Thomas Dvorak

@tomdvorak.bsky.social

Eurozone economist @OxfordEconomics

Economics alum @UniversityofGlasgow @UCL

Views & typos mine (who else's?)

Economics alum @UniversityofGlasgow @UCL

Views & typos mine (who else's?)

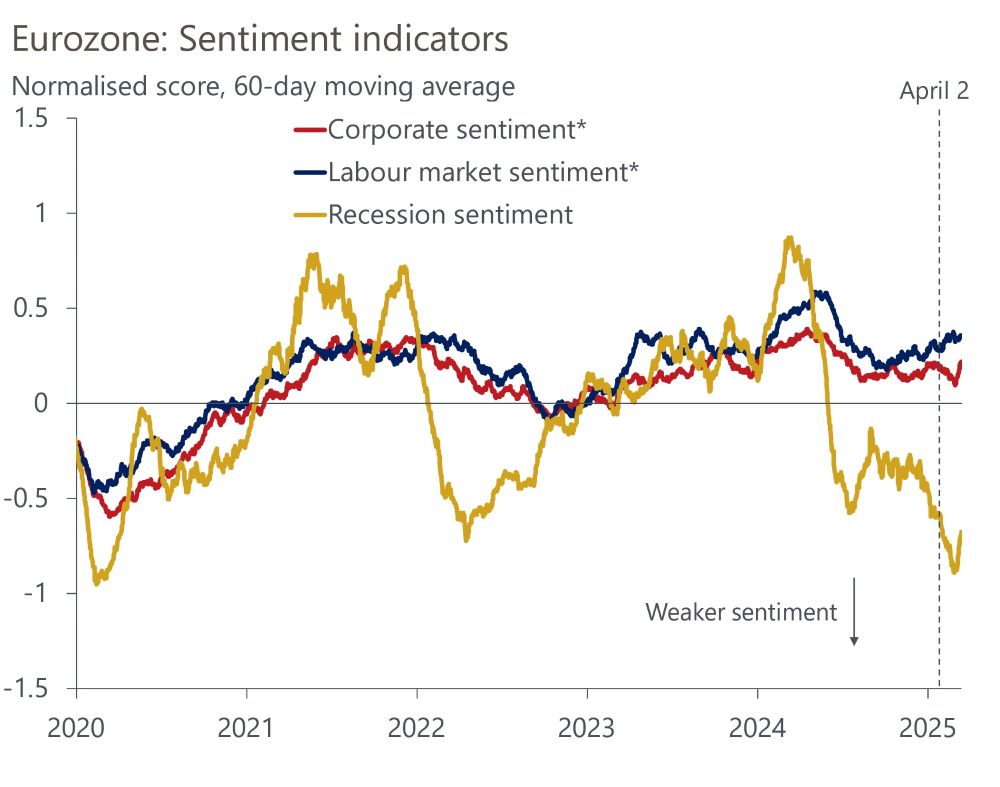

But it's not all doom and gloom: despite the heightened levels of uncertainty, double digit tariff rates being sounded off on the daily and recession fears, both consumer and business confidence seem to be holding up relatively well, as evidenced by our NLP-based proprietary sentiment data!

10/11

10/11

May 27, 2025 at 10:57 AM

But it's not all doom and gloom: despite the heightened levels of uncertainty, double digit tariff rates being sounded off on the daily and recession fears, both consumer and business confidence seem to be holding up relatively well, as evidenced by our NLP-based proprietary sentiment data!

