He just increased his position in Teradyne with +1,371%.

Making it his 5th largest.

He now owns stock worth $694M.

Cathie is a close second with $473M.

$TER

He just increased his position in Teradyne with +1,371%.

Making it his 5th largest.

He now owns stock worth $694M.

Cathie is a close second with $473M.

$TER

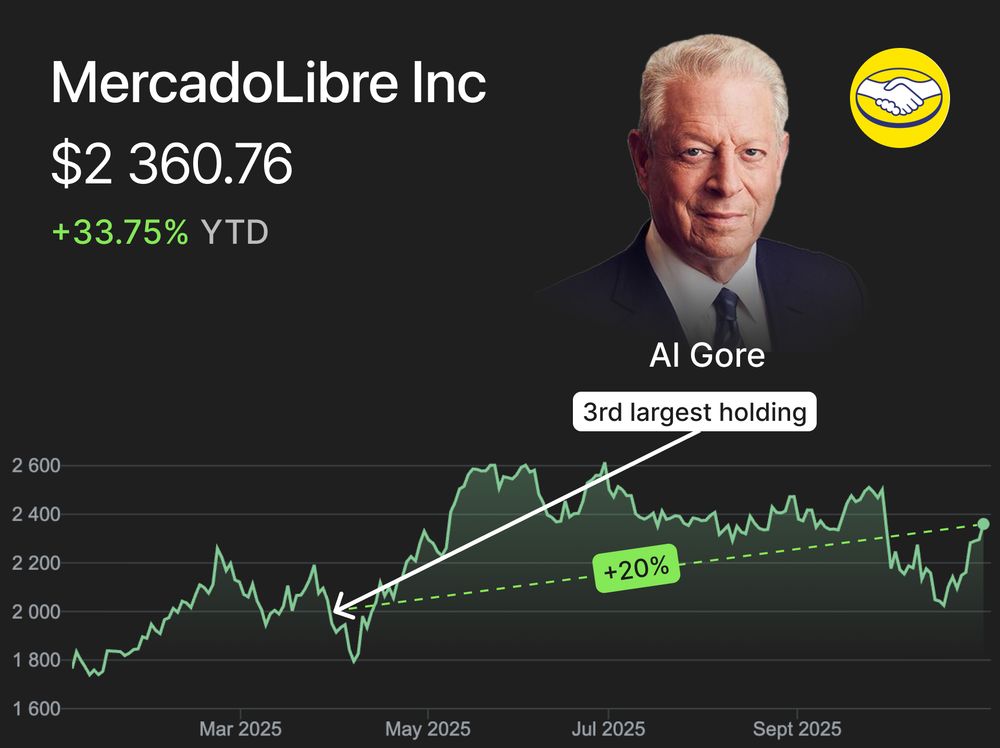

They dropped a monster Q3 with strong rev growth and profitability exploding.

Revenue: +38%

Gross Profit: +40%

EPS: +142%

But maybe he just likes the logo.

$SE #SE

They dropped a monster Q3 with strong rev growth and profitability exploding.

Revenue: +38%

Gross Profit: +40%

EPS: +142%

But maybe he just likes the logo.

$SE #SE

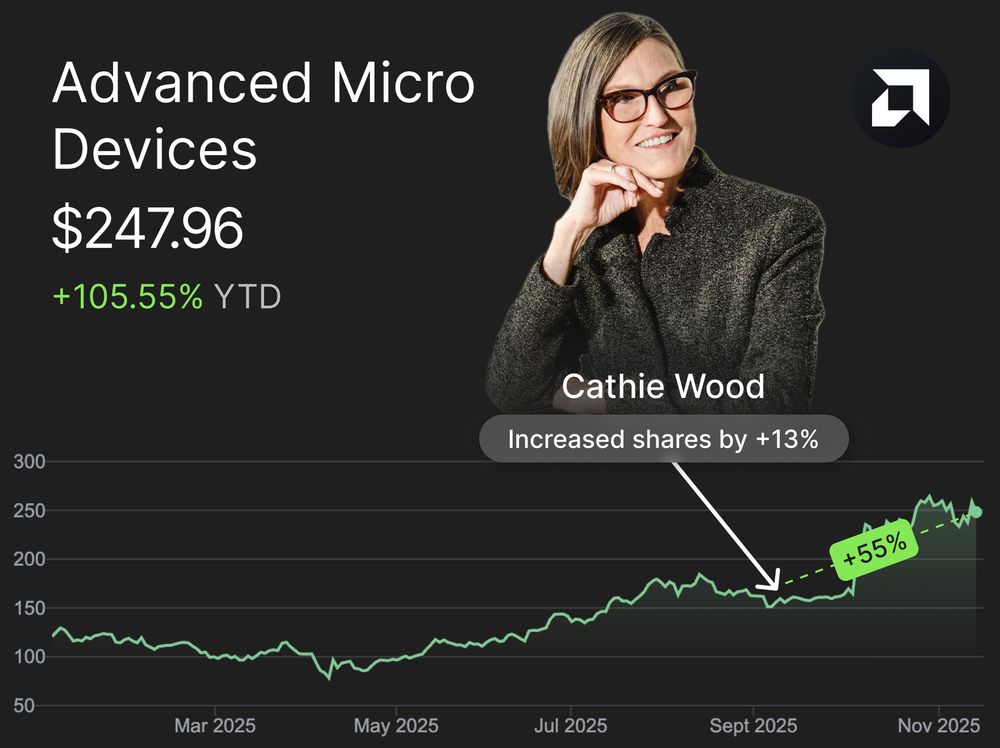

Cathie Wood increased her stake with +13% in Q3.

