www.aeaweb.org/articles?id=...

Reis and Bahaj(2021)on CB swap lines

academic.oup.com/restud/artic...

Their 2024 paper with Fuchs also worth reading for great empirics on expansion of global network of liquidity lines.See great graphs!

personal.lse.ac.uk/reisr/papers...

www.aeaweb.org/articles?id=...

Reis and Bahaj(2021)on CB swap lines

academic.oup.com/restud/artic...

Their 2024 paper with Fuchs also worth reading for great empirics on expansion of global network of liquidity lines.See great graphs!

personal.lse.ac.uk/reisr/papers...

Reading it 25+ years after publication reveals how forward-thinking and influential his analysis was for all that followed.

Reading it 25+ years after publication reveals how forward-thinking and influential his analysis was for all that followed.

His speech on need for an international lender of resort which argued for IMF to play that role. Over time as $-funding has become more important, CB swap lines led by the Fed mimic part of that role

His speech on need for an international lender of resort which argued for IMF to play that role. Over time as $-funding has become more important, CB swap lines led by the Fed mimic part of that role

-Large share of STEM grads

-Increasing rates of MSc and Doctoral students

-Growing share of grads in finance as W growth outpaced national but still absolute # of talented STEM grads is large talent reservoir

-Large share of STEM grads

-Increasing rates of MSc and Doctoral students

-Growing share of grads in finance as W growth outpaced national but still absolute # of talented STEM grads is large talent reservoir

kingcenter.stanford.edu/sites/g/file...

(Not sure how much I buy land reform story)

kingcenter.stanford.edu/sites/g/file...

(Not sure how much I buy land reform story)

I like this by Jisoo Hwang which -Shows evolution across Asia & exceptionalism of S.Korea

-role of lower ratio in higher order births

-Decline in stated son preference in surveys

I like this by Jisoo Hwang which -Shows evolution across Asia & exceptionalism of S.Korea

-role of lower ratio in higher order births

-Decline in stated son preference in surveys

Significant difference on wanting another child when comparing those with only boys vs only girls

Link to paper:

seemajayachandran.com/ten_facts_so...

Significant difference on wanting another child when comparing those with only boys vs only girls

Link to paper:

seemajayachandran.com/ten_facts_so...

-F/M ratio of infant survival marked improvement

-Eldest son preference pretty strong,when plotting non-eldest/eldest stunting rates

-F/M ratio of infant survival marked improvement

-Eldest son preference pretty strong,when plotting non-eldest/eldest stunting rates

