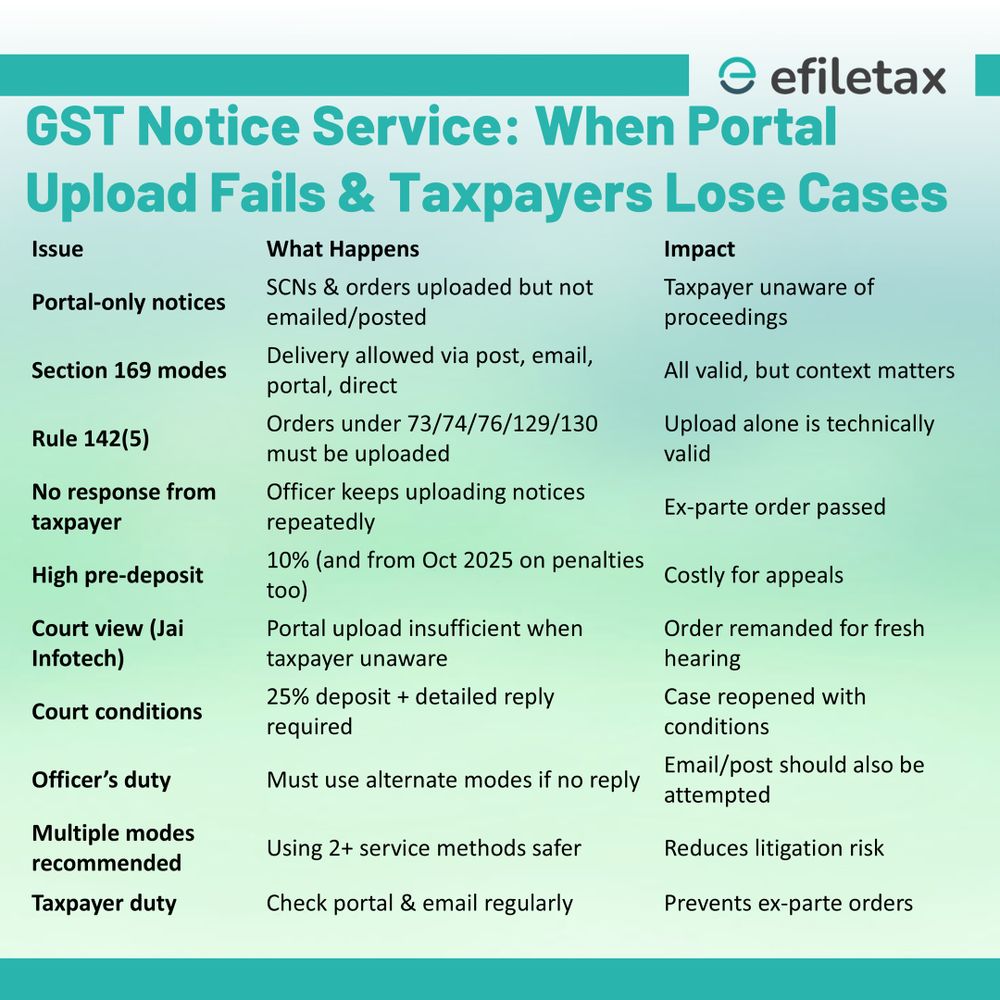

Here’s a crisp 10-point table every business owner should save today.

One wrong click or missed notice can trigger a DRC-22 attachment — but you can get it released fast.

👇 See the full action table in the image

Causes → Legal trigger → DRC-22A remedy → Timeline

Here’s a crisp 10-point table every business owner should save today.

One wrong click or missed notice can trigger a DRC-22 attachment — but you can get it released fast.