10/11

10/11

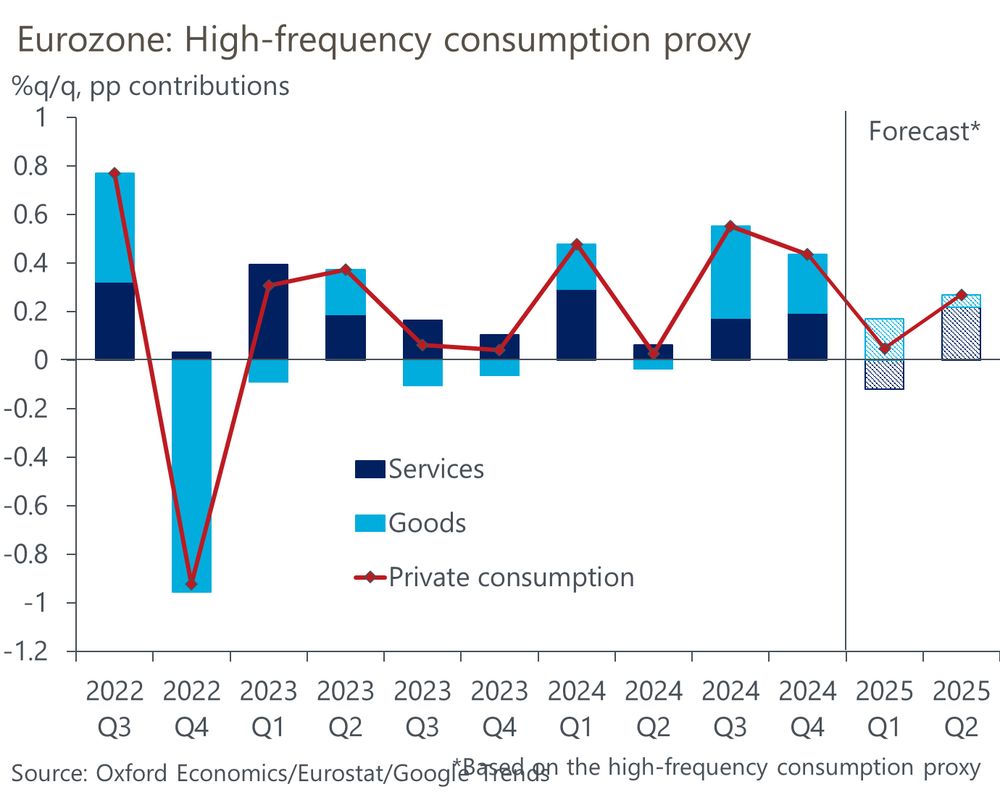

Data from online searches shows consumer spending, the key driver of growth in the eurozone over the past 18 months, is slowing down. While we tend to think of uncertainty as mainly affecting firms' investment decisions, consumers don't like it either.

8/11

8/11

May 27, 2025 at 10:57 AM

Data from online searches shows consumer spending, the key driver of growth in the eurozone over the past 18 months, is slowing down. While we tend to think of uncertainty as mainly affecting firms' investment decisions, consumers don't like it either.

8/11

8/11

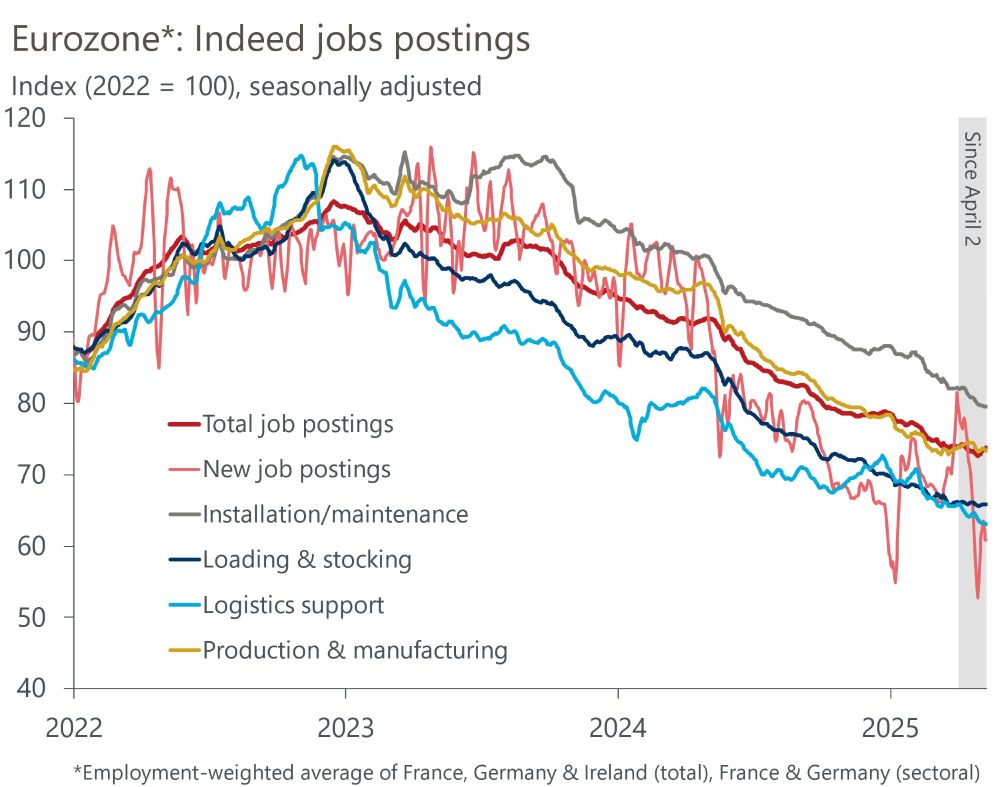

Online job postings have dipped sharply around "Liberation Day", but have bounced back since, although they remain on a downward trend. Crucially, this trend isn't any more pronounced for manufacturing or logistics jobs which are more exposed to tariffs.

7/11

7/11

May 27, 2025 at 10:57 AM

Online job postings have dipped sharply around "Liberation Day", but have bounced back since, although they remain on a downward trend. Crucially, this trend isn't any more pronounced for manufacturing or logistics jobs which are more exposed to tariffs.

7/11

7/11

These tariffs are already applied, and that chain reaction is already feeding through the economy. The problem is, waiting for that to show in the standard macroeconomic data will take quite a long while.

3/11

3/11

May 27, 2025 at 10:57 AM

These tariffs are already applied, and that chain reaction is already feeding through the economy. The problem is, waiting for that to show in the standard macroeconomic data will take quite a long while.

