Rohit Lamba

@rohitlamba.bsky.social

Economist, Himalayan boy, poetry enthusiast, foodie. Amor fati :)

www.rohitlamba.com

www.rohitlamba.com

As we approach the Fall semester, some ancient wisdom on learning...

The student obtains:

one quarter from the teacher,

one quarter by one's own intellect,

one quarter from fellow students,

and one quarter through the passage of time.

The student obtains:

one quarter from the teacher,

one quarter by one's own intellect,

one quarter from fellow students,

and one quarter through the passage of time.

August 23, 2025 at 10:33 PM

As we approach the Fall semester, some ancient wisdom on learning...

The student obtains:

one quarter from the teacher,

one quarter by one's own intellect,

one quarter from fellow students,

and one quarter through the passage of time.

The student obtains:

one quarter from the teacher,

one quarter by one's own intellect,

one quarter from fellow students,

and one quarter through the passage of time.

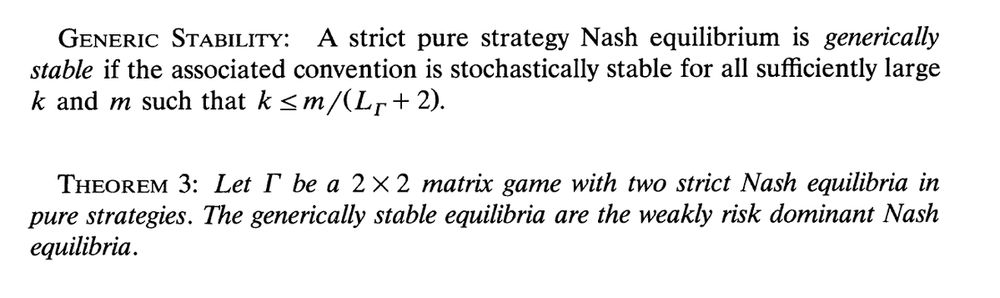

17/ A truly remarkable scholar of the field and whose book you must read is the late William H. Sandholm.

July 29, 2025 at 4:20 AM

17/ A truly remarkable scholar of the field and whose book you must read is the late William H. Sandholm.

16/ Intellectual history: Evolutionary game theory is inspired from biology’s idea of natural selection. John Maynard Smith (w/ G.R. Price) introduced the concept of Evolutionarily Stable Strategy (ESS) in 1973, showing how certain behaviors become stable in animal conflicts.

July 29, 2025 at 4:20 AM

16/ Intellectual history: Evolutionary game theory is inspired from biology’s idea of natural selection. John Maynard Smith (w/ G.R. Price) introduced the concept of Evolutionarily Stable Strategy (ESS) in 1973, showing how certain behaviors become stable in animal conflicts.

