"The short- to medium-term supply costs of renewable hydrogen exceed the indicative willingness

to pay."

"The short- to medium-term supply costs of renewable hydrogen exceed the indicative willingness

to pay."

Seems that German government officials also acknowledge the difference between h2- capex visions and the reality. That's A+ for homework!

Seems that German government officials also acknowledge the difference between h2- capex visions and the reality. That's A+ for homework!

According to @irena-official.bsky.social the cost of wind LCOE came rapidly down until 2019 after which the average cost has not declined but increased 17% (2020-2024).

According to @irena-official.bsky.social the cost of wind LCOE came rapidly down until 2019 after which the average cost has not declined but increased 17% (2020-2024).

Nevertheless, the market without 3000-5000 euro subsidies is completely different to the one before. Solid and steady progress.

bsky.app/profile/clea...

Nevertheless, the market without 3000-5000 euro subsidies is completely different to the one before. Solid and steady progress.

bsky.app/profile/clea...

Retro design is a justified pathway in bringing the icons back alive, electric. Reimagining the origin.

Europe can still do things

youtu.be/56jDjH8VnLk?...

Retro design is a justified pathway in bringing the icons back alive, electric. Reimagining the origin.

Europe can still do things

youtu.be/56jDjH8VnLk?...

Tähän kategoriaan kuuluu KAIKKI sähkön- ja lämmöntuotantonlaitokset Suomessa.

Näiden laitosten päästöt ovat vähentyneet 70% kymmenessä vuodessa! Hattuapäästä, niille jotka sen ansaitsee.

Tähän kategoriaan kuuluu KAIKKI sähkön- ja lämmöntuotantonlaitokset Suomessa.

Näiden laitosten päästöt ovat vähentyneet 70% kymmenessä vuodessa! Hattuapäästä, niille jotka sen ansaitsee.

youtu.be/zz4KgFBSRCs?...

youtu.be/zz4KgFBSRCs?...

www.linkedin.com/pulse/differ...

www.linkedin.com/pulse/differ...

Only committed actions matter.

I was criticized 2 years ago when they launched ID2 for calling out their wishy washeness and here we are. That one is delayed too.

Only committed actions matter.

I was criticized 2 years ago when they launched ID2 for calling out their wishy washeness and here we are. That one is delayed too.

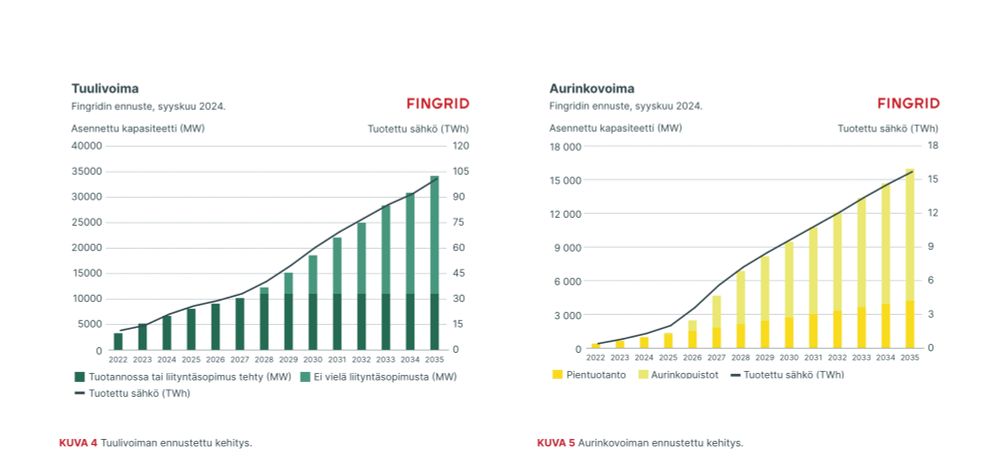

Suomessa 6,6 s/kWh.

www.vattenfall.fi/fokuksessa/s...

