www.ft.com/content/9a72...

www.ft.com/content/9a72...

One way to appreciate this is time, since we all experience it. Here's the difference between a thousand, a million, and a billion seconds.

www.theguardian.com/world/2025/j...

www.theguardian.com/world/2025/j...

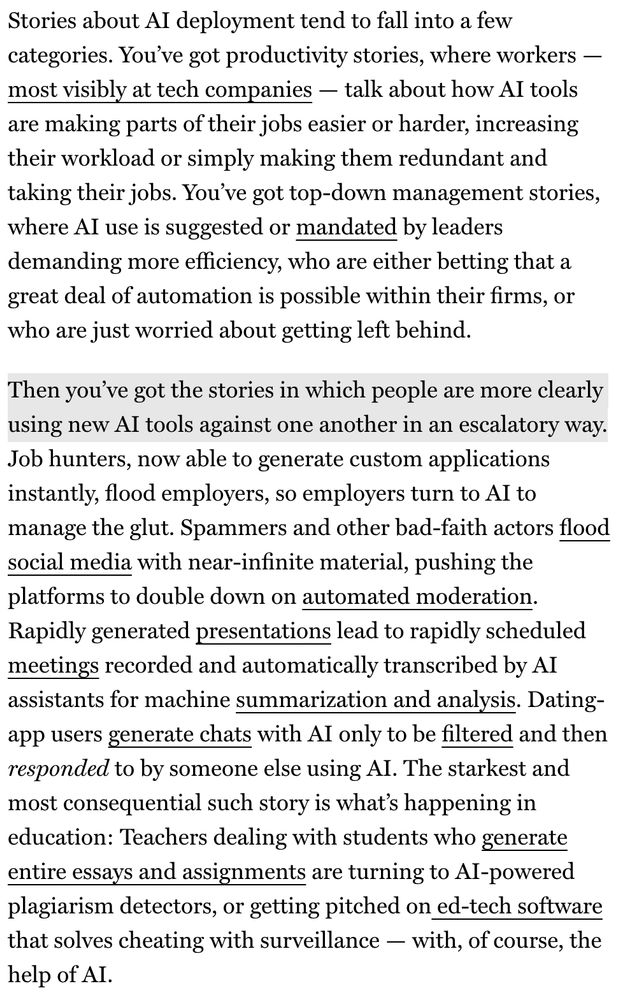

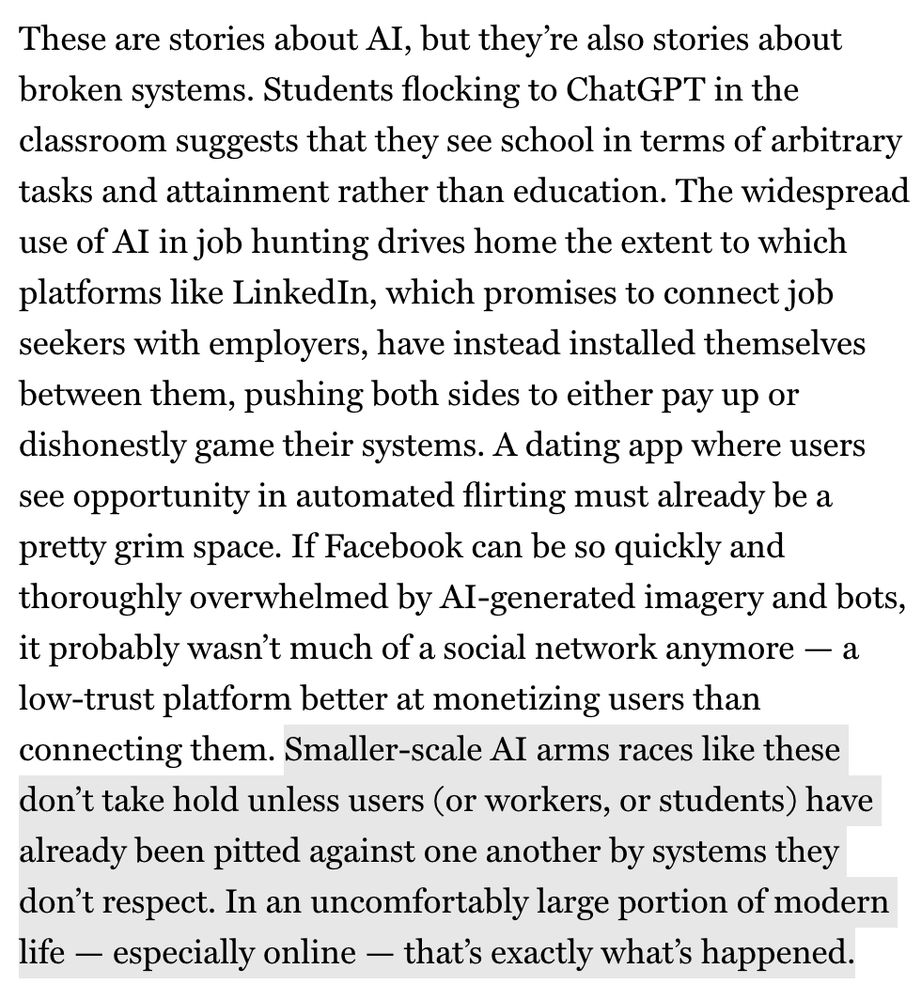

Algo's beat human traders, but then algo's had to compete against other algo's.

