Simone Arrigoni

@simonearrigoni.bsky.social

Teaching Fellow at University College Dublin | International Macro ↔️ Inequality | https://www.simone-arrigoni.com

Dublin has become a true home, so leaving definitely feels bittersweet. But I’m truly excited to move to Paris, join the amazing Econ community there, and start working on European issues. Exciting times ahead!

See you in Paris, at conferences, or around!🚀

See you in Paris, at conferences, or around!🚀

April 17, 2025 at 2:40 PM

Dublin has become a true home, so leaving definitely feels bittersweet. But I’m truly excited to move to Paris, join the amazing Econ community there, and start working on European issues. Exciting times ahead!

See you in Paris, at conferences, or around!🚀

See you in Paris, at conferences, or around!🚀

Huge thanks to everyone who supported, advised, and inspired me on this journey! I’ve grown a lot, learned tons, and made lifelong friends. Grateful to my supervisors, the whole faculty at TCD, co-authors, family, friends, and UCD for welcoming me this academic year.

April 17, 2025 at 2:40 PM

Huge thanks to everyone who supported, advised, and inspired me on this journey! I’ve grown a lot, learned tons, and made lifelong friends. Grateful to my supervisors, the whole faculty at TCD, co-authors, family, friends, and UCD for welcoming me this academic year.

🧵 A summary thread on the paper is available here: x.com/simone_arrig...

📑 The full paper can be accessed here (open access): link.springer.com/article/10.1...

📑 The full paper can be accessed here (open access): link.springer.com/article/10.1...

March 3, 2025 at 11:23 AM

🧵 A summary thread on the paper is available here: x.com/simone_arrig...

📑 The full paper can be accessed here (open access): link.springer.com/article/10.1...

📑 The full paper can be accessed here (open access): link.springer.com/article/10.1...

Ireland seems to defy the rise of "inheritocracy."

The article links this to rapid economic growth. Our paper finds inheritance in Ireland has little impact on wealth inequality, unlike in Europe, due to inheritances aiding property ownership, rising asset prices, and a wage-rental income shifts.

The article links this to rapid economic growth. Our paper finds inheritance in Ireland has little impact on wealth inequality, unlike in Europe, due to inheritances aiding property ownership, rising asset prices, and a wage-rental income shifts.

March 3, 2025 at 11:23 AM

Ireland seems to defy the rise of "inheritocracy."

The article links this to rapid economic growth. Our paper finds inheritance in Ireland has little impact on wealth inequality, unlike in Europe, due to inheritances aiding property ownership, rising asset prices, and a wage-rental income shifts.

The article links this to rapid economic growth. Our paper finds inheritance in Ireland has little impact on wealth inequality, unlike in Europe, due to inheritances aiding property ownership, rising asset prices, and a wage-rental income shifts.

Thank you very much for including my paper!

December 9, 2024 at 7:01 PM

Thank you very much for including my paper!

Grazie Andrea!!

November 27, 2024 at 11:39 AM

Grazie Andrea!!

Thank you Rebecca!

November 26, 2024 at 12:41 PM

Thank you Rebecca!

My dissertation examines dynamics within and between international macro and wealth/income inequality dimensions.

~ JMP (Ch4): lnkd.in/d5v8xTsm

~ Ch1: lnkd.in/gJUWPn7e (IMF Econ Rev)

~ Ch2: lnkd.in/dtz6prz9 ( J Econ Inequal)

~ Ch3: lnkd.in/d-pnJhD3 (JMacro)

~ JMP (Ch4): lnkd.in/d5v8xTsm

~ Ch1: lnkd.in/gJUWPn7e (IMF Econ Rev)

~ Ch2: lnkd.in/dtz6prz9 ( J Econ Inequal)

~ Ch3: lnkd.in/d-pnJhD3 (JMacro)

LinkedIn

This link will take you to a page that’s not on LinkedIn

lnkd.in

November 26, 2024 at 11:36 AM

My dissertation examines dynamics within and between international macro and wealth/income inequality dimensions.

~ JMP (Ch4): lnkd.in/d5v8xTsm

~ Ch1: lnkd.in/gJUWPn7e (IMF Econ Rev)

~ Ch2: lnkd.in/dtz6prz9 ( J Econ Inequal)

~ Ch3: lnkd.in/d-pnJhD3 (JMacro)

~ JMP (Ch4): lnkd.in/d5v8xTsm

~ Ch1: lnkd.in/gJUWPn7e (IMF Econ Rev)

~ Ch2: lnkd.in/dtz6prz9 ( J Econ Inequal)

~ Ch3: lnkd.in/d-pnJhD3 (JMacro)

Recently posted about my JMP, Thanks Khoa!

bsky.app/profile/simo...

bsky.app/profile/simo...

