Jakob Schneebacher

@jschneebacher.bsky.social

Economist at the UK Competition and Markets Authority. Interested in firms, productivity, markets, management and growth. Previously at ONS, Nuffield College Oxford. All views my own.

www.jakobschneebacher.com

www.jakobschneebacher.com

At the William Morris Gallery today. Food for thought from an earlier era of automation and deskilling, and the resulting backlash.

May 25, 2025 at 6:49 PM

At the William Morris Gallery today. Food for thought from an earlier era of automation and deskilling, and the resulting backlash.

Finally, we examine the remaining data and evidence gaps for the industrial strategy, and highlight the importance of careful design, paying for instance attention to threshold effects.

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

April 9, 2025 at 12:24 PM

Finally, we examine the remaining data and evidence gaps for the industrial strategy, and highlight the importance of careful design, paying for instance attention to threshold effects.

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

The industrial strategy is of course part of the government's wider growth mission. We therefore consider how other pillars of the growth mission might interact with it.

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

April 9, 2025 at 12:24 PM

The industrial strategy is of course part of the government's wider growth mission. We therefore consider how other pillars of the growth mission might interact with it.

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

The productivity effects of the industrial policy will depend on economies of scale in the targeted sectors, and on wider spillover effects. We examine both.

We show that the targeted sectors are more connected and more upstream than the typical sector, which should help with spillovers.

10/

We show that the targeted sectors are more connected and more upstream than the typical sector, which should help with spillovers.

10/

April 9, 2025 at 12:24 PM

The productivity effects of the industrial policy will depend on economies of scale in the targeted sectors, and on wider spillover effects. We examine both.

We show that the targeted sectors are more connected and more upstream than the typical sector, which should help with spillovers.

10/

We show that the targeted sectors are more connected and more upstream than the typical sector, which should help with spillovers.

10/

We also look at the regional distribution of establishments in the growth-driving sectors. It differs from the regional distribution of past subsidies, suggesting that gains from the new industrial strategy may vary across regions and devolved nations.

9/

9/

April 9, 2025 at 12:24 PM

We also look at the regional distribution of establishments in the growth-driving sectors. It differs from the regional distribution of past subsidies, suggesting that gains from the new industrial strategy may vary across regions and devolved nations.

9/

9/

For each sector, we undertake a detailed assessment of its component industries. Here is for example advanced manufacturing.

We hope this helps policymakers monitor and target its industrial strategy, and consider competition-enhancing tools where needed.

8/

We hope this helps policymakers monitor and target its industrial strategy, and consider competition-enhancing tools where needed.

8/

April 9, 2025 at 12:24 PM

For each sector, we undertake a detailed assessment of its component industries. Here is for example advanced manufacturing.

We hope this helps policymakers monitor and target its industrial strategy, and consider competition-enhancing tools where needed.

8/

We hope this helps policymakers monitor and target its industrial strategy, and consider competition-enhancing tools where needed.

8/

Turning to what the government calls the "growth-driving" sectors in the industrial strategy green paper, we show that they are indeed more productive, competitive and dynamic than the overall economy.

7/

7/

April 9, 2025 at 12:24 PM

Turning to what the government calls the "growth-driving" sectors in the industrial strategy green paper, we show that they are indeed more productive, competitive and dynamic than the overall economy.

7/

7/

Effect sizes also vary substantially by instrument.

Of course, since industrial policies are by their very nature targeted, even when we exploit the timing of policies there are likely still some remaining selection effects.

6/

Of course, since industrial policies are by their very nature targeted, even when we exploit the timing of policies there are likely still some remaining selection effects.

6/

April 9, 2025 at 12:24 PM

Effect sizes also vary substantially by instrument.

Of course, since industrial policies are by their very nature targeted, even when we exploit the timing of policies there are likely still some remaining selection effects.

6/

Of course, since industrial policies are by their very nature targeted, even when we exploit the timing of policies there are likely still some remaining selection effects.

6/

There is suggestive evidence both at the industry and regional level that increased exposure to industrial policies is associated with subsequently higher productivity.

But as data on industrial policies is still new and under development, we often lack statistical power to distinguish effects.

5/

But as data on industrial policies is still new and under development, we often lack statistical power to distinguish effects.

5/

April 9, 2025 at 12:24 PM

There is suggestive evidence both at the industry and regional level that increased exposure to industrial policies is associated with subsequently higher productivity.

But as data on industrial policies is still new and under development, we often lack statistical power to distinguish effects.

5/

But as data on industrial policies is still new and under development, we often lack statistical power to distinguish effects.

