Erik Fossing Nielsen

@erikfossingnielsen.bsky.social

Sr Advisor ‘Independent Economics’

Former Chief Economist, UniCredit, Chief European Economist, Goldman Sachs, former World Bank, IMF, Danish central bank.

Former Chief Economist, UniCredit, Chief European Economist, Goldman Sachs, former World Bank, IMF, Danish central bank.

One of America’s truly finest - the one and only Carlos Santana - wrapped up his European tour tonight in Copenhagen. What an evening with one of the real greats.

August 11, 2025 at 10:13 PM

One of America’s truly finest - the one and only Carlos Santana - wrapped up his European tour tonight in Copenhagen. What an evening with one of the real greats.

A European - indeed a German - finance minister who wants to be known as an investment minister.

Bravo!

Bravo!

June 14, 2025 at 8:45 AM

A European - indeed a German - finance minister who wants to be known as an investment minister.

Bravo!

Bravo!

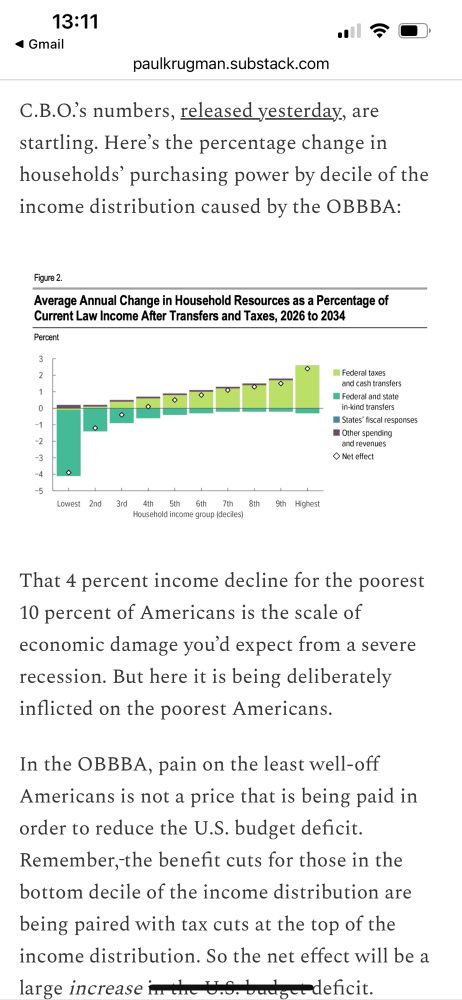

From CBO (h/t Krugman):

Distribution of pain and gain from Trump’s BBB.

The far-right column of biggest net gainers helped finance Trump’s campaign - while the negative dark greens towards the left side voted to a large extent for him.

Strange world indeed.

Distribution of pain and gain from Trump’s BBB.

The far-right column of biggest net gainers helped finance Trump’s campaign - while the negative dark greens towards the left side voted to a large extent for him.

Strange world indeed.

June 13, 2025 at 11:18 AM

From CBO (h/t Krugman):

Distribution of pain and gain from Trump’s BBB.

The far-right column of biggest net gainers helped finance Trump’s campaign - while the negative dark greens towards the left side voted to a large extent for him.

Strange world indeed.

Distribution of pain and gain from Trump’s BBB.

The far-right column of biggest net gainers helped finance Trump’s campaign - while the negative dark greens towards the left side voted to a large extent for him.

Strange world indeed.

The Chinese leadership fly US made Boring (still)

The Russian President drives a Russian Zil (but powered by a German made Porsche powertrain)

The US President wants to accept as a gift a used (but nice) plane from Qatar to replace AirForce One.

Wow.

The Russian President drives a Russian Zil (but powered by a German made Porsche powertrain)

The US President wants to accept as a gift a used (but nice) plane from Qatar to replace AirForce One.

Wow.

May 12, 2025 at 11:51 AM

The Chinese leadership fly US made Boring (still)

The Russian President drives a Russian Zil (but powered by a German made Porsche powertrain)

The US President wants to accept as a gift a used (but nice) plane from Qatar to replace AirForce One.

Wow.

The Russian President drives a Russian Zil (but powered by a German made Porsche powertrain)

The US President wants to accept as a gift a used (but nice) plane from Qatar to replace AirForce One.

Wow.

A multi-lingual, dual-citizen American has been elected head of 1.4 bn people across more than 100 countries after standing up to the Trump administration.

There is hope.

There is hope.