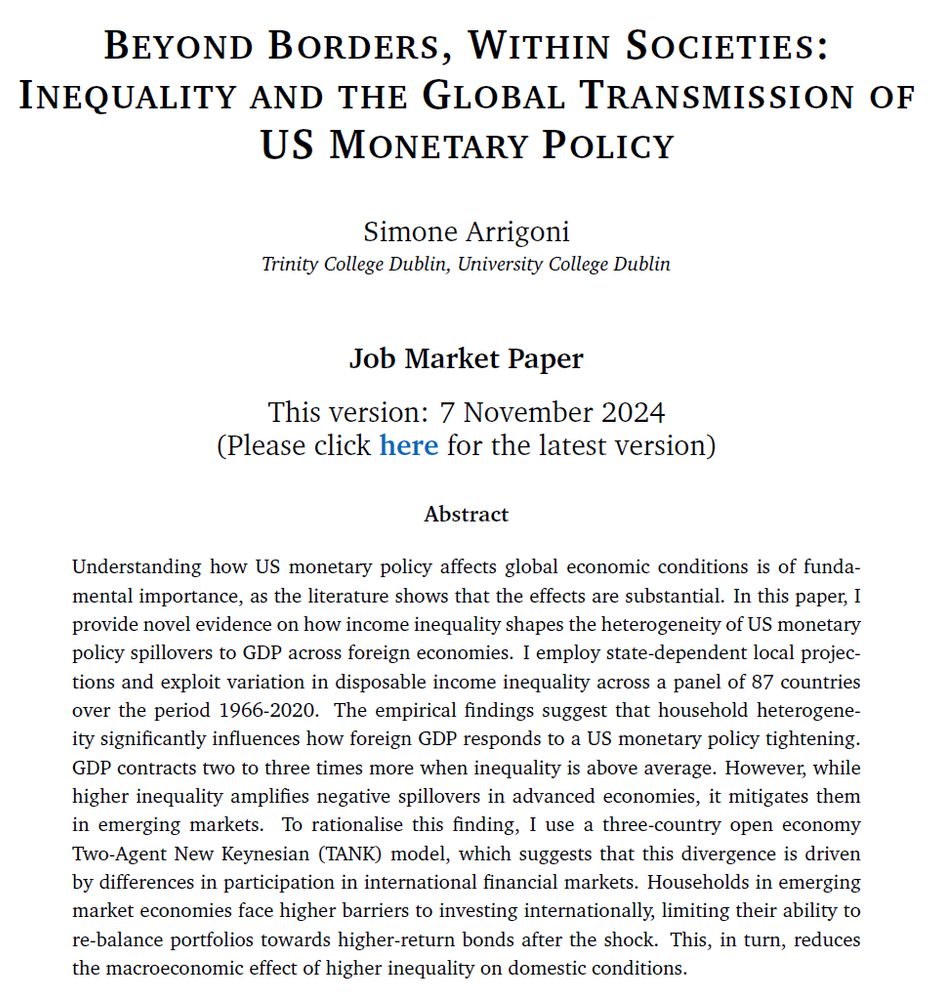

📢I'm on the #EconJobMarket!

My #EconJMP studies how inequality in foreign economies shapes the effects of Fed's tightening on their GDP.

Spoiler: higher ineq = larger (smaller) GDP drop in AEs (EMEs). Mainly via financial channel.

👉 tinyurl.com/4e2y9598

🌐 simone-arrigoni.com

#EconSky

Thread👇1/11

My #EconJMP studies how inequality in foreign economies shapes the effects of Fed's tightening on their GDP.

Spoiler: higher ineq = larger (smaller) GDP drop in AEs (EMEs). Mainly via financial channel.

👉 tinyurl.com/4e2y9598

🌐 simone-arrigoni.com

#EconSky

Thread👇1/11

November 21, 2024 at 8:45 AM

Recently posted about my JMP, Thanks Khoa!

bsky.app/profile/simo...

bsky.app/profile/simo...

People made me notice that if you click on my website link it does not work.

This is because bluesky truncates the https.

Type this full link or you can just use the one in my bio

"https://www.simone-arrigoni.com/home"

This is because bluesky truncates the https.

Type this full link or you can just use the one in my bio

"https://www.simone-arrigoni.com/home"

November 20, 2024 at 10:34 AM

People made me notice that if you click on my website link it does not work.

This is because bluesky truncates the https.

Type this full link or you can just use the one in my bio

"https://www.simone-arrigoni.com/home"

This is because bluesky truncates the https.

Type this full link or you can just use the one in my bio

"https://www.simone-arrigoni.com/home"

🔚 The End! (for now😉)

Huge thanks to my supervisors Agustín Bénétrix & @davideromelli.bsky.social, co-authors, Ph.D. colleagues, and everyone at @tcdeconomics.bsky.social for their invaluable support along the journey!

🌐 More about my research: simone-arrigoni.com

👉 JMP: tinyurl.com/4e2y9598

11/11

Huge thanks to my supervisors Agustín Bénétrix & @davideromelli.bsky.social, co-authors, Ph.D. colleagues, and everyone at @tcdeconomics.bsky.social for their invaluable support along the journey!

🌐 More about my research: simone-arrigoni.com

👉 JMP: tinyurl.com/4e2y9598

11/11

Arrigoni_JobMarketPaper.pdf

Job Market Paper (Simone Arrigoni - Trinity College Dublin)

tinyurl.com

November 20, 2024 at 10:24 AM

🔚 The End! (for now😉)

Huge thanks to my supervisors Agustín Bénétrix & @davideromelli.bsky.social, co-authors, Ph.D. colleagues, and everyone at @tcdeconomics.bsky.social for their invaluable support along the journey!

