Rashad Ahmed

@rashad-ahmed.bsky.social

Economist at the Andersen Institute | global macro | stablecoins | views are my own

https://sites.google.com/view/rashad-ahmed

https://sites.google.com/view/rashad-ahmed

Reposted by Rashad Ahmed

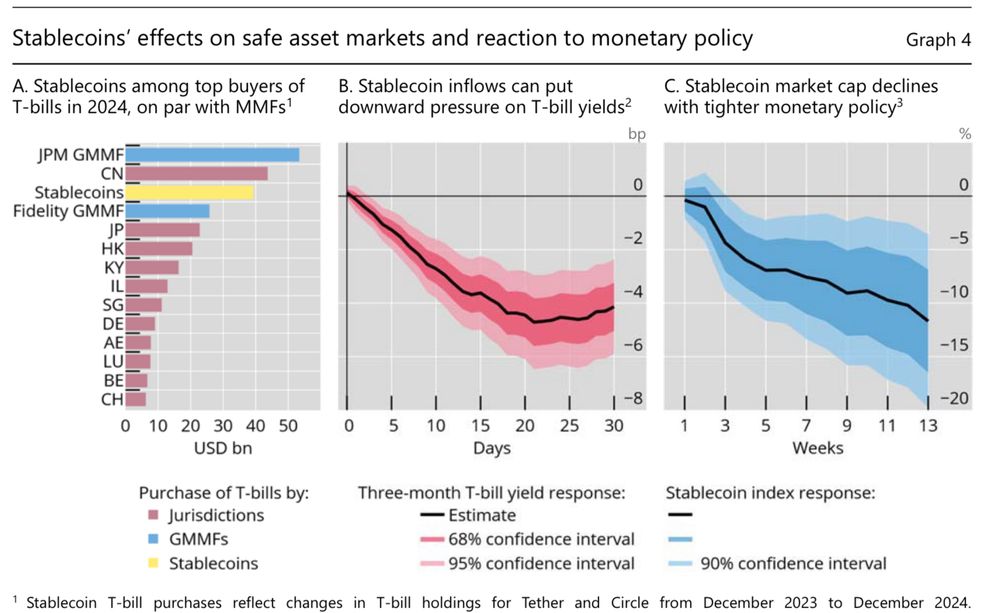

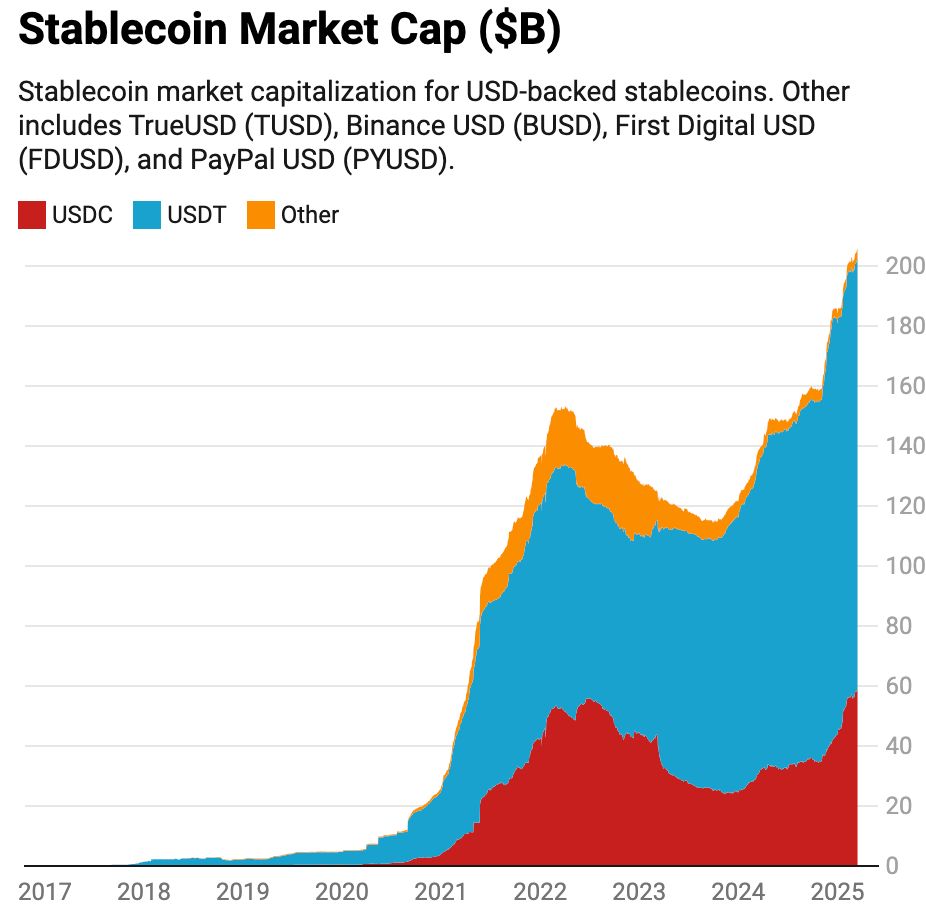

Stablecoins are already meaningful players in the Treasury market, as we show in more detail in a recent paper with @rashad-ahmed.bsky.social

www.bis.org/publ/work127...

www.bis.org/publ/work127...

July 11, 2025 at 11:11 AM

Stablecoins are already meaningful players in the Treasury market, as we show in more detail in a recent paper with @rashad-ahmed.bsky.social

www.bis.org/publ/work127...

www.bis.org/publ/work127...

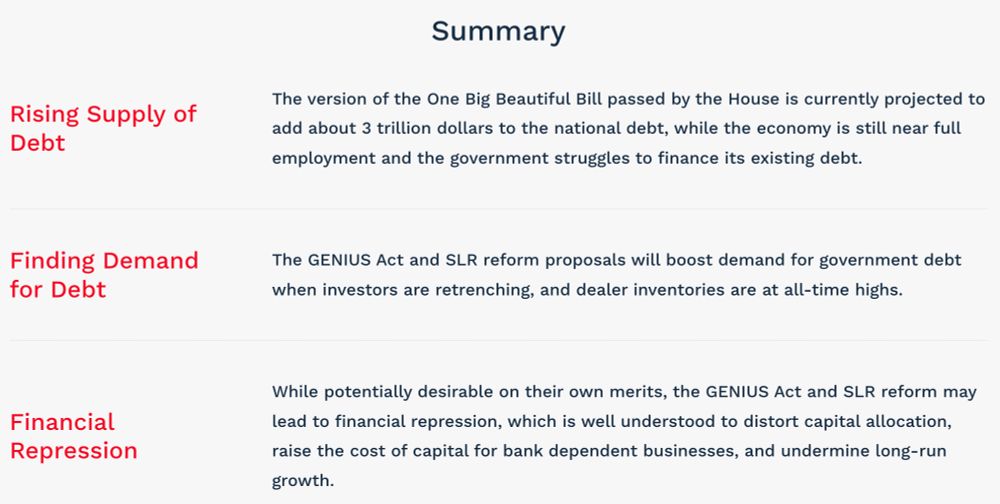

New @anderseninstitute.bsky.social Note: "When financial regulation becomes financial repression" (link below)

We take a macro view on the interactions between:

(i) high and rising debt

(ii) OBBB expansionary spending

(iii) GENIUS Act stablecoin legislation

(iv) SLR bank capital reform

We take a macro view on the interactions between:

(i) high and rising debt

(ii) OBBB expansionary spending

(iii) GENIUS Act stablecoin legislation

(iv) SLR bank capital reform