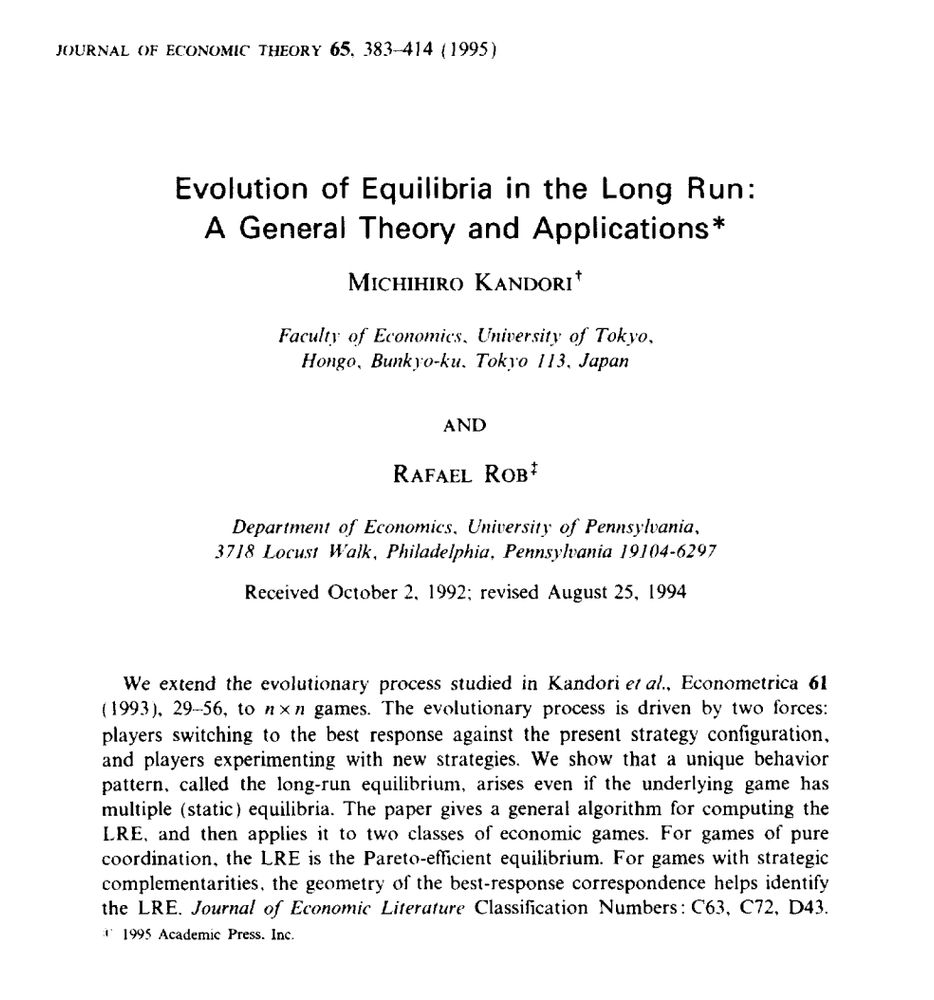

14/ Beyond 2×2 games: Young showed the selected convention need not be the risk-dominant or Pareto-best. Nonetheless, his general algorithm can identify the stochastically stable convention in such cases. And more work has generalized the KMR techniques to general games as well.

July 29, 2025 at 4:20 AM

14/ Beyond 2×2 games: Young showed the selected convention need not be the risk-dominant or Pareto-best. Nonetheless, his general algorithm can identify the stochastically stable convention in such cases. And more work has generalized the KMR techniques to general games as well.

13/ The two papers--- KMR and Young have somewhat different setups, but they both eventually use Markov chain methods and results from perturbation theory (Freidlin–Wentzell).

July 29, 2025 at 4:20 AM

13/ The two papers--- KMR and Young have somewhat different setups, but they both eventually use Markov chain methods and results from perturbation theory (Freidlin–Wentzell).

11/ Young’s result: By analyzing the “graph” of state transitions, he finds a unique stochastically stable equilibrium in many games. In 2×2 coordination games, it coincides with the risk-dominant convention – exactly as in KMR.

July 29, 2025 at 4:20 AM

11/ Young’s result: By analyzing the “graph” of state transitions, he finds a unique stochastically stable equilibrium in many games. In 2×2 coordination games, it coincides with the risk-dominant convention – exactly as in KMR.

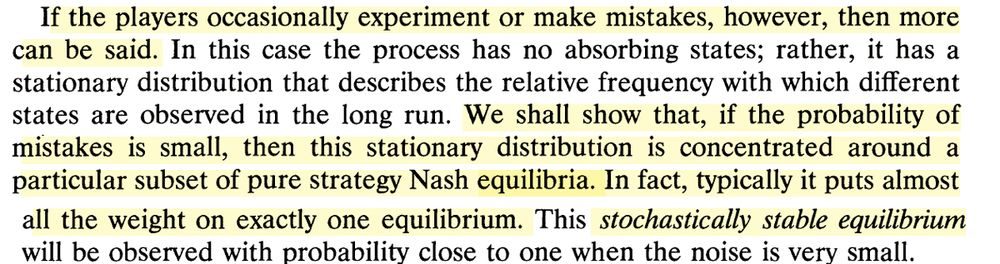

10/ Even under adaptive play, multiple equilibria can persist (each is an absorbing convention if no one deviates). Young adds a small chance that players choose a non-best-response at random. Just as in KMR, these “mistakes” let some conventions prove more enduring than others.

July 29, 2025 at 4:20 AM

10/ Even under adaptive play, multiple equilibria can persist (each is an absorbing convention if no one deviates). Young adds a small chance that players choose a non-best-response at random. Just as in KMR, these “mistakes” let some conventions prove more enduring than others.

