It's a difference of about $165 per month on a $400,000 loan amount.

To make matters a lot worse, you’d be looking at total interest of $863k versus $418k if you went with a traditional 30-year loan.

It's a difference of about $165 per month on a $400,000 loan amount.

To make matters a lot worse, you’d be looking at total interest of $863k versus $418k if you went with a traditional 30-year loan.

A) He's never heard of the ATR/QM rule that banned mortgages with loan terms longer than 30 years.

B) He's given up on returning the 30-year fixed to 3% or lower.

A) He's never heard of the ATR/QM rule that banned mortgages with loan terms longer than 30 years.

B) He's given up on returning the 30-year fixed to 3% or lower.

It also paves the way for the Fed to justify a rate cut next week less friction.

And gets us ever closer to the 5s for the 30-year fixed, albeit slowly and likely with resistance.

It also paves the way for the Fed to justify a rate cut next week less friction.

And gets us ever closer to the 5s for the 30-year fixed, albeit slowly and likely with resistance.

If it comes in hot, mortgage rates might push back toward 6.5%.

If it comes in cold, mortgage rates might be knocking on 5%'s door.

The first time they've been there since February 2nd, 2023!

If it comes in hot, mortgage rates might push back toward 6.5%.

If it comes in cold, mortgage rates might be knocking on 5%'s door.

The first time they've been there since February 2nd, 2023!

Formerly known as Footprint Center, it will now be known as Mortgage Matchup Center, home of the Phoenix Suns and Mercury.

Formerly known as Footprint Center, it will now be known as Mortgage Matchup Center, home of the Phoenix Suns and Mercury.

"And then on top of that Maria, refinancings are through the roof."

"And then on top of that Maria, refinancings are through the roof."

But the $12k minimum spend is pretty steep and the mortgage payment itself doesn't count toward that.

I've been pondering the card but remain on the fence.

But the $12k minimum spend is pretty steep and the mortgage payment itself doesn't count toward that.

I've been pondering the card but remain on the fence.

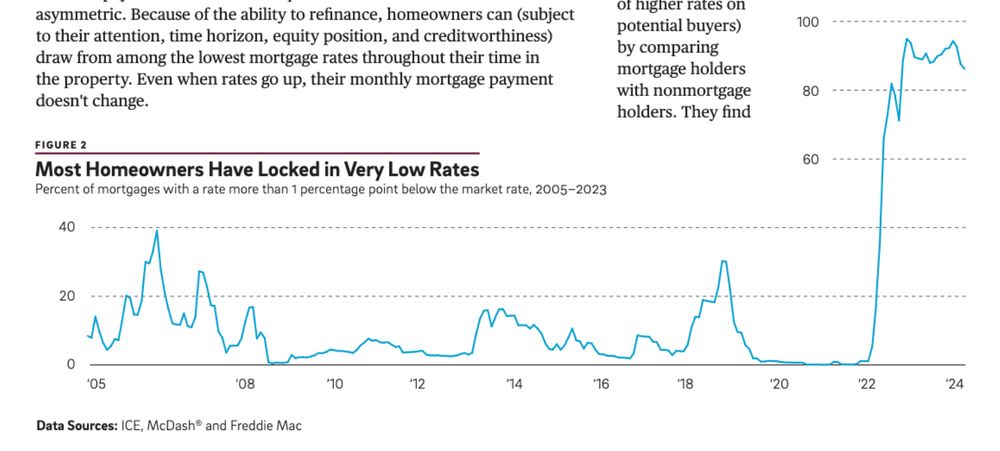

But if you zoom out they’ve been trending lower as opposed to higher since late 2023 and despite the past couple days, could well continue that move lower.

But if you zoom out they’ve been trending lower as opposed to higher since late 2023 and despite the past couple days, could well continue that move lower.

The question now is will they keep moving lower or reverse course and turn higher again?

The answer will be determined by either increased unemployment or worsening inflation.

The question now is will they keep moving lower or reverse course and turn higher again?

The answer will be determined by either increased unemployment or worsening inflation.

When there are less jobs available, employers can pay less and that's good for wage inflation.

