🚂📞🛢️🤖 … 𝑀𝑎𝑛𝑖𝑎 𝑖𝑠 𝑎 𝑓𝑒𝑎𝑡𝑢𝑟𝑒, 𝑛𝑜𝑡 𝑎 𝑏𝑢𝑔.

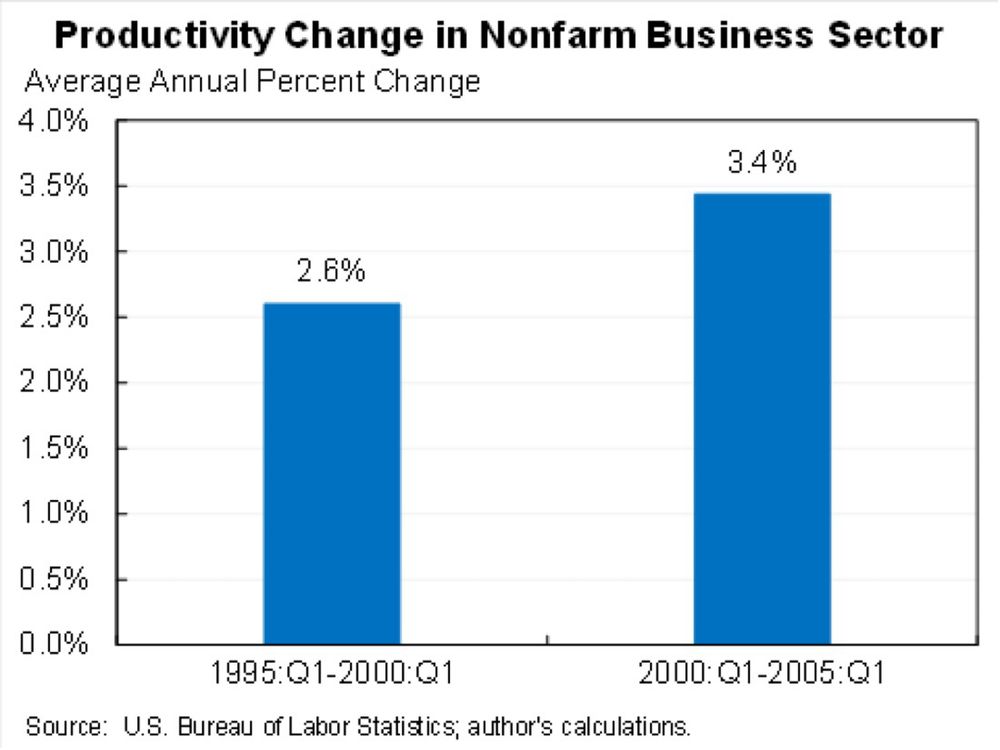

Every tech boom rides in with productivity gains and capital euphoria—then leaves investors holding the bubble bag.

From railways to AI: +600% up, then reality.

So what’s your edge ..?

x.com/mohossain/st...

🚂📞🛢️🤖 … 𝑀𝑎𝑛𝑖𝑎 𝑖𝑠 𝑎 𝑓𝑒𝑎𝑡𝑢𝑟𝑒, 𝑛𝑜𝑡 𝑎 𝑏𝑢𝑔.

Every tech boom rides in with productivity gains and capital euphoria—then leaves investors holding the bubble bag.

From railways to AI: +600% up, then reality.

So what’s your edge ..?

x.com/mohossain/st...

90‑day correlation between US IG spreads & S&P is rising — rare territory.

Only 5 times in the past decade we’ve seen less‑negative readings

Now? Mini‑decoupling driven by:

• AI issuance wave

• Hidden risk jitters

Credit isn’t just following equities anymore…

90‑day correlation between US IG spreads & S&P is rising — rare territory.