3/11

3/11

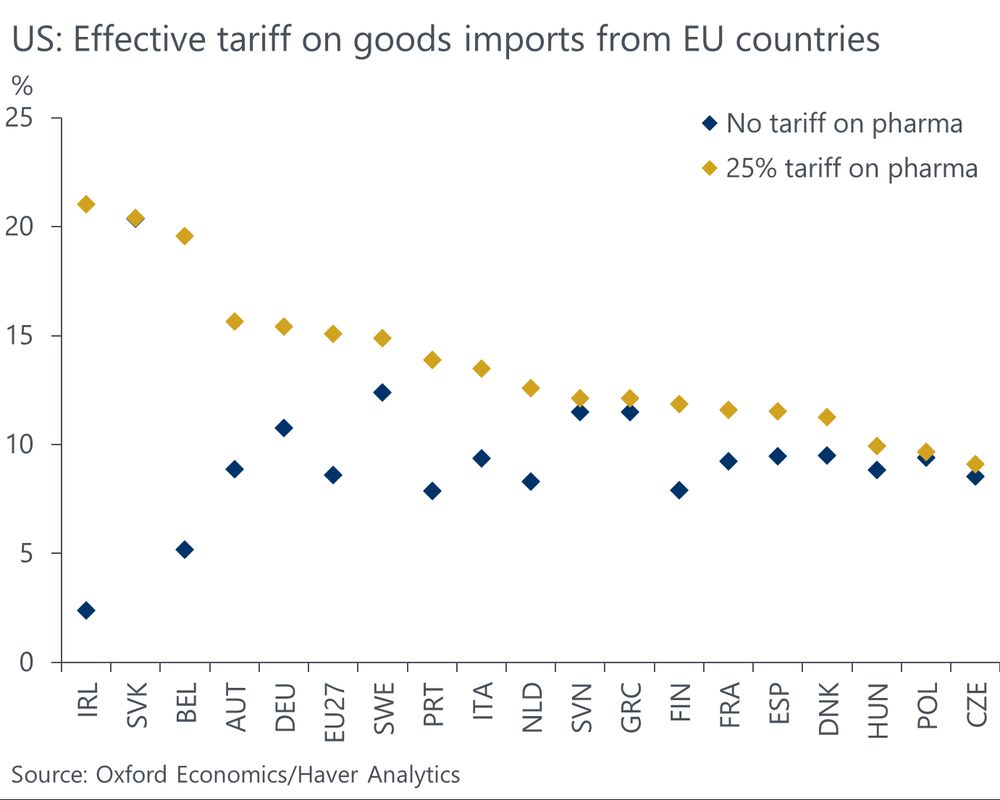

In fact, the current trade-weighted tariff rate is about 9%, accounting for all the exceptions and higher rates on specific goods such as metals or cars. It could rise to 15% if pharmaceuticals are also tariffed.

2/11

2/11

May 27, 2025 at 10:57 AM

In fact, the current trade-weighted tariff rate is about 9%, accounting for all the exceptions and higher rates on specific goods such as metals or cars. It could rise to 15% if pharmaceuticals are also tariffed.