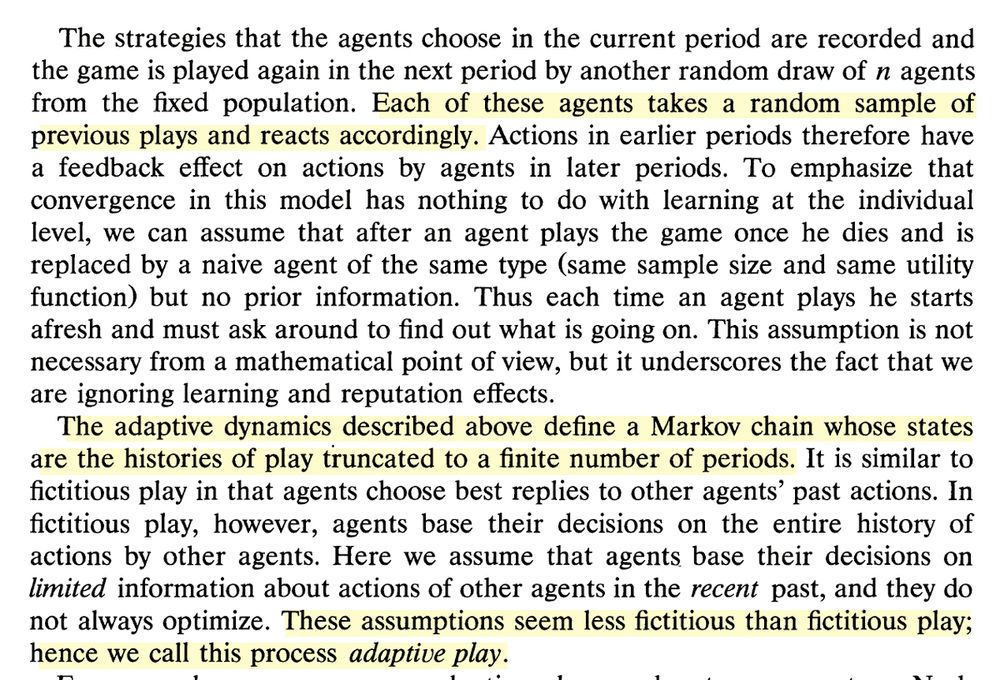

9/ Young introduces a boundedly rational learning rule: adaptive play. Population of players randomly matched to play a game; only remember a small sample of recent rounds; choose a best response to that. This limited memory (different for each player) prevents cyclic behavior.

July 29, 2025 at 4:20 AM

9/ Young introduces a boundedly rational learning rule: adaptive play. Population of players randomly matched to play a game; only remember a small sample of recent rounds; choose a best response to that. This limited memory (different for each player) prevents cyclic behavior.

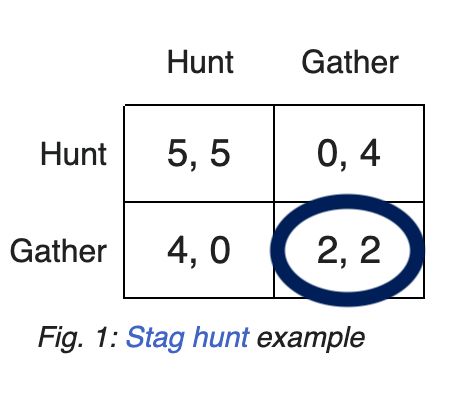

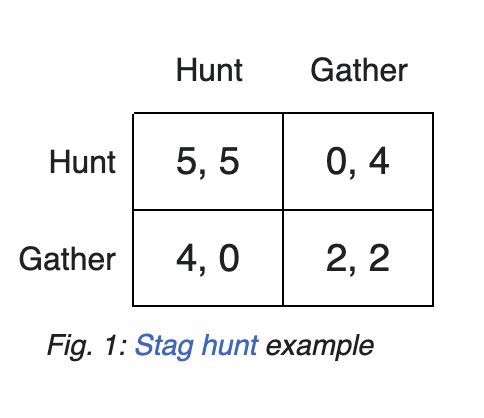

8/ Risk dominance was introduced by Harsayni and Selten (1988): (G,G) here risk dominates (H,H) because the expected payoff from playing G is higher than H when you assume the other player is playing 50-50:

1/2* 4 + 1/2* 2 > 1/2* 5 + 1/2* 0.