She boosted her position 6 quarters in a row.

Now up +105% and worth $792M.

$AMD #AMD

Cathie Wood increased her stake with +13% in Q3.

She boosted her position 6 quarters in a row.

Now up +105% and worth $792M.

$AMD #AMD

Demand is exploding. Yet it’s trading at P/E 16.

Ken Griffin tripled his stake last quarter to $222M.

Baillie Gifford, Jeremy Grantham, and Joel Greenblatt all joined in.

Deep value. High growth.

$EXEL

Demand is exploding. Yet it’s trading at P/E 16.

Ken Griffin tripled his stake last quarter to $222M.

Baillie Gifford, Jeremy Grantham, and Joel Greenblatt all joined in.

Deep value. High growth.

$EXEL

Baillie Gifford bought back in.

They quietly bought $49M worth of stock in Q3.

Now that position’s worth $62M.

Up +27% in weeks.

$BABA #BABA

Baillie Gifford bought back in.

They quietly bought $49M worth of stock in Q3.

Now that position’s worth $62M.

Up +27% in weeks.

$BABA #BABA

• Lululemon – Michael Burry (2nd)

• Pdd Holdings – Li Lu (3rd)

• Kraft Heinz – Warren Buffet (8th)

• CRISPR – Cathie Wood (9th)

• Wix.com – Pat Dorsey (10th)

Which one stands out?

$LULU $PDD $KHC $CRSP $WIX

• Lululemon – Michael Burry (2nd)

• Pdd Holdings – Li Lu (3rd)

• Kraft Heinz – Warren Buffet (8th)

• CRISPR – Cathie Wood (9th)

• Wix.com – Pat Dorsey (10th)

Which one stands out?

$LULU $PDD $KHC $CRSP $WIX

$66M bought in Q2

$160m sold

Bulls:

• Ray Dalio – $208M (26 largest)

• Ken Griffin – $457M (33rd largest)

• Jeremy Grantham – $35.2M (117th largest)

Bears:

• Pat Dorsey – Sold $59M (-100%)

• Jim Simons (RIP) – Sold $32M (-100%)

Wouldn’t be so sure.

$PYPL #PYPL

$66M bought in Q2

$160m sold

Bulls:

• Ray Dalio – $208M (26 largest)

• Ken Griffin – $457M (33rd largest)

• Jeremy Grantham – $35.2M (117th largest)

Bears:

• Pat Dorsey – Sold $59M (-100%)

• Jim Simons (RIP) – Sold $32M (-100%)

Wouldn’t be so sure.

$PYPL #PYPL

Over the last 3 quarters, 5 investors bought $239M worth of stock. Only 2 sold.

All of them added more in Q2:

• Steven Cohen – $76M (+43%)

• Ken Griffin – $58M (+310%)

• Ray Dalio – $17M (+208%)

Looks cheap.

$FOUR #FOUR #Stocks

Novo bulls:

• Jim Simons – $244M (50th largest)

• Tom Gayner – $18M (32nd)

• Grantham – $3M (339th)

Eli bulls:

• Ken Fisher – $3.7B (19th)

• Coleman – $1.3B (9th)

• Ken Griffin – $736M (12th)

GLP-1’s first mover? Novo. Winner so far? Lilly.

$NVO $LLY #NVO #LLY #Stocks

Basically no investors had bought this tiny biotech company.

Until...

In Q2 – Jim Simons (RenTech), Ken Griffin and Chuck Royce bought $2.4M worth of stock.

Current market cap: $688M

Huge runway.

$GLUE

Basically no investors had bought this tiny biotech company.

Until...

In Q2 – Jim Simons (RenTech), Ken Griffin and Chuck Royce bought $2.4M worth of stock.

Current market cap: $688M

Huge runway.

$GLUE

In Q1 he made Nokia his 6th largest holding.

He bought $119M worth at $4.88/share.

Already up +67%

Legendary move.

$NOK $NVDA

In Q1 he made Nokia his 6th largest holding.

He bought $119M worth at $4.88/share.

Already up +67%

Legendary move.

$NOK $NVDA

Surprise surprise, it’s not an American invention.

Nicotine pouches are a Swedish tradition dating back to the 1600s.

