@jadhazell.bsky.social

London School of Economics, macro professor

2) Low interest rates cause LASH risk. In the time series, low interest rates associate with high LASH risk. In the cross section, institutions that are more exposed to falling rates take on more LASH risk. (8/11)

December 16, 2024 at 12:02 PM

2) Low interest rates cause LASH risk. In the time series, low interest rates associate with high LASH risk. In the cross section, institutions that are more exposed to falling rates take on more LASH risk. (8/11)

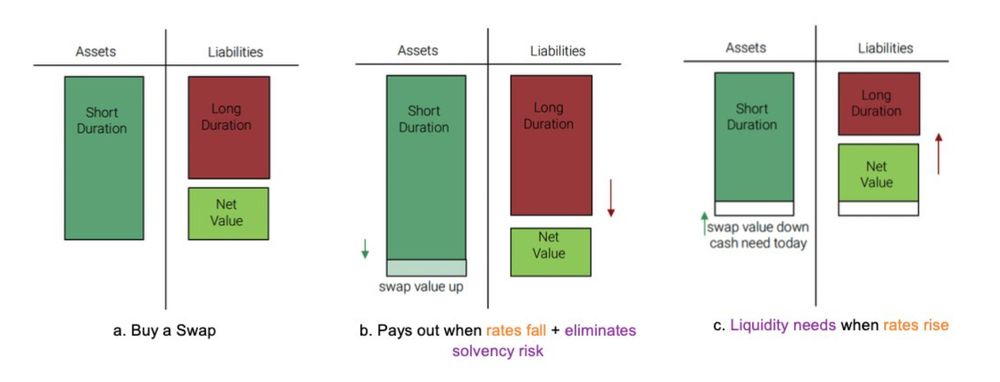

But when rates rise, the value of the swap falls, and the fund must pay liquid assets (“margin”) to their counterparty. The margin requirement is LASH risk, which materializes even as the solvency of the fund improves with rising rates. (5/11)

December 16, 2024 at 11:57 AM

But when rates rise, the value of the swap falls, and the fund must pay liquid assets (“margin”) to their counterparty. The margin requirement is LASH risk, which materializes even as the solvency of the fund improves with rising rates. (5/11)

🚨 New paper🚨

Liquidity crises have become common in the non-bank financial sector. One reason is LASH risk.

With awesome coauthors Laura Alfaro, Saleem Bahaj, Robert Czech and Ioana Neamtu

#econsky

(1/11)

Liquidity crises have become common in the non-bank financial sector. One reason is LASH risk.

With awesome coauthors Laura Alfaro, Saleem Bahaj, Robert Czech and Ioana Neamtu

#econsky

(1/11)

December 16, 2024 at 11:56 AM

🚨 New paper🚨

Liquidity crises have become common in the non-bank financial sector. One reason is LASH risk.

With awesome coauthors Laura Alfaro, Saleem Bahaj, Robert Czech and Ioana Neamtu

#econsky

(1/11)

Liquidity crises have become common in the non-bank financial sector. One reason is LASH risk.

With awesome coauthors Laura Alfaro, Saleem Bahaj, Robert Czech and Ioana Neamtu

#econsky

(1/11)

Hi #econsky!

Macro at LSE is hiring pre docs for September 2025.

Come and work in the best city in the world, on cutting edge macro with me, Ethan Ilzetzki, Ricardo Reis, Matthias Doepke and Ben Moll.

jobs.lse.ac.uk/Vacancies/W/...

#econ_ra

Macro at LSE is hiring pre docs for September 2025.

Come and work in the best city in the world, on cutting edge macro with me, Ethan Ilzetzki, Ricardo Reis, Matthias Doepke and Ben Moll.

jobs.lse.ac.uk/Vacancies/W/...

#econ_ra

November 20, 2024 at 3:12 AM

Hi #econsky!

Macro at LSE is hiring pre docs for September 2025.

Come and work in the best city in the world, on cutting edge macro with me, Ethan Ilzetzki, Ricardo Reis, Matthias Doepke and Ben Moll.

jobs.lse.ac.uk/Vacancies/W/...

#econ_ra

Macro at LSE is hiring pre docs for September 2025.

Come and work in the best city in the world, on cutting edge macro with me, Ethan Ilzetzki, Ricardo Reis, Matthias Doepke and Ben Moll.

jobs.lse.ac.uk/Vacancies/W/...

#econ_ra