July 2, 2025 at 12:48 PM

New @anderseninstitute.bsky.social Note: "When financial regulation becomes financial repression" (link below)

We take a macro view on the interactions between:

(i) high and rising debt

(ii) OBBB expansionary spending

(iii) GENIUS Act stablecoin legislation

(iv) SLR bank capital reform

We take a macro view on the interactions between:

(i) high and rising debt

(ii) OBBB expansionary spending

(iii) GENIUS Act stablecoin legislation

(iv) SLR bank capital reform

Reposted by Rashad Ahmed

Nice Big Read by @staffordphilip.bsky.social on stablecoins, featuring our paper with @rashad-ahmed.bsky.social on the impact of SCs on the Treasury market

on.ft.com/3ZvMDw5

on.ft.com/3ZvMDw5

How stablecoins are entering the financial mainstream

Usage of the digital assets is growing rapidly, but concerns remain about supervision and their impact on other parts of the financial system

on.ft.com

June 12, 2025 at 5:33 PM

Nice Big Read by @staffordphilip.bsky.social on stablecoins, featuring our paper with @rashad-ahmed.bsky.social on the impact of SCs on the Treasury market

on.ft.com/3ZvMDw5

on.ft.com/3ZvMDw5

Reposted by Rashad Ahmed

Great Long Read by @katie0martin.ft.com featuring our recent paper with @rashad-ahmed.bsky.social