2/11

2/11

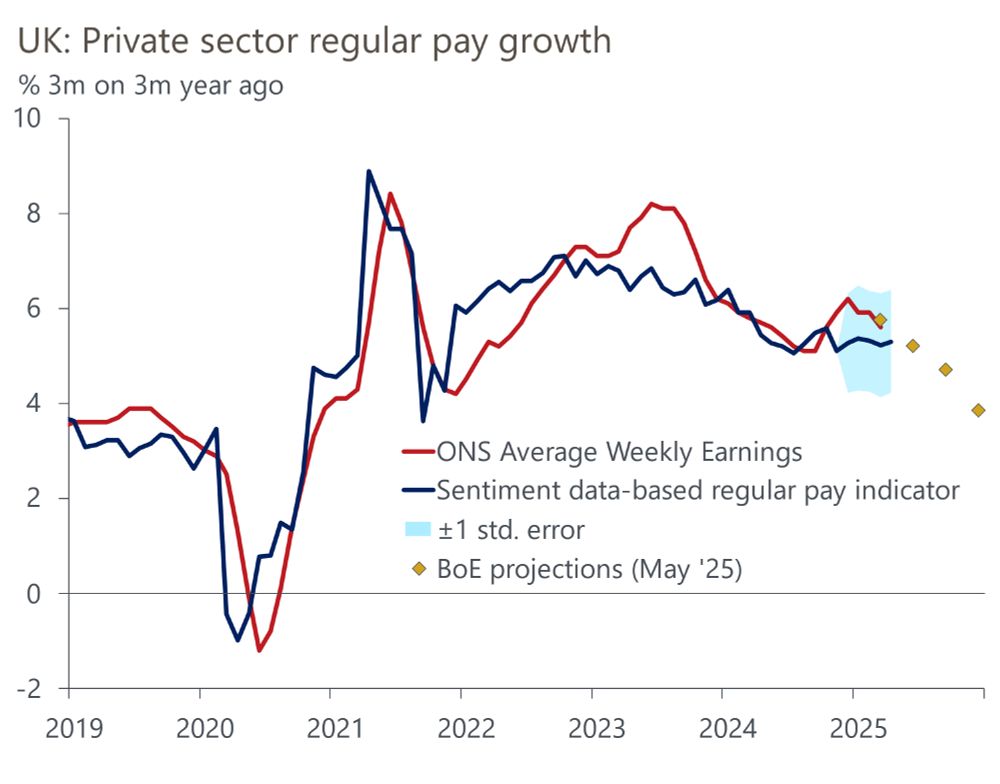

Our pay nowcast suggests private sector regular pay growth will stabilise in Q2, rather than fall as the BoE expects. As the MPC puts a high weight on pay as an indicator of underlying inflation pressures, this is likely to reinforce the caution around the pace of rate cuts.

7/8

7/8

May 23, 2025 at 9:56 AM

Our pay nowcast suggests private sector regular pay growth will stabilise in Q2, rather than fall as the BoE expects. As the MPC puts a high weight on pay as an indicator of underlying inflation pressures, this is likely to reinforce the caution around the pace of rate cuts.

7/8

7/8

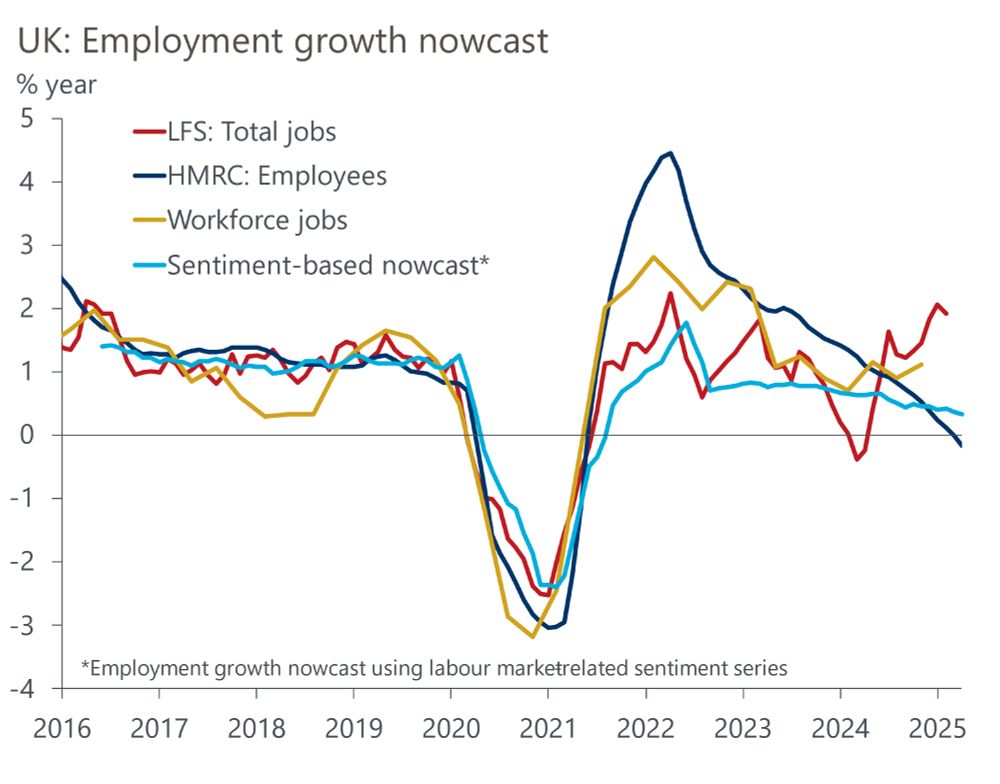

What's the data saying at the moment then? UK employment growth has continued to slow in recent months. But as yet, there is no evidence that last month’s increases in employers’ NICs and the national living wage have triggered large-scale job losses.

5/8

5/8

May 23, 2025 at 9:56 AM

What's the data saying at the moment then? UK employment growth has continued to slow in recent months. But as yet, there is no evidence that last month’s increases in employers’ NICs and the national living wage have triggered large-scale job losses.

