America’s growing advantage in services isn’t confined to the tech (ICT) sector. Professional services account for 2x as much of the recent productivity divergence. In reality, the US has outperformed the UK in a range of key service sectors.

America’s growing advantage in services isn’t confined to the tech (ICT) sector. Professional services account for 2x as much of the recent productivity divergence. In reality, the US has outperformed the UK in a range of key service sectors.

This isn’t to say energy prices don’t matter, but other factors have been more important in explaining sectoral productivity growth in recent years.

This isn’t to say energy prices don’t matter, but other factors have been more important in explaining sectoral productivity growth in recent years.

The UK has seen a massive spike in energy prices since 2019. Industrial gas prices rose by 158% between 2019 and 2023, compared to a 21% rise in the US. And because we’re so gas-dependent for electricity generation, electricity prices rose sharply too.

The UK has seen a massive spike in energy prices since 2019. Industrial gas prices rose by 158% between 2019 and 2023, compared to a 21% rise in the US. And because we’re so gas-dependent for electricity generation, electricity prices rose sharply too.

Production keeps booming in America while dwindling in Britain. Hours are sticky though: workers in UK mining and sector clocked the same number of hours in 2019 as they did in 2005, despite extraction falling ~50%. Less output + same hours = falling productivity.

Production keeps booming in America while dwindling in Britain. Hours are sticky though: workers in UK mining and sector clocked the same number of hours in 2019 as they did in 2005, despite extraction falling ~50%. Less output + same hours = falling productivity.

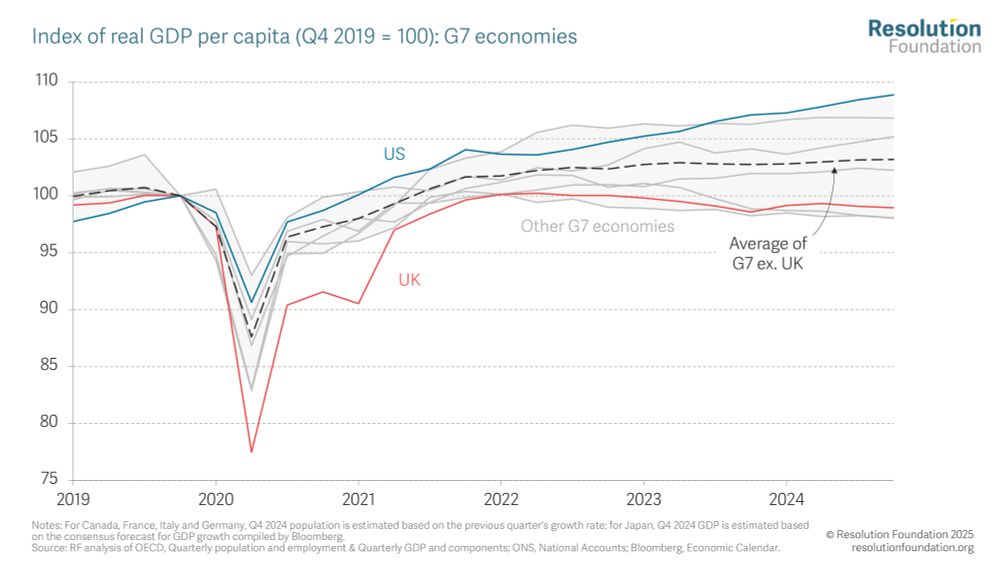

In the paper, I set out three things to know about the recent US-UK divergence in productivity.

In the paper, I set out three things to know about the recent US-UK divergence in productivity.

But this is based on unreliable LFS data and probably *understates* the scale of the problem.

But this is based on unreliable LFS data and probably *understates* the scale of the problem.