So, (G,G) is the SSE.

1/2* 4 + 1/2* 2 > 1/2* 5 + 1/2* 0.

So, (G,G) is the SSE.

July 29, 2025 at 4:20 AM

8/ Risk dominance was introduced by Harsayni and Selten (1988): (G,G) here risk dominates (H,H) because the expected payoff from playing G is higher than H when you assume the other player is playing 50-50:

1/2* 4 + 1/2* 2 > 1/2* 5 + 1/2* 0.

So, (G,G) is the SSE.

1/2* 4 + 1/2* 2 > 1/2* 5 + 1/2* 0.

So, (G,G) is the SSE.

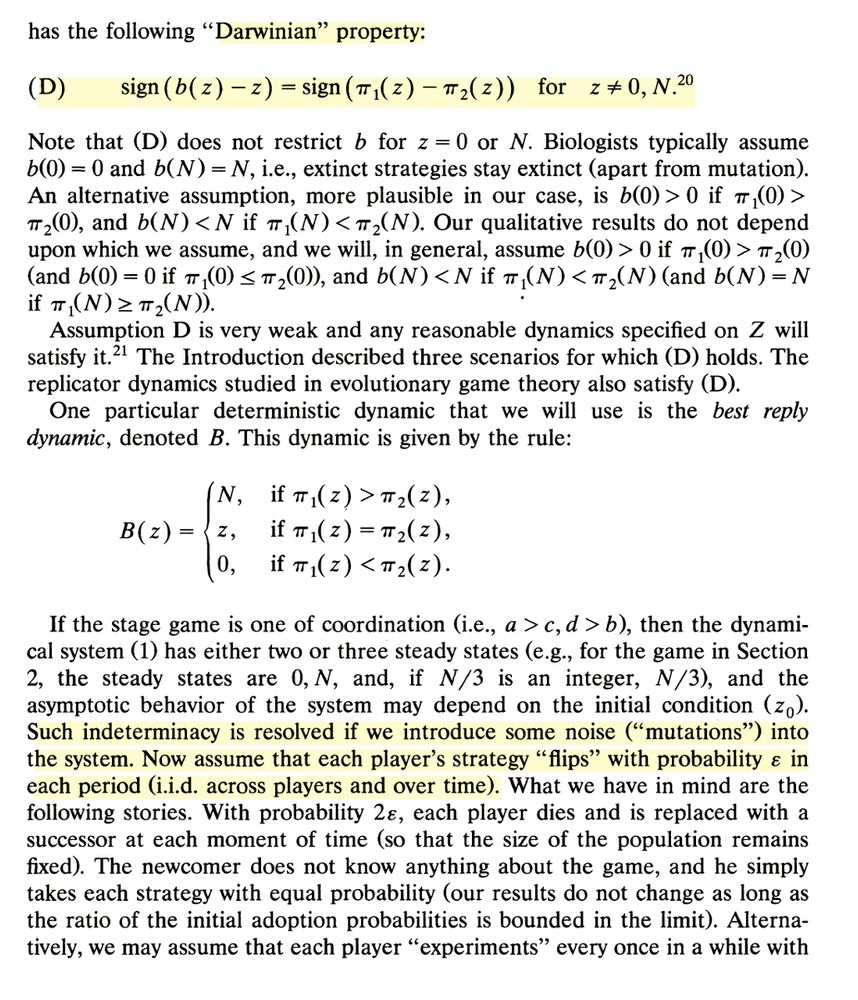

6/ KMR analyze a finite population repeatedly playing a symmetric game. Successful strategies spread (Darwinian) and each player occasionally mutates (chooses a random action) instead of the best response. This ongoing noise “drastically reduces” the set of long-run equilibria.

July 29, 2025 at 4:20 AM

6/ KMR analyze a finite population repeatedly playing a symmetric game. Successful strategies spread (Darwinian) and each player occasionally mutates (chooses a random action) instead of the best response. This ongoing noise “drastically reduces” the set of long-run equilibria.

3/ Consider the Stag Hunt: In this coordination game, two pure Nash equilibria (NE) exist: (Hunt,Hunt) and (Gather,Gather). (Hunt,Hunt) is Pareto-best for both, but (Gather,Gather) is risk-dominant – it’s safer if you’re unsure what the other will do.

