Rate guy at MND.news

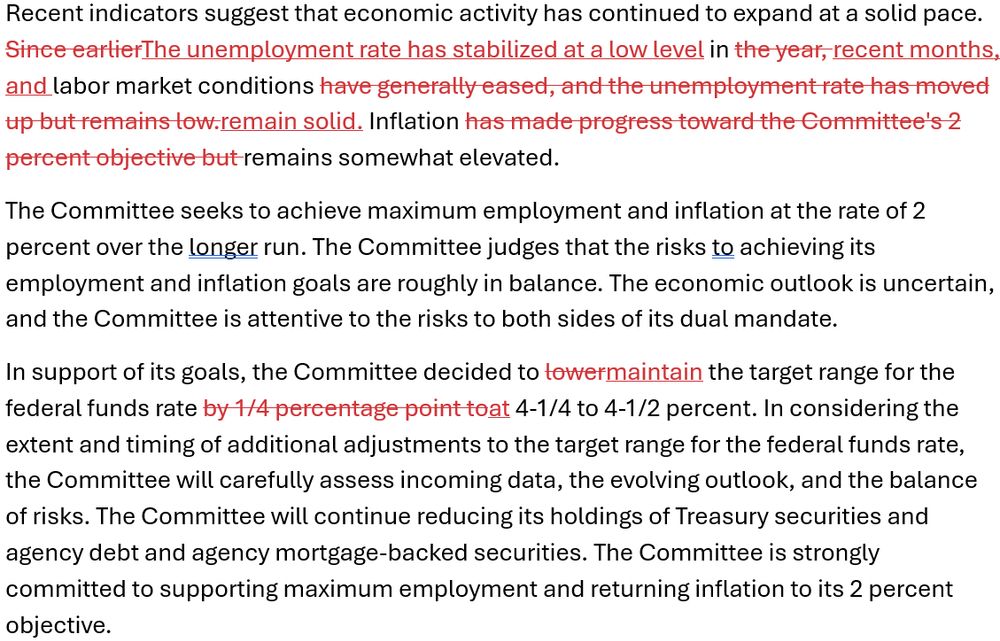

Both of these signify less easing.

Both of these signify less easing.

Most of the miss of core against target remains housing and auto insurance.

Most of the miss of core against target remains housing and auto insurance.

1/ Last week's weird initial claims jump reversed in the 2nd week of December.

1/ Last week's weird initial claims jump reversed in the 2nd week of December.

Q3 2024 = 409.43

Q3 2023 = 389.15

According to FHFA's methodology here: fhfa.gov/sites/defaul... this equates to a new conforming loan limit of 806,500 (806,497 before rounding).

Disclaimer: Math is challenging sometimes

Q3 2024 = 409.43

Q3 2023 = 389.15

According to FHFA's methodology here: fhfa.gov/sites/defaul... this equates to a new conforming loan limit of 806,500 (806,497 before rounding).

Disclaimer: Math is challenging sometimes