But share paid is a terrible metric. If you get rid of all taxes except for a dollar on Elon Musk, he’s now paying 100% of the share, but the system got way more regressive

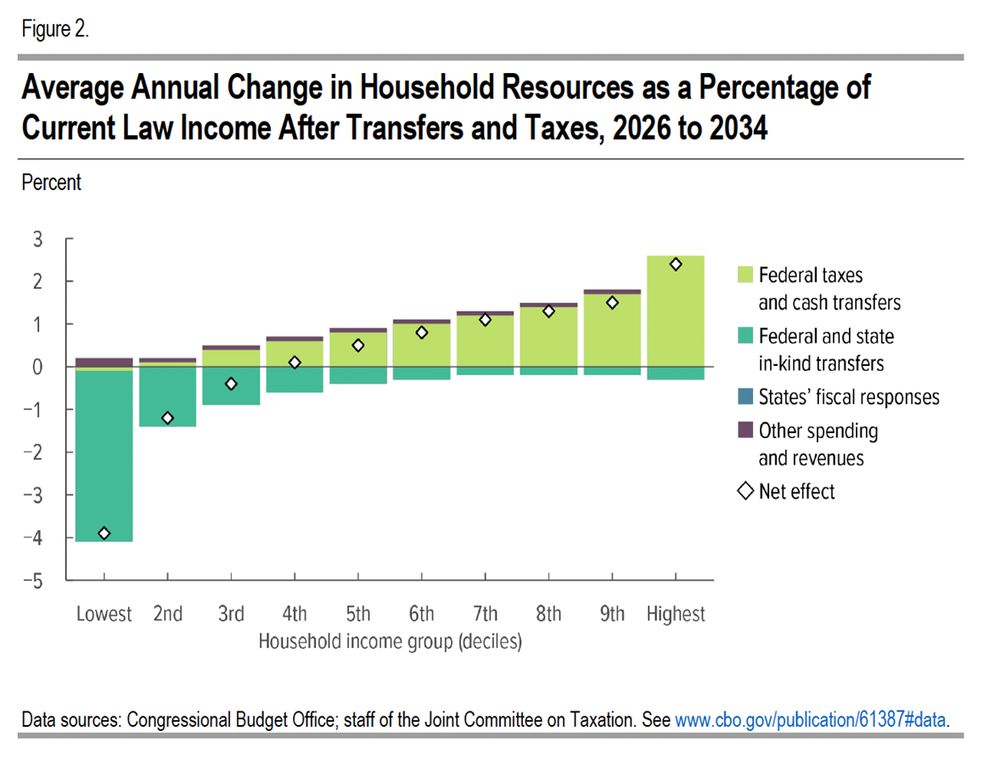

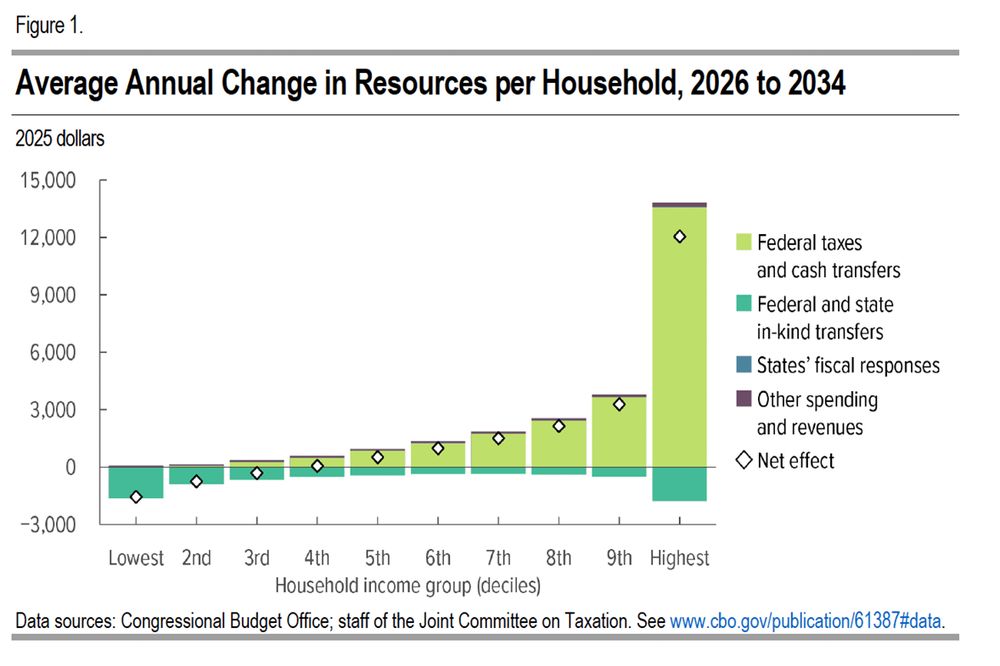

On avg the bottom 30% of households get poorer under the GOP bill

Avg gets little - and are worse off if you include tariffs

This'd be the largest transfer of wealth from the poor to the rich in a single law in history

But share paid is a terrible metric. If you get rid of all taxes except for a dollar on Elon Musk, he’s now paying 100% of the share, but the system got way more regressive

www.hamiltonproject.org/wp-content/u...

www.hamiltonproject.org/wp-content/u...

econjared.substack.com/p/the-conser...

econjared.substack.com/p/the-conser...

www.wsj.com/opinion/what...

www.wsj.com/opinion/what...