His speech on need for an international lender of resort which argued for IMF to play that role. Over time as $-funding has become more important, CB swap lines led by the Fed mimic part of that role

His speech on need for an international lender of resort which argued for IMF to play that role. Over time as $-funding has become more important, CB swap lines led by the Fed mimic part of that role

-Large share of STEM grads

-Increasing rates of MSc and Doctoral students

-Growing share of grads in finance as W growth outpaced national but still absolute # of talented STEM grads is large talent reservoir

-Large share of STEM grads

-Increasing rates of MSc and Doctoral students

-Growing share of grads in finance as W growth outpaced national but still absolute # of talented STEM grads is large talent reservoir

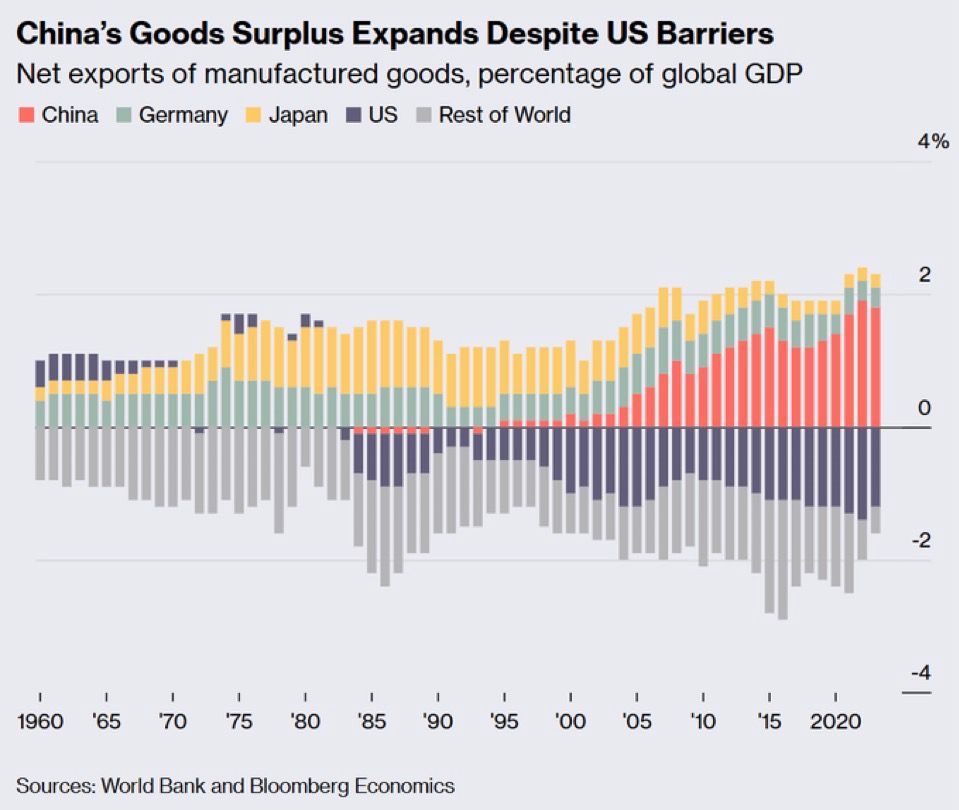

Throwback to Feenstra et al(1998), examining growing US-China trade deficit back then(!) linking to

-Macro forces

-China crowding out East Asian imports

“By 1995, China has displaced South Korea as one of the top 5 suppliers of "apparel and other textile products"

Throwback to Feenstra et al(1998), examining growing US-China trade deficit back then(!) linking to

-Macro forces

-China crowding out East Asian imports

“By 1995, China has displaced South Korea as one of the top 5 suppliers of "apparel and other textile products"

This shows how Gov Debt to GDP has evolved for a range of advanced economies, reaching extremely high levels.

An increasing share of that extra issuance absorbed by domestic banks, possibly a source of fin repression.

This shows how Gov Debt to GDP has evolved for a range of advanced economies, reaching extremely high levels.

An increasing share of that extra issuance absorbed by domestic banks, possibly a source of fin repression.

Rather than you know,my posts being bad.

Rather than you know,my posts being bad.

Or you know the BoJ has no idea how to end this um great experiment in monetary policy

Or you know the BoJ has no idea how to end this um great experiment in monetary policy

To add to Pseudos predictably good point, I’d add Crafts takes arguments of his opponents seriously & was devastatingly clear where they fell short.

Tonight’s reading was a review of Allen & Mokyr

To add to Pseudos predictably good point, I’d add Crafts takes arguments of his opponents seriously & was devastatingly clear where they fell short.

Tonight’s reading was a review of Allen & Mokyr

A great day of tennis and overall the best first week of a slam I can remember in some time

A great day of tennis and overall the best first week of a slam I can remember in some time

Millennials have been hit by so many economic shocks that we now seem incapable of holding out celebrities,artists and sports people to any moral standard if it conflicts with $$$$

Millennials have been hit by so many economic shocks that we now seem incapable of holding out celebrities,artists and sports people to any moral standard if it conflicts with $$$$

Some of them clearly have not heard of ggplot2

Some of them clearly have not heard of ggplot2

https://web.stanford.edu/~gentzkow/research/facebook.pdf

https://web.stanford.edu/~gentzkow/research/facebook.pdf

“I’m only funny through long-form bits developed via repeated interactions.”

So they have something to look forward to after 9 years of marriage

“I’m only funny through long-form bits developed via repeated interactions.”

So they have something to look forward to after 9 years of marriage

Why am I still crowding around people to see the little text box next to the painting, why is that not on an app??

(Lourve gave you a little Nintendo 3DS for €5 to map your journey)

Why am I still crowding around people to see the little text box next to the painting, why is that not on an app??

(Lourve gave you a little Nintendo 3DS for €5 to map your journey)

(TSLA shares also need to be seen as eligible collateral)

(TSLA shares also need to be seen as eligible collateral)

Economy running hot: your appliances will last 5 years

Economy sinking: everyone’s laptops start overheating

Economy running hot: your appliances will last 5 years

Economy sinking: everyone’s laptops start overheating

It’s harder when it’s about a topic where we live in one closed system and have a few crumbs of relevant historical data.

It’s harder when it’s about a topic where we live in one closed system and have a few crumbs of relevant historical data.

The two tv shows I watch are good. Have no idea what else is on

The two tv shows I watch are good. Have no idea what else is on

(translated after decades of work):

Do you understand the dynamics of this relationship, see attached JPEG??

(translated after decades of work):

Do you understand the dynamics of this relationship, see attached JPEG??

https://www.federalreserve.gov/publications/files/financial-stability-report-20230508.pdf

“Second, CRE property valuations are elevated, and current LTVs could rise considerably if CRE property valuations were to fall .”

https://www.federalreserve.gov/publications/files/financial-stability-report-20230508.pdf

“Second, CRE property valuations are elevated, and current LTVs could rise considerably if CRE property valuations were to fall .”