Only 5 times in the past decade we’ve seen less‑negative readings

Now? Mini‑decoupling driven by:

• AI issuance wave

• Hidden risk jitters

Credit isn’t just following equities anymore…

🐸 Renovo’s 💯‑to‑zero overnight

From Zips Car Wash to Tricolor Auto, everyone fears the boiling frog — but in this market, you don’t simmer. You splat.

x.com/mohossain/st...

🐸 Renovo’s 💯‑to‑zero overnight

From Zips Car Wash to Tricolor Auto, everyone fears the boiling frog — but in this market, you don’t simmer. You splat.

x.com/mohossain/st...

Deals: $30B @ 6.58% | $38B @ 6.40% | $12–20B @ 10.50%

Capital costs rise, structures get complex. Yield for credit investors, risk for equity holders?

x.com/mohossain/st... #privatedebt

x.com/mohossain/st...

Deals: $30B @ 6.58% | $38B @ 6.40% | $12–20B @ 10.50%

Capital costs rise, structures get complex. Yield for credit investors, risk for equity holders?

x.com/mohossain/st... #privatedebt

x.com/mohossain/st...

Will AI shrink HR?

x.com/mohossain/st...

x.com/mohossain/st...

Will AI shrink HR?

x.com/mohossain/st...

x.com/mohossain/st...

🔹 $56B in H1 2025 — up 40% YoY

🔹 54% of total secondaries volume

🔹 40% of LP sellers = first-timers

Exit drought + aging PE portfolios = liquidity hunt.

The seller universe isn’t just bigger — it’s bolder.

#PrivateEquity #Secondaries #Liquidity #@PitchBook

🔹 $56B in H1 2025 — up 40% YoY

🔹 54% of total secondaries volume

🔹 40% of LP sellers = first-timers

Exit drought + aging PE portfolios = liquidity hunt.

The seller universe isn’t just bigger — it’s bolder.

#PrivateEquity #Secondaries #Liquidity #@PitchBook

Real assets, with tangible income and “political sizzle,” are the only strategy outperforming their long-term IRRs?

#news @PitchBook #realtor #Rent #mbs

Q2 2025 data says yes—with correlations dropping as pandemic-era volatility fades and public markets spiral over trade drama. Independence looks good on alternatives.

ht @PitchBook @ennovance

Q2 2025 data says yes—with correlations dropping as pandemic-era volatility fades and public markets spiral over trade drama. Independence looks good on alternatives.

ht @PitchBook @ennovance

Tech and warehousing led the reductions, driven by AI adoption, rising costs, and weaker consumer spending. It’s the highest October layoff total since 2003.

via BBG

#Jobs #Layoffs

x.com/mohossain/st...

Tech and warehousing led the reductions, driven by AI adoption, rising costs, and weaker consumer spending. It’s the highest October layoff total since 2003.

via BBG

#Jobs #Layoffs

x.com/mohossain/st...

x.com/mohossain/st... #merger #acquisition #deals #privateequity #buyouts M&A #pensionfund #Endowment #valuation #Fed #Interestrate #lp #fund #investor

x.com/mohossain/st... #merger #acquisition #deals #privateequity #buyouts M&A #pensionfund #Endowment #valuation #Fed #Interestrate #lp #fund #investor

#job #unemployment #productivity #economy #fed #interestrates #investment #ennovance

#job #unemployment #productivity #economy #fed #interestrates #investment #ennovance

✨ 25Q4 GDP 🆙 with consumers showing strength.

💡 All 7 sectors expanding: Financials lead, Healthcare at 13‑mo high, HH spending again.

𝑀𝑎𝑟𝑔𝑖𝑛𝑠 𝑚𝑎𝑦 𝑏𝑒 𝑡𝑖𝑔ℎ𝑡, 𝑏𝑢𝑡 𝑏𝑟𝑒𝑎𝑑𝑡ℎ + 𝑟𝑎𝑡𝑒 𝑡𝑎𝑖𝑙𝑤𝑖𝑛𝑑𝑠 + 𝐴𝑚𝑒𝑟𝑖𝑐𝑎𝑛 𝑟𝑒𝑠𝑖𝑙𝑖𝑒𝑛𝑐𝑒 = 2026 𝑐𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝑟𝑒𝑏𝑜𝑢𝑛𝑑 𝑤𝑖𝑡ℎ 𝑏𝑒𝑡𝑡𝑒𝑟 𝑜𝑑𝑑𝑠.