July 29, 2025 at 4:20 AM

3/ Consider the Stag Hunt: In this coordination game, two pure Nash equilibria (NE) exist: (Hunt,Hunt) and (Gather,Gather). (Hunt,Hunt) is Pareto-best for both, but (Gather,Gather) is risk-dominant – it’s safer if you’re unsure what the other will do.

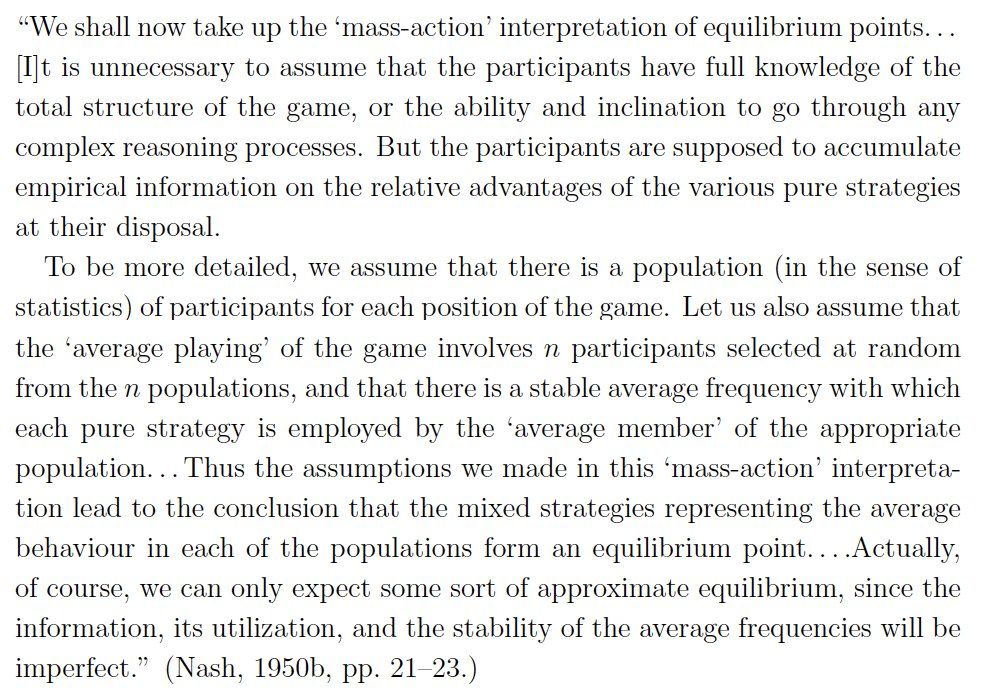

2/ Just when you think you've understood all that Nash brought to game theory, he surprises you. This from his PhD thesis (1950), where he conceptualizes early on, how players could arrive at playing the (well, Nash) equilibrium: a population and an empirical perspective!

July 29, 2025 at 4:20 AM

2/ Just when you think you've understood all that Nash brought to game theory, he surprises you. This from his PhD thesis (1950), where he conceptualizes early on, how players could arrive at playing the (well, Nash) equilibrium: a population and an empirical perspective!

