Dad, optimist and vegan who hates salads.

Views of this account are my own.

www.davidcimon.ca

Non-Bank Dealing and Liquidity Bifurcation in Fixed-Income Markets” with Michael Brolley at WLU

papers.ssrn.com/sol3/papers....

We do some applied game theory on the role of dealers in bond markets.

#econsky

Non-Bank Dealing and Liquidity Bifurcation in Fixed-Income Markets” with Michael Brolley at WLU

papers.ssrn.com/sol3/papers....

We do some applied game theory on the role of dealers in bond markets.

#econsky

Together with the Bank of Canada and the Chicago Fed, we're organizing a Conference on #FixedIncome Research and Implications for #MonetaryPolicy on May 22-23, 2025, in San Francisco. Submissions due by January 31. More details: www.frbsf.org/news-and-med...

#EconSky

Together with the Bank of Canada and the Chicago Fed, we're organizing a Conference on #FixedIncome Research and Implications for #MonetaryPolicy on May 22-23, 2025, in San Francisco. Submissions due by January 31. More details: www.frbsf.org/news-and-med...

#EconSky

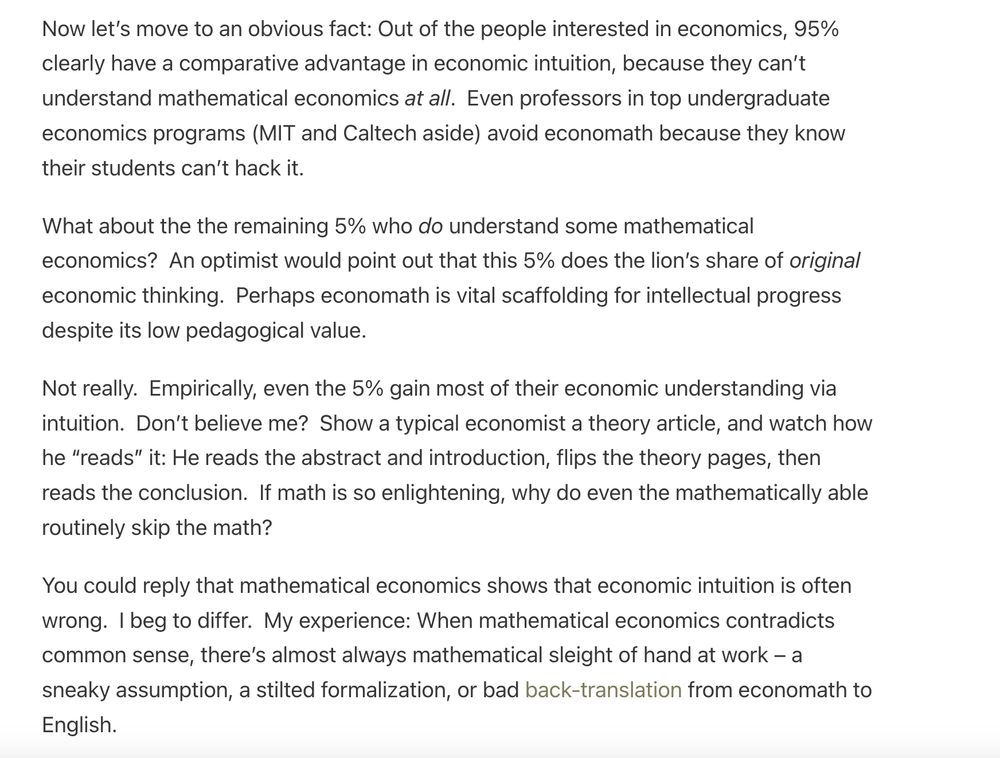

Seems very wrong to me. I wonder what the quickest refutation is that would make sense to most practicing economists.

www.betonit.ai/p/economath_...

Seems very wrong to me. I wonder what the quickest refutation is that would make sense to most practicing economists.

www.betonit.ai/p/economath_...

#econsky #finsky

#econsky #finsky