✨ 25Q4 GDP 🆙 with consumers showing strength.

💡 All 7 sectors expanding: Financials lead, Healthcare at 13‑mo high, HH spending again.

𝑀𝑎𝑟𝑔𝑖𝑛𝑠 𝑚𝑎𝑦 𝑏𝑒 𝑡𝑖𝑔ℎ𝑡, 𝑏𝑢𝑡 𝑏𝑟𝑒𝑎𝑑𝑡ℎ + 𝑟𝑎𝑡𝑒 𝑡𝑎𝑖𝑙𝑤𝑖𝑛𝑑𝑠 + 𝐴𝑚𝑒𝑟𝑖𝑐𝑎𝑛 𝑟𝑒𝑠𝑖𝑙𝑖𝑒𝑛𝑐𝑒 = 2026 𝑐𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝑟𝑒𝑏𝑜𝑢𝑛𝑑 𝑤𝑖𝑡ℎ 𝑏𝑒𝑡𝑡𝑒𝑟 𝑜𝑑𝑑𝑠.

BDCs are off 14% YTD while the S&P 500’s up 16%, yet the “weak link” narrative hasn’t cracked credit quality yet

Private lenders could replace 15% of traditional fixed-income

www.bloomberg.com/news/article...

BDCs are off 14% YTD while the S&P 500’s up 16%, yet the “weak link” narrative hasn’t cracked credit quality yet

Private lenders could replace 15% of traditional fixed-income

www.bloomberg.com/news/article...

ht: BBG

ht: BBG

📉 Private credit’s “bad PIK” pile is swelling — now seen as a shadow default rate, hitting 6% vs. 2% in 2021. Deferred interest may soon become deferred pain as 40%+ of borrowers show negative cash flow

x.com/mohossain/st...

📉 Private credit’s “bad PIK” pile is swelling — now seen as a shadow default rate, hitting 6% vs. 2% in 2021. Deferred interest may soon become deferred pain as 40%+ of borrowers show negative cash flow

x.com/mohossain/st...

• Percentage of wealth creation accounted for by the best-performing 1% of firms

• Just 3% of companies generated all the net wealth in the US stock market since 1926

x.com/mohossain/st... #monopoly

x.com/mohossain/st...

• Percentage of wealth creation accounted for by the best-performing 1% of firms

• Just 3% of companies generated all the net wealth in the US stock market since 1926

x.com/mohossain/st... #monopoly

x.com/mohossain/st...

x.com/mohossain/st...

x.com/mohossain/st...

• Jobless claims down to 220K 📉

• Consumer spend +0.8% YoY 💳

• Hospitality payrolls +13.8% 🍽️

• Transport +4.8% 🚚

Erosion at the edges ≠ collapse at the core. Is resilience the most underpriced asset?

x.com/mohossain/st...

• Jobless claims down to 220K 📉

• Consumer spend +0.8% YoY 💳

• Hospitality payrolls +13.8% 🍽️

• Transport +4.8% 🚚

Erosion at the edges ≠ collapse at the core. Is resilience the most underpriced asset?

x.com/mohossain/st...

Behind insurer profit strategies stand real patients…Insurers’ push for “discipline” in slashes benefits and narrows networks, raising the stakes for hospitals

𝐇𝐨𝐰 𝐰𝐢𝐥𝐥 𝐂𝐌𝐒 𝐬𝐚𝐟𝐞𝐠𝐮𝐚𝐫𝐝?

x.com/mohossain/st...

