Luca Riva

@rivluc.bsky.social

Ph.D. Economist at the Central Bank of Ireland (Research) • Adjunct Lecturer at University College Dublin • Bocconi, Brown University • Macroeconomics, Financial Stability • Views are my own

Webpage: https://lucariva.net

Webpage: https://lucariva.net

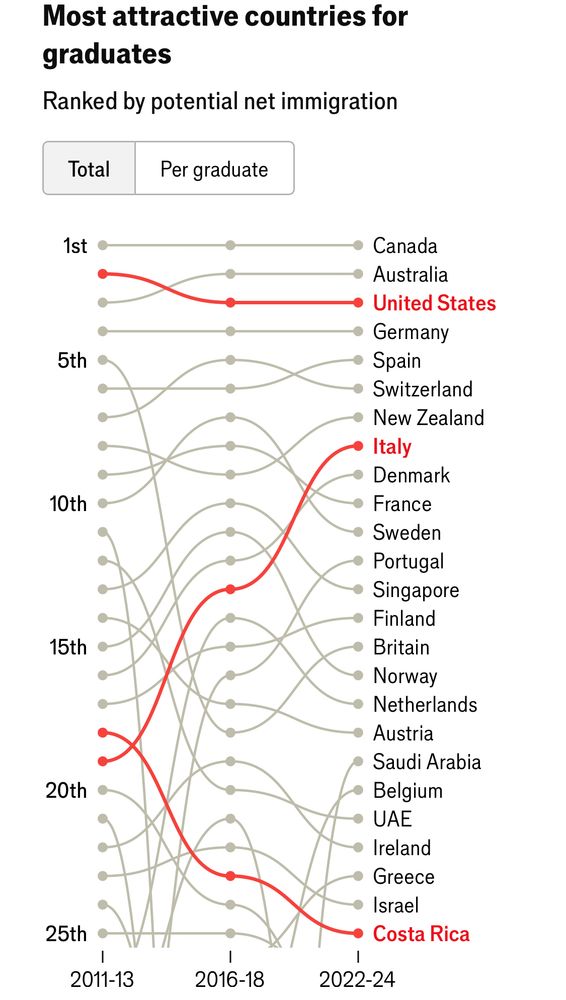

Students and graduates seem willing to come economist.com/graphic-deta...

April 15, 2025 at 8:42 PM

Students and graduates seem willing to come economist.com/graphic-deta...

1928 SF-style streetcars still going strong in Milan, Italy

April 1, 2025 at 1:38 PM

1928 SF-style streetcars still going strong in Milan, Italy

A big round of applause to the presenters, discussants, and participants who made our research gathering truly exceptional. Stay tuned for the call for papers coming late spring next year—see you in 2025! 13/13 #EconSky

December 13, 2024 at 4:51 PM

A big round of applause to the presenters, discussants, and participants who made our research gathering truly exceptional. Stay tuned for the call for papers coming late spring next year—see you in 2025! 13/13 #EconSky

We conclude our workshop with a fireside chat with John Fell (ECB) on “a research agenda for financial stability policy” 12/13

December 13, 2024 at 4:51 PM

We conclude our workshop with a fireside chat with John Fell (ECB) on “a research agenda for financial stability policy” 12/13

The second paper in the “Banks’ foreign homes”, presented by @ltonzer.bsky.social, Magdeburg University (discussant: Jin Cao, Norges Bank) 11/13

December 13, 2024 at 4:51 PM

The second paper in the “Banks’ foreign homes”, presented by @ltonzer.bsky.social, Magdeburg University (discussant: Jin Cao, Norges Bank) 11/13

Session 4 focusses on banking. “Climate stress tests, bank lending, and the transition to the carbon-neutral economy” is presented by Klaus Schaeck, Bristol (discussant: Alessandro Scopelliti, KU Leuven) 10/13

December 13, 2024 at 4:51 PM

Session 4 focusses on banking. “Climate stress tests, bank lending, and the transition to the carbon-neutral economy” is presented by Klaus Schaeck, Bristol (discussant: Alessandro Scopelliti, KU Leuven) 10/13