5/

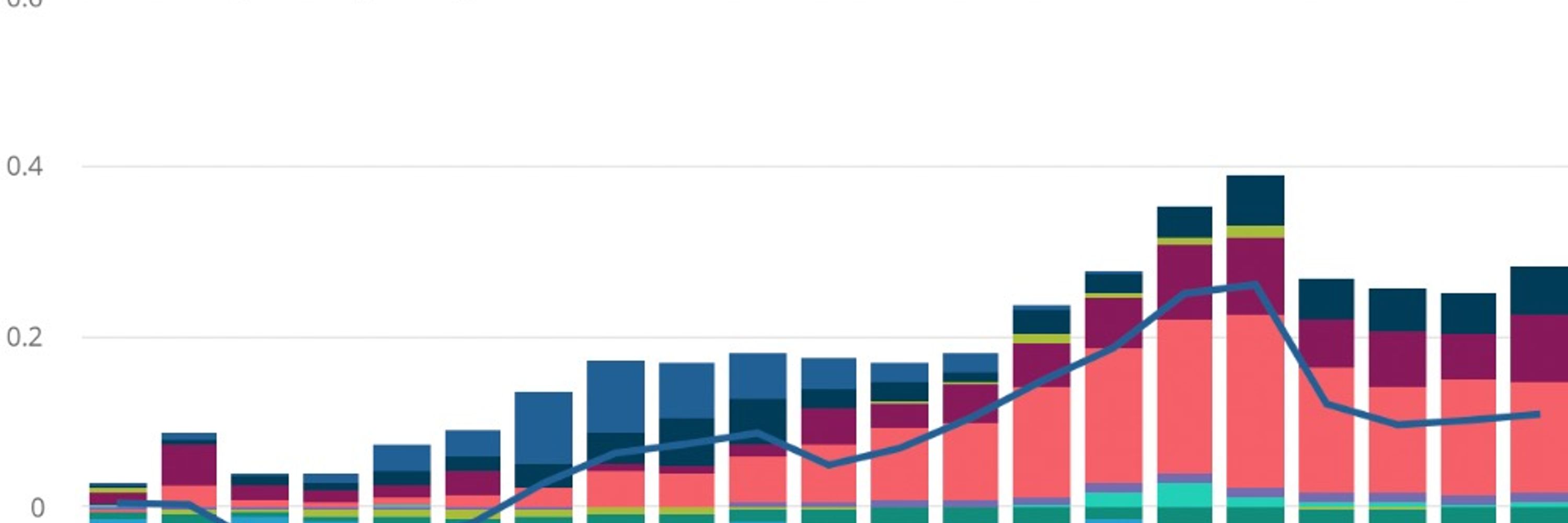

The UK also conducts more of its industrial policies via tax credits than other instruments, such as loans, guarantees and capital injections.

4/

4/

April 9, 2025 at 12:24 PM

The UK also conducts more of its industrial policies via tax credits than other instruments, such as loans, guarantees and capital injections.

4/

4/

First, countries differ in how much they spend on industrial policies, what they spend it on, and what policy instruments they use.

In recent years, the UK has spent relatively more than its peers on mining and quarrying (which contains oil and gas), wholesale and retail, and ICT.

3/

In recent years, the UK has spent relatively more than its peers on mining and quarrying (which contains oil and gas), wholesale and retail, and ICT.

3/

April 9, 2025 at 12:24 PM

First, countries differ in how much they spend on industrial policies, what they spend it on, and what policy instruments they use.

In recent years, the UK has spent relatively more than its peers on mining and quarrying (which contains oil and gas), wholesale and retail, and ICT.

3/

In recent years, the UK has spent relatively more than its peers on mining and quarrying (which contains oil and gas), wholesale and retail, and ICT.

3/

Finally, we examine the remaining data and evidence gaps for the industrial strategy, and highlight the importance of careful design, paying for instance attention to threshold effects.

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

April 9, 2025 at 12:16 PM

Finally, we examine the remaining data and evidence gaps for the industrial strategy, and highlight the importance of careful design, paying for instance attention to threshold effects.

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

We highlight the need for better microdata to monitor and evaluate the new industrial policy over time.

12/

The industrial strategy is of course part of the government's wider growth mission. We therefore consider how other pillars of the growth mission might interact with it.

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

April 9, 2025 at 12:16 PM

The industrial strategy is of course part of the government's wider growth mission. We therefore consider how other pillars of the growth mission might interact with it.

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

Investment and skills shortages in particular may constrain how effective industrial policies will be in some sectors.

11/

One interesting finding: the dispersion of labour productivity continues to increase in services, and decrease in manufacturing.

The latter may be a selection effect, as the UK manufacturing share continues to fall (second chart from our State of Competition report).

2/

The latter may be a selection effect, as the UK manufacturing share continues to fall (second chart from our State of Competition report).

2/

December 3, 2024 at 10:35 PM

One interesting finding: the dispersion of labour productivity continues to increase in services, and decrease in manufacturing.

The latter may be a selection effect, as the UK manufacturing share continues to fall (second chart from our State of Competition report).

2/

The latter may be a selection effect, as the UK manufacturing share continues to fall (second chart from our State of Competition report).