Why we should worry about the rise of stablecoins | Opinion

https://www.ft.com/content/e5701ff2-d976-451f-9ca2-68cd5f833c1a

https://www.ft.com/content/e5701ff2-d976-451f-9ca2-68cd5f833c1a

Why we should worry about the rise of stablecoins | Opinion

Asset-backed digital currencies could pose risks to bedrock of global financial system

www.ft.com

June 6, 2025 at 7:48 PM

Great Long Read by @katie0martin.ft.com featuring our recent paper with @rashad-ahmed.bsky.social

Reposted by Rashad Ahmed

Aaaand new paper is out!

“Stablecoins and safe asset prices” with the awesome @rashad-ahmed.bsky.social

Quantifying the effects pf stablecoin flows on Tsy yields with instrumented linear projections, documenting asymmetric effects of inflows vs outflows

www.bis.org/publ/work127...

“Stablecoins and safe asset prices” with the awesome @rashad-ahmed.bsky.social

Quantifying the effects pf stablecoin flows on Tsy yields with instrumented linear projections, documenting asymmetric effects of inflows vs outflows

www.bis.org/publ/work127...

May 28, 2025 at 12:10 PM

Aaaand new paper is out!

“Stablecoins and safe asset prices” with the awesome @rashad-ahmed.bsky.social

Quantifying the effects pf stablecoin flows on Tsy yields with instrumented linear projections, documenting asymmetric effects of inflows vs outflows

www.bis.org/publ/work127...

“Stablecoins and safe asset prices” with the awesome @rashad-ahmed.bsky.social

Quantifying the effects pf stablecoin flows on Tsy yields with instrumented linear projections, documenting asymmetric effects of inflows vs outflows

www.bis.org/publ/work127...

Reposted by Rashad Ahmed

Join us at the 2025 Johns Hopkins Geoeconomics Conference Keynote Presentation and Panel Discussion

🗓️ Friday, May 2 | 2:00–7:00 PM

📍 Hopkins Bloomberg Center, Washington, DC

🔗 Register here: lnkd.in/eEzhX_PQ.

The conference Website is here: lnkd.in/eGbz-s_j

#Geoeconomics #JohnsHopkins

🗓️ Friday, May 2 | 2:00–7:00 PM

📍 Hopkins Bloomberg Center, Washington, DC

🔗 Register here: lnkd.in/eEzhX_PQ.

The conference Website is here: lnkd.in/eGbz-s_j

#Geoeconomics #JohnsHopkins

LinkedIn

This link will take you to a page that’s not on LinkedIn

lnkd.in

April 16, 2025 at 5:49 PM

Join us at the 2025 Johns Hopkins Geoeconomics Conference Keynote Presentation and Panel Discussion

🗓️ Friday, May 2 | 2:00–7:00 PM

📍 Hopkins Bloomberg Center, Washington, DC

🔗 Register here: lnkd.in/eEzhX_PQ.

The conference Website is here: lnkd.in/eGbz-s_j

#Geoeconomics #JohnsHopkins

🗓️ Friday, May 2 | 2:00–7:00 PM

📍 Hopkins Bloomberg Center, Washington, DC

🔗 Register here: lnkd.in/eEzhX_PQ.