We're now just seeing the same tech applied to job hunting and dating websites.

Algo's beat human traders, but then algo's had to compete against other algo's.

We're now just seeing the same tech applied to job hunting and dating websites.

www.ft.com/content/90d0... @bondhack.ft.com

...but will anyone lend Lars a tenner?

www.ft.com/content/90d0... @bondhack.ft.com

...but will anyone lend Lars a tenner?

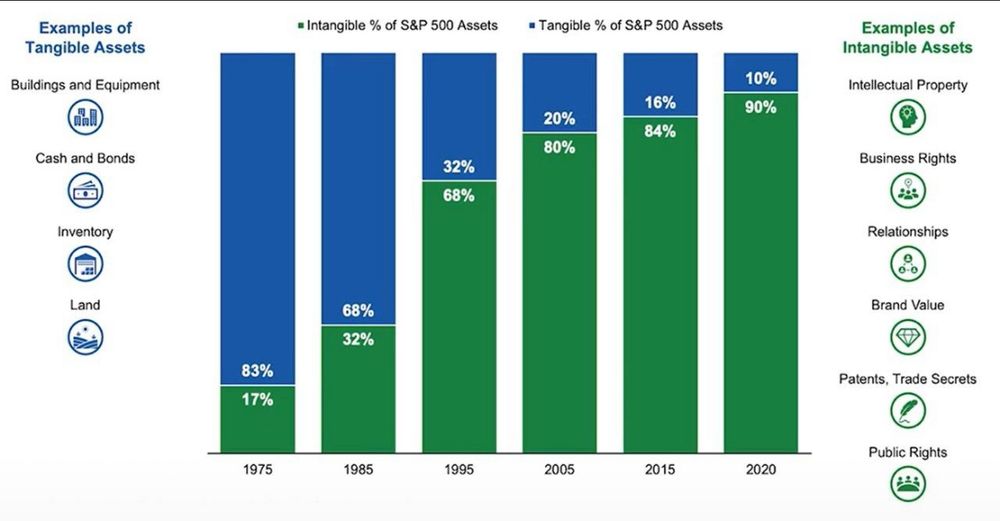

Shows the changing share of S&P 500 assets which are intangible vs tangible, from a CFA institute report

H/t Matteo Lombardo on LI

Shows the changing share of S&P 500 assets which are intangible vs tangible, from a CFA institute report

H/t Matteo Lombardo on LI

An implicit assumption in financial regulation is that professionals with Bloomberg terminals and access to company management have an advantage. People should hand their money to someone in The City to manage because they can't trust themselves.

I disagree.

An implicit assumption in financial regulation is that professionals with Bloomberg terminals and access to company management have an advantage. People should hand their money to someone in The City to manage because they can't trust themselves.

I disagree.

As government debt fears grow, precious metals are surging. Who's buying 1,000 tons of gold a year and why?

Spotlight on #FTC, #GHH & #RFX

As government debt fears grow, precious metals are surging. Who's buying 1,000 tons of gold a year and why?

Spotlight on #FTC, #GHH & #RFX

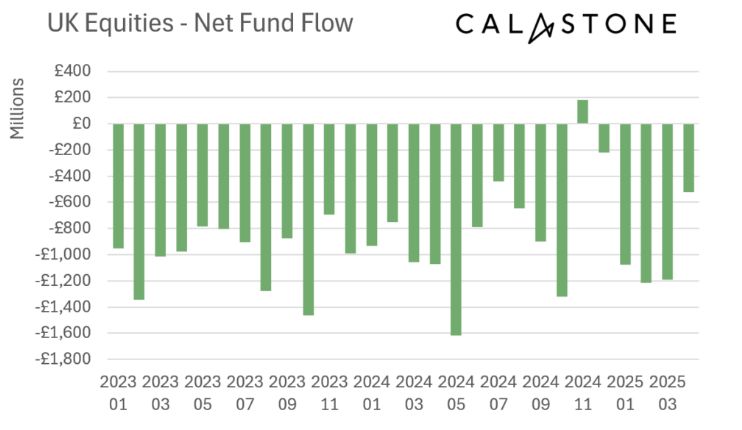

how can Calastone still be reporting monthly fund outflows from UK equities, while AIM has bounced +22% since the start of April?

Is this retail money going directly into AIM, as professional fund mgrs are forced sellers?

how can Calastone still be reporting monthly fund outflows from UK equities, while AIM has bounced +22% since the start of April?

Is this retail money going directly into AIM, as professional fund mgrs are forced sellers?

This is also why we don't move to Minsk to found start-ups

This is also why we don't move to Minsk to found start-ups