Behind insurer profit strategies stand real patients…Insurers’ push for “discipline” in slashes benefits and narrows networks, raising the stakes for hospitals

𝐇𝐨𝐰 𝐰𝐢𝐥𝐥 𝐂𝐌𝐒 𝐬𝐚𝐟𝐞𝐠𝐮𝐚𝐫𝐝?

x.com/mohossain/st...

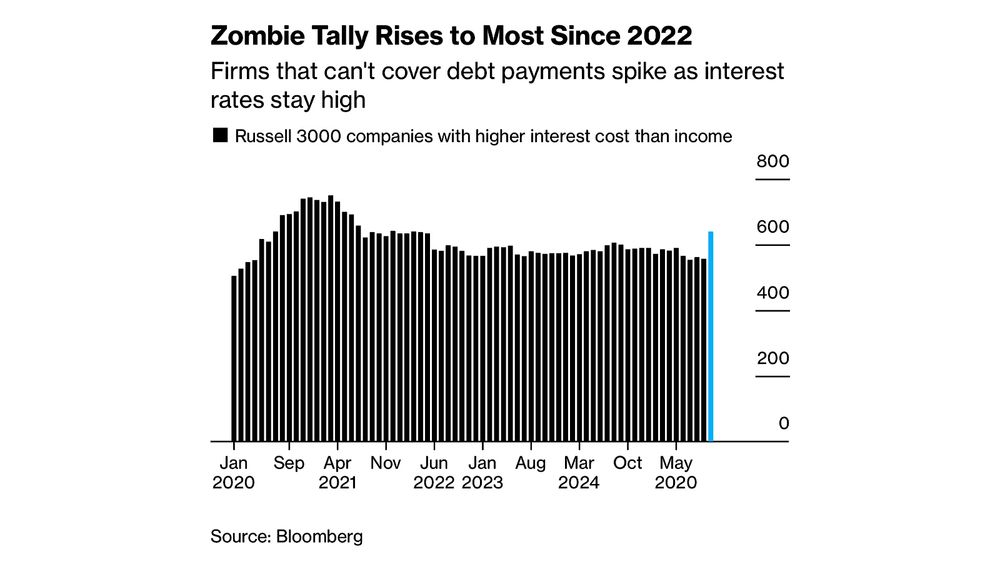

'Zombie companies' (earnings < interest) just hit their highest level since early 2022.

easy money era is over,"massive maturity wall"

Are you checking high-leverage firms in healthcare, biotech, old LBOs?

www.bloomberg.com/news/article...

'Zombie companies' (earnings < interest) just hit their highest level since early 2022.

easy money era is over,"massive maturity wall"

Are you checking high-leverage firms in healthcare, biotech, old LBOs?

www.bloomberg.com/news/article...

x.com/mohossain/st...

ht:MCO

x.com/mohossain/st...

ht:MCO

Did you know public colleges and community colleges now account for ~75% of yoy enrollment gains, even as avg tuition revenue per student dips ~1%?

Student loan caps tightening = value

x.com/mohossain/st...

Did you know public colleges and community colleges now account for ~75% of yoy enrollment gains, even as avg tuition revenue per student dips ~1%?

Student loan caps tightening = value

x.com/mohossain/st...

🇺🇸 has 5,400+ data centers. 10x Germany.

PE’s betting AI won’t just live there—it’ll pay the mortgage and tip the doorman. Overbuild or empire? Stay tuned.

Should we be training AI… or licensing it as Realtor 2.0? 🏢

x.com/mohossain/st...

🇺🇸 has 5,400+ data centers. 10x Germany.

PE’s betting AI won’t just live there—it’ll pay the mortgage and tip the doorman. Overbuild or empire? Stay tuned.

Should we be training AI… or licensing it as Realtor 2.0? 🏢

x.com/mohossain/st...

📰More via @FT:

x.com/mohossain/st...

📰More via @FT:

x.com/mohossain/st...