We continue with “A lending network under stress: a structural analysis of the Money Market Funds industry”, by Paula Beltran, IMF (discussant: Oana Peia, UCD) 9/13

December 13, 2024 at 4:51 PM

We continue with “A lending network under stress: a structural analysis of the Money Market Funds industry”, by Paula Beltran, IMF (discussant: Oana Peia, UCD) 9/13

We resume on Day 2 with a new session on financial markets. The first presentation is “The effect of primary dealer constraints on intermediation in the Treasury

market”, presented by Hillary Stein, Boston Fed (discussant: Rhys Bidder, King’s College) 8/13

market”, presented by Hillary Stein, Boston Fed (discussant: Rhys Bidder, King’s College) 8/13

December 13, 2024 at 4:51 PM

We resume on Day 2 with a new session on financial markets. The first presentation is “The effect of primary dealer constraints on intermediation in the Treasury

market”, presented by Hillary Stein, Boston Fed (discussant: Rhys Bidder, King’s College) 8/13

market”, presented by Hillary Stein, Boston Fed (discussant: Rhys Bidder, King’s College) 8/13

We conclude the day with “Investment funds and euro disaster risk”, presented by Georgios Georgiadis, ECB (discussant: Roman Goncharenko, CBI) 7/13

December 13, 2024 at 4:48 PM

We conclude the day with “Investment funds and euro disaster risk”, presented by Georgios Georgiadis, ECB (discussant: Roman Goncharenko, CBI) 7/13

We now transition to Session 2 on financial intermediation. The first paper is “Institutional investors and house prices”, presented by @emilbandoni.bsky.social, CBI (discussant: Rhiannon Sowerbutts, BOE) 6/13

December 13, 2024 at 4:48 PM

We now transition to Session 2 on financial intermediation. The first paper is “Institutional investors and house prices”, presented by @emilbandoni.bsky.social, CBI (discussant: Rhiannon Sowerbutts, BOE) 6/13

We conclude the session with “Corporate Debt Maturity and Business Cycle Fluctuations”, presented by Francesco Ferrante, from the Federal Reserve Board (discussant: Paul Scanlon, Trinity College) 5/13

December 13, 2024 at 4:47 PM

We conclude the session with “Corporate Debt Maturity and Business Cycle Fluctuations”, presented by Francesco Ferrante, from the Federal Reserve Board (discussant: Paul Scanlon, Trinity College) 5/13

We then move to “The shadow banking sector trade-off. Lower state-dependence vs. amplification of the transmission channel of monetary policy”, presented by Chiara Punzo , BOE (discussant: Elizaveta Lukmanova, CBI) 4/13

December 13, 2024 at 4:47 PM

We then move to “The shadow banking sector trade-off. Lower state-dependence vs. amplification of the transmission channel of monetary policy”, presented by Chiara Punzo , BOE (discussant: Elizaveta Lukmanova, CBI) 4/13

Session 1 focusses on macroprudential policy. The first paper is “The positive neutral countercyclical capital buffer”, presented by Manuel Muñoz, Spanish Treasury (discussant: @aldasoro.bsky.social, BIS) 3/13

December 13, 2024 at 4:46 PM

Session 1 focusses on macroprudential policy. The first paper is “The positive neutral countercyclical capital buffer”, presented by Manuel Muñoz, Spanish Treasury (discussant: @aldasoro.bsky.social, BIS) 3/13

We start Day 1 with a welcome address by Vasileios Madouros, Deputy Governor for Monetary and Financial Stability 2/13

December 13, 2024 at 4:46 PM

We start Day 1 with a welcome address by Vasileios Madouros, Deputy Governor for Monetary and Financial Stability 2/13

I have compiled a very imperfect preliminary list of monetary/macro people I’ve found so far on this site.

If you are active in the field, feel free to DM and I’ll add you! go.bsky.app/DS8T3ug

If you are active in the field, feel free to DM and I’ll add you! go.bsky.app/DS8T3ug

November 17, 2024 at 7:36 PM

I have compiled a very imperfect preliminary list of monetary/macro people I’ve found so far on this site.

