www.youtube.com/live/nVAEfXl...

www.youtube.com/live/nVAEfXl...

🚨 Well tune in TODAY at 1PM for Let’s Talk Markets with Mihir Dange, CEO of XCF Global ($SAFX) the road to IPO and XCF’s first day of trading!

www.youtube.com/live/esEAEKR...

🚨 Well tune in TODAY at 1PM for Let’s Talk Markets with Mihir Dange, CEO of XCF Global ($SAFX) the road to IPO and XCF’s first day of trading!

www.youtube.com/live/esEAEKR...

*JOHNSON: TAX BILL WILL REDUCE DEFICIT, IF YOU DO THE MATH RIGHT

Payrolls +151k vs exp +160k/+143k prev

Private payrolls +140k vs +145k exp/+111k prev

Unemployment rate 4.1% vs 4.0% exp/prev

Avg hourly earnings +0.3% MoM vs exp +0.3%/+0.5% prev

Weekly hours 34.1 vs 34.2 exp/34.1 prev

Payrolls exp +160k vs +143k prev

Private payrolls exp +145k vs +111k prev

Unemployment rate exp stable at 4.0%

Avg hourly earnings exp +0.3% MoM vs +0.5% est

Weekly hours exp 34.2 vs 34.1 prev

www.youtube.com/watch?v=I8ho...

www.youtube.com/watch?v=I8ho...

www.youtube.com/watch?v=I8ho...

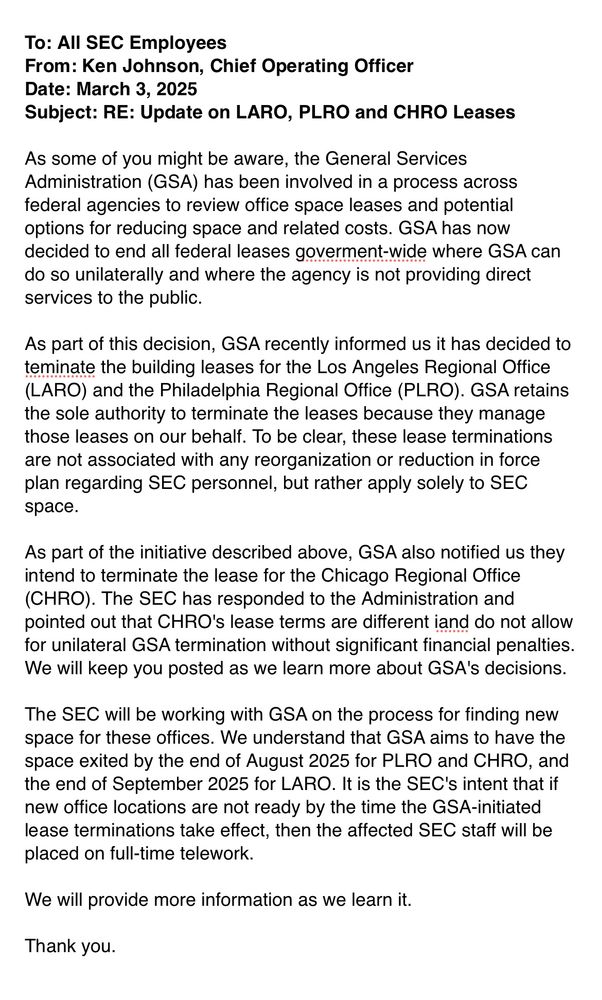

“5 alarm fire,” SEC employee tells me.

Full email text:

even right wing populists in other countries are going to have to get on the Fuck America train out of political necessity

www.youtube.com/watch?v=16Fw...

www.youtube.com/watch?v=16Fw...

missingmoney.com

www.youtube.com/watch?v=16Fw...

missingmoney.com

www.youtube.com/watch?v=bZ7d...

www.youtube.com/watch?v=bZ7d...

www.youtube.com/watch?v=bZ7d...

www.youtube.com/watch?v=bZ7d...

www.youtube.com/watch?v=bZ7d...

1) the average workweek is very low

2) manufacturing job growth is negative and is worsening

3) the hires rate remains early 2010’s sluggish

4) the largest publicly-traded homebuilder stock is cratering

Nov/Dec were revised UP, with 100,000 jobs added total.

Markets down a bit, not much of an impact.

Nov/Dec were revised UP, with 100,000 jobs added total.

Markets down a bit, not much of an impact.

Full writeup on @urvin.bsky.social: urvin.finance/community/ma...

Full writeup on @urvin.bsky.social: urvin.finance/community/ma...