The conference Website is here: lnkd.in/eGbz-s_j

#Geoeconomics #JohnsHopkins

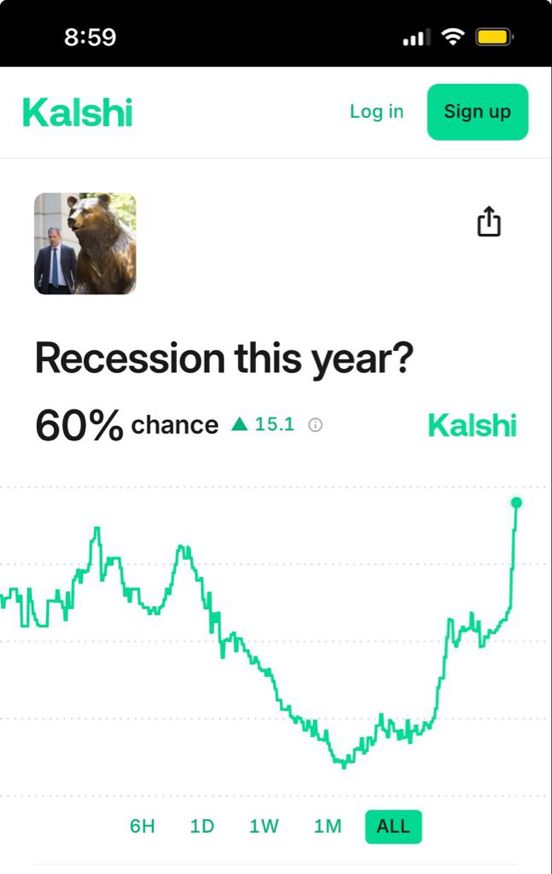

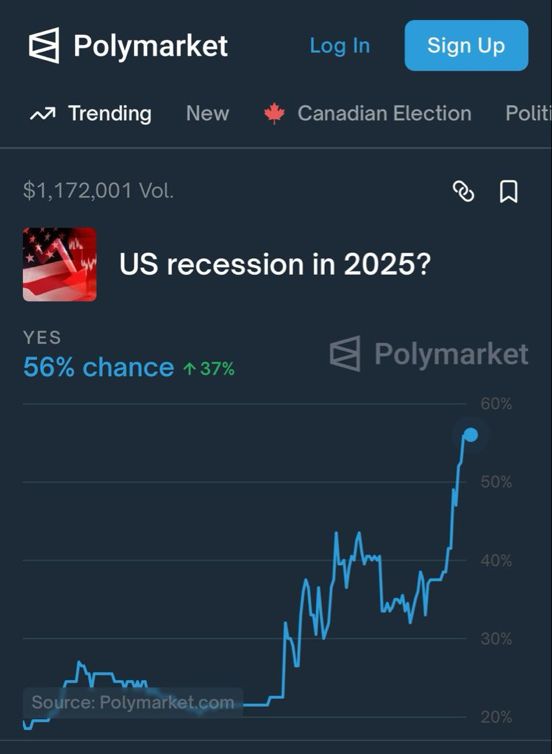

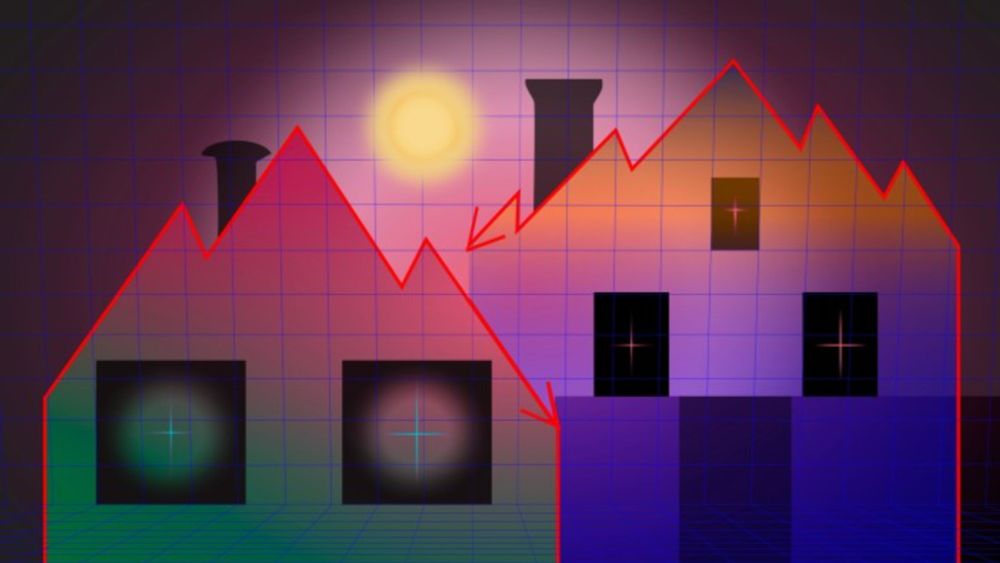

The idea that these tarriffs will be recessionary is consistent with cross asset market moves and even more directly, rising recession odds in prediction markets

equities (-)

mid/long rates (-)