Bond yields dropped on the news and if labor comes in cold Friday, the 30-yr fixed may finally break meaningfully below 6.50%.

When there are less jobs available, employers can pay less and that's good for wage inflation.

Bond yields dropped on the news and if labor comes in cold Friday, the 30-yr fixed may finally break meaningfully below 6.50%.

He didn't understand it. Said but I only owe ~$800k...

I said yeah, lenders require a buffer so you aren't levered to 100%.

A) Thank goodness for guardrails

B) Crazy how little the average homeowner understands

He didn't understand it. Said but I only owe ~$800k...

I said yeah, lenders require a buffer so you aren't levered to 100%.

A) Thank goodness for guardrails

B) Crazy how little the average homeowner understands

The 30-year fixed fell to 6.52%, per Mortgage News Daily, the lowest level since early October.

However, rates could rise between now and Fed cut day in mid-September, and a cut still isn't a guarantee.

The 30-year fixed fell to 6.52%, per Mortgage News Daily, the lowest level since early October.

However, rates could rise between now and Fed cut day in mid-September, and a cut still isn't a guarantee.

And Bill Ackman thinks a combined company could lead to lower mortgage rates for consumers.

All somehow expected to happen in three months.

And Bill Ackman thinks a combined company could lead to lower mortgage rates for consumers.

All somehow expected to happen in three months.

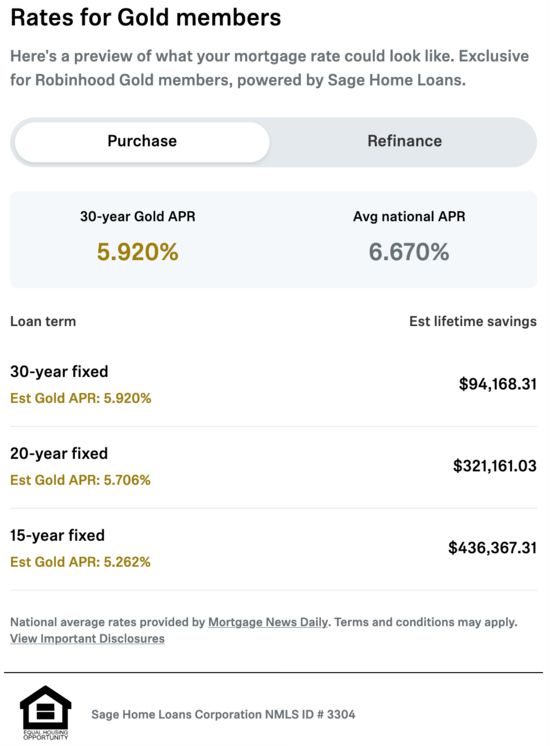

We're talking a 0.75% rate discount (relative to the daily MND rate) & a $500 closing cost credit.

However, Robinhood Gold costs $5 per month (or $50 per year). And you still need to shop around.

We're talking a 0.75% rate discount (relative to the daily MND rate) & a $500 closing cost credit.

However, Robinhood Gold costs $5 per month (or $50 per year). And you still need to shop around.

Here's a first look at the new Rocket Preferred Pricing.

