Please read disclosure information: http://bit.ly/3VBK8na

Skol Vikes!

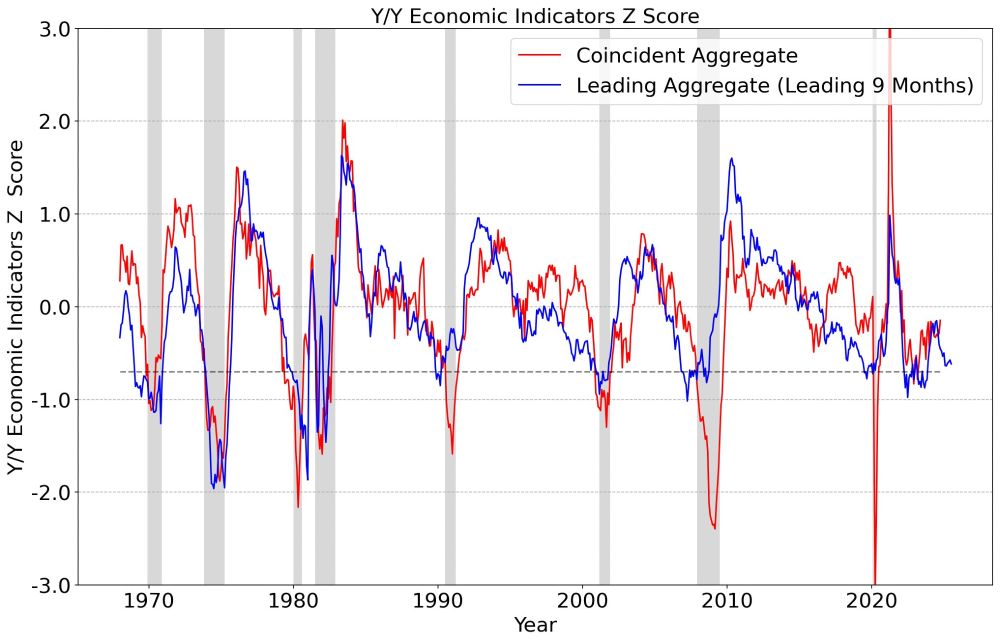

Only thing I'll say is that I don't think leading data are recessionary, just very low growth.

Only thing I'll say is that I don't think leading data are recessionary, just very low growth.

www.artificialalphainvestments.com/p/misleading...

www.artificialalphainvestments.com/p/misleading...

www.artificialalphainvestments.com/p/misleading...

www.artificialalphainvestments.com/p/misleading...

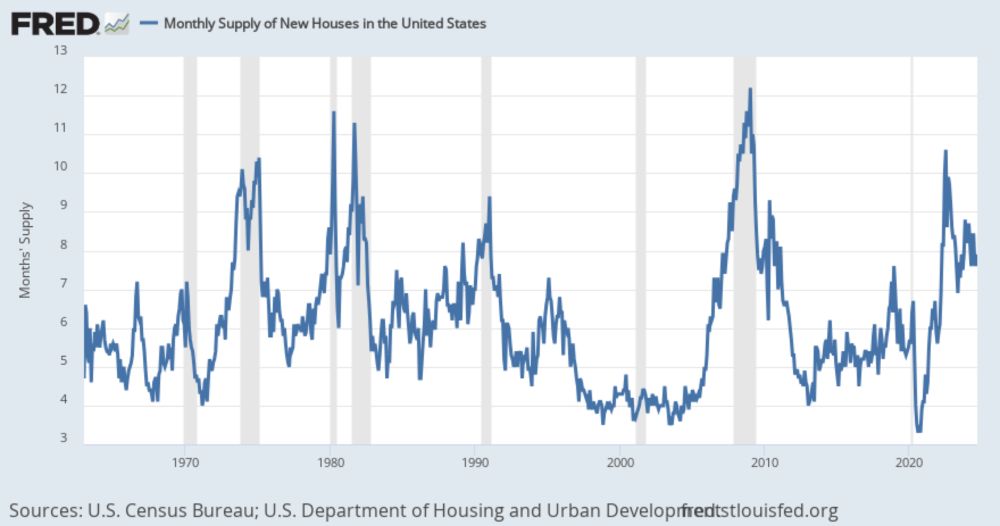

I'm watching next Tuesday's housing data closely for additional signs of easing.

Year ahead macro is starting to get more constructive.

I'm watching next Tuesday's housing data closely for additional signs of easing.

Year ahead macro is starting to get more constructive.

Similar article from 2021: www.washingtonpost.com/politics/202...

Similar article from 2021: www.washingtonpost.com/politics/202...

1920-1967

NFL = 27.2%

S&P 500 = 5.0%

1967-2023

NFL = 12.6%

S&P 500 = 7.1%

1920-1967

NFL = 27.2%

S&P 500 = 5.0%

1967-2023

NFL = 12.6%

S&P 500 = 7.1%

1920-1967

NFL = 27.2%

S&P 500 = 5.0%

1967-2023

NFL = 12.6%

S&P 500 = 7.1%

1920-1967

NFL = 27.2%

S&P 500 = 5.0%

1967-2023

NFL = 12.6%

S&P 500 = 7.1%

1) BTC is a hedge against debasement. Short-term it is in fact inversely correlated to the dollar.

1) BTC is a hedge against debasement. Short-term it is in fact inversely correlated to the dollar.

fred.stlouisfed.org/series/MSACSR

fred.stlouisfed.org/series/MSACSR

"Valuation matters, both only when a company f***s up"

I've written about it at the macro level (www.artificialalphainvestments.com/p/when-valua...), I agree at the individual equity level too.

"Valuation matters, both only when a company f***s up"

I've written about it at the macro level (www.artificialalphainvestments.com/p/when-valua...), I agree at the individual equity level too.

1) The stock market reacts to leading and coincident economic activity. It doesn't live too far in the future or the past

2) The impact of presidential decisions will not be felt for 1-5 years

1) The stock market reacts to leading and coincident economic activity. It doesn't live too far in the future or the past

2) The impact of presidential decisions will not be felt for 1-5 years