5/8

5/8

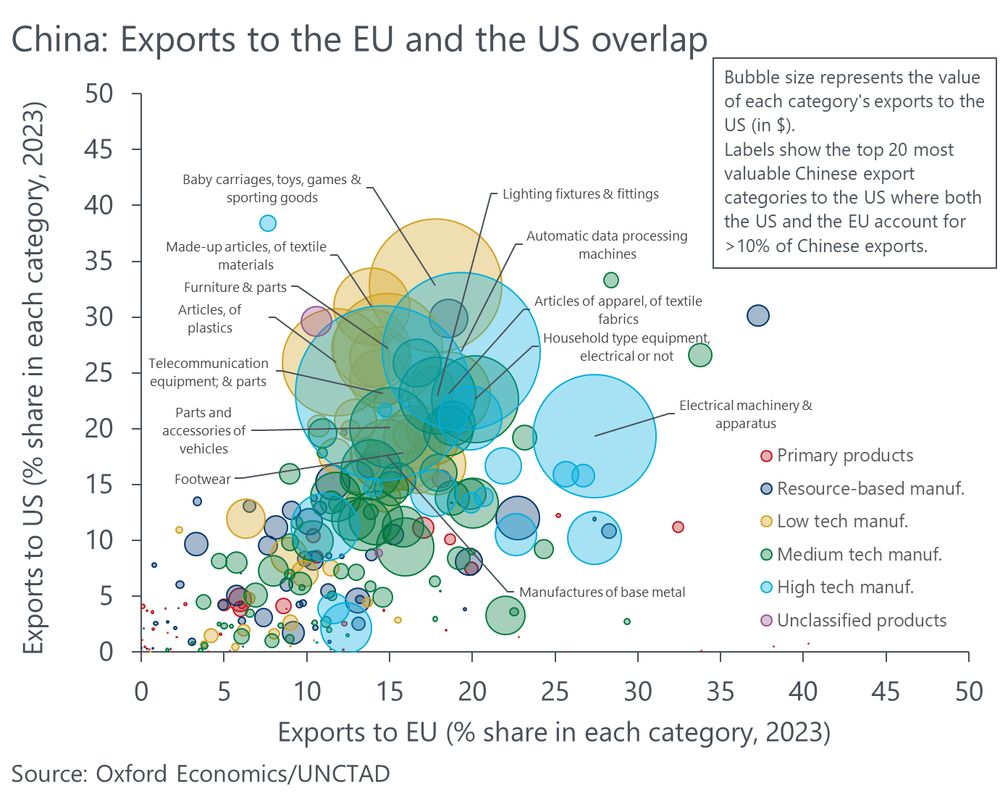

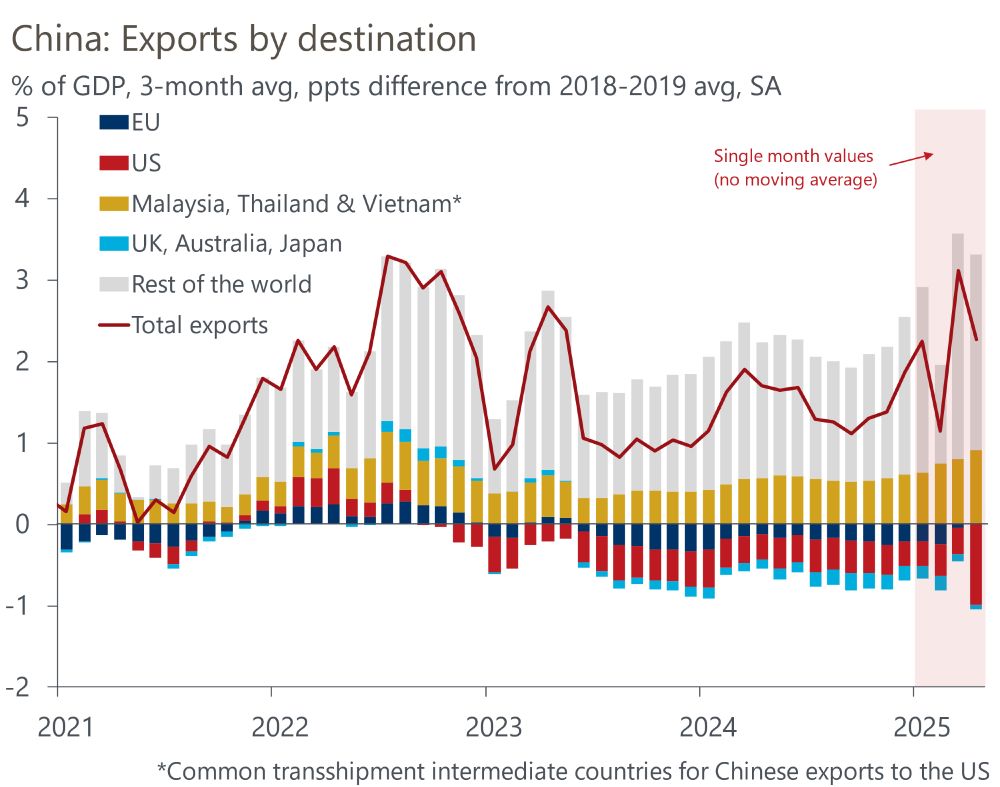

There is a substantial overlap between the Chinese exports to the US & the EU but we remain sceptical about the flooding of EU markets.

Chinese firms' profitability is already low and the government stimulus efforts seem to be focused elsewhere. Plus the EC might always respond with tariffs.

9/10

Chinese firms' profitability is already low and the government stimulus efforts seem to be focused elsewhere. Plus the EC might always respond with tariffs.

9/10

May 21, 2025 at 8:52 AM

There is a substantial overlap between the Chinese exports to the US & the EU but we remain sceptical about the flooding of EU markets.

Chinese firms' profitability is already low and the government stimulus efforts seem to be focused elsewhere. Plus the EC might always respond with tariffs.