Suomessa 6,6 s/kWh.

www.vattenfall.fi/fokuksessa/s...

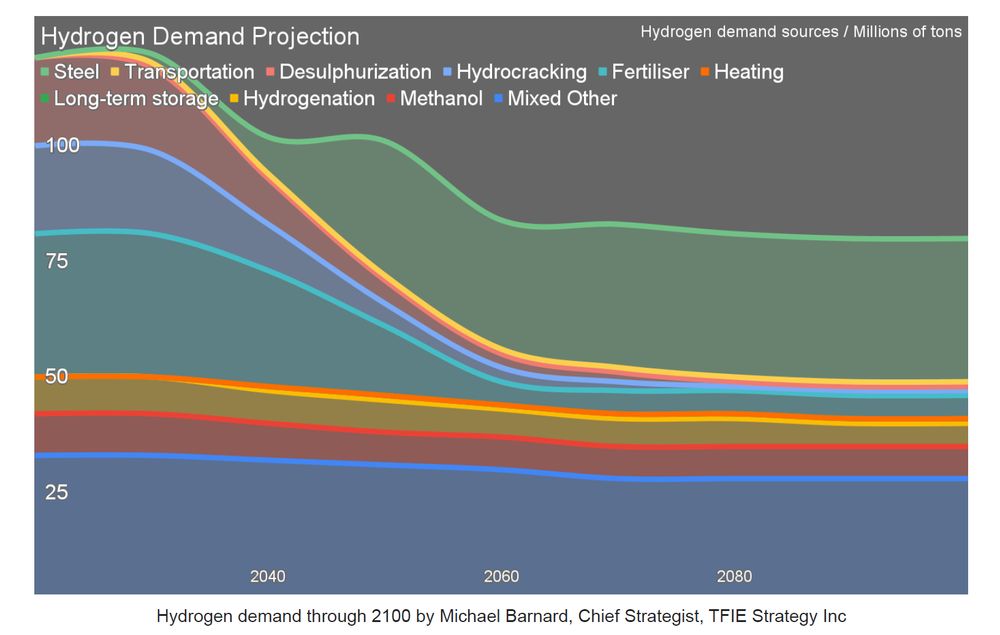

After all the land transportation has electrified and ships and planes use biofuels around 80-120 Mt of h2-demand remains.

Perhaps, I would put more emphasis on fertilizer (ammonia) put that will not elevate the demand.

After all the land transportation has electrified and ships and planes use biofuels around 80-120 Mt of h2-demand remains.

Perhaps, I would put more emphasis on fertilizer (ammonia) put that will not elevate the demand.

Things live on even if you turn into Russia pleasing oligarch.

That’s why it’s called Tesla not Muskla.

Things live on even if you turn into Russia pleasing oligarch.

That’s why it’s called Tesla not Muskla.

Big letters: UAE-Morocco venture TO INVEST $25 bln green hydrogen project.

Small print: "is planning"

www.zawya.com/en/projects/...

Big letters: UAE-Morocco venture TO INVEST $25 bln green hydrogen project.

Small print: "is planning"

www.zawya.com/en/projects/...

Kiinassa sähköautot ovat jo edullisempia kuin polttikset.

Kiinassa sähköautot ovat jo edullisempia kuin polttikset.

Latauspisteiden (krhm) lisäksi en voi liikaa odottaa näitä kaupunkeihin, koska työkoneet pitävät paljon kovempaa meteliä kuin V8:t, AMG:t ja muut.

Sähköinen. Nostokykyä 700 kg.

youtu.be/KCfiJHB9HCc?...

Latauspisteiden (krhm) lisäksi en voi liikaa odottaa näitä kaupunkeihin, koska työkoneet pitävät paljon kovempaa meteliä kuin V8:t, AMG:t ja muut.

Sähköinen. Nostokykyä 700 kg.

youtu.be/KCfiJHB9HCc?...