2/

The ONS today published its latest productivity and business dynamism bulletin. Headline figures: no change year-on-year to average markups, job reallocation or the overall labour productivity distribution.

www.ons.gov.uk/economy/econ...

1/

www.ons.gov.uk/economy/econ...

1/

December 3, 2024 at 10:35 PM

The ONS today published its latest productivity and business dynamism bulletin. Headline figures: no change year-on-year to average markups, job reallocation or the overall labour productivity distribution.

www.ons.gov.uk/economy/econ...

1/

www.ons.gov.uk/economy/econ...

1/

One advantage of reading Material World only now is that I have been playing around with @trfetzer.com, @prashantgarg.bsky.social and @econopete.bsky.social's AIPNET alongside reading the book, allowing me to explore some of these supply chain linkages myself. Highly recommend!

4/4

4/4

November 30, 2024 at 5:11 PM

One advantage of reading Material World only now is that I have been playing around with @trfetzer.com, @prashantgarg.bsky.social and @econopete.bsky.social's AIPNET alongside reading the book, allowing me to explore some of these supply chain linkages myself. Highly recommend!

4/4

4/4

Relatedly, our report on labour market power in the UK found that while hybrid vacancies are still concentrated in the least concentrated (mostly dense, urban) labour markets, the rise of hybrid working has led to a shift in where work is performed (out of city centres into surrounding suburbs).

November 11, 2024 at 10:30 PM

Relatedly, our report on labour market power in the UK found that while hybrid vacancies are still concentrated in the least concentrated (mostly dense, urban) labour markets, the rise of hybrid working has led to a shift in where work is performed (out of city centres into surrounding suburbs).

We therefore conclude the report with a simple clustering exercise that shows how competition and competitive outcomes vary in complex ways across the economy, and that any single competition measure will miss this complexity. Detailed IO industry studies are needed to round out the picture.

25/

25/

October 24, 2024 at 6:09 AM

We therefore conclude the report with a simple clustering exercise that shows how competition and competitive outcomes vary in complex ways across the economy, and that any single competition measure will miss this complexity. Detailed IO industry studies are needed to round out the picture.

25/

25/

Ownership networks span businesses within and across industries, and as we show in our earlier report, a sizeable fraction of firms also has market power in the labour market.

24/

24/

October 24, 2024 at 6:09 AM

Ownership networks span businesses within and across industries, and as we show in our earlier report, a sizeable fraction of firms also has market power in the labour market.

24/

24/

On the other hand, we replicate US work by Chris Conlon, @natehmiller.bsky.social, Tsolmon Otgon and Yi Yao and show that industry price changes are not systematically related to markup changes. This casts doubt on previously-popular “greedflation” narratives.

22/

22/

October 24, 2024 at 6:09 AM

On the other hand, we replicate US work by Chris Conlon, @natehmiller.bsky.social, Tsolmon Otgon and Yi Yao and show that industry price changes are not systematically related to markup changes. This casts doubt on previously-popular “greedflation” narratives.

22/

22/

What should we make of these changes in competition then? In the report, we show that the dispersion of markups in the UK economy has increased. This indicates that the frictions in the economy may be higher now than twenty years ago.

21/

21/

October 24, 2024 at 6:09 AM

What should we make of these changes in competition then? In the report, we show that the dispersion of markups in the UK economy has increased. This indicates that the frictions in the economy may be higher now than twenty years ago.

21/

21/

Finally, the UK is facing quite similar trends in markups, concentration and business dynamism to many other developed countries, as we can show thanks to CompNet data. This suggests wider, structural trends may be partly at play.

20/

20/

October 24, 2024 at 6:09 AM

Finally, the UK is facing quite similar trends in markups, concentration and business dynamism to many other developed countries, as we can show thanks to CompNet data. This suggests wider, structural trends may be partly at play.

20/

20/

Even within industry, we show that firms have become less responsive to material inputs over time. We can also show that the rise of markups does not correspond to a similar rise in the profit share. This indicates a rise in returns to scale.

19/

19/

October 24, 2024 at 6:09 AM

Even within industry, we show that firms have become less responsive to material inputs over time. We can also show that the rise of markups does not correspond to a similar rise in the profit share. This indicates a rise in returns to scale.

19/

19/

What about technology? Over the past twenty years, the UK has continued to de-industrialise, and as we show in the report, services have a higher fixed-cost share.

18/

18/

October 24, 2024 at 6:09 AM

What about technology? Over the past twenty years, the UK has continued to de-industrialise, and as we show in the report, services have a higher fixed-cost share.

18/

18/

Second, while mergers have risen across the UK economy, the industries with the biggest increase in mergers are not those that have seen their markups increase the most. UK competition enforcement activity has also been mostly stable over this period.

17/

17/

October 24, 2024 at 6:09 AM

Second, while mergers have risen across the UK economy, the industries with the biggest increase in mergers are not those that have seen their markups increase the most. UK competition enforcement activity has also been mostly stable over this period.

17/

17/