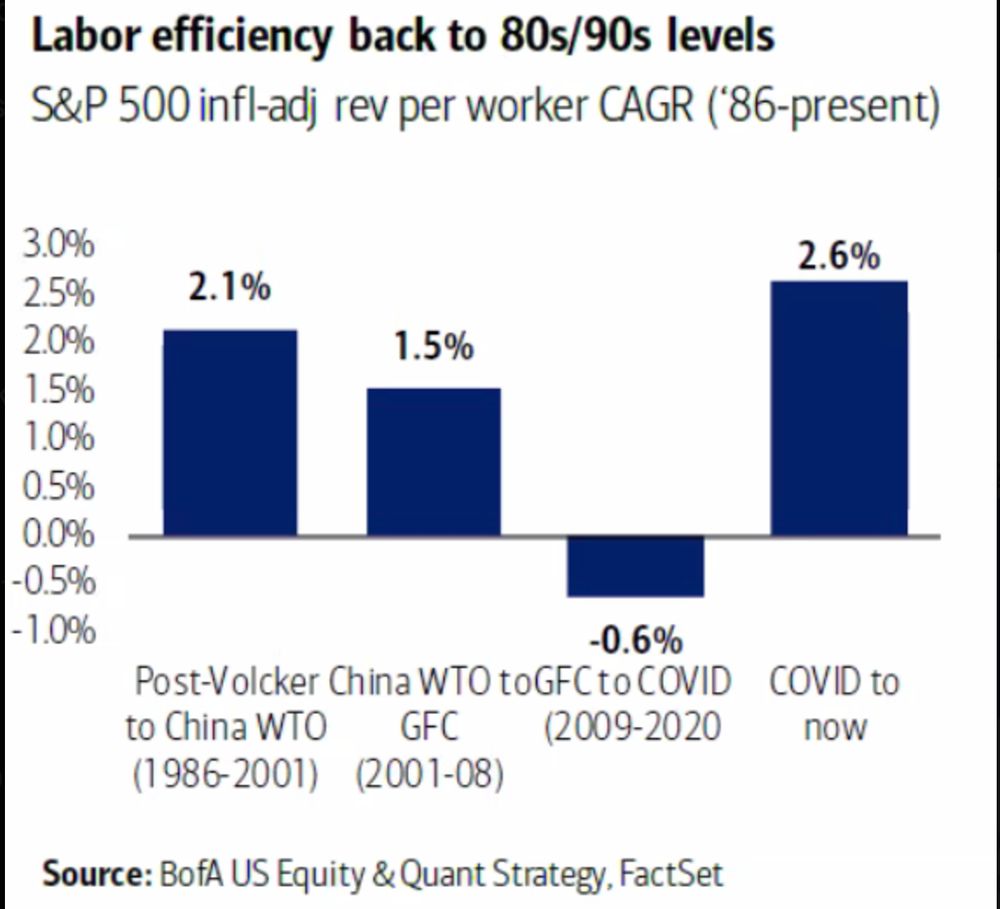

BofA: "We think we're going back to more of that 80s, 90s type of market environment where productivity drives gains."

BofA: "We think we're going back to more of that 80s, 90s type of market environment where productivity drives gains."

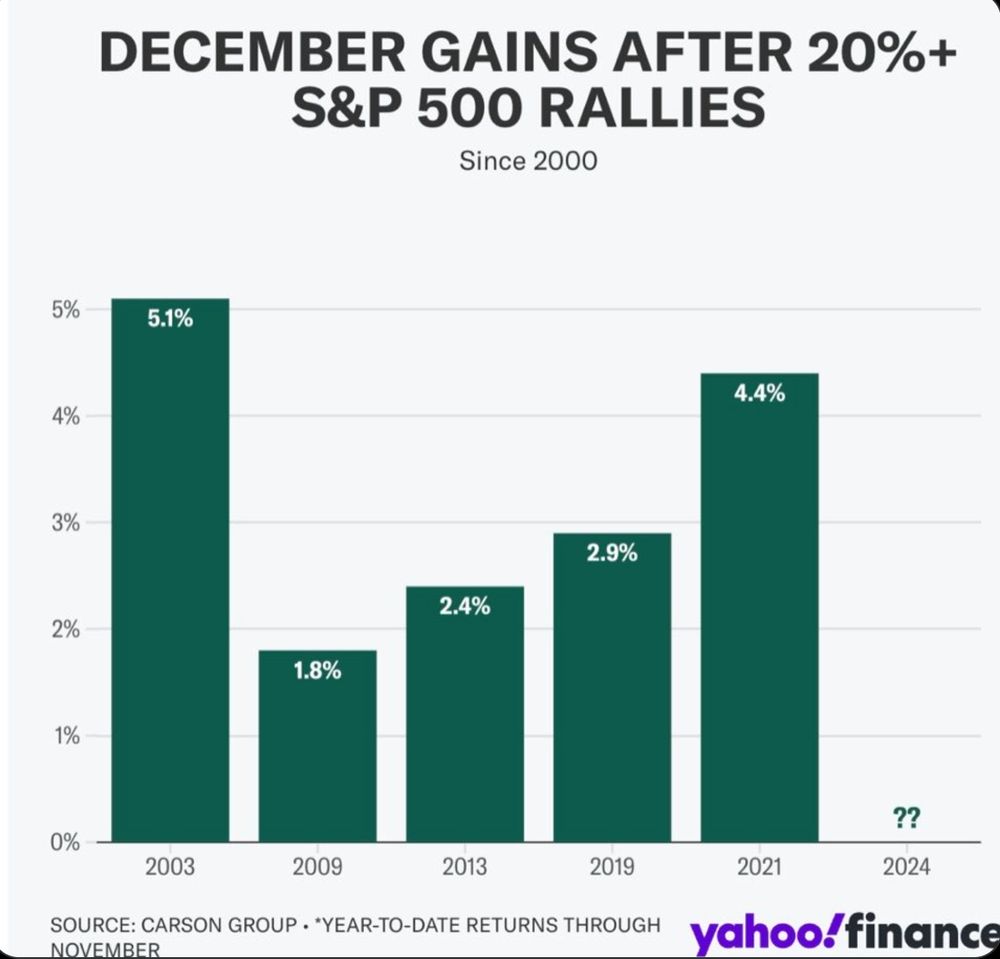

Since 2000, every year the S&P 500 has risen more than 20% entering December, the index has rallied further to end the year, according to Carson Group's Ryan Detrick.

Since 2000, every year the S&P 500 has risen more than 20% entering December, the index has rallied further to end the year, according to Carson Group's Ryan Detrick.

Full story breaking down how economists are talking about the Fed’s path next year for @yahoo-finance.bsky.social.

finance.yahoo.com/news/wall-st...

Full story breaking down how economists are talking about the Fed’s path next year for @yahoo-finance.bsky.social.

finance.yahoo.com/news/wall-st...