BLS just issued some clarifying material

BLS just issued some clarifying material

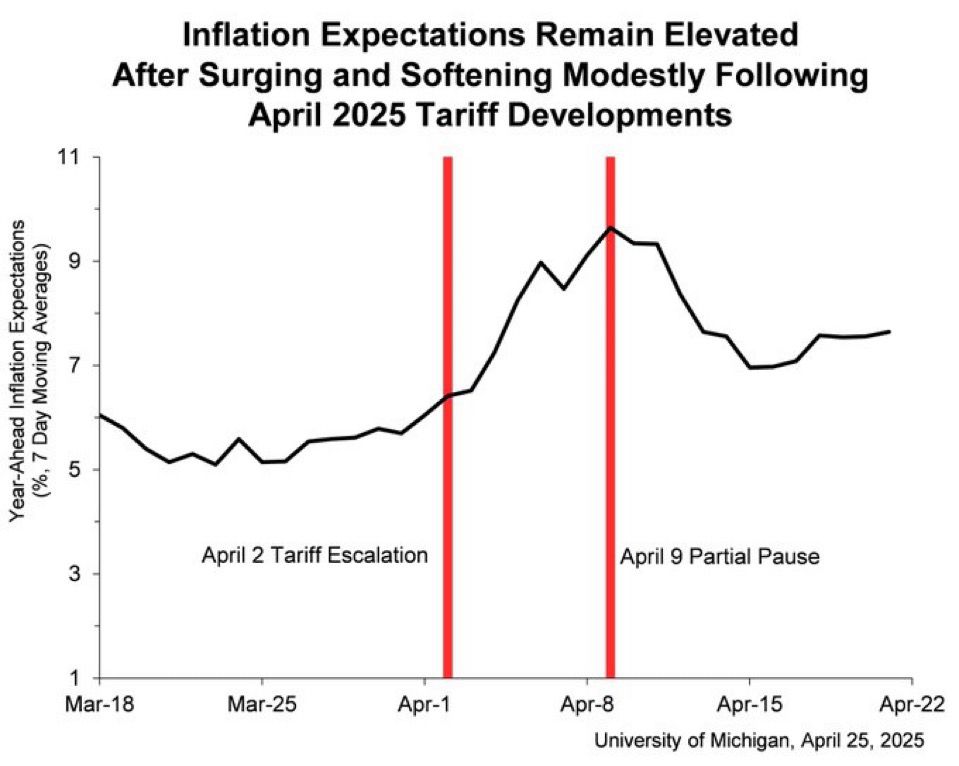

“The committee … judges that the risks of higher unemployment and higher inflation have risen.”

“The committee … judges that the risks of higher unemployment and higher inflation have risen.”

It was up 5.3% on the year in April and has held in a range over the last year that is back to where it was from 2018-19

It was up 5.3% on the year in April and has held in a range over the last year that is back to where it was from 2018-19

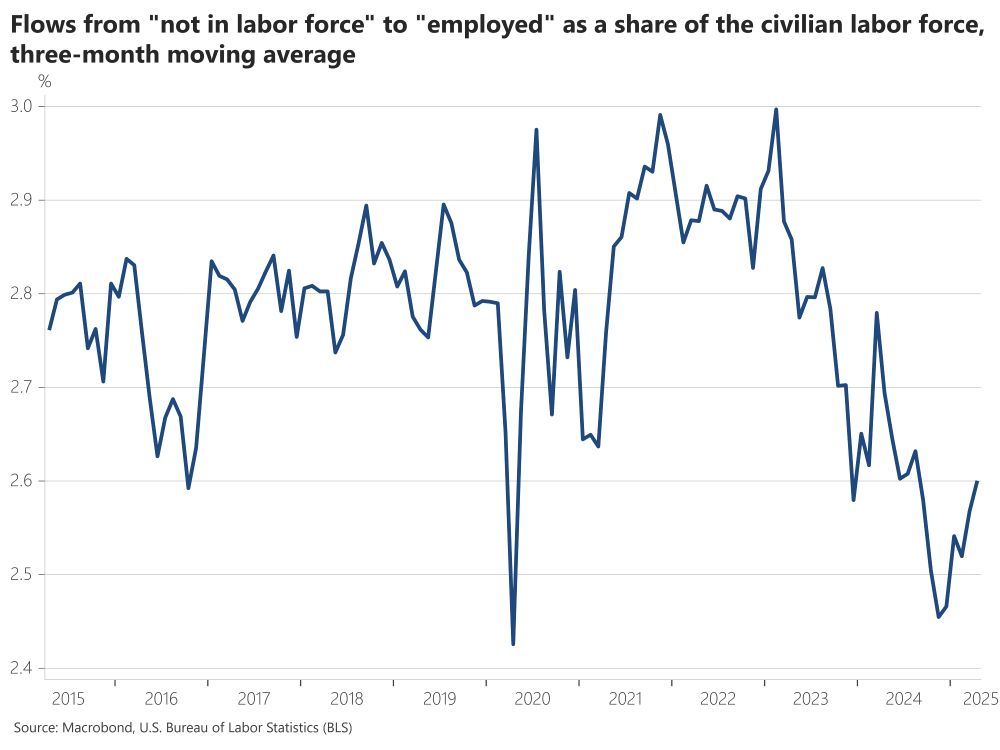

April labor market data shows continued resilience. March PCE inflation was 2.3%, 2.6% on core.