May 9, 2025 at 6:53 AM

A multi-lingual, dual-citizen American has been elected head of 1.4 bn people across more than 100 countries after standing up to the Trump administration.

There is hope.

There is hope.

The TACO trade! Brilliant.

April 30, 2025 at 7:18 AM

The TACO trade! Brilliant.

In my last UniCredit Sunday Wrap (after 13 years of weekend writing), I discuss the medium term outlook for the world - and markets.

Bad for the US - but there’s still hope for Europe and the rest of the world.

Stay tuned ….

www.research.unicredit.eu/DocsKey/econ...

Bad for the US - but there’s still hope for Europe and the rest of the world.

Stay tuned ….

www.research.unicredit.eu/DocsKey/econ...

April 6, 2025 at 1:46 PM

In my last UniCredit Sunday Wrap (after 13 years of weekend writing), I discuss the medium term outlook for the world - and markets.

Bad for the US - but there’s still hope for Europe and the rest of the world.

Stay tuned ….

www.research.unicredit.eu/DocsKey/econ...

Bad for the US - but there’s still hope for Europe and the rest of the world.

Stay tuned ….

www.research.unicredit.eu/DocsKey/econ...

In today’s Sunday Wrap - the penultimate before the curtain goes down on it (at least under the UniCredit banner):

Reflections on the sudden jaw-dropping change in relative business and markets sentiment between Europe and the US.

www.research.unicredit.eu/DocsKey/econ...

Reflections on the sudden jaw-dropping change in relative business and markets sentiment between Europe and the US.

www.research.unicredit.eu/DocsKey/econ...

March 30, 2025 at 11:23 AM

In today’s Sunday Wrap - the penultimate before the curtain goes down on it (at least under the UniCredit banner):

Reflections on the sudden jaw-dropping change in relative business and markets sentiment between Europe and the US.

www.research.unicredit.eu/DocsKey/econ...

Reflections on the sudden jaw-dropping change in relative business and markets sentiment between Europe and the US.

www.research.unicredit.eu/DocsKey/econ...

In today’s Sunday Wrap I discuss this past week’s era-defining German decision on defence + investment.

- I conclude that EU defence-independence from US is within reach in maybe 3-4 years

- and that the effort will have big positive effects for growth.

www.research.unicredit.eu/DocsKey/econ...

- I conclude that EU defence-independence from US is within reach in maybe 3-4 years

- and that the effort will have big positive effects for growth.

www.research.unicredit.eu/DocsKey/econ...

March 23, 2025 at 1:26 PM

In today’s Sunday Wrap I discuss this past week’s era-defining German decision on defence + investment.

- I conclude that EU defence-independence from US is within reach in maybe 3-4 years

- and that the effort will have big positive effects for growth.

www.research.unicredit.eu/DocsKey/econ...

- I conclude that EU defence-independence from US is within reach in maybe 3-4 years

- and that the effort will have big positive effects for growth.

www.research.unicredit.eu/DocsKey/econ...

In today’s Sunday Wrap I reflect on what I learned at this past week’s ECB Watchers conference about the ECB’s plans for dealing with the uncertainties of Trump policies.

www.research.unicredit.eu/DocsKey/econ...

www.research.unicredit.eu/DocsKey/econ...

March 16, 2025 at 1:57 PM

In today’s Sunday Wrap I reflect on what I learned at this past week’s ECB Watchers conference about the ECB’s plans for dealing with the uncertainties of Trump policies.

www.research.unicredit.eu/DocsKey/econ...

www.research.unicredit.eu/DocsKey/econ...

In today’s Sunday Wrap I discuss the forceful responses from around the world to Trump’s economic and other threats, particularly Germany’s stunning policy announcement on Tuesday.

And I summarise my preliminary thoughts on the effects on growth and markets

www.research.unicredit.eu/DocsKey/econ...

And I summarise my preliminary thoughts on the effects on growth and markets

www.research.unicredit.eu/DocsKey/econ...

March 9, 2025 at 1:53 PM

In today’s Sunday Wrap I discuss the forceful responses from around the world to Trump’s economic and other threats, particularly Germany’s stunning policy announcement on Tuesday.

And I summarise my preliminary thoughts on the effects on growth and markets

www.research.unicredit.eu/DocsKey/econ...

And I summarise my preliminary thoughts on the effects on growth and markets

www.research.unicredit.eu/DocsKey/econ...