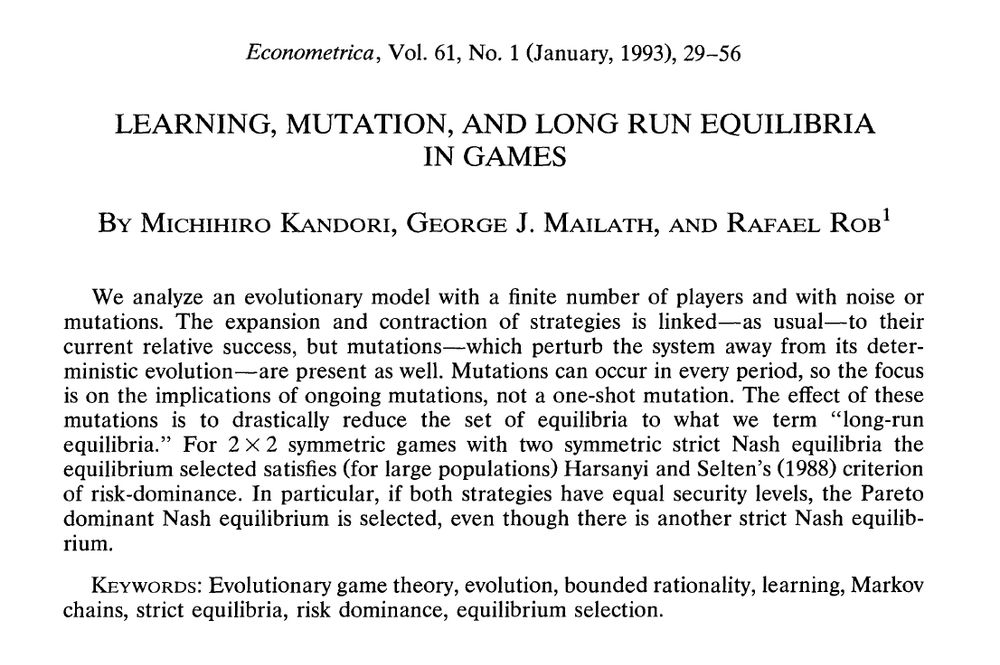

1/ Week 30: The theory paper(s) in focus this week are KMR 93 & Young 93, which provided a remarkably elegant evolutionary perspective to equilibrium selection in games. If games have multiple equilibria, which is more "reasonable", if at all? A deep problem in game theory.

July 29, 2025 at 4:20 AM

1/ Week 30: The theory paper(s) in focus this week are KMR 93 & Young 93, which provided a remarkably elegant evolutionary perspective to equilibrium selection in games. If games have multiple equilibria, which is more "reasonable", if at all? A deep problem in game theory.

The consequences for human welfare involved in questions like these are simply staggering: Once one starts to think about them, it is hard to think about anything else. --- Bob Lucas (1988).

July 20, 2025 at 4:47 AM

The consequences for human welfare involved in questions like these are simply staggering: Once one starts to think about them, it is hard to think about anything else. --- Bob Lucas (1988).

22/ Excellent recent work by Pai-@philippstrack.bsky.social, and Doligalski-Dworczak-Akbarpour- @skominers.bsky.social brings fresh perspectives on the Atkinson-Stiglitz theorem.

July 11, 2025 at 11:25 PM

22/ Excellent recent work by Pai-@philippstrack.bsky.social, and Doligalski-Dworczak-Akbarpour- @skominers.bsky.social brings fresh perspectives on the Atkinson-Stiglitz theorem.

21/ A-S remains a benchmark, but knowing when it fails is key for real-world tax design. These lectures by @s-stantcheva.bsky.social provide a great overview of how relaxing A-S assumptions shows when commodity or capital taxes become warranted. stantcheva.scholars.harvard.edu/sites/g/file...

July 11, 2025 at 11:25 PM

21/ A-S remains a benchmark, but knowing when it fails is key for real-world tax design. These lectures by @s-stantcheva.bsky.social provide a great overview of how relaxing A-S assumptions shows when commodity or capital taxes become warranted. stantcheva.scholars.harvard.edu/sites/g/file...

20/ @josephestiglitz.bsky.social critiques 0-capital-tax view. Notes A-S separability assump is implausible. In more realistic settings (imperfect info, inheritance, etc.), taxing capital can improve equity w/ acceptable efficiency costs.

[Though implementing inheritance taxes well has been hard.]

[Though implementing inheritance taxes well has been hard.]

July 11, 2025 at 11:25 PM

20/ @josephestiglitz.bsky.social critiques 0-capital-tax view. Notes A-S separability assump is implausible. In more realistic settings (imperfect info, inheritance, etc.), taxing capital can improve equity w/ acceptable efficiency costs.

[Though implementing inheritance taxes well has been hard.]

[Though implementing inheritance taxes well has been hard.]

19/ In a lovely paper, @ludwigstraub.bsky.social & @ivanwerning.bsky.social revisit Chamley-Judd & overturn the zero-capital-tax result. If people are not very willing to substitute consumption over time (low intertemporal elasticity), the optimal policy has a positive long-run capital tax!