9/10

Chinese firms' profitability is already low and the government stimulus efforts seem to be focused elsewhere. Plus the EC might always respond with tariffs.

9/10

On the downside, the most commonly cited risk is China flooding the EU markets with its surplus capacity it might no longer be able to export to the US. There has been a steady rise in Chinese exports to the EU in the latest data.

8/10

8/10

May 21, 2025 at 8:52 AM

On the downside, the most commonly cited risk is China flooding the EU markets with its surplus capacity it might no longer be able to export to the US. There has been a steady rise in Chinese exports to the EU in the latest data.

8/10

8/10

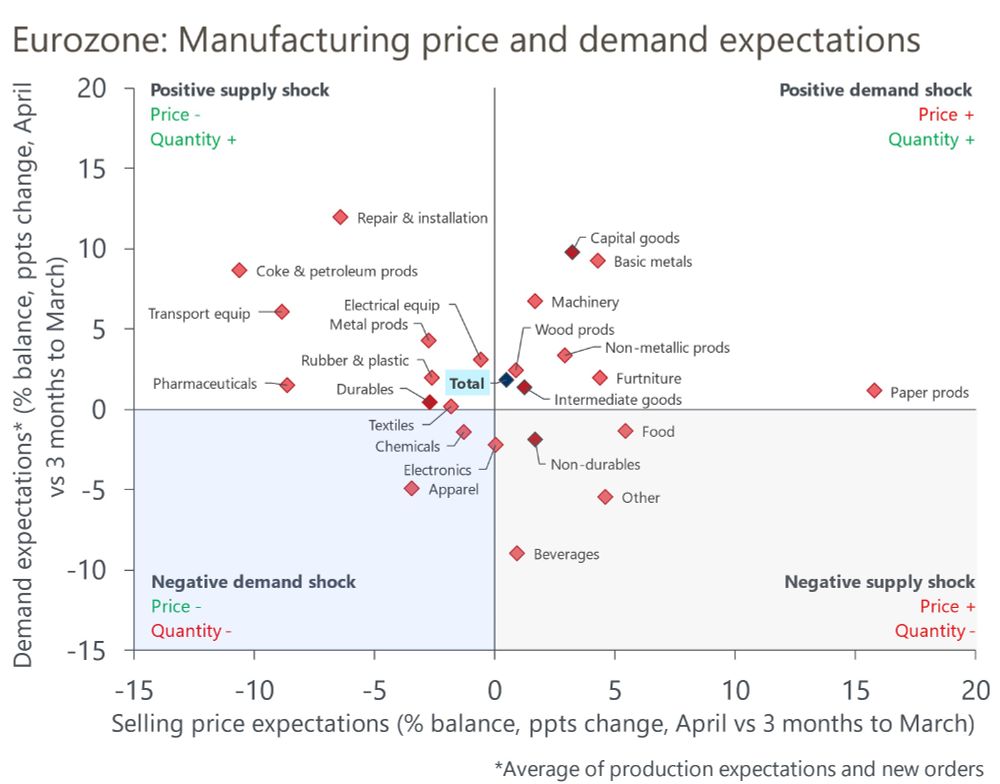

Timely survey data corroborate this. Eurozone manufacturing firms reported a softer assessment of expected capacity constraints in Q2, and production expectations fell across sectors. This suggests the negative demand shock from US tariffs outweighs any supply concerns.

3/10

3/10

May 21, 2025 at 8:52 AM

Timely survey data corroborate this. Eurozone manufacturing firms reported a softer assessment of expected capacity constraints in Q2, and production expectations fell across sectors. This suggests the negative demand shock from US tariffs outweighs any supply concerns.