👇 See the full action table in the image

Causes → Legal trigger → DRC-22A remedy → Timeline

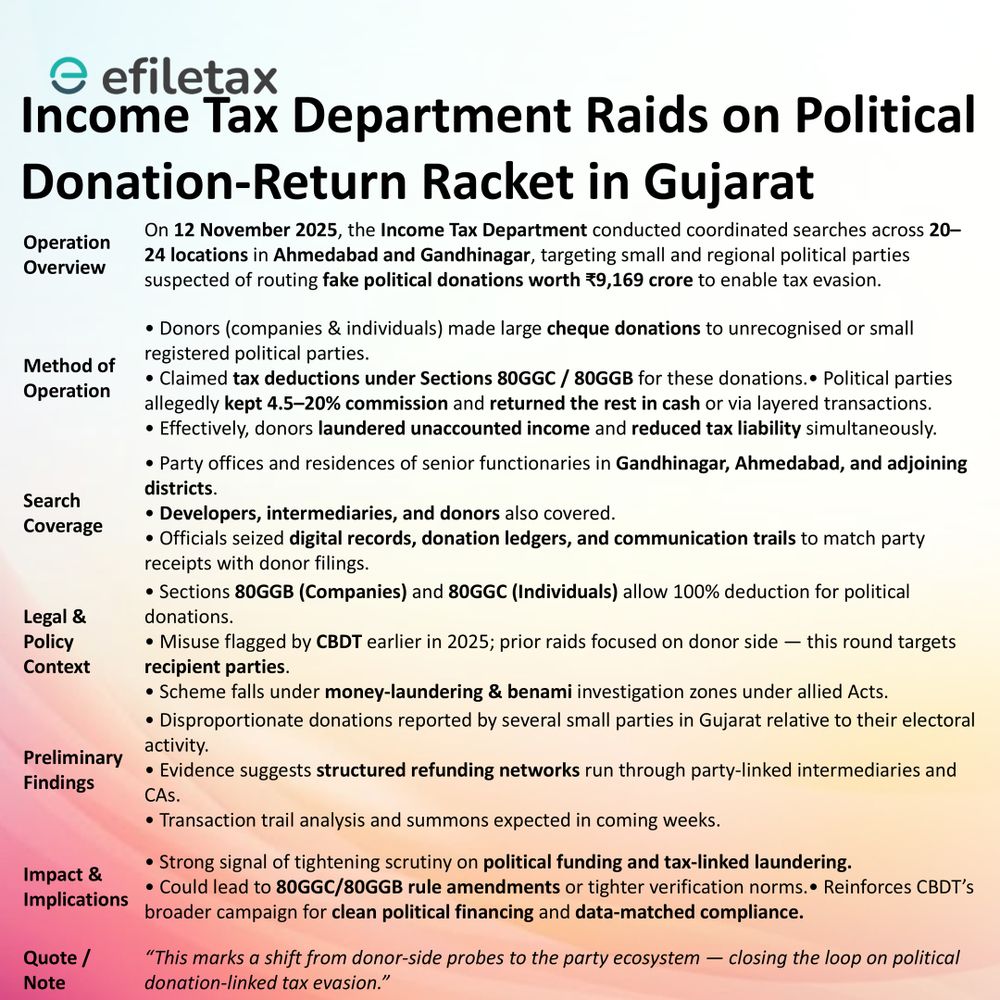

Allahabad HC quashes GST detention against GAIL — here’s the quick table on what went wrong and why the Court stepped in.

Allahabad HC quashes GST detention against GAIL — here’s the quick table on what went wrong and why the Court stepped in.

#gst #gst2.0 #tax #taxreforms

#gst #gst2.0 #tax #taxreforms

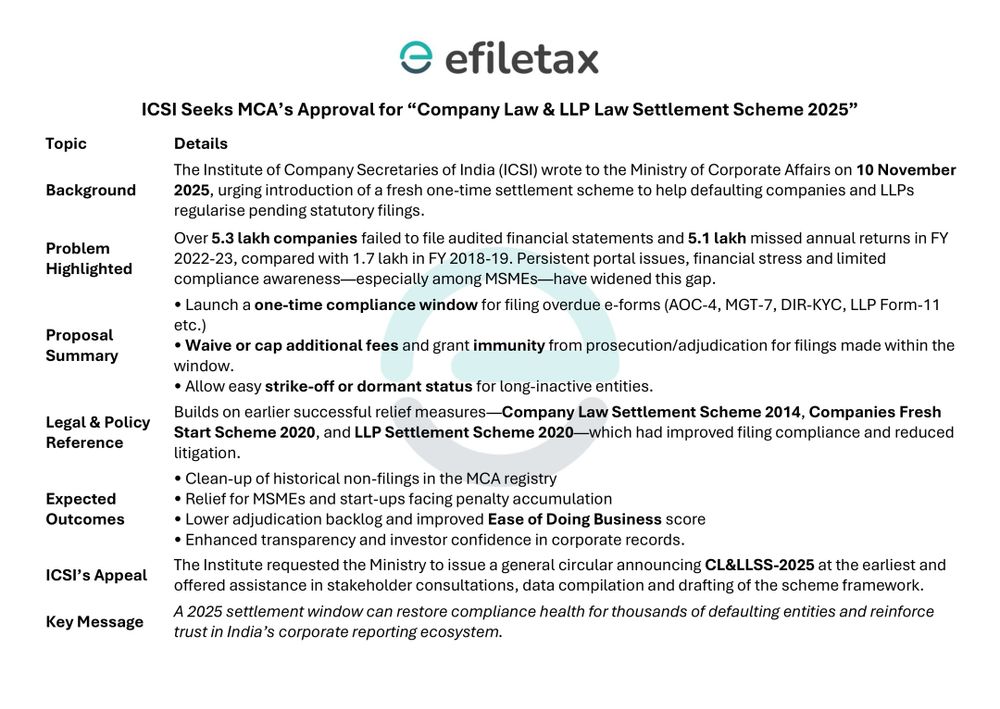

Small taxpayers with output tax ≤ ₹2.5 L / month (on supplies to registered persons) can now opt for simplified Aadhaar-based registration.

✅ Fully electronic process

✅ Registration in 3 working days

Optional & faster route under #GST 🇮🇳

#Rule14A #GST