Macroeconomics, political economy e altre sciocchezze.

The model offers a flexible framework to explore economy-ecology feedbacks - and to test policies for faster, more effective decarbonization.

Read it here: doi.org/10.1016/j.st...

The model offers a flexible framework to explore economy-ecology feedbacks - and to test policies for faster, more effective decarbonization.

Read it here: doi.org/10.1016/j.st...

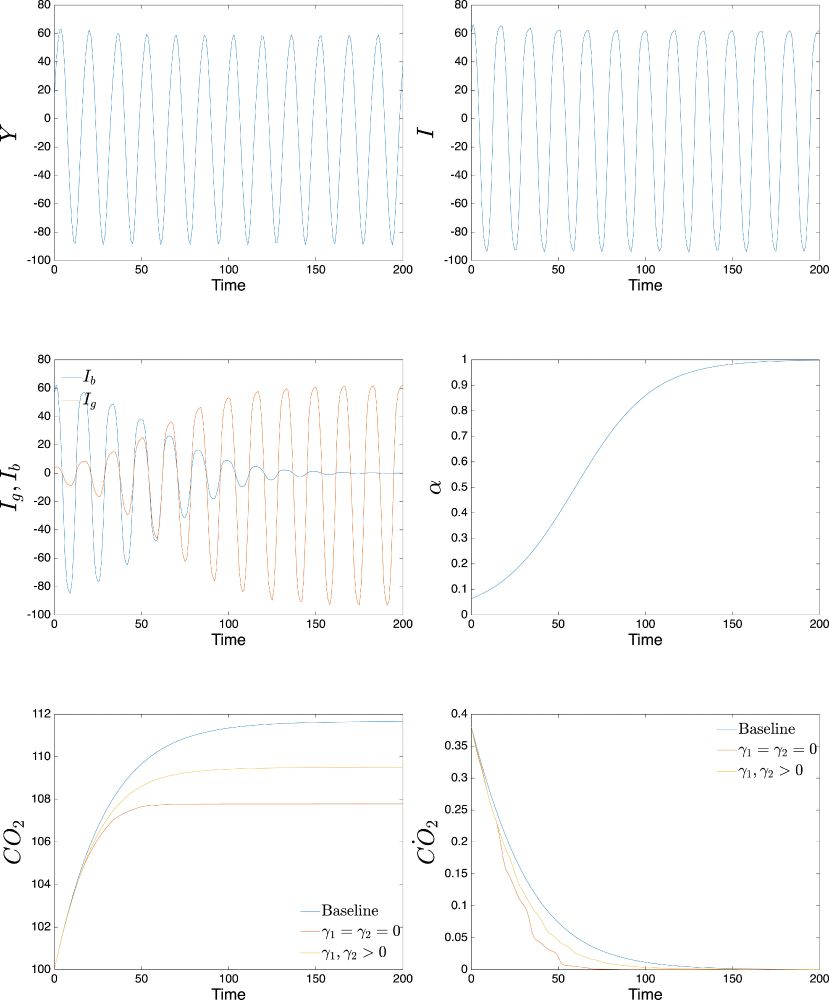

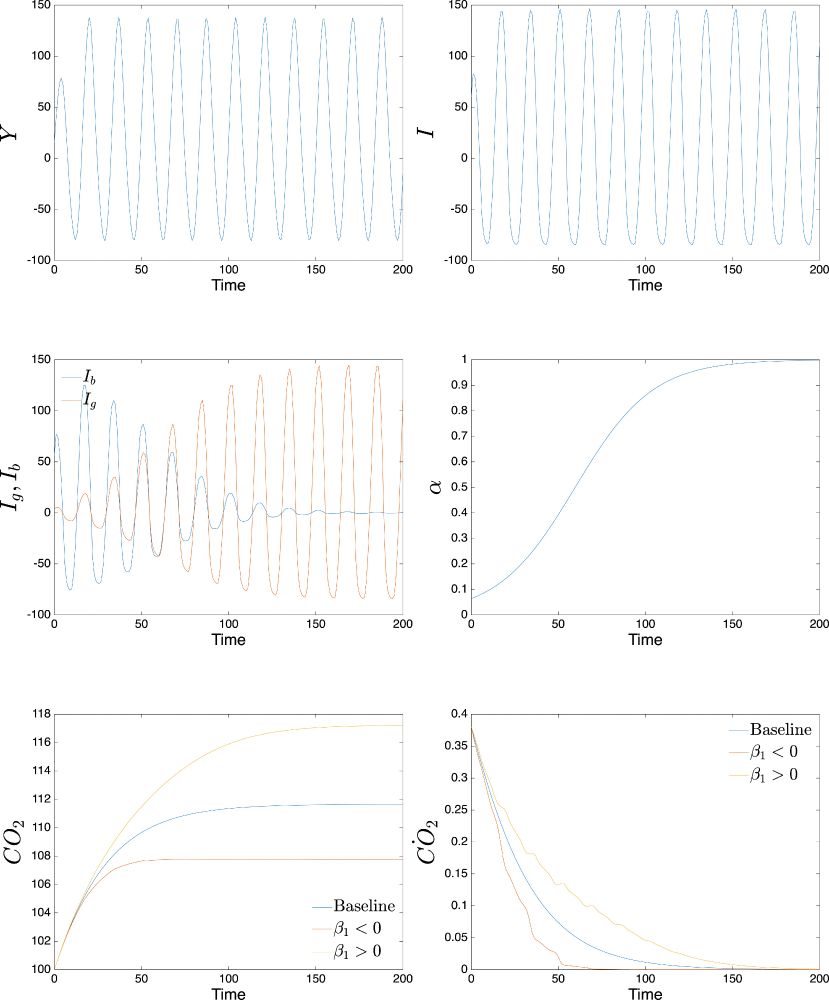

📉 When climate damages are introduced (e.g. via extreme events), they dampen booms and sharpen downturns, limiting the positive impact of the green transition.

5/

📉 When climate damages are introduced (e.g. via extreme events), they dampen booms and sharpen downturns, limiting the positive impact of the green transition.

5/

4/

4/

3/

3/

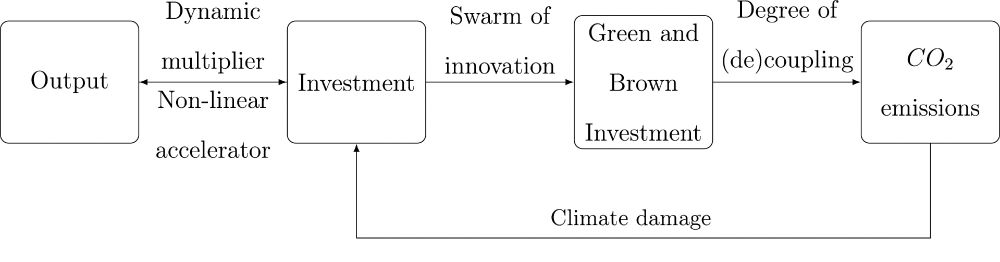

This allows to explore the procyclical behavior of emissions and the conditions for (de)coupling.

2/

This allows to explore the procyclical behavior of emissions and the conditions for (de)coupling.

2/

Most climate-economic models focus on long-run dynamics.

This paper tackles a missing link: the short-run interaction between green investment, emissions, and business cycles.

1/

Most climate-economic models focus on long-run dynamics.

This paper tackles a missing link: the short-run interaction between green investment, emissions, and business cycles.

1/

A trend-cum-cycle model where fluctuations persist endogenously, while long-run growth remains demand-led.

This bridges business cycle theory with supermultiplier models! 🔄📈

#MacroEcon #BusinessCycles #EconomicGrowth

3/3

A trend-cum-cycle model where fluctuations persist endogenously, while long-run growth remains demand-led.

This bridges business cycle theory with supermultiplier models! 🔄📈

#MacroEcon #BusinessCycles #EconomicGrowth

3/3

I develop a model showing how investment-driven cycles can work alongside autonomous demand-led growth.

2/3

I develop a model showing how investment-driven cycles can work alongside autonomous demand-led growth.

2/3