3/10

3/10

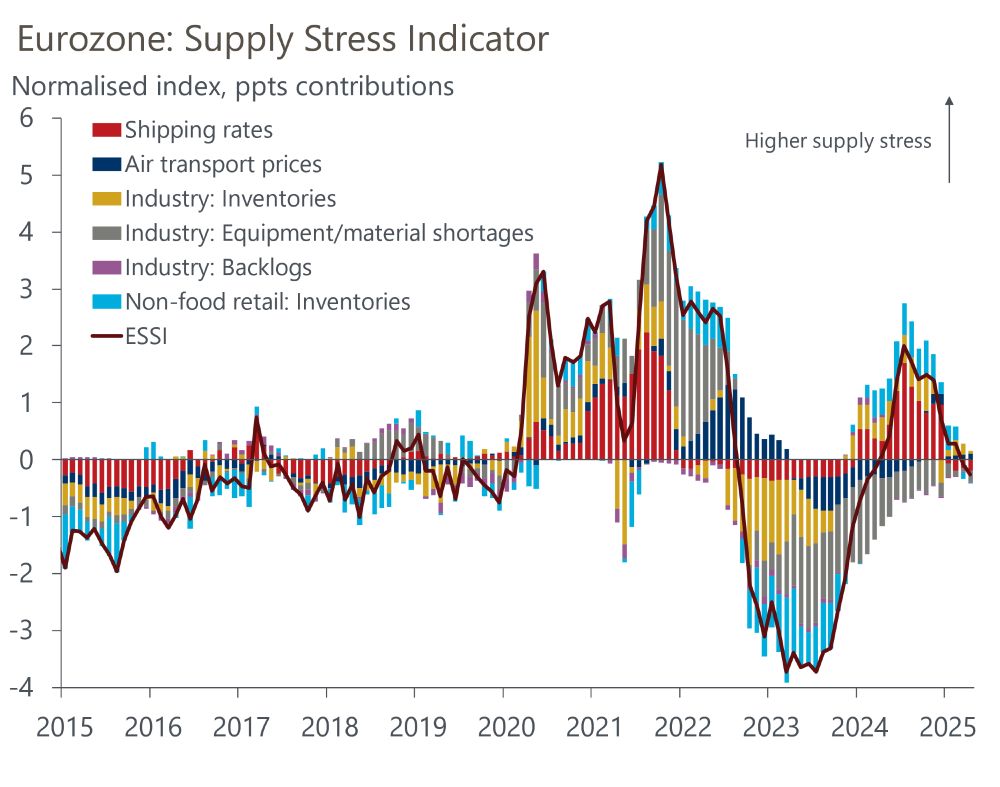

First of all, our proprietary Eurozone Supply Stress Indicator (ESSI) points to ongoing easing in supply pressures since mid-2024 - this trend remains intact even after the April 2 US tariff announcement. Supply pressures are now broadly at their historical average.

2/10

2/10

May 21, 2025 at 8:52 AM

First of all, our proprietary Eurozone Supply Stress Indicator (ESSI) points to ongoing easing in supply pressures since mid-2024 - this trend remains intact even after the April 2 US tariff announcement. Supply pressures are now broadly at their historical average.

2/10

2/10

There are interesting country differences by the way. I think you can plausibly say the French don't go to the US anymore. But that most certainly can't be said about the Italians.

9/9

9/9

May 15, 2025 at 12:51 PM

There are interesting country differences by the way. I think you can plausibly say the French don't go to the US anymore. But that most certainly can't be said about the Italians.

9/9

9/9

You can see perhaps a small drop in the seasonally-adjusted data. Seasonal adjustment methods always have a degree of imprecision, but we're looking at anything between 0-5% y/y drop in European tourist arrivals to the US in April.

March was weak, April quite strong.

7/9

March was weak, April quite strong.

7/9

May 15, 2025 at 12:51 PM

You can see perhaps a small drop in the seasonally-adjusted data. Seasonal adjustment methods always have a degree of imprecision, but we're looking at anything between 0-5% y/y drop in European tourist arrivals to the US in April.

March was weak, April quite strong.

7/9

March was weak, April quite strong.

7/9

So to the bigger question then - once adjusted for Easter, are Europeans really shunning the US under Trump?

In short, it's hard to tell. It's true that March was pretty weak even adjusted for Easter. But guess what, April was pretty strong by historical standards.

6/9

In short, it's hard to tell. It's true that March was pretty weak even adjusted for Easter. But guess what, April was pretty strong by historical standards.

6/9

May 15, 2025 at 12:51 PM

So to the bigger question then - once adjusted for Easter, are Europeans really shunning the US under Trump?

In short, it's hard to tell. It's true that March was pretty weak even adjusted for Easter. But guess what, April was pretty strong by historical standards.

6/9

In short, it's hard to tell. It's true that March was pretty weak even adjusted for Easter. But guess what, April was pretty strong by historical standards.

6/9

The Easter "boost" to European tourism flows to the US is large, to the tune of ~20-40% m/m increase over the previous "non-Easter" month.

It's much more pronounced for Western European countries, and it's a seasonal effect you can depend on.

5/9

It's much more pronounced for Western European countries, and it's a seasonal effect you can depend on.

5/9

May 15, 2025 at 12:51 PM

The Easter "boost" to European tourism flows to the US is large, to the tune of ~20-40% m/m increase over the previous "non-Easter" month.

It's much more pronounced for Western European countries, and it's a seasonal effect you can depend on.

5/9

It's much more pronounced for Western European countries, and it's a seasonal effect you can depend on.

5/9

In April, it's basically the whole thing in reverse. No Easter in April 2024. Yes Easter in April 2025. And suddenly, you get this big "bounce" in Europeans coming to the US.

This has nothing to do with Trump, and all to do with public holidays and a certain "Jesus" fellow.

4/9

This has nothing to do with Trump, and all to do with public holidays and a certain "Jesus" fellow.

4/9

May 15, 2025 at 12:51 PM

In April, it's basically the whole thing in reverse. No Easter in April 2024. Yes Easter in April 2025. And suddenly, you get this big "bounce" in Europeans coming to the US.

This has nothing to do with Trump, and all to do with public holidays and a certain "Jesus" fellow.

4/9

This has nothing to do with Trump, and all to do with public holidays and a certain "Jesus" fellow.

4/9

Remember the FT chart about European tourist arrivals in the US dropping off a cliff in March?