Spoiler: it’s not just tech companies and energy prices 🧵

Spoiler: it’s not just tech companies and energy prices 🧵

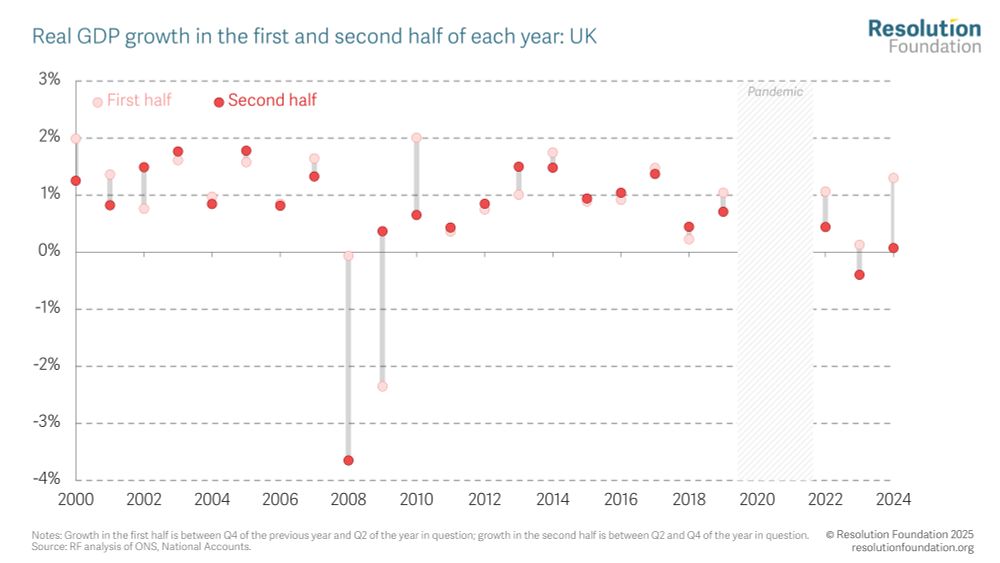

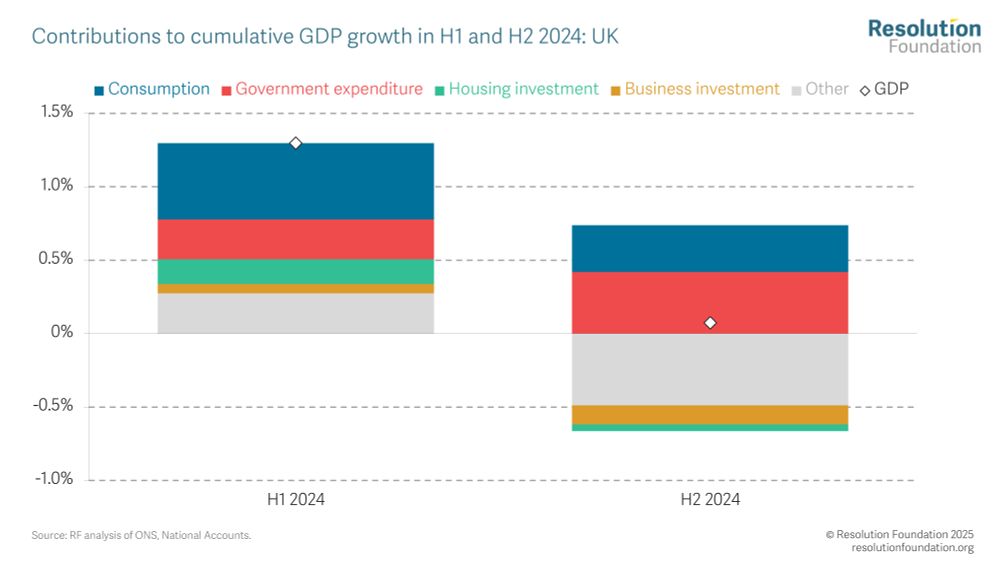

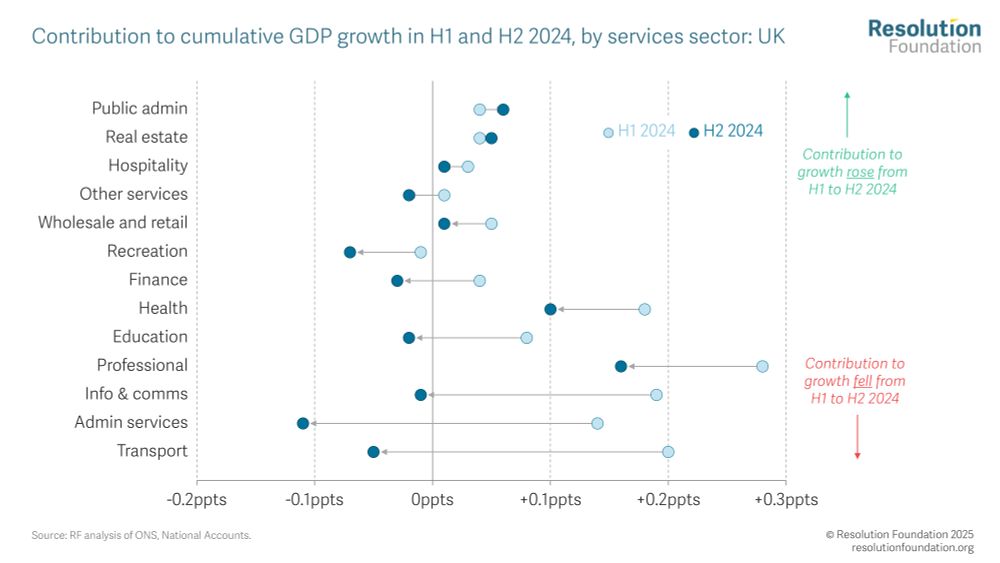

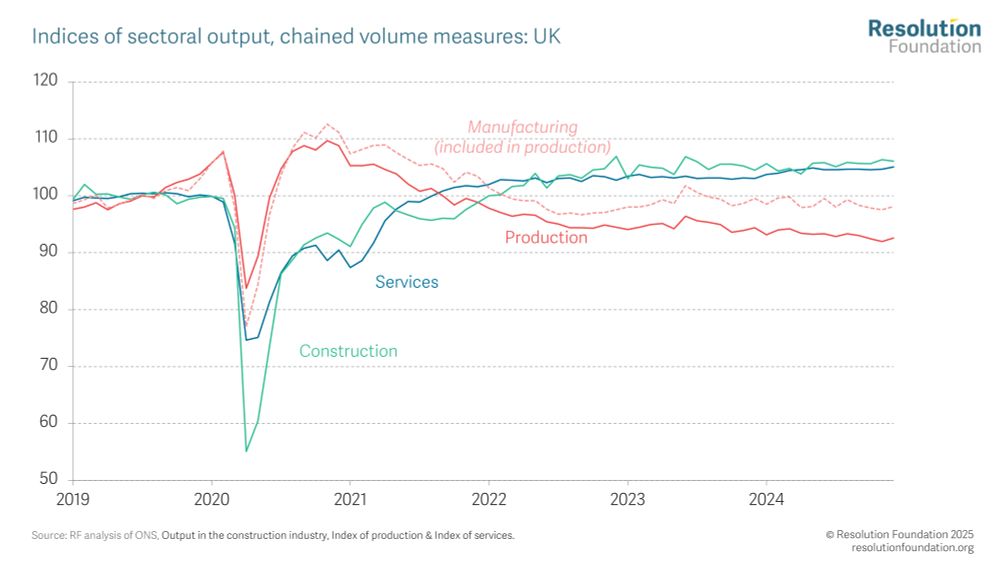

Most of the slowdown came from services, which contributed 1.3ppts to total growth in H1 and just 0.1ppts in H2. But note that the *level* of activity remains weakest in the production sector.

Most of the slowdown came from services, which contributed 1.3ppts to total growth in H1 and just 0.1ppts in H2. But note that the *level* of activity remains weakest in the production sector.