If you are active in the field, feel free to DM and I’ll add you! go.bsky.app/DS8T3ug

If you are active in the field, feel free to DM and I’ll add you! go.bsky.app/DS8T3ug

Very cool paper by Barnichon and Mesters presented today at the @ecb Fiscal Policy Conference. Accounting for constraints to macro-stabilisation, Italian fiscal discipline is actually quite high post 1998!

Paper:...

Paper:...

November 24, 2024 at 12:48 PM

Very cool paper by Barnichon and Mesters presented today at the @ecb Fiscal Policy Conference. Accounting for constraints to macro-stabilisation, Italian fiscal discipline is actually quite high post 1998!

Paper:...

Paper:...

And that's a wrap! Infinite thanks to all presenters, discussant, participants and fellow organisers @centralbank_ie for making this happen. And if you made it to the end, take a look at these amazing papers, you'll learn a ton on all things #financialstability. 19/19

November 24, 2024 at 3:54 PM

And that's a wrap! Infinite thanks to all presenters, discussant, participants and fellow organisers @centralbank_ie for making this happen. And if you made it to the end, take a look at these amazing papers, you'll learn a ton on all things #financialstability. 19/19

And finally we close our conference with "The housing supply channel of monetary policy", presented by Bruno Albuquerque (discussant: @kat_bergant) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4543733 18/

November 24, 2024 at 3:47 PM

And finally we close our conference with "The housing supply channel of monetary policy", presented by Bruno Albuquerque (discussant: @kat_bergant) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4543733 18/

And last but not least Session 5 on housing (chair: Mark Cassidy) starts with "Housing markets and the heterogeneous effects of monetary policy across the euro area" presented by @pica_ste (discussant: @daraghsclancy) https://www.stefanopica.com/publication/heterogmp 17/

November 24, 2024 at 3:39 PM

And last but not least Session 5 on housing (chair: Mark Cassidy) starts with "Housing markets and the heterogeneous effects of monetary policy across the euro area" presented by @pica_ste (discussant: @daraghsclancy) https://www.stefanopica.com/publication/heterogmp 17/

We conclude with "How to release capital requirements in an economic downturn? Evidence from Euro Area Credit Register", presented by Alessandro Scopelliti (discussant: Michele Pelli) https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2720~e6f3686548.en.pdf 16/

November 24, 2024 at 3:32 PM

We conclude with "How to release capital requirements in an economic downturn? Evidence from Euro Area Credit Register", presented by Alessandro Scopelliti (discussant: Michele Pelli) https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2720~e6f3686548.en.pdf 16/

We now move to two mini-sessions. Session 4 addresses macro-prudential policies (chair: @PeiaOana). The first paper is "The state-dependent impact of changes in bank capital requirements", presented by @DominikMenno (discussant: @WhelanKarl)...

November 24, 2024 at 3:17 PM

We now move to two mini-sessions. Session 4 addresses macro-prudential policies (chair: @PeiaOana). The first paper is "The state-dependent impact of changes in bank capital requirements", presented by @DominikMenno (discussant: @WhelanKarl)...

Finally, we close the session with "Effects of bank capital requirements on lending by banks and non-bank financial institutions", presented by @Agn_ssa (discussant: Yassine Bakkar)...

November 24, 2024 at 3:02 PM

Finally, we close the session with "Effects of bank capital requirements on lending by banks and non-bank financial institutions", presented by @Agn_ssa (discussant: Yassine Bakkar)...

We continue with "Non-bank lending during crises", presented by @i_aldasoro (discussant: @danielkdimitrov) https://www.bis.org/publ/work1074.htm

November 24, 2024 at 2:55 PM

We continue with "Non-bank lending during crises", presented by @i_aldasoro (discussant: @danielkdimitrov) https://www.bis.org/publ/work1074.htm

Next is "Macroprudential regulation of investment funds", presented by @FWicknig (discussant: @DavideRomelli) https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2695~22731e2f05.en.pdf

November 24, 2024 at 2:48 PM

Next is "Macroprudential regulation of investment funds", presented by @FWicknig (discussant: @DavideRomelli) https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2695~22731e2f05.en.pdf