This is him in April. Feel old yet?

1/9

This is him in April. Feel old yet?

1/9

May 15, 2025 at 12:51 PM

Remember the FT chart about European tourist arrivals in the US dropping off a cliff in March?

This is him in April. Feel old yet?

1/9

This is him in April. Feel old yet?

1/9

No, this chart is wrong because of the reasons above. It shows annual growth rates, so it compared March this year (no Easter) with March last year (yes Easter). The Easter effect for European countries is ~20-40% m/m. Adjusted chart would look like this.

May 4, 2025 at 8:57 PM

No, this chart is wrong because of the reasons above. It shows annual growth rates, so it compared March this year (no Easter) with March last year (yes Easter). The Easter effect for European countries is ~20-40% m/m. Adjusted chart would look like this.

In fact, this year's March has been historically poor for arrivals from most European countries. I think for Denmark, it's pretty self evident why (given the Greenland "situation" which kicked off in January already).

There is a sizeable "TRUMP" effect in tourism flows.

9/10

There is a sizeable "TRUMP" effect in tourism flows.

9/10

April 20, 2025 at 8:38 AM

In fact, this year's March has been historically poor for arrivals from most European countries. I think for Denmark, it's pretty self evident why (given the Greenland "situation" which kicked off in January already).

There is a sizeable "TRUMP" effect in tourism flows.

9/10

There is a sizeable "TRUMP" effect in tourism flows.

9/10

The chart above (and the original chart) mostly looks at countries that have recorded sharp annual drops in the March unadjusted data. In some other countries, it's less pronounced. Tourist inflows from the Netherlands and Poland even rose.

7/10

7/10

April 20, 2025 at 8:38 AM

The chart above (and the original chart) mostly looks at countries that have recorded sharp annual drops in the March unadjusted data. In some other countries, it's less pronounced. Tourist inflows from the Netherlands and Poland even rose.

7/10

7/10

I say "might" because the seasonal adjustment is tricky. In the chart above, I remove both the average Easter effect based on 2000-2024 data excl Covid (diamond) and the very recent 2023-24 average effect (circle). Note that they can be quite different!

6/10

6/10

April 20, 2025 at 8:38 AM

I say "might" because the seasonal adjustment is tricky. In the chart above, I remove both the average Easter effect based on 2000-2024 data excl Covid (diamond) and the very recent 2023-24 average effect (circle). Note that they can be quite different!

6/10

6/10

What would the original chart look like if we adjusted for the Easter effect?

Something like this.

Note that there are still sizeable declines for most countries, but smaller than in the raw data. For Italy or the UK, there might not be any real decline at all.

5/10

Something like this.

Note that there are still sizeable declines for most countries, but smaller than in the raw data. For Italy or the UK, there might not be any real decline at all.

5/10

April 20, 2025 at 8:38 AM

What would the original chart look like if we adjusted for the Easter effect?

Something like this.

Note that there are still sizeable declines for most countries, but smaller than in the raw data. For Italy or the UK, there might not be any real decline at all.

5/10

Something like this.

Note that there are still sizeable declines for most countries, but smaller than in the raw data. For Italy or the UK, there might not be any real decline at all.

5/10

Easter is a problematic holiday for seasonal adjustment because of its moving date. It shifts from March to April and from Q1 to Q2.

For things like tourism which are very dependent on holidays, the boost can be as much as 20-30% month on month.

4/10

For things like tourism which are very dependent on holidays, the boost can be as much as 20-30% month on month.

4/10

April 20, 2025 at 8:38 AM

Easter is a problematic holiday for seasonal adjustment because of its moving date. It shifts from March to April and from Q1 to Q2.

For things like tourism which are very dependent on holidays, the boost can be as much as 20-30% month on month.

4/10

For things like tourism which are very dependent on holidays, the boost can be as much as 20-30% month on month.

4/10

So naturally with fewer bank holidays in March this year, European travel flows fall in annual comparison. They will "artificially" rise next month, as there were fewer days off in April last year.

Notice how the annual growth rate data spike and and dip around Easter?

3/10

Notice how the annual growth rate data spike and and dip around Easter?

3/10

April 20, 2025 at 8:38 AM

So naturally with fewer bank holidays in March this year, European travel flows fall in annual comparison. They will "artificially" rise next month, as there were fewer days off in April last year.

Notice how the annual growth rate data spike and and dip around Easter?

3/10

Notice how the annual growth rate data spike and and dip around Easter?

3/10

You may have seen this chart doing rounds of Twitter et al, showing that Europeans are not travelling to the US under Trump.

The chart shows steep drops in March. It's not wrong, but it is inaccurate.

1/10

The chart shows steep drops in March. It's not wrong, but it is inaccurate.

1/10

April 20, 2025 at 8:38 AM

You may have seen this chart doing rounds of Twitter et al, showing that Europeans are not travelling to the US under Trump.

The chart shows steep drops in March. It's not wrong, but it is inaccurate.

1/10

The chart shows steep drops in March. It's not wrong, but it is inaccurate.

1/10