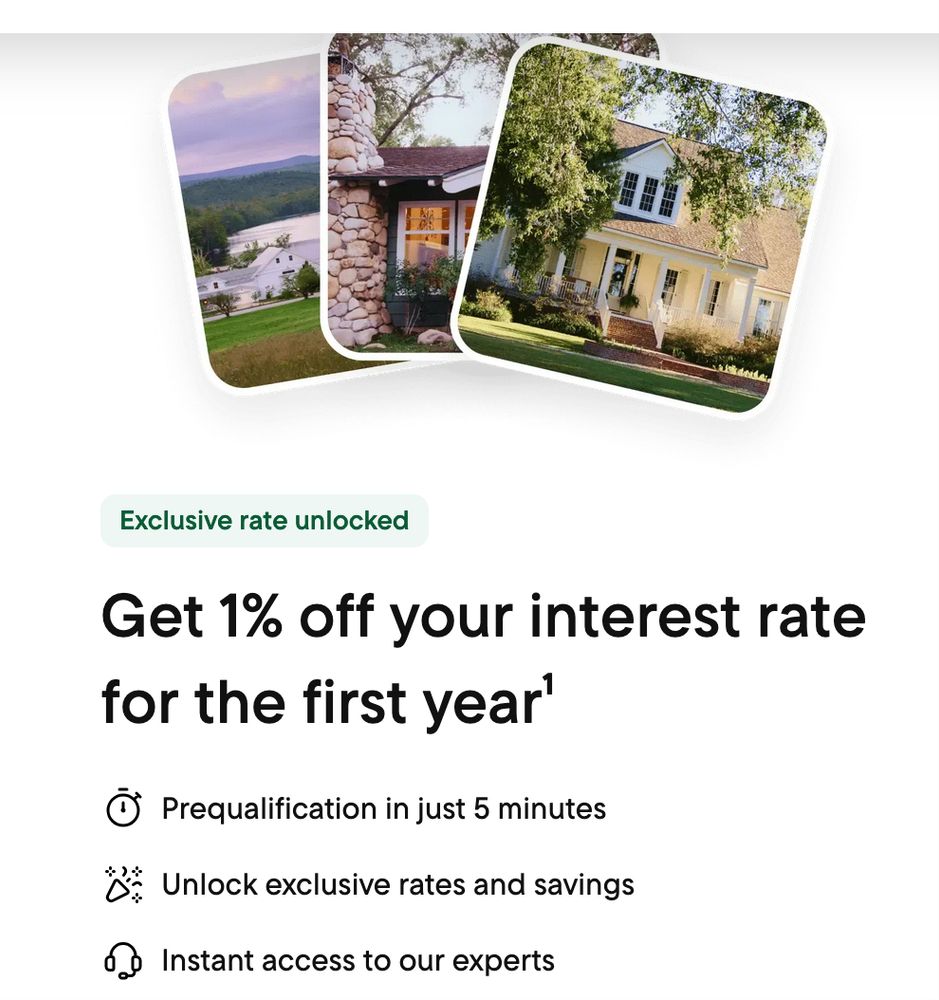

Customers who use Redfin & Rocket Mortgage get either a 1% rate buydown in year one or up to a $6k lender credit.

Here's a first look at the new Rocket Preferred Pricing.

Customers who use Redfin & Rocket Mortgage get either a 1% rate buydown in year one or up to a $6k lender credit.

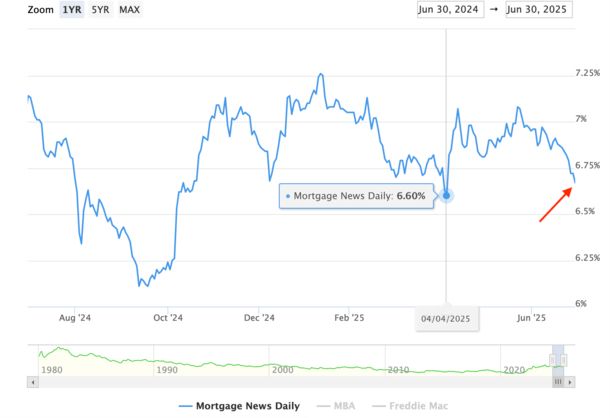

Now even the most aggressive 2025 mortgage rate forecasts (think sub-6% by year-end) are on the table again.

And there are still six months left in the year to get there.

Now even the most aggressive 2025 mortgage rate forecasts (think sub-6% by year-end) are on the table again.

And there are still six months left in the year to get there.