STIR fwds (-)

inflation fwds beyond 1-year (-)

crude oil (-)

equities (-)

mid/long rates (-)

STIR fwds (-)

inflation fwds beyond 1-year (-)

crude oil (-)

April 4, 2025 at 1:28 PM

The idea that these tarriffs will be recessionary is consistent with cross asset market moves and even more directly, rising recession odds in prediction markets

equities (-)

mid/long rates (-)

STIR fwds (-)

inflation fwds beyond 1-year (-)

crude oil (-)

equities (-)

mid/long rates (-)

STIR fwds (-)

inflation fwds beyond 1-year (-)

crude oil (-)

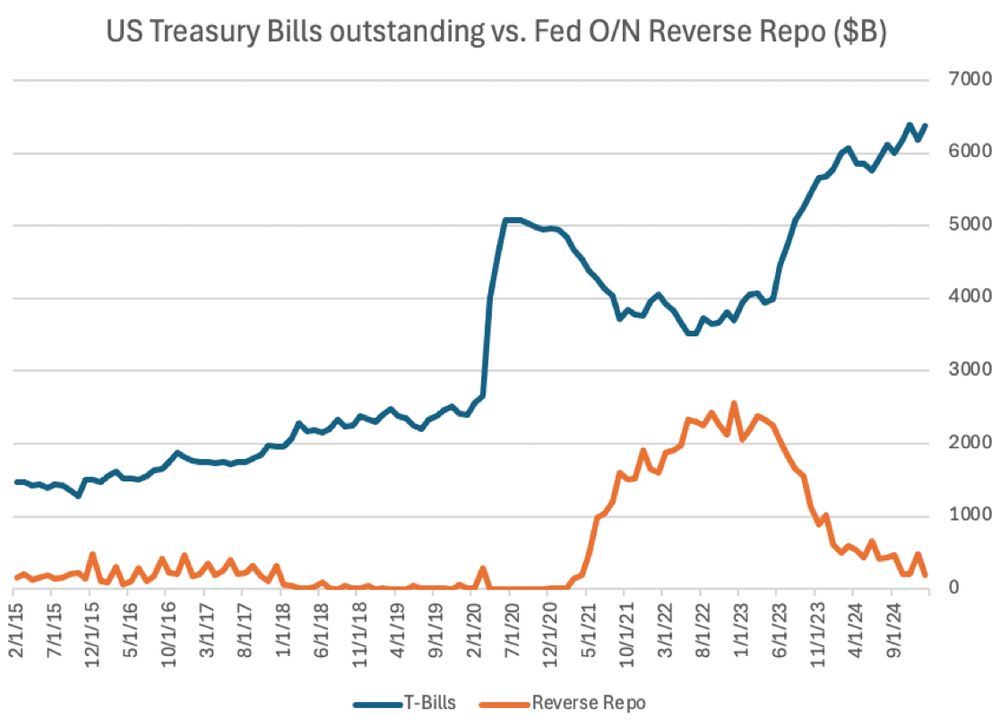