Suomessa puhutaan vedyn osalta siitä, että: "Olemme samassa tilanteessa kuin Norja löytäessään öljyä 70-luvulla- Suomen rahahuolet olisivat ohi" 1/5 yle.fi/a/74-20087954

Suomessa puhutaan vedyn osalta siitä, että: "Olemme samassa tilanteessa kuin Norja löytäessään öljyä 70-luvulla- Suomen rahahuolet olisivat ohi" 1/5 yle.fi/a/74-20087954

"Kokonaisuudessaan Ukrainassa arvioidaan olevan 5 prosenttia maailman kriittisistä mineraaleista"

Asiaa on toki tutkittu aiemmin. Suomessa vain fosfaattikivivarannot ylittävät 1% rajan.

"Kokonaisuudessaan Ukrainassa arvioidaan olevan 5 prosenttia maailman kriittisistä mineraaleista"

Asiaa on toki tutkittu aiemmin. Suomessa vain fosfaattikivivarannot ylittävät 1% rajan.

Heart Aerospce CEO Anders Forslund. @cleaninguppod.bsky.social

Heart Aerospce CEO Anders Forslund. @cleaninguppod.bsky.social

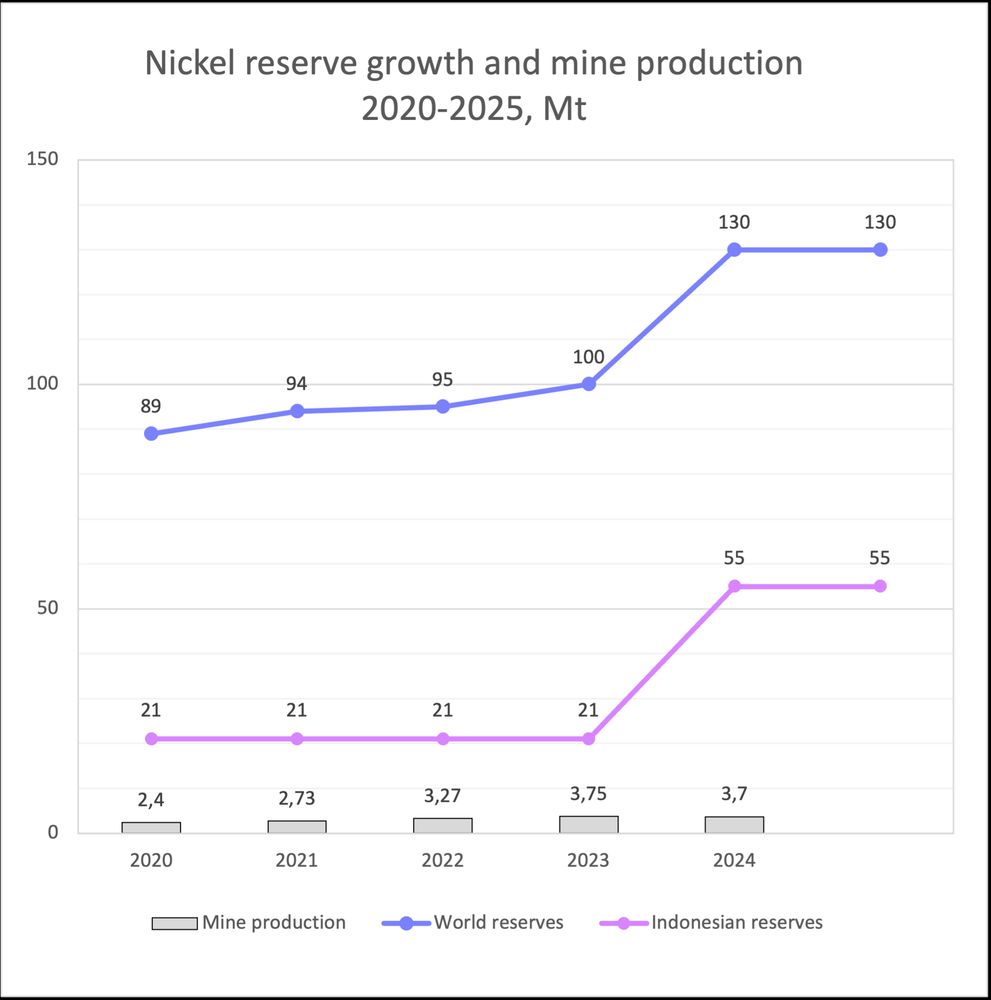

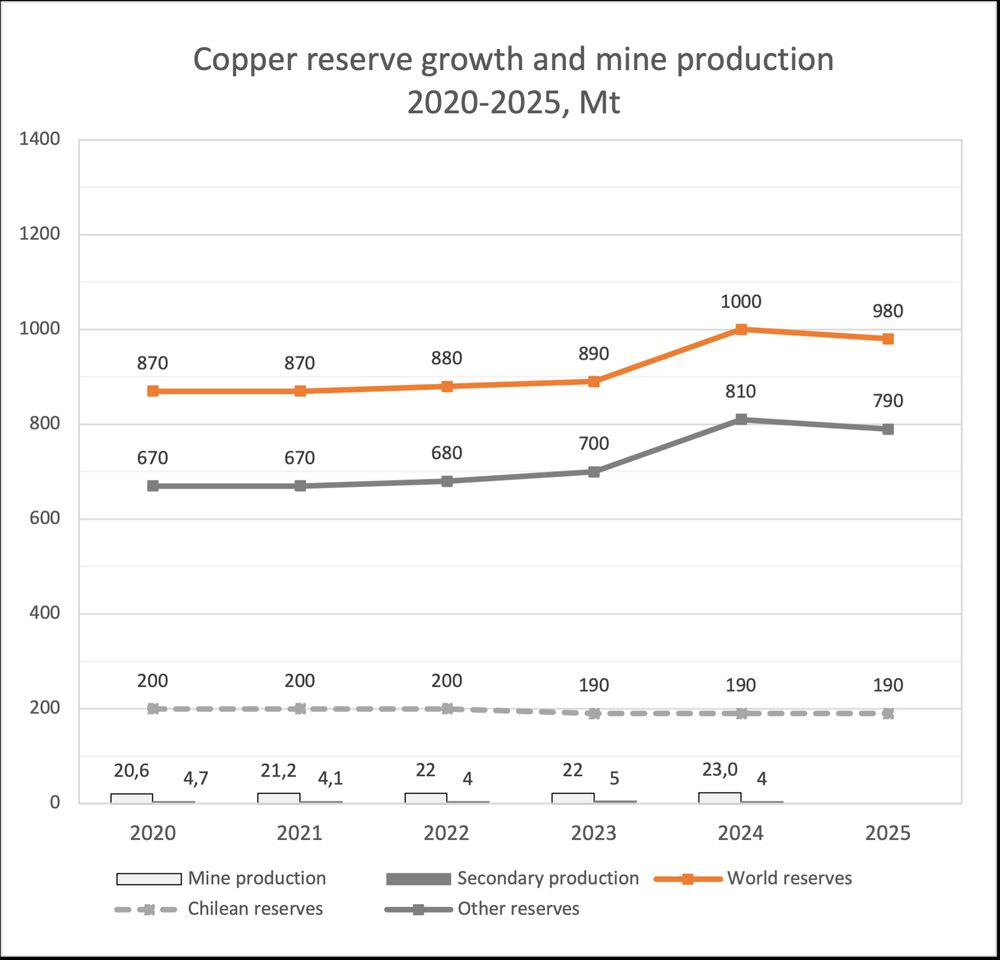

Copper reserves retracted 20 Mt, after 110 Mt hike in 2023. Mined output has increased from 20,6 to 23 Mt in five years.