July 11, 2025 at 11:25 PM

19/ In a lovely paper, @ludwigstraub.bsky.social & @ivanwerning.bsky.social revisit Chamley-Judd & overturn the zero-capital-tax result. If people are not very willing to substitute consumption over time (low intertemporal elasticity), the optimal policy has a positive long-run capital tax!

18/ If inequality has multiple sources, the A-S result can fail. Their model assumed only ability differences. In reality, people also differ in inherited wealth. With such inequality, taxing only labor income may not suffice—some capital taxation can be part of the optimum.

July 11, 2025 at 11:25 PM

18/ If inequality has multiple sources, the A-S result can fail. Their model assumed only ability differences. In reality, people also differ in inherited wealth. With such inequality, taxing only labor income may not suffice—some capital taxation can be part of the optimum.

17/ Another assumption was identical preferences. If people's tastes differ, A-S can fail. For example, if high-ability people spend more on certain luxuries, taxing those goods effectively targets them. Different preferences can thus justify commodity taxes.

July 11, 2025 at 11:25 PM

17/ Another assumption was identical preferences. If people's tastes differ, A-S can fail. For example, if high-ability people spend more on certain luxuries, taxing those goods effectively targets them. Different preferences can thus justify commodity taxes.

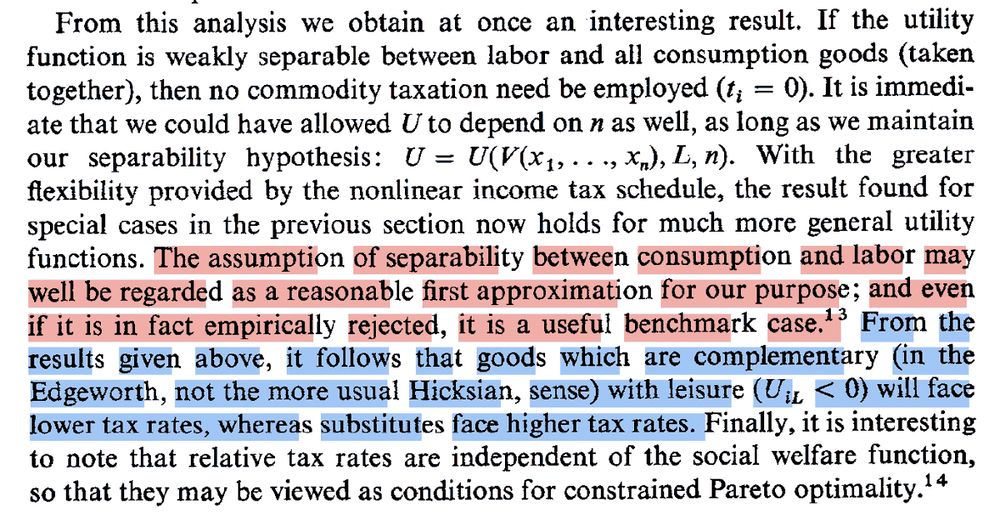

16/ If separability fails, the optimal tax mix changes. For example, if a certain good is consumed mostly during leisure, taxing it effectively taxes leisure (which otherwise escapes taxation). In such cases, differential commodity taxes can improve outcomes.

July 11, 2025 at 11:25 PM

16/ If separability fails, the optimal tax mix changes. For example, if a certain good is consumed mostly during leisure, taxing it effectively taxes leisure (which otherwise escapes taxation). In such cases, differential commodity taxes can improve outcomes.

12/ In a macro image, Chamley-Judd (1986/85) found that optimal long-run tax on capital is zero! In A-S terms, a capital tax is a tax on future consumption. If consuming tomorrow is "like" consuming today in utility, then there's no gain to taxing future consumption.

July 11, 2025 at 11:25 PM

12/ In a macro image, Chamley-Judd (1986/85) found that optimal long-run tax on capital is zero! In A-S terms, a capital tax is a tax on future consumption. If consuming tomorrow is "like" consuming today in utility, then there's no gain to taxing future consumption.

11/ We are considering the "direct planner's problem". One could plausibly think that in the "indirect" world of prices, redistribution can be achieved by differential pricing? Since ability is unobservable, deadweight loss from doing this would outweigh the benefits.

July 11, 2025 at 11:25 PM

11/ We are considering the "direct planner's problem". One could plausibly think that in the "indirect" world of prices, redistribution can be achieved by differential pricing? Since ability is unobservable, deadweight loss from doing this would outweigh the benefits.