Turns out that RRP drainage was highly responsive to T-bill supply

February 12, 2025 at 5:42 PM

Turns out that RRP drainage was highly responsive to T-bill supply

Reposted by Rashad Ahmed

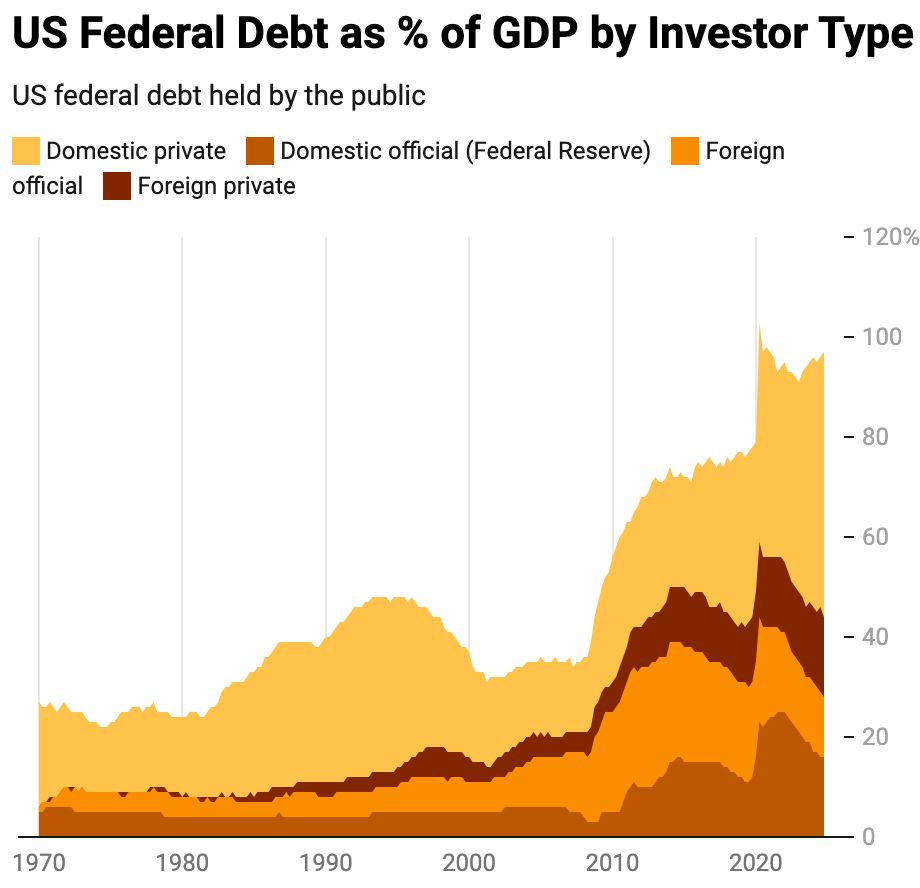

@katie0martin.ft.com notes that the US Treasury market reflects the inconsistencies in the administration's policy goals

www.ft.com/content/5d69...

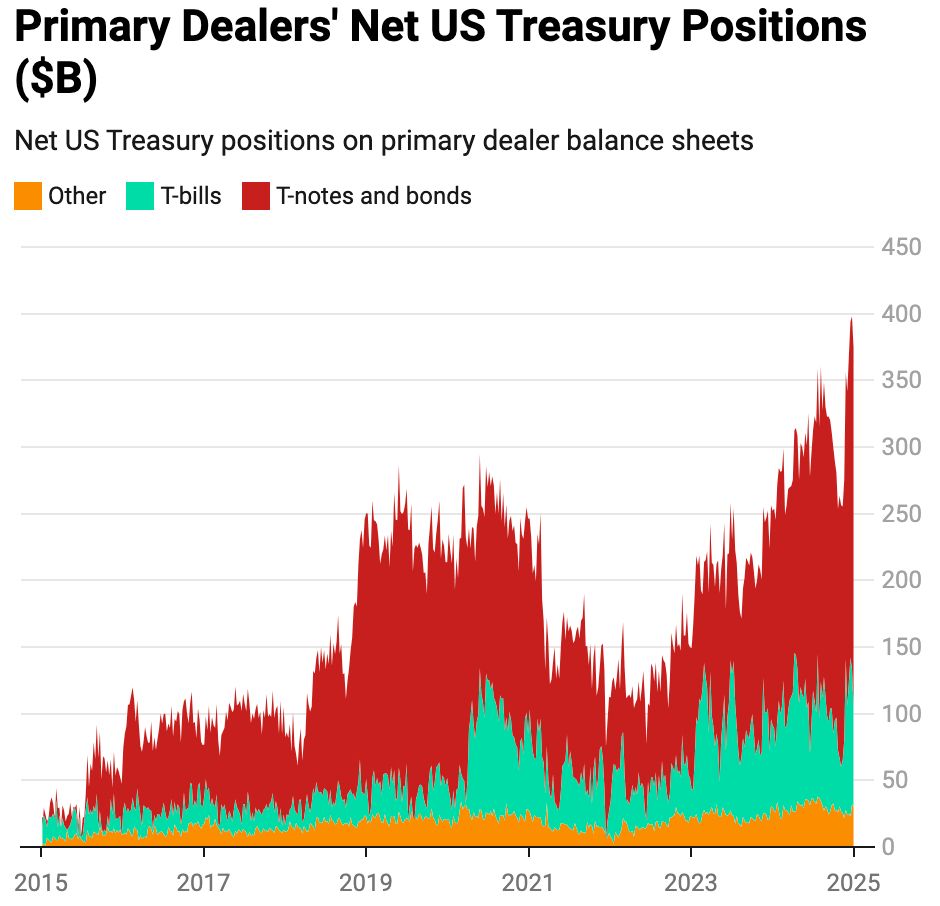

@rashad-ahmed.bsky.social and I find that dealers' constraints are a geopolitical vulnerability

cepr.org/voxeu/column...