🌐 More about my research: simone-arrigoni.com

👉 JMP: tinyurl.com/4e2y9598

11/11

Huge thanks to my supervisors Agustín Bénétrix & @davideromelli.bsky.social, co-authors, Ph.D. colleagues, and everyone at @tcdeconomics.bsky.social for their invaluable support along the journey!

🌐 More about my research: simone-arrigoni.com

👉 JMP: tinyurl.com/4e2y9598

11/11

⚖️ High US interest rates in recent years underscore the importance of this study. Recipient countries can use these findings to inform policies that mitigate spillover effects (e.g., redistribution, capital controls).

🔮 Future research: spillovers from other CBs, types of monetary policy.

10/11

🔮 Future research: spillovers from other CBs, types of monetary policy.

10/11

November 20, 2024 at 10:24 AM

⚖️ High US interest rates in recent years underscore the importance of this study. Recipient countries can use these findings to inform policies that mitigate spillover effects (e.g., redistribution, capital controls).

🔮 Future research: spillovers from other CBs, types of monetary policy.

10/11

🔮 Future research: spillovers from other CBs, types of monetary policy.

10/11

Model's bottom line: inequality shapes foreign monetary policy spillovers to GDP mainly via the financial channel.

Do the data support this? Yes.

I study the interaction between inequality and financial openness. Financially closed (open): higher inequality = weaker (stronger) spillovers.

9/11

Do the data support this? Yes.

I study the interaction between inequality and financial openness. Financially closed (open): higher inequality = weaker (stronger) spillovers.

9/11

November 20, 2024 at 10:24 AM

Model's bottom line: inequality shapes foreign monetary policy spillovers to GDP mainly via the financial channel.

Do the data support this? Yes.

I study the interaction between inequality and financial openness. Financially closed (open): higher inequality = weaker (stronger) spillovers.

9/11

Do the data support this? Yes.

I study the interaction between inequality and financial openness. Financially closed (open): higher inequality = weaker (stronger) spillovers.

9/11

Bond mkt access within-country: constrained ×, unconstrained ✓.

But unconstrained HHs differ btwn countries (home bias, fees,...).

I raise foreign bond holding cost for country 3, now representing an EME. This replicates the empirical result for EMEs: higher inequality = weaker spillovers.

8/11

But unconstrained HHs differ btwn countries (home bias, fees,...).

I raise foreign bond holding cost for country 3, now representing an EME. This replicates the empirical result for EMEs: higher inequality = weaker spillovers.

8/11

November 20, 2024 at 10:24 AM

Bond mkt access within-country: constrained ×, unconstrained ✓.

But unconstrained HHs differ btwn countries (home bias, fees,...).

I raise foreign bond holding cost for country 3, now representing an EME. This replicates the empirical result for EMEs: higher inequality = weaker spillovers.

8/11

But unconstrained HHs differ btwn countries (home bias, fees,...).

I raise foreign bond holding cost for country 3, now representing an EME. This replicates the empirical result for EMEs: higher inequality = weaker spillovers.

8/11

In the baseline scenario (classic spillover), US monetary tightening causes a GDP contraction in foreign countries, a stronger dollar, and reduced exports.

As in the empirics, higher inequality (higher proportion of constrained households) amplifies negative spillovers in foreign countries.

7/11

As in the empirics, higher inequality (higher proportion of constrained households) amplifies negative spillovers in foreign countries.

7/11

November 20, 2024 at 10:24 AM

In the baseline scenario (classic spillover), US monetary tightening causes a GDP contraction in foreign countries, a stronger dollar, and reduced exports.

As in the empirics, higher inequality (higher proportion of constrained households) amplifies negative spillovers in foreign countries.

7/11

As in the empirics, higher inequality (higher proportion of constrained households) amplifies negative spillovers in foreign countries.

7/11

Why? 🔍Theoretical framework

Scope: understand what drives the discrepancy of the effects between AEs and EMEs.

Open-economy model of Eichenbaum et al. (2021)

+ household heterogeneity: financially constrained vs unconstrained HHs. Gini generated by income differences between the two HHs.

6/11

Scope: understand what drives the discrepancy of the effects between AEs and EMEs.

Open-economy model of Eichenbaum et al. (2021)

+ household heterogeneity: financially constrained vs unconstrained HHs. Gini generated by income differences between the two HHs.

6/11

November 20, 2024 at 10:24 AM

Why? 🔍Theoretical framework

Scope: understand what drives the discrepancy of the effects between AEs and EMEs.

Open-economy model of Eichenbaum et al. (2021)

+ household heterogeneity: financially constrained vs unconstrained HHs. Gini generated by income differences between the two HHs.

6/11

Scope: understand what drives the discrepancy of the effects between AEs and EMEs.

Open-economy model of Eichenbaum et al. (2021)

+ household heterogeneity: financially constrained vs unconstrained HHs. Gini generated by income differences between the two HHs.

6/11