*ALL CAPS HEADLINES LIKE THIS ARE FROM BLOOMBERG

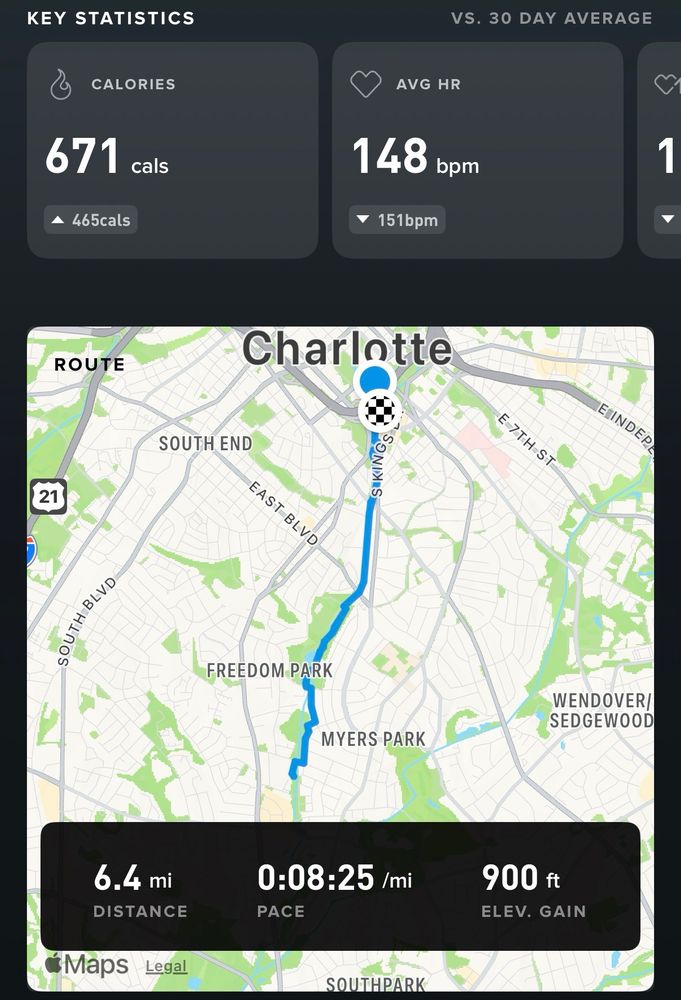

📍 CLT

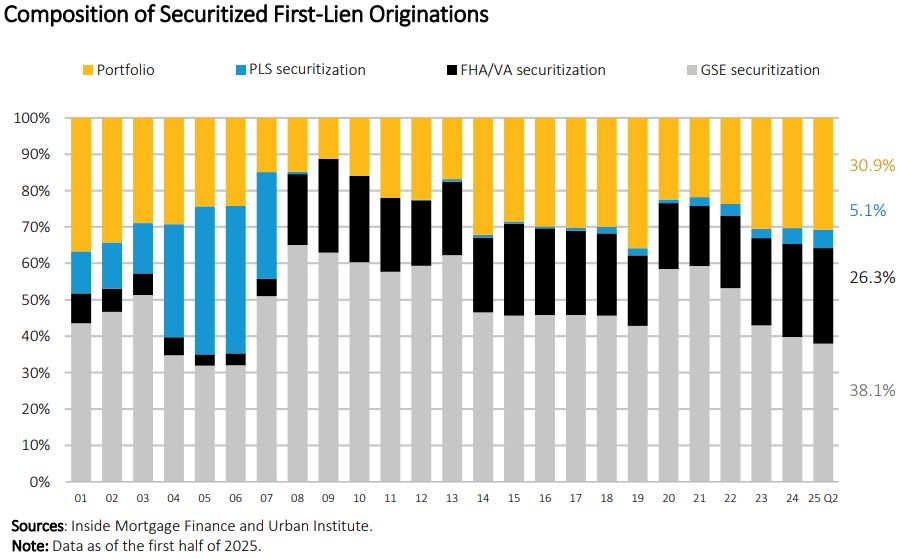

www.urban.org/sites/defaul...

www.urban.org/sites/defaul...

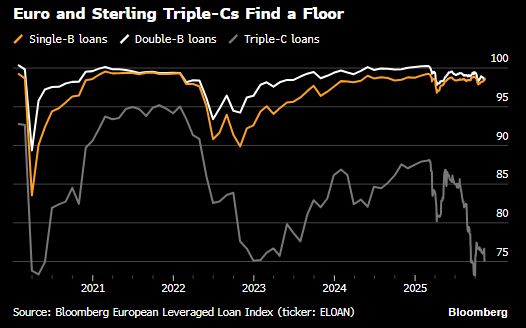

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

Mid-day 10k on Little Sugar Creek would have been the best even without a pace I am very happy with.

Mid-day 10k on Little Sugar Creek would have been the best even without a pace I am very happy with.

- Ozzie consumer confidence rips

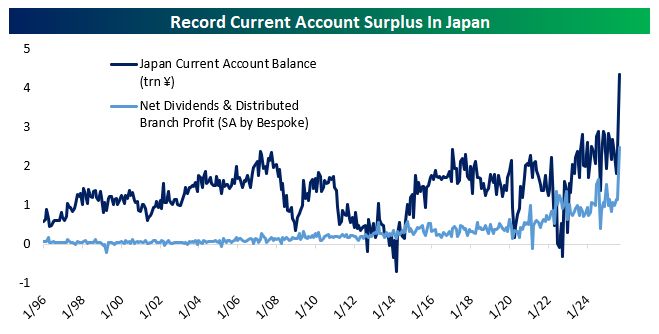

- Repatriated profits drive a record Japanese current account surplus

- European investors still expecting weak US growth and high US inflation

- UK labor markets continue to weaken with new local high for the UER and softening wage growth

- Ozzie consumer confidence rips

- Repatriated profits drive a record Japanese current account surplus

- European investors still expecting weak US growth and high US inflation

- UK labor markets continue to weaken with new local high for the UER and softening wage growth

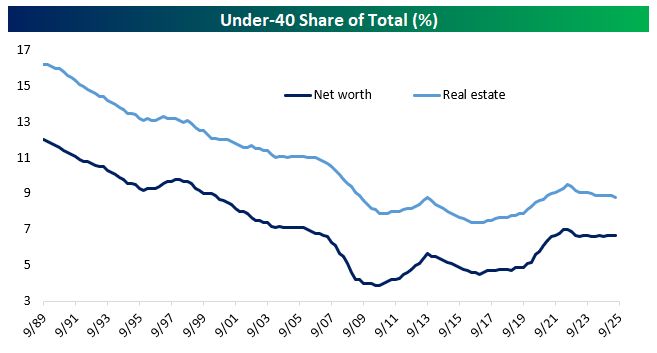

www.bloomberg.com/news/feature...

www.bloomberg.com/news/feature...