9/ Why consider taxing specific goods? Because of screening. In the model, government can't observe ability—only earnings or spending. A high-ability person might try to act low-income to pay less tax. Taxing certain goods that high-skill folks favor could help separate types.

July 11, 2025 at 11:25 PM

9/ Why consider taxing specific goods? Because of screening. In the model, government can't observe ability—only earnings or spending. A high-ability person might try to act low-income to pay less tax. Taxing certain goods that high-skill folks favor could help separate types.

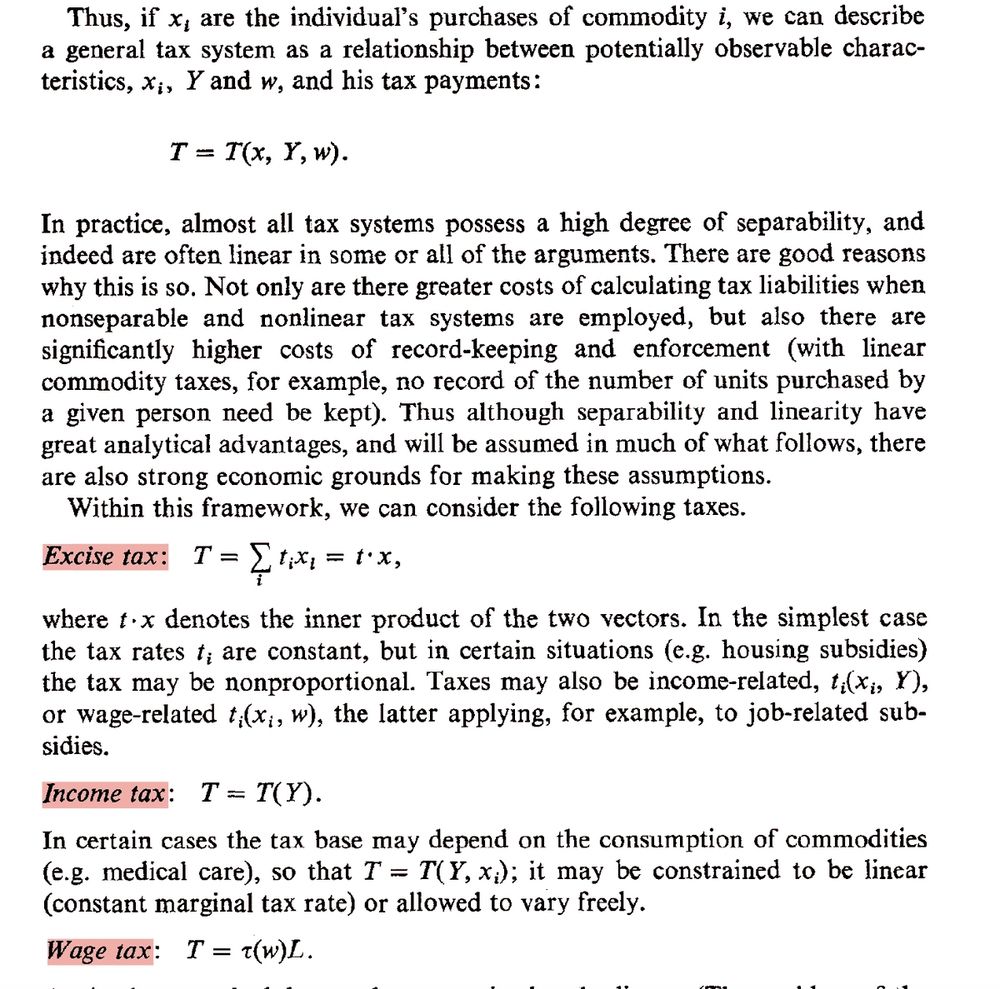

8/ In full generality, the planner can tax the purchase of commodities, and it can also tax income and wages. And boom, A-S say to solve this problem you can only tax income, that is sufficient to achieve the redistributive objective.

July 11, 2025 at 11:25 PM

8/ In full generality, the planner can tax the purchase of commodities, and it can also tax income and wages. And boom, A-S say to solve this problem you can only tax income, that is sufficient to achieve the redistributive objective.