Copper reserves retracted 20 Mt, after 110 Mt hike in 2023. Mined output has increased from 20,6 to 23 Mt in five years.

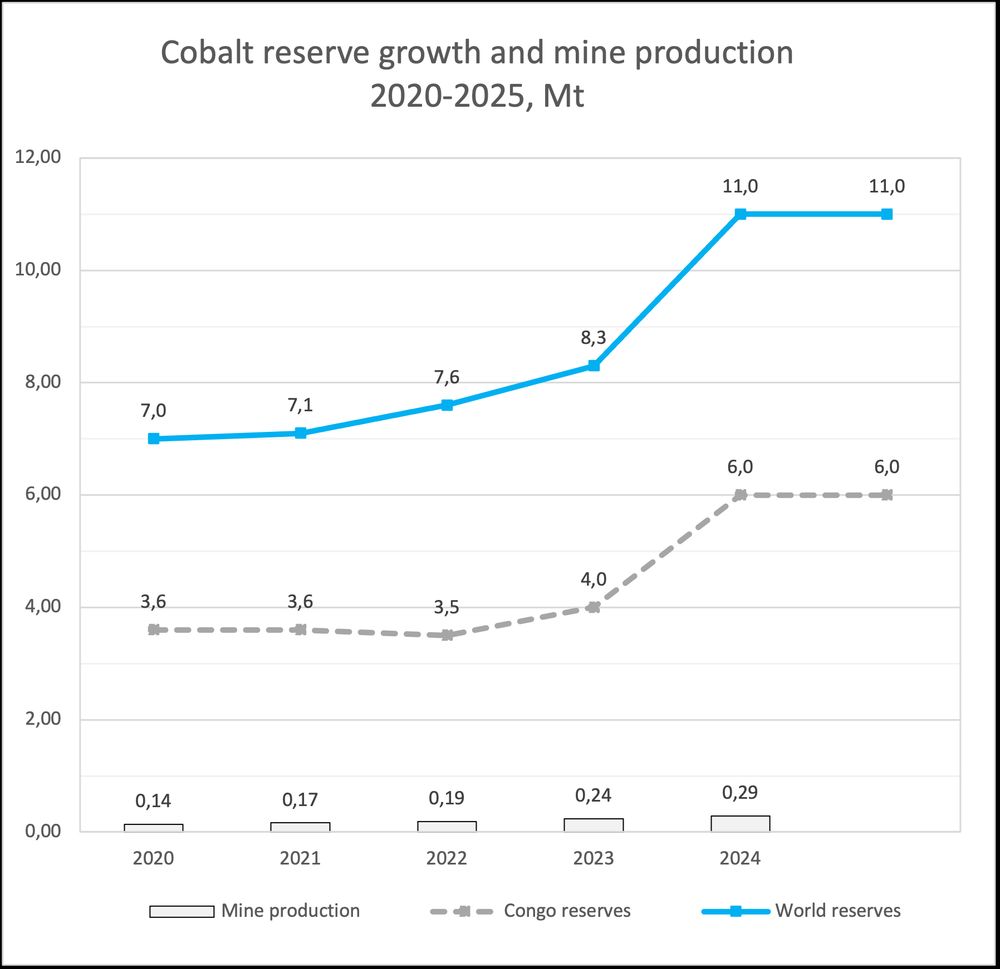

Global mined output is 2X what it was five years ago and the Democratic Republic of Congos's share of the production has increased from 68% to 76%.

Global mined output is 2X what it was five years ago and the Democratic Republic of Congos's share of the production has increased from 68% to 76%.

Last year 17 million EVs were sold (PHEVs included).

Identified lithium resources has grown too like Dave mentions in his thread.

x.com/CleanPowerDa...

Last year 17 million EVs were sold (PHEVs included).

Identified lithium resources has grown too like Dave mentions in his thread.

x.com/CleanPowerDa...