#Econsky #AcademicSky

www.ft.com/content/5d69...

@rashad-ahmed.bsky.social and I find that dealers' constraints are a geopolitical vulnerability

cepr.org/voxeu/column...

#Econsky #AcademicSky

Trump should not take bond investors for granted

It needs only a small reduction in the dollar slice of global reserves to hit prices and raise borrowing costs

www.ft.com

February 9, 2025 at 9:57 PM

@katie0martin.ft.com notes that the US Treasury market reflects the inconsistencies in the administration's policy goals

www.ft.com/content/5d69...

@rashad-ahmed.bsky.social and I find that dealers' constraints are a geopolitical vulnerability

cepr.org/voxeu/column...

#Econsky #AcademicSky

www.ft.com/content/5d69...

@rashad-ahmed.bsky.social and I find that dealers' constraints are a geopolitical vulnerability

cepr.org/voxeu/column...

#Econsky #AcademicSky

What was meant as a quick n dirty weekend analysis by @arebucci.bsky.social and I.. now catching the attn of @reuters.com and @financialtimes.com. Grateful to see interest in our work

Our piece: cepr.org/voxeu/column...

FT: on.ft.com/3QaAVCc

Reuters: www.reuters.com/markets/rate...

Our piece: cepr.org/voxeu/column...

FT: on.ft.com/3QaAVCc

Reuters: www.reuters.com/markets/rate...

A ‘reverse conundrum’ and foreign official demand for US Treasuries

Reminiscent of the ‘Greenspan conundrum’, since 18 September 2024 the Federal Reserve has cut short-term interest rates by 100 basis points, while 10-year interest rates have risen by 100 basis points, defying conventional expectations. This column argues that this ‘reverse conundrum’ can be explained by a sharp decline in foreign official demand for US Treasuries and a likely shift towards gold, which is less vulnerable to sanctions and asset freezes.

cepr.org

February 9, 2025 at 3:51 PM

What was meant as a quick n dirty weekend analysis by @arebucci.bsky.social and I.. now catching the attn of @reuters.com and @financialtimes.com. Grateful to see interest in our work

Our piece: cepr.org/voxeu/column...

FT: on.ft.com/3QaAVCc

Reuters: www.reuters.com/markets/rate...

Our piece: cepr.org/voxeu/column...

FT: on.ft.com/3QaAVCc

Reuters: www.reuters.com/markets/rate...

Reposted by Rashad Ahmed

Video interviews are not my favorite, and I don't like to rewatch myself, but you might find this discussion of our paper with @rashad-ahmed.bsky.social on the price impact of foreign official sales of treasuries on their yileds informative: www.youtube.com/watch?v=FGGQ... #Econsky

Dollar reserves and U.S. yields - Alessandro Rebucci

YouTube video by Faculti

www.youtube.com

February 7, 2025 at 7:00 PM

Video interviews are not my favorite, and I don't like to rewatch myself, but you might find this discussion of our paper with @rashad-ahmed.bsky.social on the price impact of foreign official sales of treasuries on their yileds informative: www.youtube.com/watch?v=FGGQ... #Econsky

Reposted by Rashad Ahmed

January 22, 2025 at 12:54 AM

Reposted by Rashad Ahmed

#FT and #Reuters covering our analysis of foreign official flows and US yileds:

@

www.ft.com/content/7201...

www.reuters.com/markets/rate...

@

www.ft.com/content/7201...

www.reuters.com/markets/rate...

The bond markets vs Donald Trump

There is a notable — and rising — risk of financial turmoil if the new White House does anything to spook investors

www.ft.com

January 20, 2025 at 6:43 PM

#FT and #Reuters covering our analysis of foreign official flows and US yileds:

@

www.ft.com/content/7201...

www.reuters.com/markets/rate...

@

www.ft.com/content/7201...

www.reuters.com/markets/rate...