Holding tight to their ZYN:

• Terry Smith – $1.4B (6th largest)

• First Eagle – $1.1B (14th largest)

See more 👇

Surprise surprise, it’s not an American invention.

Nicotine pouches are a Swedish tradition dating back to the 1600s.

Holding tight to their ZYN:

• Terry Smith – $1.4B (6th largest)

• First Eagle – $1.1B (14th largest)

See more 👇

It’s already 16% of his portfolio and he just increased his stake by +34%

• Danaher Corp – $194M (+34% increase)

Pat with conviction is the Pat we like.

$DHR

It’s already 16% of his portfolio and he just increased his stake by +34%

• Danaher Corp – $194M (+34% increase)

Pat with conviction is the Pat we like.

$DHR

After a +122% gain since her first position in 2017, she’s still adding at an avg. price of $99.82

• Shopify – $797M (+13.6% increase)

Her biggest add came in August 2022 when she bought 13M shares at $40. Legendary move.

Now her 6th largest holding.

$SHOP

After a +122% gain since her first position in 2017, she’s still adding at an avg. price of $99.82

• Shopify – $797M (+13.6% increase)

Her biggest add came in August 2022 when she bought 13M shares at $40. Legendary move.

Now her 6th largest holding.

$SHOP

He bought this stock a month ago and is already down -6%

• Centuri Holdings – $218M (+69% increase)

Now his 6th largest

$CTRI

He bought this stock a month ago and is already down -6%

• Centuri Holdings – $218M (+69% increase)

Now his 6th largest

$CTRI

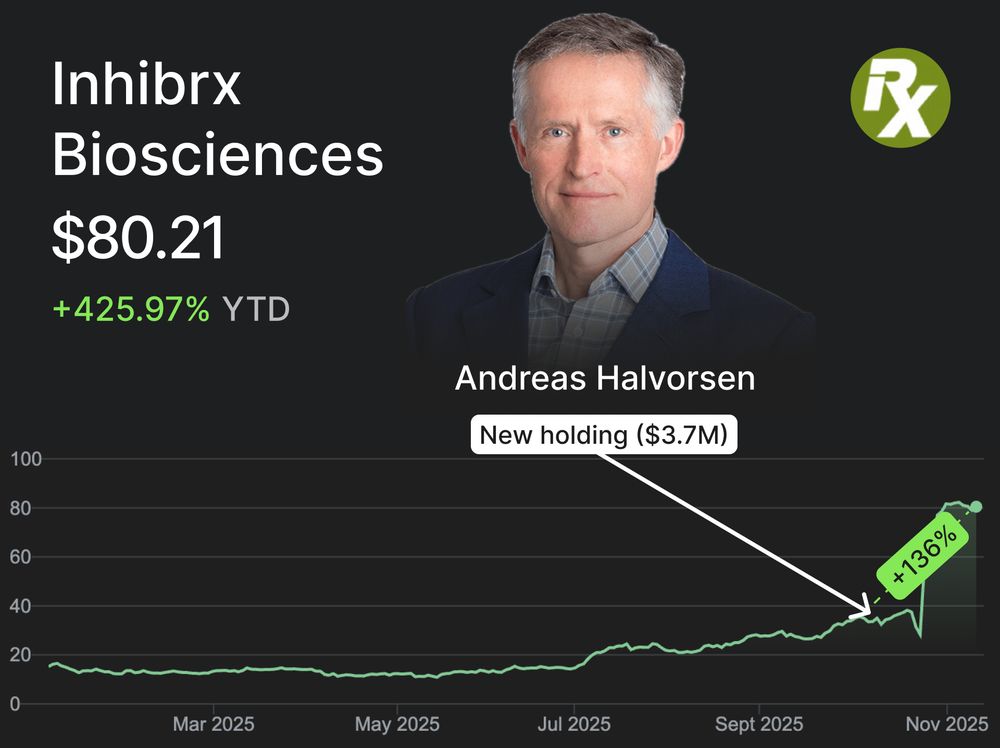

This trade was executed only 8-days ago.

• Inhibrx Biosciences – $3.7M (+7% return)

He’s adding at these levels? Wtf.

$INBX #INBX #Stocks #Investing

This trade was executed only 8-days ago.

• Inhibrx Biosciences – $3.7M (+7% return)

He’s adding at these levels? Wtf.

$INBX #INBX #Stocks #Investing

Well, Tom Russo is. And he has a track record.

• Doordash – $35M (+22% increase)

Position is now worth $262M. His 14th largest.

$DASH

Well, Tom Russo is. And he has a track record.

• Doordash – $35M (+22% increase)

Position is now worth $262M. His 14th largest.

$DASH

It’s now his 20th largest holding.

• Palantir Technologies – $56.2M

He’s sitting on a 613% gain. And he’s still buying.

$PLTR

It’s now his 20th largest holding.

• Palantir Technologies – $56.2M

He’s sitting on a 613% gain. And he’s still buying.

$PLTR