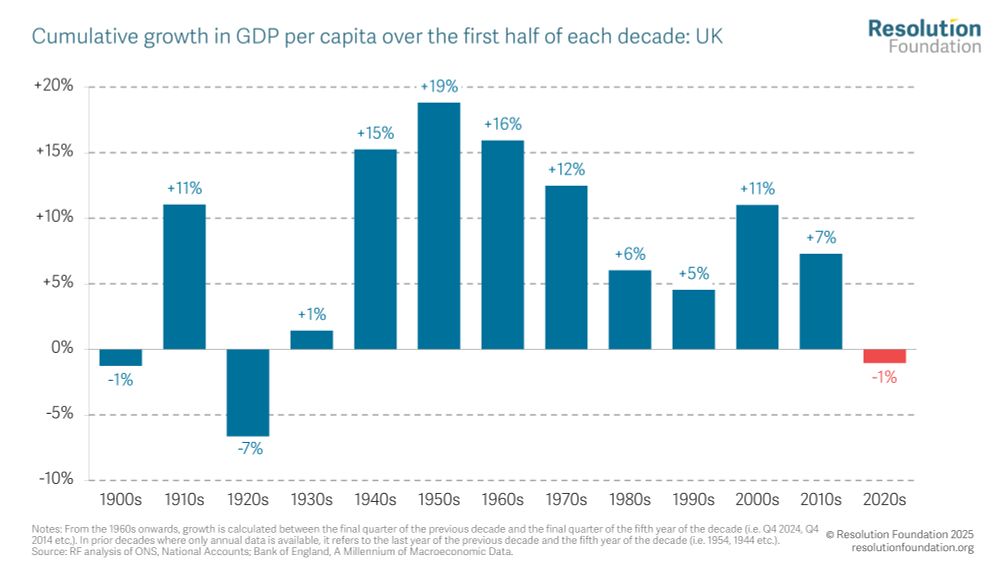

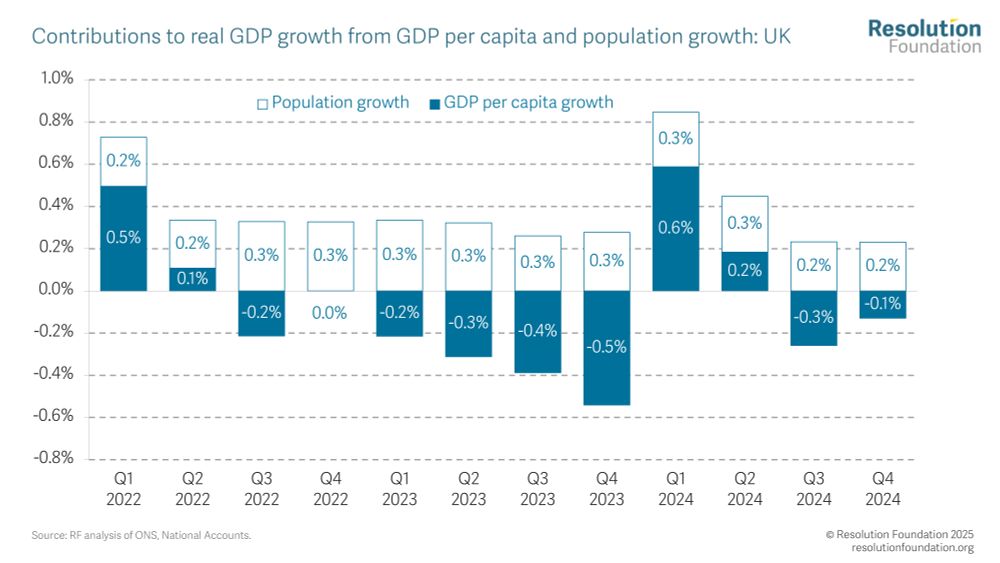

Worryingly, we’ve now only seen four quarters of per capita growth in the past three years of data (going back to the start of 2022).

Worryingly, we’ve now only seen four quarters of per capita growth in the past three years of data (going back to the start of 2022).