In today’s Sunday Wrap - on Germany:

1- recent years’ poor growth more the result of shocks than structural weakness. But an investment boom still needed:

2- the routes available to Merz to create the fiscal space.

www.research.unicredit.eu/DocsKey/econ...

1- recent years’ poor growth more the result of shocks than structural weakness. But an investment boom still needed:

2- the routes available to Merz to create the fiscal space.

www.research.unicredit.eu/DocsKey/econ...

March 2, 2025 at 1:52 PM

In today’s Sunday Wrap - on Germany:

1- recent years’ poor growth more the result of shocks than structural weakness. But an investment boom still needed:

2- the routes available to Merz to create the fiscal space.

www.research.unicredit.eu/DocsKey/econ...

1- recent years’ poor growth more the result of shocks than structural weakness. But an investment boom still needed:

2- the routes available to Merz to create the fiscal space.

www.research.unicredit.eu/DocsKey/econ...

In today’s Sunday Wrap:

The importance of the German election at a time when the US Gov has lost all sanity and decency.

What to look for when the results come in tonight.

www.research.unicredit.eu/DocsKey/econ...

The importance of the German election at a time when the US Gov has lost all sanity and decency.

What to look for when the results come in tonight.

www.research.unicredit.eu/DocsKey/econ...

February 23, 2025 at 3:29 PM

In today’s Sunday Wrap:

The importance of the German election at a time when the US Gov has lost all sanity and decency.

What to look for when the results come in tonight.

www.research.unicredit.eu/DocsKey/econ...

The importance of the German election at a time when the US Gov has lost all sanity and decency.

What to look for when the results come in tonight.

www.research.unicredit.eu/DocsKey/econ...

In today’s Sunday Wrap I argue that multilateralism has been withering away for some years now, at huge cost to the world. Trump is turbo-charging it towards its end.

I discuss the challenge it poses to Europe.

www.research.unicredit.eu/DocsKey/econ...

I discuss the challenge it poses to Europe.

www.research.unicredit.eu/DocsKey/econ...

January 26, 2025 at 1:15 PM

In today’s Sunday Wrap I argue that multilateralism has been withering away for some years now, at huge cost to the world. Trump is turbo-charging it towards its end.

I discuss the challenge it poses to Europe.

www.research.unicredit.eu/DocsKey/econ...

I discuss the challenge it poses to Europe.

www.research.unicredit.eu/DocsKey/econ...

In the first Sunday Wrap of the year I discuss Trump’s military threat to Greenland, and hence NATO (and why it’s complexed), his financial backers’ threat to European politics - and why I’m optimistic that Europe will respond properly.

www.research.unicredit.eu/DocsKey/econ...

www.research.unicredit.eu/DocsKey/econ...

January 12, 2025 at 1:34 PM

In the first Sunday Wrap of the year I discuss Trump’s military threat to Greenland, and hence NATO (and why it’s complexed), his financial backers’ threat to European politics - and why I’m optimistic that Europe will respond properly.

www.research.unicredit.eu/DocsKey/econ...

www.research.unicredit.eu/DocsKey/econ...

Angela Merkel on the debt brake: “it needs to be reformed to allow higher levels of debt to be assumed for the sake of investment in the future”.

She is right!!!

She is right!!!

December 22, 2024 at 4:58 PM

Angela Merkel on the debt brake: “it needs to be reformed to allow higher levels of debt to be assumed for the sake of investment in the future”.

She is right!!!

She is right!!!

In today’s Sunday Wrap - the last of the year- I summarise my expectations for 2025 across policies, economics and markets.

Happy to be told I’m wrong….

www.research.unicredit.eu/DocsKey/econ...

Happy to be told I’m wrong….

www.research.unicredit.eu/DocsKey/econ...

December 15, 2024 at 1:28 PM

In today’s Sunday Wrap - the last of the year- I summarise my expectations for 2025 across policies, economics and markets.

Happy to be told I’m wrong….

www.research.unicredit.eu/DocsKey/econ...

Happy to be told I’m wrong….

www.research.unicredit.eu/DocsKey/econ...

From Merkel’s book:

Only in Germany would you call a budget deficit of 3.3%, rather than 3.0% “appalling” 😁

Only in Germany would you call a budget deficit of 3.3%, rather than 3.0% “appalling” 😁

December 14, 2024 at 8:10 PM

From Merkel’s book:

Only in Germany would you call a budget deficit of 3.3%, rather than 3.0% “appalling” 😁

Only in Germany would you call a budget deficit of 3.3%, rather than 3.0% “appalling” 😁