To avoid a cliff, they phase in the 5% over $1B to $1.1B wealth. You pay $0 at $1B and 5% at $1.1B. That's $55M, or a 55% tax on tha $100M marginal wealth.

To avoid a cliff, they phase in the 5% over $1B to $1.1B wealth. You pay $0 at $1B and 5% at $1.1B. That's $55M, or a 55% tax on tha $100M marginal wealth.

Their platform helps families and case managers navigate public benefits and tax credits - powered by the @us.policyengine.org API for tax and benefit calculations. Excited to see tech and policy come together to expand access.

Their platform helps families and case managers navigate public benefits and tax credits - powered by the @us.policyengine.org API for tax and benefit calculations. Excited to see tech and policy come together to expand access.

Links:

instagram.com/p/DHWA8BWJHl6

washingtonsocialist.mdcdsa.org/ws-articles/...

instagram.com/p/DPUllyAjkxb

chatgpt.com/share/68e223...

Links:

instagram.com/p/DHWA8BWJHl6

washingtonsocialist.mdcdsa.org/ws-articles/...

instagram.com/p/DPUllyAjkxb

chatgpt.com/share/68e223...

As a result, a married couple, each 64 years old earning $83k, would gain $57,292 in 2026 if the enhanced subsidies are extended. They'd get some PTC with up to $756k income.

As a result, a married couple, each 64 years old earning $83k, would gain $57,292 in 2026 if the enhanced subsidies are extended. They'd get some PTC with up to $756k income.

An extreme case: A 64-year-old in Fairbanks, AK would gain $655 in 2026 if they earn $61k, but gain $26,861 if they earn $62k.

Try it here: policyengine.org/us/aca-calc

An extreme case: A 64-year-old in Fairbanks, AK would gain $655 in 2026 if they earn $61k, but gain $26,861 if they earn $62k.

Try it here: policyengine.org/us/aca-calc

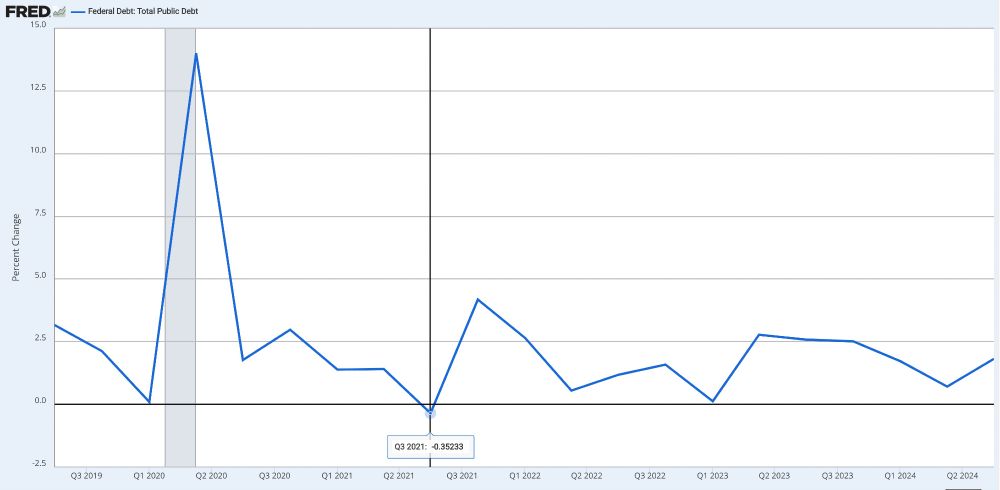

You could run a bunching study on this synthetic data! (And we will.)

You could run a bunching study on this synthetic data! (And we will.)

