habitatenergy.bamboohr.com/careers/140

habitatenergy.bamboohr.com/careers/140

#EnergySky

#EnergySky

#EnergySky

#EnergySky

#EnergySky

#EnergySky

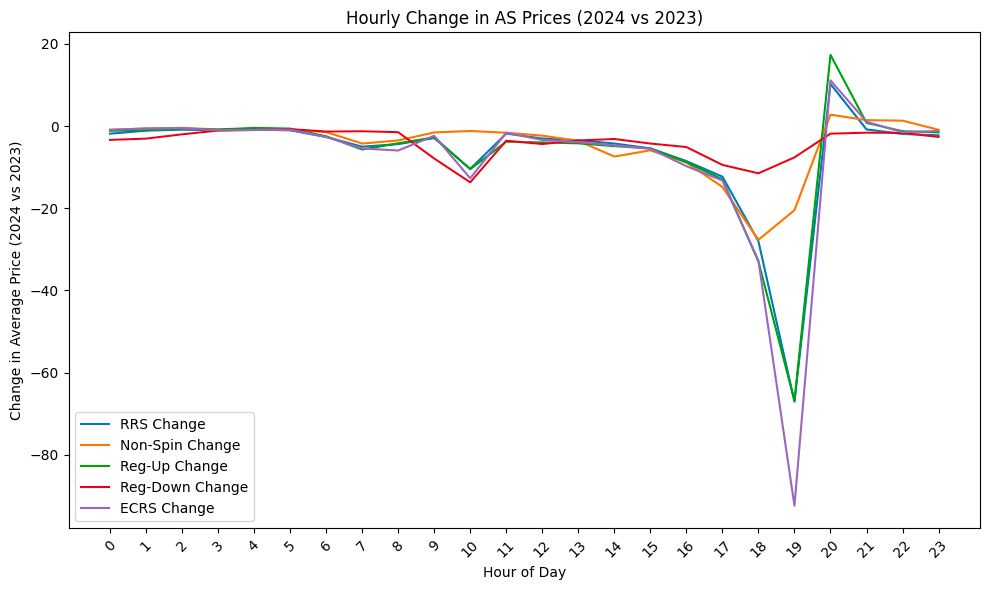

thinking about how much *useful* information can be condensed into the least amount of digital ink to start more automated reporting that's not just a line graph where one price blowout ruins the y-axis

#energysky

#EnergySky