www.shiftaction.ca

win.newmode.net/shiftaction/...

win.newmode.net/shiftaction/...

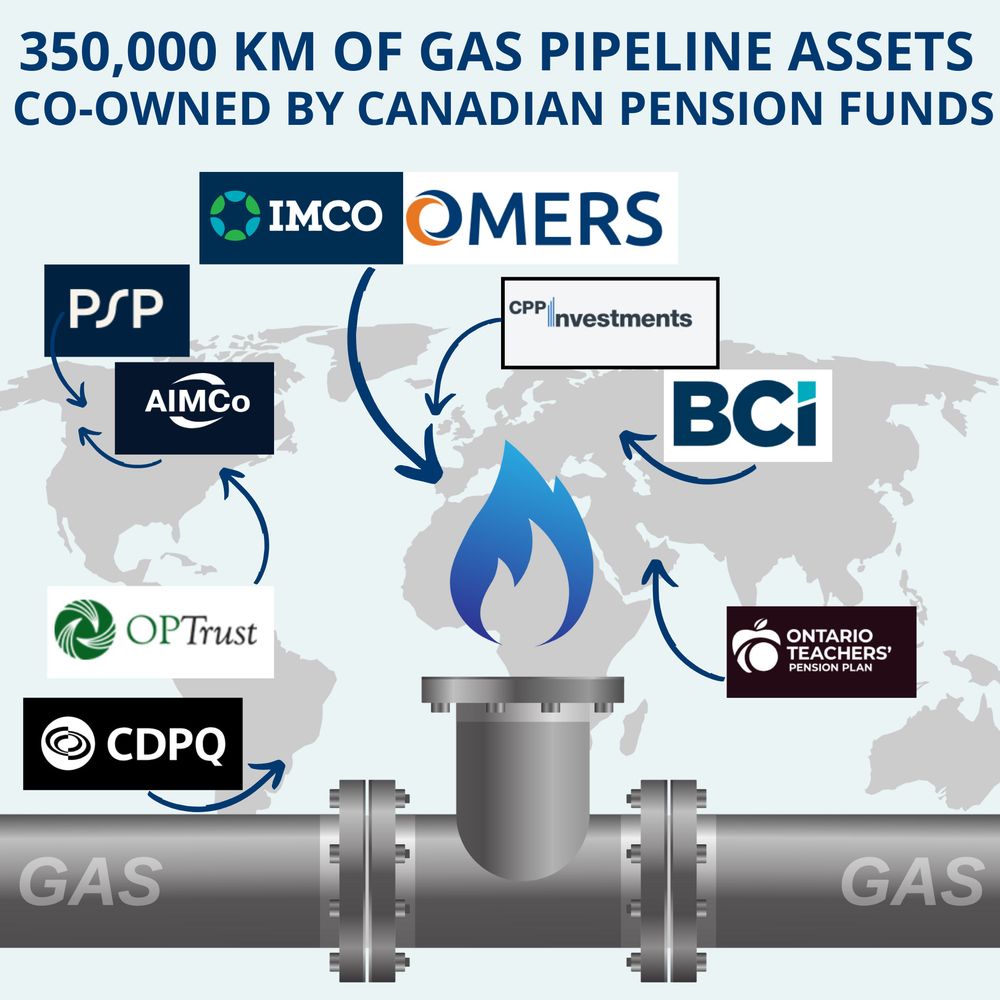

“I can’t help but wonder if these fossil fuel interests influenced CPPIB’s decision to abandon net-zero by 2050 and continue investing billions in oil and gas expansion.”

📉 Conflict or coincidence? Read the report to decide.

“I can’t help but wonder if these fossil fuel interests influenced CPPIB’s decision to abandon net-zero by 2050 and continue investing billions in oil and gas expansion.”

📉 Conflict or coincidence? Read the report to decide.