www.barrineau.substack.com

Ex-USN, ex-CIA

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

The 80% is getting battered from all sides.

on.ft.com/4rzWDAY

The 80% is getting battered from all sides.

on.ft.com/4rzWDAY

www.nytimes.com/2025/11/30/u...

www.nytimes.com/2025/11/30/u...

www.wsj.com/world/russia...

www.wsj.com/world/russia...

www.nytimes.com/2025/11/25/u...

www.nytimes.com/2025/11/25/u...

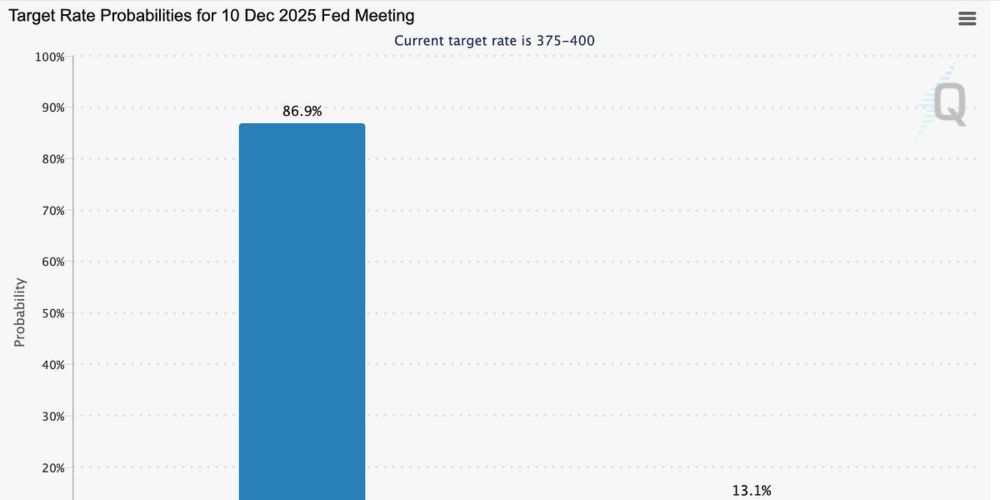

We are an economy of financial asset inflation. If you own financial assets, you are golden. If you do not, you are dead in the water. It's not much more complicated than that.

We are an economy of financial asset inflation. If you own financial assets, you are golden. If you do not, you are dead in the water. It's not much more complicated than that.

www.wsj.com/business/cal...

www.wsj.com/business/cal...