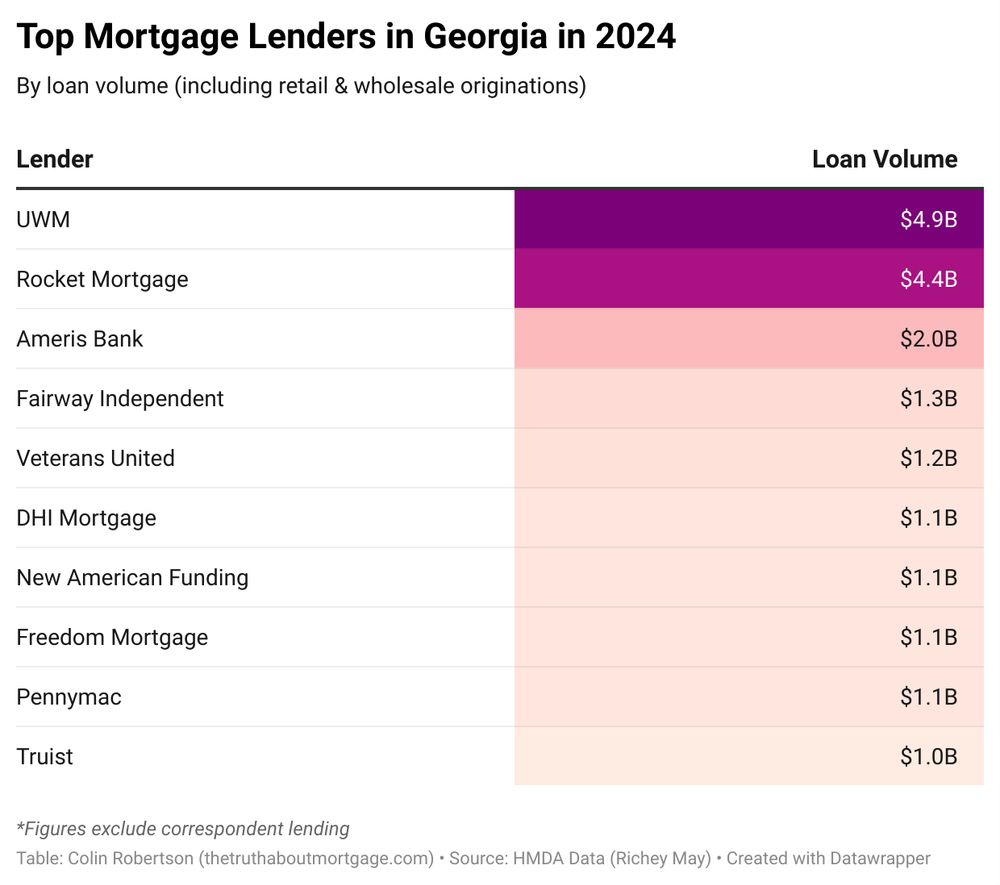

Total production of nearly $5 billion, followed by Rocket Mortgage with $4.4B and Ameris Bank with $2B.

Top home builder D.R. Horton's in-house lender DHI Mortgage also made the list.

Total production of nearly $5 billion, followed by Rocket Mortgage with $4.4B and Ameris Bank with $2B.

Top home builder D.R. Horton's in-house lender DHI Mortgage also made the list.

The driver is cheaper oil prices (for now), less concern about tariffs being inflationary, and a second Fed official calling for rate cuts earlier.

But geopolitics will keep things choppy.

The driver is cheaper oil prices (for now), less concern about tariffs being inflationary, and a second Fed official calling for rate cuts earlier.

But geopolitics will keep things choppy.

If you truly want to bring down mortgage rates and help the housing market, clarity is needed.

This means finalizing all the tariffs, the government spending bill, etc.

If you truly want to bring down mortgage rates and help the housing market, clarity is needed.

This means finalizing all the tariffs, the government spending bill, etc.

E.g. a rate of 6.49% and below and it appears to be game on for home buyers.

E.g. a rate of 6.49% and below and it appears to be game on for home buyers.

Both D.R. Horton's DHI Mortgage and Lennar Mortgage made the list last year thanks to their massive mortgage rate buydowns.

Sign of the times...

Both D.R. Horton's DHI Mortgage and Lennar Mortgage made the list last year thanks to their massive mortgage rate buydowns.

Sign of the times...

Yet any time rates drop, home buyers pounce. So clearly rates ARE too high.

Yet any time rates drop, home buyers pounce. So clearly rates ARE too high.

If you got a mortgage in CA last year, did you use one of these lenders?

If you got a mortgage in CA last year, did you use one of these lenders?