April labor market data shows continued resilience. March PCE inflation was 2.3%, 2.6% on core.

Prices paid continues to accelerate while new orders and employment remains in contractionary territory. This wasn't the case in 2021, when all were in expansionary territory.

Prices paid continues to accelerate while new orders and employment remains in contractionary territory. This wasn't the case in 2021, when all were in expansionary territory.

But this doesn't tell us much we didn't already know: The economy was OK before the storm, but a storm is comin'

But this doesn't tell us much we didn't already know: The economy was OK before the storm, but a storm is comin'

This is a key difference from 2021, when the Fed's "transitory" inflation forecast ran aground in part because housing markets were on fire.

Prices in Tampa are flat to down.

This is a key difference from 2021, when the Fed's "transitory" inflation forecast ran aground in part because housing markets were on fire.

Prices in Tampa are flat to down.

"The general business activity index fell 20 points to -35.8, its lowest reading since May 2020"

"The general business activity index fell 20 points to -35.8, its lowest reading since May 2020"

Consumers have also turned bearish on the stock market.

Consumers have also turned bearish on the stock market.

Independents are back to the low point of the Biden presidency.

Independents are back to the low point of the Biden presidency.

But the March CPI report was exceptionally cool.

Headline CPI fell -0.05%, and core CPI rose just 0.06%

This lowered the 12-month rate for both measures to a 4-year low

But the March CPI report was exceptionally cool.

Headline CPI fell -0.05%, and core CPI rose just 0.06%

This lowered the 12-month rate for both measures to a 4-year low

If these forecasters are right, then we will see the second-lowest headline CPI reading (2.5%) in four years, and the lowest core CPI reading (3.0%) in four years

If these forecasters are right, then we will see the second-lowest headline CPI reading (2.5%) in four years, and the lowest core CPI reading (3.0%) in four years

It lost 10.5% over the last two days, the worst two-day decline since March 12, 2020

It lost 10.5% over the last two days, the worst two-day decline since March 12, 2020

