https://www.epi.org/people/elise-gould/

#EconSky

#EconSky

#EconSky

#EconSky

#EconSky

#EconSky

#EconSky

#EconSky

#EconSky #NumbersDay

#EconSky #NumbersDay

#EconSky

#EconSky

Highlights:

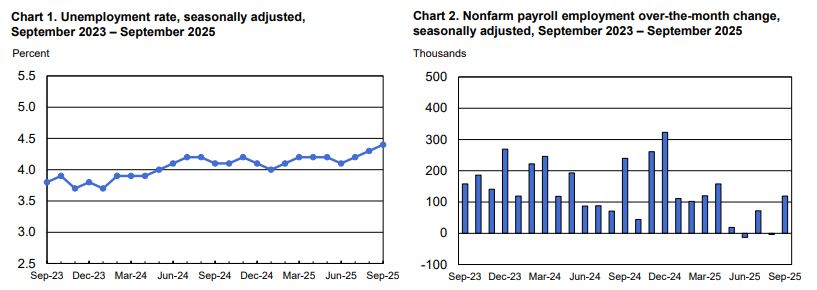

- payroll employment up 119k for Sept while August change was revised down to below zero

- unemployment rate ticked up 3 months in a row to 4.4%

#EconSky

After tomorrow's release of September 2025 #Jobs data, I'll be looking forward to #JOLTS on December 9 and Jobs on Dec 16. These will be highly unusual with catchup data on the establishment side.

#NumbersDay #EconSky @epi.org

After tomorrow's release of September 2025 #Jobs data, I'll be looking forward to #JOLTS on December 9 and Jobs on Dec 16. These will be highly unusual with catchup data on the establishment side.

#NumbersDay #EconSky @epi.org

#NumbersDay #EconSky

#NumbersDay #EconSky

#EconSky

#EconSky

#NumbersDay #EconSky

#NumbersDay #EconSky

#EconSky

#EconSky

#EconSky

#EconSky

#NumbersDay #EconSky

#NumbersDay #EconSky

#EconSky

#EconSky

#NumbersDay #EconSky

#NumbersDay #EconSky

#EconSky

#EconSky