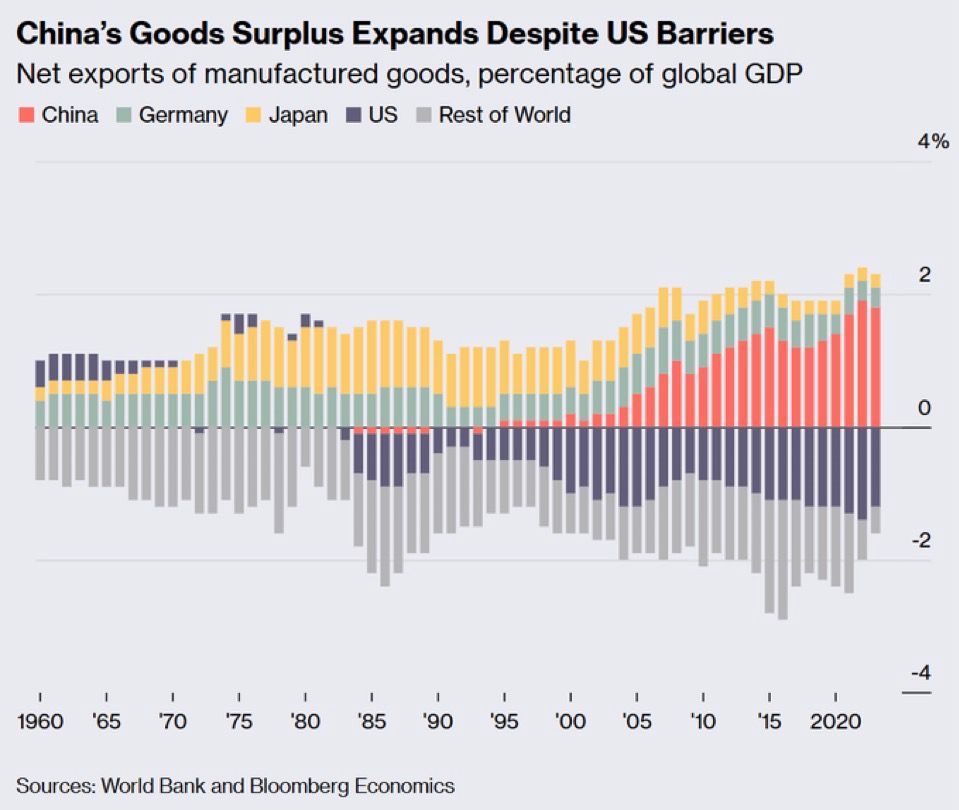

Throwback to Feenstra et al(1998), examining growing US-China trade deficit back then(!) linking to

-Macro forces

-China crowding out East Asian imports

“By 1995, China has displaced South Korea as one of the top 5 suppliers of "apparel and other textile products"

Throwback to Feenstra et al(1998), examining growing US-China trade deficit back then(!) linking to

-Macro forces

-China crowding out East Asian imports

“By 1995, China has displaced South Korea as one of the top 5 suppliers of "apparel and other textile products"

Here is the case of Japan

Here is the case of Japan

-Jeanne(2024) have straightforward model showing bank balance sheet decisions interacting with gov debt issuance

-Some data on threshold of gov debt/GDP, after which greater issuance absorbed by banks

www.imf.org/en/News/Semi...

-Jeanne(2024) have straightforward model showing bank balance sheet decisions interacting with gov debt issuance

-Some data on threshold of gov debt/GDP, after which greater issuance absorbed by banks

www.imf.org/en/News/Semi...

This shows how Gov Debt to GDP has evolved for a range of advanced economies, reaching extremely high levels.

An increasing share of that extra issuance absorbed by domestic banks, possibly a source of fin repression.

This shows how Gov Debt to GDP has evolved for a range of advanced economies, reaching extremely high levels.

An increasing share of that extra issuance absorbed by domestic banks, possibly a source of fin repression.

Or you know the BoJ has no idea how to end this um great experiment in monetary policy

Or you know the BoJ has no idea how to end this um great experiment in monetary policy

Here Craft has a wonderful analysis of Allen and Mokyr competing frameowrks for the 1st IR and role of micro and macro inventions(& overlapping definitions).

Crafts is also very clear on the evidence base required for thier arguments on first IR to be robust

Here Craft has a wonderful analysis of Allen and Mokyr competing frameowrks for the 1st IR and role of micro and macro inventions(& overlapping definitions).

Crafts is also very clear on the evidence base required for thier arguments on first IR to be robust

https://web.stanford.edu/~gentzkow/research/facebook.pdf

https://web.stanford.edu/~gentzkow/research/facebook.pdf

(translated after decades of work):

Do you understand the dynamics of this relationship, see attached JPEG??

(translated after decades of work):

Do you understand the dynamics of this relationship, see attached JPEG??

https://www.federalreserve.gov/publications/files/financial-stability-report-20230508.pdf

“Second, CRE property valuations are elevated, and current LTVs could rise considerably if CRE property valuations were to fall .”

https://www.federalreserve.gov/publications/files/financial-stability-report-20230508.pdf

“Second, CRE property valuations are elevated, and current LTVs could rise considerably if CRE property valuations were to fall .”

And I’m past prelims and am not going to be a micro-theorist but still very tempted to buy this and spend the summer flicking through it

And I’m past prelims and am not going to be a micro-theorist but still very tempted to buy this and spend the summer flicking through it