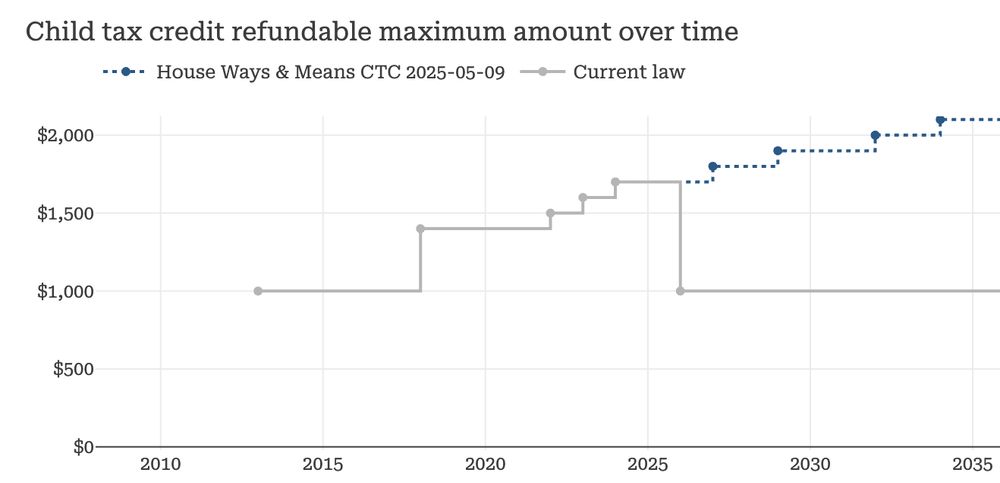

2024-26: $1,700

2027-28: $1,800

2029-31: $1,900

2032-33: $2,000

2034-35: $2,100

2024-26: $1,700

2027-28: $1,800

2029-31: $1,900

2032-33: $2,000

2034-35: $2,100

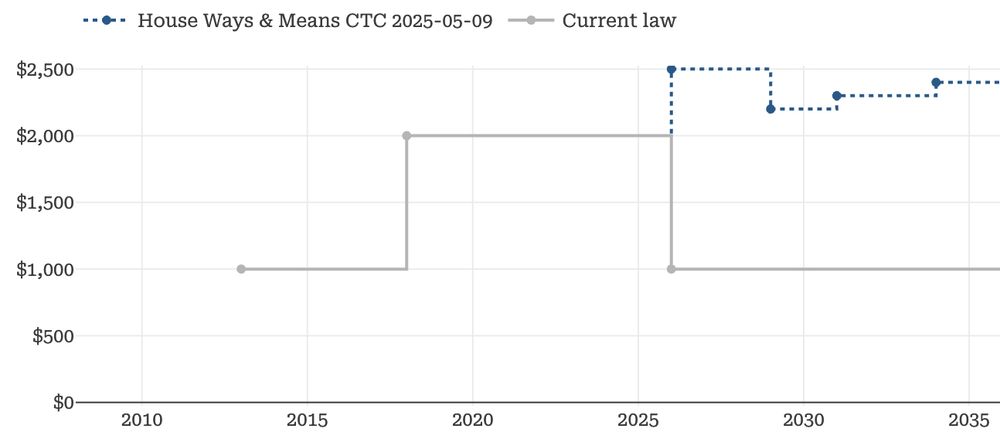

2029-30: $2,200

2031-33: $2,300

2034-35: $2,400

2029-30: $2,200

2031-33: $2,300

2034-35: $2,400

For example, a joint filer with $250k income faces these effective SALT caps in 2026:

Current law: $38,876

W&M: $72,747

For example, a joint filer with $250k income faces these effective SALT caps in 2026:

Current law: $38,876

W&M: $72,747

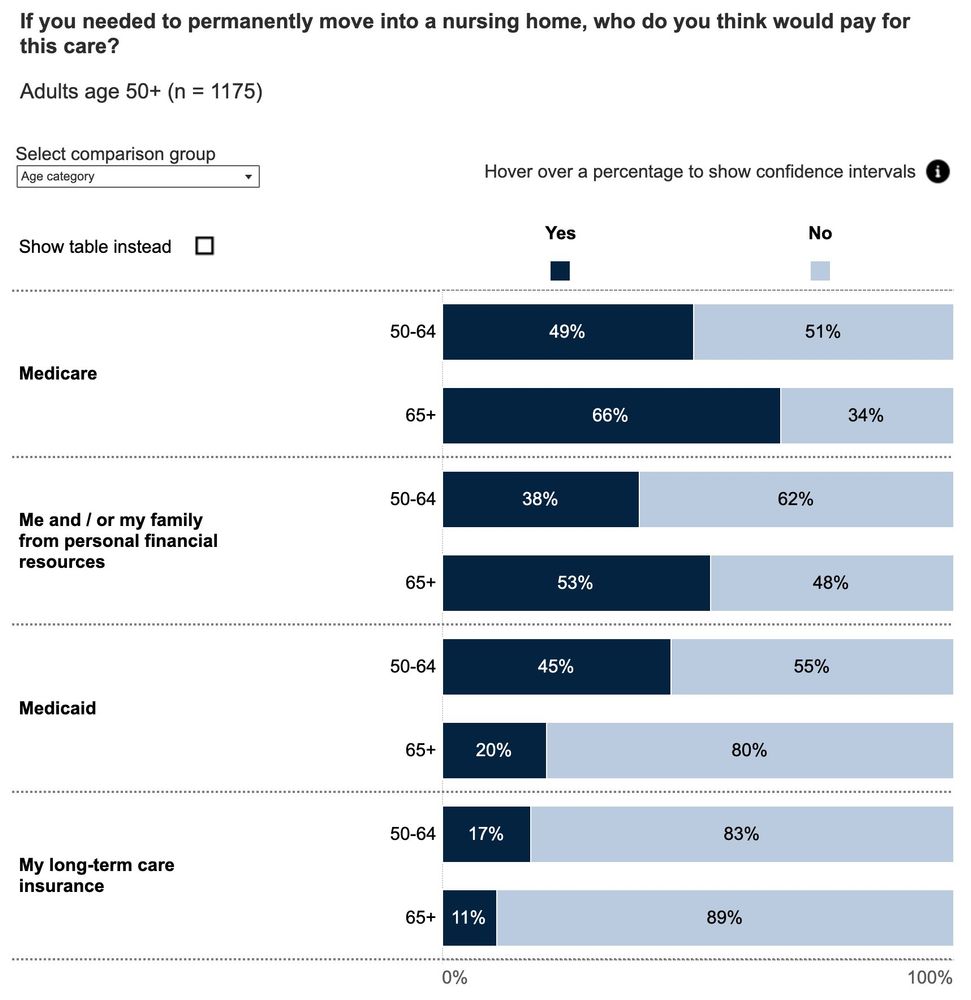

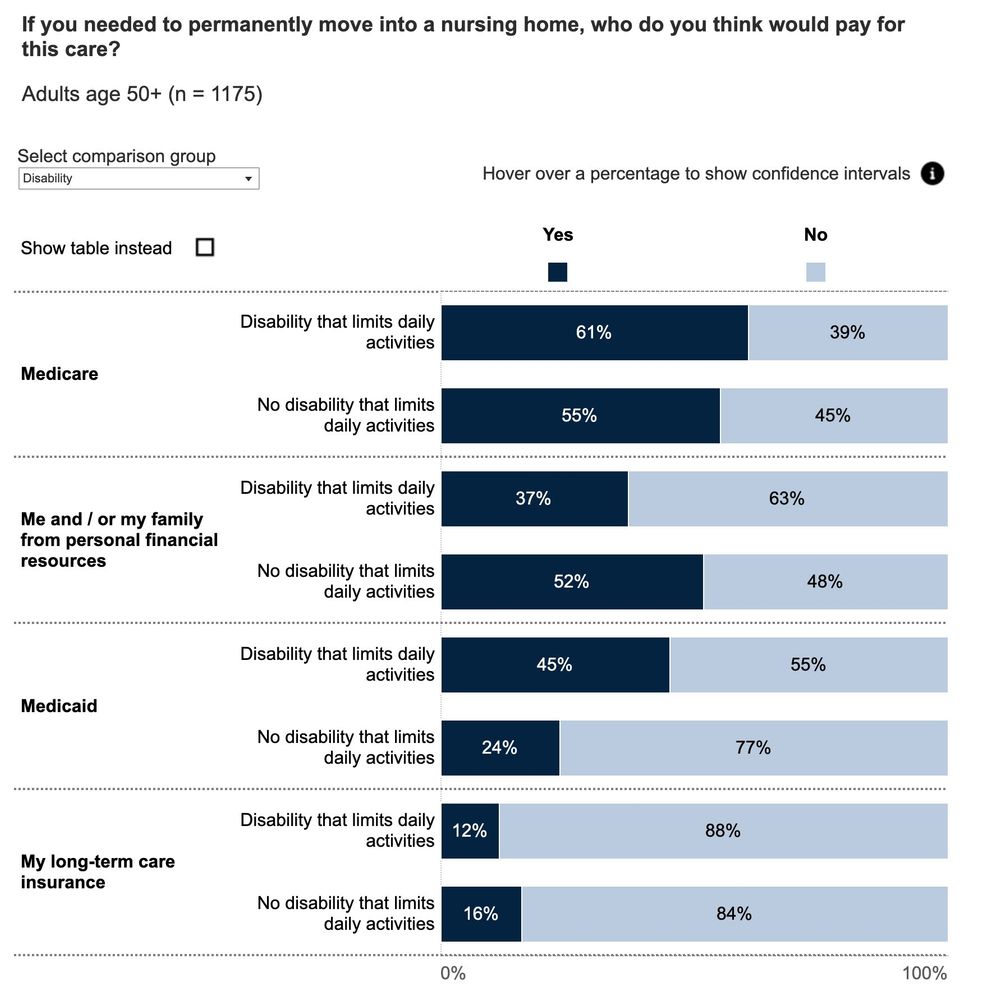

Medicare doesn't cover long term care.

Medicare doesn't cover long term care.

I asked o3 to identify some, along with estimates and CIs. It estimated that tool usage would shrink its CIs by 20-40%.

Motivating for our work arming AI with models via MCP.

I asked o3 to identify some, along with estimates and CIs. It estimated that tool usage would shrink its CIs by 20-40%.

Motivating for our work arming AI with models via MCP.

This combinatorics problem grows exponentially, but with the help of Claude Code, I've built a tool to solve it, at least for common fruits.

Here it is in action:

This combinatorics problem grows exponentially, but with the help of Claude Code, I've built a tool to solve it, at least for common fruits.

Here it is in action:

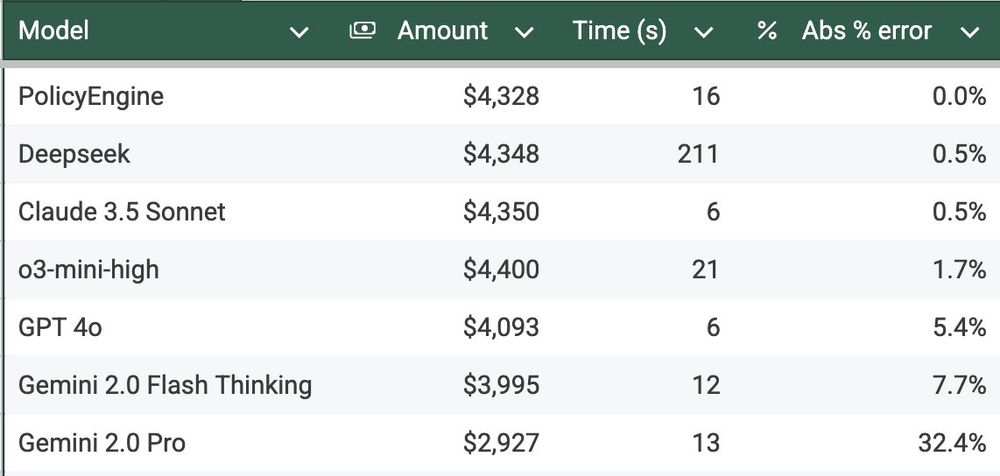

Deepseek and Claude estimated this most accurately (though Deepseek thought about it for over three minutes!); Gemini estimated least accurately.

Deepseek and Claude estimated this most accurately (though Deepseek thought about it for over three minutes!); Gemini estimated least accurately.

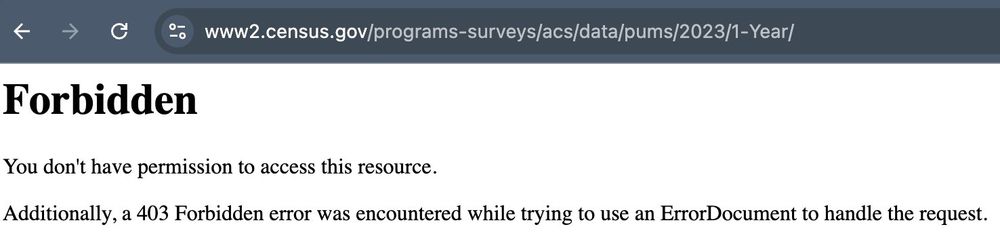

Thankfully we had a local copy, and now store it on @policyengine.bsky.social servers.

Thankfully we had a local copy, and now store it on @policyengine.bsky.social servers.

oews-explorer.streamlit.app

oews-explorer.streamlit.app

pr-improver.streamlit.app

pr-improver.streamlit.app

codestitch.dev

codestitch.dev