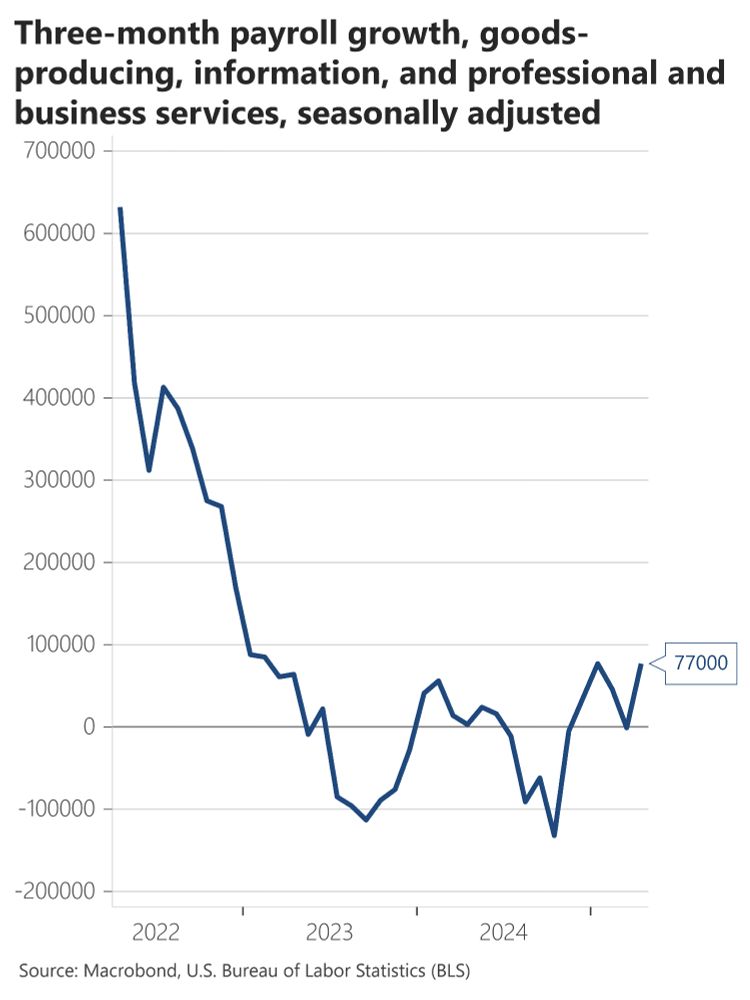

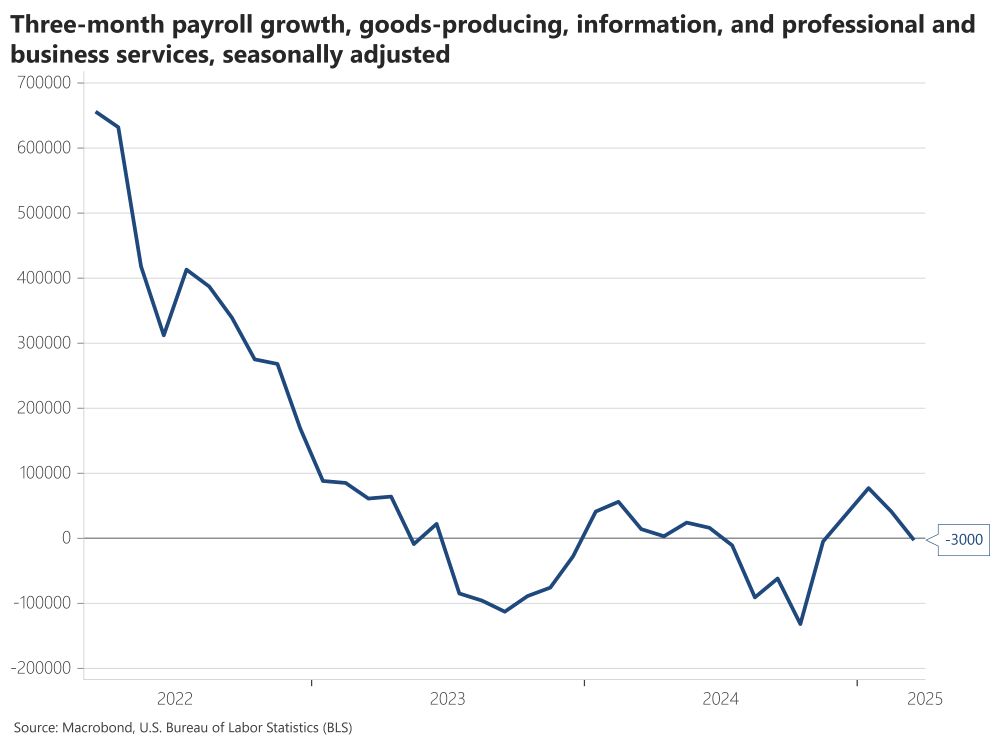

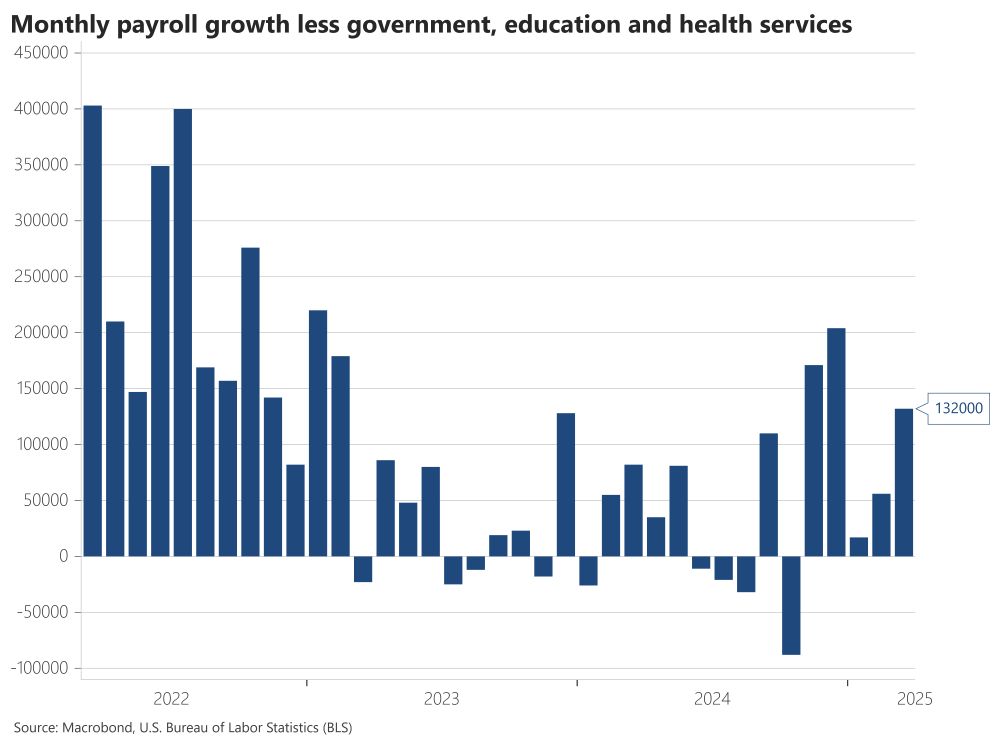

This wasn't the case in March. Hiring less government, education, and health services was +132,000.

This wasn't the case in March. Hiring less government, education, and health services was +132,000.